Construction sector, bird's eye view 🧵

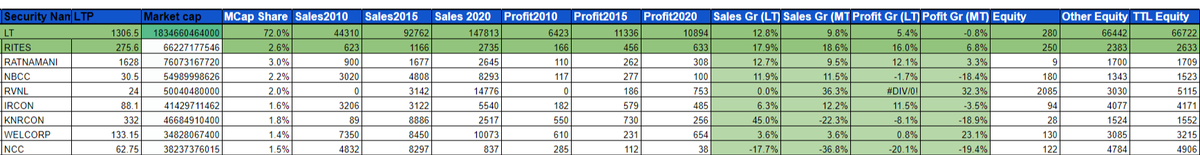

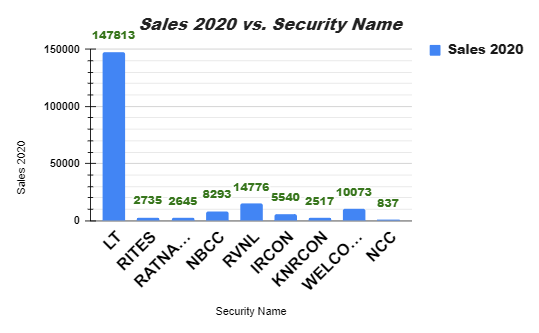

The top player #LnT takes home almost 75% of the market share. The rest are small fish in a pond where L&T is the biggest crocodile.

Qualitative analysis in comments 👇

The top player #LnT takes home almost 75% of the market share. The rest are small fish in a pond where L&T is the biggest crocodile.

Qualitative analysis in comments 👇

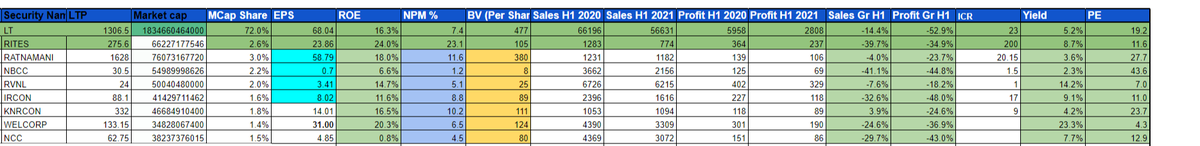

#RITES has better efficiency than #LnT (i.e whatever little profit it churns out, it does it with very low cost, unlike LnT which is laden with debt), hence RITES has higher ROE, NPM and ICR.

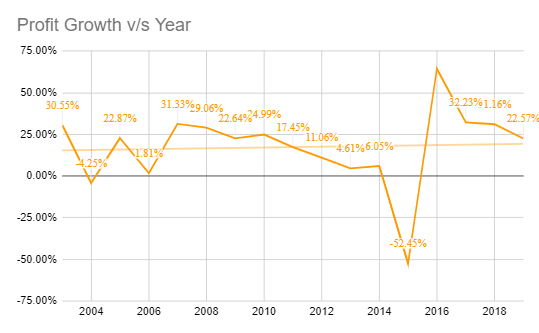

Verdict : The construction sector is very capital intensive sector that does well only when the government does CAPEX for infra projects

LnT & RITES are the only 2 good companies. Buy if bullish on sarkari spending on Infra (100 smart cities, bullet train, river linking project)

LnT & RITES are the only 2 good companies. Buy if bullish on sarkari spending on Infra (100 smart cities, bullet train, river linking project)

• • •

Missing some Tweet in this thread? You can try to

force a refresh