Warren Buffet & Charlie Munger's wisdom on

- Understanding the Price of business

- Understanding Risk

- Pharmaceutical Industries

- Qualities to look in for business

@unseenvalue @dmuthuk @utsav1711 @suru27

A Long thread 🧵👇

#investing

- Understanding the Price of business

- Understanding Risk

- Pharmaceutical Industries

- Qualities to look in for business

@unseenvalue @dmuthuk @utsav1711 @suru27

A Long thread 🧵👇

#investing

Never pay too much

Warren - You cannot pay too much, at least in the short run, for businesses. No matter how wonderful a business is, there is always a risk that you will pay where it will take a few years for the business to catch up with the stock.

Warren - You cannot pay too much, at least in the short run, for businesses. No matter how wonderful a business is, there is always a risk that you will pay where it will take a few years for the business to catch up with the stock.

- If you understand businesses and feel very certain about them and if you decide they’re fairly priced and they have marvelous prospects, you’re going to do very well. Don’t pay too much for a business which is run by outstanding managers in the short run.

- There is always a risk of time when the price catches up with stock. We don't price securities; we try to price businesses. You don't always have time to buy things cheap.

Charlie - We guarantee real inflation adjusted return from investing in standard collection of stocks will be lower in the longer term future.

Qualities to look in a business

Warren- There are few qualities in a business which are essential, if one is planning to invest for lifetime

- They are dominant players, like coca-cola and Gillette

- Their base business is what I call “Inevitables”

Having outstanding managers

Warren- There are few qualities in a business which are essential, if one is planning to invest for lifetime

- They are dominant players, like coca-cola and Gillette

- Their base business is what I call “Inevitables”

Having outstanding managers

Impact of interest rates

Warren:-Businesses are worth more money if the interest rate falls and stock rises . But then eventually market action of the securities themselves creates its own rationale for buyers and people forget about the reasons and the mathematical limitations.

Warren:-Businesses are worth more money if the interest rate falls and stock rises . But then eventually market action of the securities themselves creates its own rationale for buyers and people forget about the reasons and the mathematical limitations.

- These were implied in what they got excited at first place and after a while, rising prices themselves alone will keep people excited and cause more people to enter.

On risk

Warren - We first think of Business Risk. Think stocks as a part of a business. If business does well, they’re going to do all right as long as they don’t pay way too much to join that business.

Then the risk becomes the risk of you yourself.

Warren - We first think of Business Risk. Think stocks as a part of a business. If business does well, they’re going to do all right as long as they don’t pay way too much to join that business.

Then the risk becomes the risk of you yourself.

- Business risk can arise in various ways- like capital structure, nature of the business like aircraft manufacturers, type of business like the commodity business got their risk unless you’re the low-cost producer.

- The risk beyond that is you pay too much for a business. That risk is usually a risk of time rather than loss of principal, unless you get into a really extravagant situation.

“The stock market is there to serve you and not to instruct you. And that’s a key to owning a good business. And getting rid of the risk that would otherwise exist in the market”

- Volatility is a huge plus to the real investor. That’s how Mr. Market works- the crazier he is the more money you’re going to make

-The financial department teaches that volatility equals risk. Now they want to measure risk, and they don’t know any other way

-The financial department teaches that volatility equals risk. Now they want to measure risk, and they don’t know any other way

Charlie - Risk had a very good colloquial meaning , a substantial chance that something would go horribly wrong. And financial professors sort of got volatility mixed up with a lot of foolish mathematics

Determine companies' intrinsic value

Warren- Looking at any business, what its future cash inflows and outflows from the business to the owners would be over the next 100 years and then discount that back at the appropriate interest rate.

Warren- Looking at any business, what its future cash inflows and outflows from the business to the owners would be over the next 100 years and then discount that back at the appropriate interest rate.

- This would give us several intrinsic value just like how bonds are looked who has a different value because they have different coupons printed on them that are going to develop in the future too.

- The only problem is they aren't printed on the instrument. It's up to the investor to estimate what those coupons are going to be over time. When we get into businesses where we think we can understand them reasonably well, we are trying to print the coupons out.

- We are trying to figure out what businesses are going to be worth in 10-20 years.

- If you attempt to assess intrinsic value, it all relates to cash flows. There are a number of filters which say to us, we don't know what that business is going to be worth in 10 -20 years

- If you attempt to assess intrinsic value, it all relates to cash flows. There are a number of filters which say to us, we don't know what that business is going to be worth in 10 -20 years

Charlie - I would argue that one filter that’s useful in investing in the simple idea of opportunity cost. If you have one opportunity that you already have available in large quantities, and you like it better than 98% of the other things.

- You can just screen out the other 98% because you already know something better. People who have very good opportunities and using a concept of opportunity cost, they can make better decisions about what to buy

Warren - The first thing that goes through our head is would we rather own this business than more coca cola? Would we rather own it than more Gillette? It’s crazy not to compare it to things you are very certain of.

5 min test to evaluate acquisitions potential

Warren- Understanding business for more than 40 years gives some edge. After looking at business, we have a bunch of filters we’ve developed in our minds over time. They have hindrances, but they are efficient.

Warren- Understanding business for more than 40 years gives some edge. After looking at business, we have a bunch of filters we’ve developed in our minds over time. They have hindrances, but they are efficient.

- And they work just and if we spent months and hired experts and did all kinds of things.

1. We never owed flight safety, but we’d been familiar with the company for at least 20 years

2. We’ve got a fix on what we don’t understand

1. We never owed flight safety, but we’d been familiar with the company for at least 20 years

2. We’ve got a fix on what we don’t understand

Business expansion

Charlie- There's a vast class of businesses in America which are strong and throw out large amounts of cash in relation to their size but can’t be expanded very much. And if you try to expand certain kinds of businesses, you’re throwing money down the rat hole

Charlie- There's a vast class of businesses in America which are strong and throw out large amounts of cash in relation to their size but can’t be expanded very much. And if you try to expand certain kinds of businesses, you’re throwing money down the rat hole

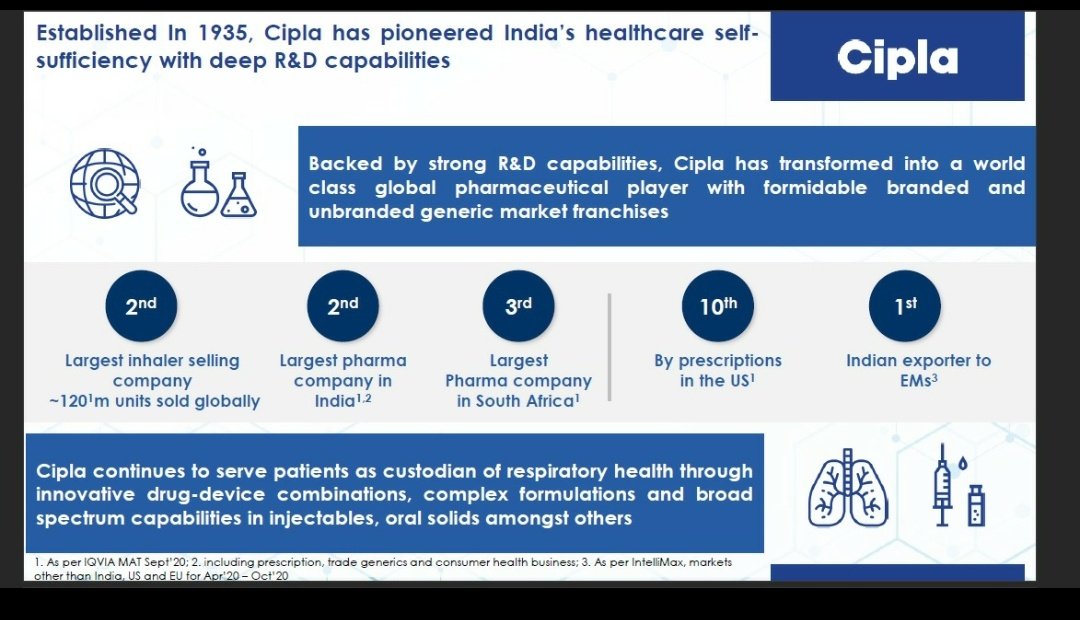

On Pharmaceuticals industries

Warren - Pharmaceuticals industries obviously have been a terrific industry to invest in. We had trouble distinguishing companies and seeing them 10 years from now I am not saying you can't do it.

Warren - Pharmaceuticals industries obviously have been a terrific industry to invest in. We had trouble distinguishing companies and seeing them 10 years from now I am not saying you can't do it.

Charlie- It's hard to think of any industry that’s done more good for consumers. When you think of the way children used to die and now they very seldom die and it’s been a fabulous business and it's been one of the American civilization

Calculation of Owner Earnings

Charlie - Maintenance expenditures and working capital and so forth. The compulsory investment.

- After some unpleasant early experience, we have tried to avoid places where there was a lot of compulsory reinvestment in order to stand still.

Charlie - Maintenance expenditures and working capital and so forth. The compulsory investment.

- After some unpleasant early experience, we have tried to avoid places where there was a lot of compulsory reinvestment in order to stand still.

Warren - We regard the reported earnings plus or minus purchase adjustments to be a good representation of proper business, except for coca-cola marketing advisement as it played a real portion in creating an asset.

On index funds

Warren - Money managers in aggregate have underperformed index funds. And it’s the nature of the game. They simply cannot over-perform in aggregate.

-There are too many of them managing too big a portion of the pool.

Warren - Money managers in aggregate have underperformed index funds. And it’s the nature of the game. They simply cannot over-perform in aggregate.

-There are too many of them managing too big a portion of the pool.

- Money management is the only field in the world where the amateur, as long as he recognizes he’s an amature, will do better than the professional does for the people whose money he’s handling.

Importance of margin of safety

Warren- If you understood a business, you would need very little in the way of a margin of safety. The biggest thing to do is understand the business. Understand the business and get into the businesses where surprises are few.

Warren- If you understood a business, you would need very little in the way of a margin of safety. The biggest thing to do is understand the business. Understand the business and get into the businesses where surprises are few.

- So the more volatile the business is, or the possibility is the larger the margin of safety required.

Learn from other people’s mistakes

Warren- I've said about learning from your mistakes, but the best thing to do is learn from other guys' mistakes. Our approach is really to learn vicariously, but there’s a lot of mistakes I've repeated.

Warren- I've said about learning from your mistakes, but the best thing to do is learn from other guys' mistakes. Our approach is really to learn vicariously, but there’s a lot of mistakes I've repeated.

- The biggest one is being reluctant to pay up a little for a business I knew was outstanding, or continue to buy it at higher prices.

- The mistakes are made when there are businesses you can understand and they’re attractive and you don't do something about it.

- The mistakes are made when there are businesses you can understand and they’re attractive and you don't do something about it.

Most of our mistakes were omission rather than commission

Charlie- Very few get no-brainer opportunities, where it's just obvious that this is going to work. People have to learn the courage and the intelligence to step up in a major way when those rare opportunities come by.

Charlie- Very few get no-brainer opportunities, where it's just obvious that this is going to work. People have to learn the courage and the intelligence to step up in a major way when those rare opportunities come by.

Why is Berkshire’s investment style taken lightly

Warren - I think there are other things that are probably better to copy about Berkshire, but they don't get copied either. It was always interesting to me how few people read Graham’s and they didn’t really disagree with him.

Warren - I think there are other things that are probably better to copy about Berkshire, but they don't get copied either. It was always interesting to me how few people read Graham’s and they didn’t really disagree with him.

- They just didn’t like following him because it wasn't enough.

Charlie:- I always believe in getting the fundamental tools in place, and I always believe in running reality. I not only think that work in life creates success. I think it makes life more fun

Charlie:- I always believe in getting the fundamental tools in place, and I always believe in running reality. I not only think that work in life creates success. I think it makes life more fun

Warren - There are tons of opportunities out there and I would do something I enjoyed. I wouldn't do something because I thought it was going to get me to a life I was going to enjoy later on.

Owning Berkshire vs having a diversified portfolio

Warren- I’ve got 99% of my money in Berkshire, but it was bought at a different price. And Charlie bought a little cheaper. We like the idea of having it all in there.

Warren- I’ve got 99% of my money in Berkshire, but it was bought at a different price. And Charlie bought a little cheaper. We like the idea of having it all in there.

- But we don’t recommend that people do that because you will get very low cost management. What we hope is that from this point forward, that cost does not reflect its value.

-But the price at which you enter is very important.

-But the price at which you enter is very important.

- Charlie- If the success continues and we have more of this hagiography, the stock will get to such a high price that it’s no longer sensible at all to buy

Buying any business

Warren- We like businesses with low labour costs, but we like business with low costs of every kind. Because the rest is profit, so in BS we would we would not be high on labor intensive companies. But there’s some very good business that are labour intensive

Warren- We like businesses with low labour costs, but we like business with low costs of every kind. Because the rest is profit, so in BS we would we would not be high on labor intensive companies. But there’s some very good business that are labour intensive

Managers trust

Warren- We basically let our managers run their own business, we let every manager make his decisions if we tell something that managers ought to take they lose some responsibility for their operations.

Warren- We basically let our managers run their own business, we let every manager make his decisions if we tell something that managers ought to take they lose some responsibility for their operations.

Most of the managers don't need to work for a living, they run their businesses for the same reason Charlie and I run Berkshire. They jump out of bed in the morning because it’s exciting to do.

Leverage in investing

Warren- I think investors should stick to buying ownership in businesses, but introducing leverage to investing is a dangerous path to start borrowing money usually or frequently leads to trouble

Warren- I think investors should stick to buying ownership in businesses, but introducing leverage to investing is a dangerous path to start borrowing money usually or frequently leads to trouble

It’s not necessary if you want to double your money by end of the year then I would head to the futures market

But note once you focus on short-term price behaviour, which is the nature of buying calls or LEAPS or speculating in index futures , once you concentrate on that, I think you’re very likely to take your eyes off the main ball ,which is just value businesses.

• • •

Missing some Tweet in this thread? You can try to

force a refresh