Cipla concall was today at 10:40 pm (late night)

Here are the key takeaways 😃

@unseenvalue @darshanvmehta1 @AlgoBoffin @iramneek

Here are the key takeaways 😃

@unseenvalue @darshanvmehta1 @AlgoBoffin @iramneek

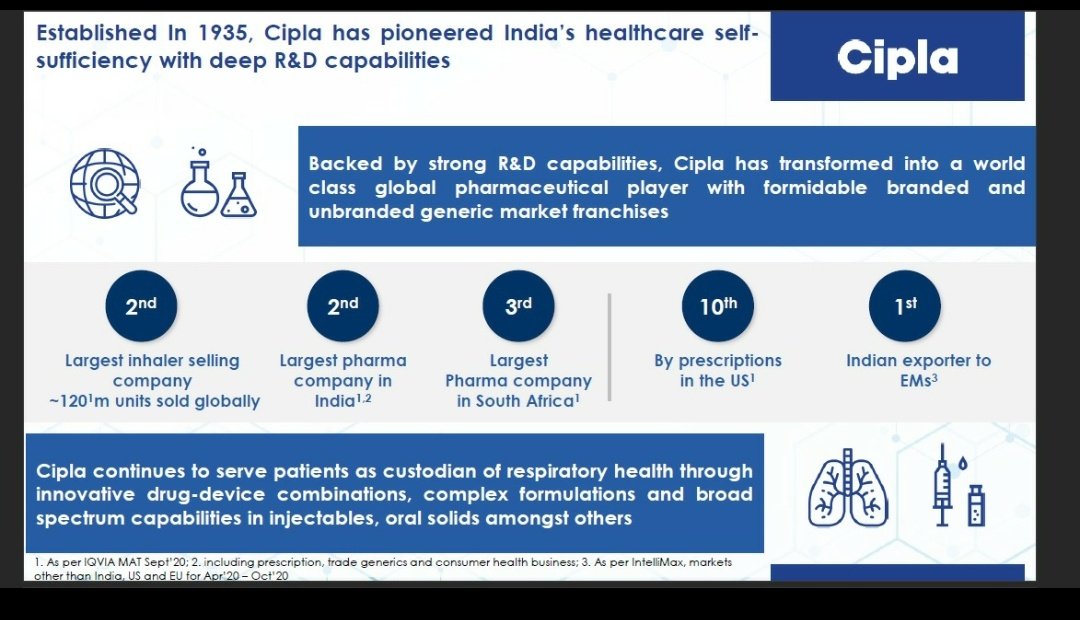

Introduction

- Company being the first one to launch Remdesivir and the whole portfolio for covid 19

- Company is no.2 in lung leadership. Will try to unlock the complex generics in US.

- Growing faster than the average market growth.

- Company being the first one to launch Remdesivir and the whole portfolio for covid 19

- Company is no.2 in lung leadership. Will try to unlock the complex generics in US.

- Growing faster than the average market growth.

- Trying to bring respiratory technology in China and in Brazil.

- There is a fair amount of unlocking through digitalization.

- ESG to improve in future. Becoming carbon neutral and water neutral.

- There is a fair amount of unlocking through digitalization.

- ESG to improve in future. Becoming carbon neutral and water neutral.

US business

- Were able to add

- would be doubling the revenue in US.

- The pipeline is nicely diversified , now the products are diversified into respiratory + injectable around 30%

- Were able to add

- would be doubling the revenue in US.

- The pipeline is nicely diversified , now the products are diversified into respiratory + injectable around 30%

Indian market: One india strategy

- To cosumerize the business.

- Generic business is no.1 in india.

- Brand is moving from generic business to consumer business.

- Goal is to keep beating market growth by expanding the depth in portfolio.

- To cosumerize the business.

- Generic business is no.1 in india.

- Brand is moving from generic business to consumer business.

- Goal is to keep beating market growth by expanding the depth in portfolio.

- There has been a deeper distribution system because the generic business is moving faster than expected.

- Synergizing the distribution channel for prescription, trade generics, and consumer health.

- Synergizing the distribution channel for prescription, trade generics, and consumer health.

Consumer wellness

- Goal is to make 12- 15% of revenue in next 3 to 5 years. Right now ots around 5 percent.

- Goal is to make 12- 15% of revenue in next 3 to 5 years. Right now ots around 5 percent.

South African business

- Going relatively fast in CNS and respiratory business.

- Nice portfolio in HIV.

Emerging markets

- Solid partnership are present in these market.

- Going relatively fast in CNS and respiratory business.

- Nice portfolio in HIV.

Emerging markets

- Solid partnership are present in these market.

Digital initiative

- Can unlock a great potential in profit through digitalization

- Automation in manufacturing and digitization of data.

- Company is re imagining the business to be more digital.

- Can unlock a great potential in profit through digitalization

- Automation in manufacturing and digitization of data.

- Company is re imagining the business to be more digital.

ROIC story

- Capital is being diverted to respiratory division. Comaony likes this category.

- 50 to 60% will come from new launch of products and rest would be through cost control.

- Capital is being diverted to respiratory division. Comaony likes this category.

- 50 to 60% will come from new launch of products and rest would be through cost control.

- In india company want to expand a bit but the major focus is to push the revenues higher.

Respiratory portfolio

- The company has a para 4 filing and has a partnership with a generic company.

Respiratory portfolio

- The company has a para 4 filing and has a partnership with a generic company.

Future acquisition

- Company is open to acquisition which would be easy to digest

- India and us business are very attractive but company is not seeing huge potential in capital allocation towards acquisition.

- Company is open to acquisition which would be easy to digest

- India and us business are very attractive but company is not seeing huge potential in capital allocation towards acquisition.

• • •

Missing some Tweet in this thread? You can try to

force a refresh