@fintelegra nice article on #thechange #bitconvert I'm not surprised that they have been on your radar as a scam operator. They have a sketchy history entwined in the #isignthis $isx train-wreck @ASX and @asicmedia

fintelegram.org/r4i-scam-facil…

fintelegram.org/r4i-scam-facil…

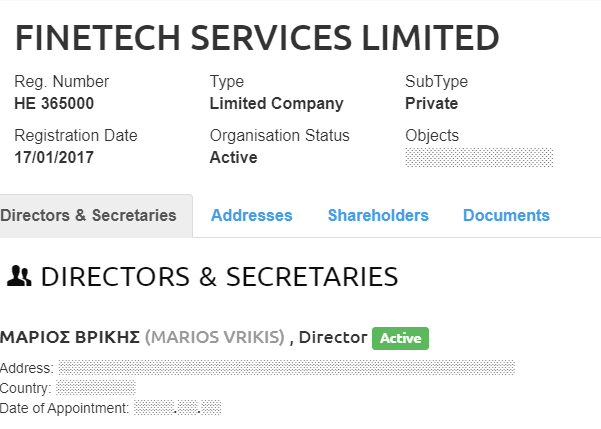

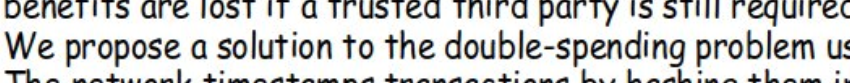

A bit of a recap according to $isx #bitconvert is the successor company to #immoservis a Czech company that was counterparty to one of the allegedly 'suspect' agreements central to the issue of 336m shares to $isx management

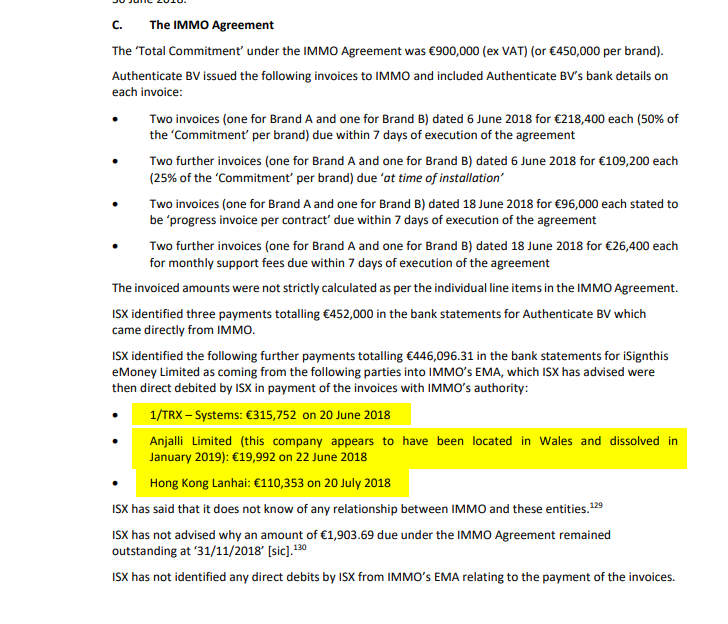

The whole deal started out stinky when the IMMO agreement was signed by the straw director (and sole director) 5 days after resigning from the company.

$ISX had to outsource the work which was completed in record time (lets not even talk about the faceless, contactless group that was contracted to provide the work).

money flowed in for payment from various ratholes... of which $isx wasn't sure how they were related to #immo

One of the key issues raised by @asx was that these contracts were not business as usual services, and very conveniently timed to coincide with the issuing of 336m shares to insiders.

$isx defence is while #immo didn't produce any revenues its successor #bitconvert became a 'large' customer processing AU$35m in funds for #bitconvert (and the very dodgy #fcorp)

@ebit4u perhaps $isx can help with your investigations into the recovery of victims funds from #bitconvert and #thechange they clearly have a solid relationship.

@threadreaderapp rollup

• • •

Missing some Tweet in this thread? You can try to

force a refresh