What is scaling in - out?

1. Scaling in is adding on to the positions when they move in our favor (Pyramiding).

2. Scaling - out is exiting the portion of the position when the trade moves in our favor.

I have explained about pyramiding in previous tweets.

1. Scaling in is adding on to the positions when they move in our favor (Pyramiding).

2. Scaling - out is exiting the portion of the position when the trade moves in our favor.

I have explained about pyramiding in previous tweets.

// Why use scaling out instead of exiting all position at once ?

When you are using ALL - out method where you exit positions at once, mostly you use wider Trail SL as you want to capture big moves and exit all when trail sl hits.

When you are using ALL - out method where you exit positions at once, mostly you use wider Trail SL as you want to capture big moves and exit all when trail sl hits.

The problem with this method is that either you make too big or many times your medium size winners turns out to become Scratch trades.

So, when we use the scaling out method, we are trying to capture most of our medium size trades , so that they do not turn into scratch trades.

So, when we use the scaling out method, we are trying to capture most of our medium size trades , so that they do not turn into scratch trades.

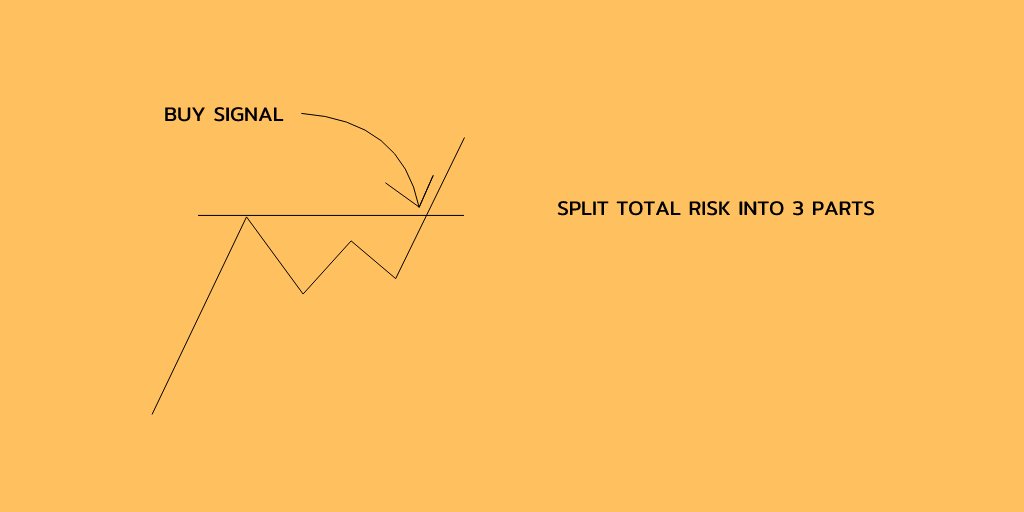

// How to use scaling out method -

Say we have to got a signal to enter in a trade, and we have to buy 1200 qty according to our Position sizing.

So, we have to divide this 1200 qty into parts, how much? It depends on you.

We can divide into 3 parts, each part 400 qty.

Say we have to got a signal to enter in a trade, and we have to buy 1200 qty according to our Position sizing.

So, we have to divide this 1200 qty into parts, how much? It depends on you.

We can divide into 3 parts, each part 400 qty.

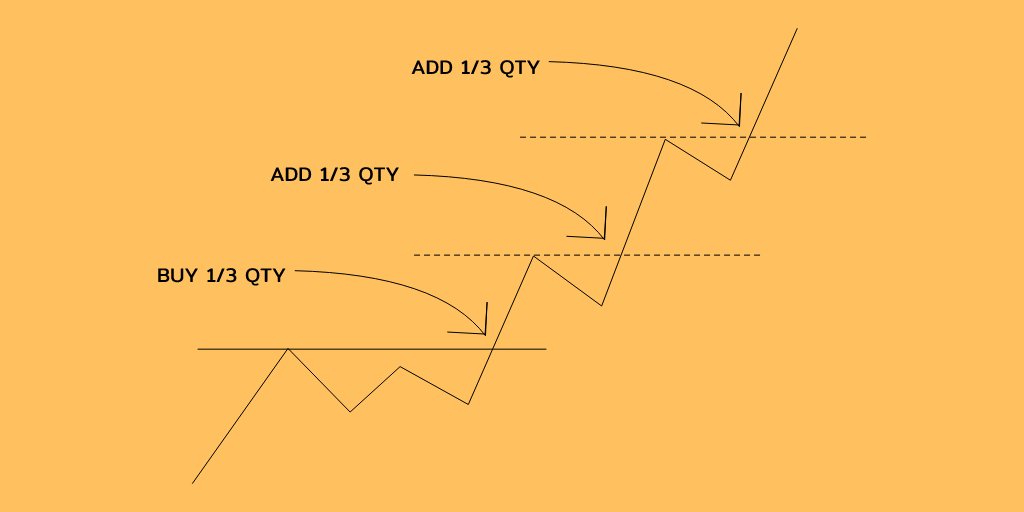

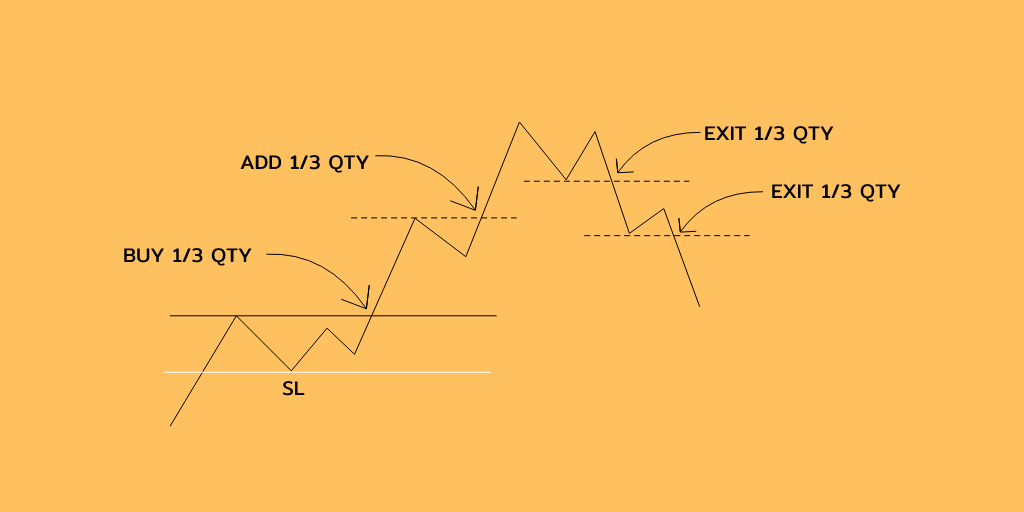

So initially when we get a signal to buy we will buy only 400 qty.

Now , we will wait for the stock to go in our direction and then add , we can use various methods for determining when to add, like Structure method, RR method.

I have covered these in pyramiding thread.

Now , we will wait for the stock to go in our direction and then add , we can use various methods for determining when to add, like Structure method, RR method.

I have covered these in pyramiding thread.

We add 400 qty when stock breaks above swing high, then again add 400 qty on second swing high break.

// Now we are done with 1st part, of scaling in, We now have 1200 qty.

Now comes the second part, of exiting the positions.

// Now we are done with 1st part, of scaling in, We now have 1200 qty.

Now comes the second part, of exiting the positions.

There are various methods we can use to decide where to exit positions.

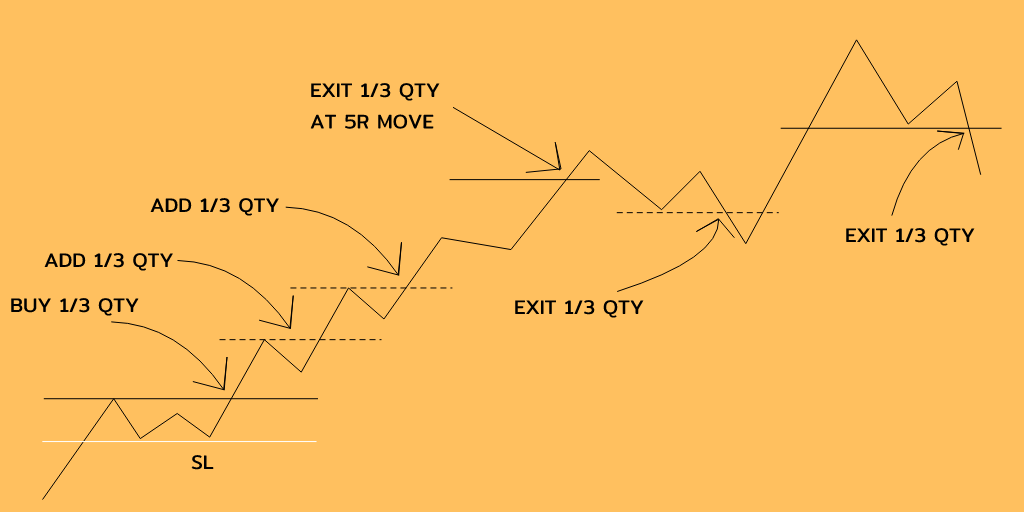

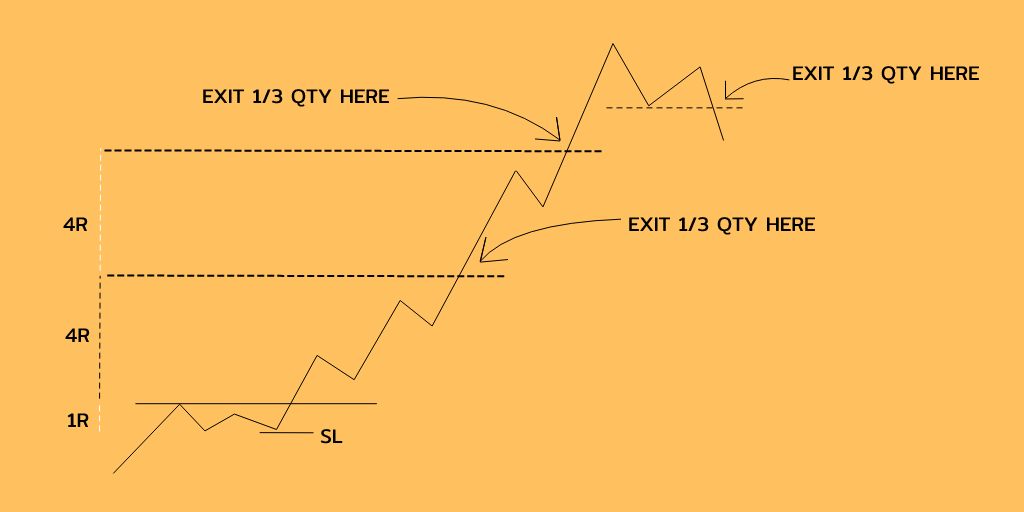

1. Exiting using R -

• In this method we will decide the exiting levels is advance.

• Eg- We can exit 1st position at 4 R and second position at 8 R and the last qty we can trail using Swing method.

1. Exiting using R -

• In this method we will decide the exiting levels is advance.

• Eg- We can exit 1st position at 4 R and second position at 8 R and the last qty we can trail using Swing method.

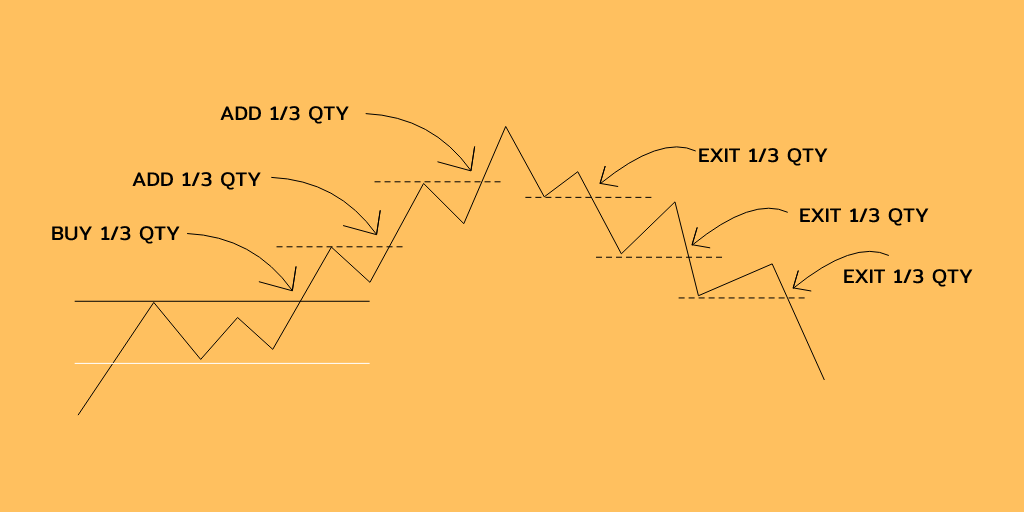

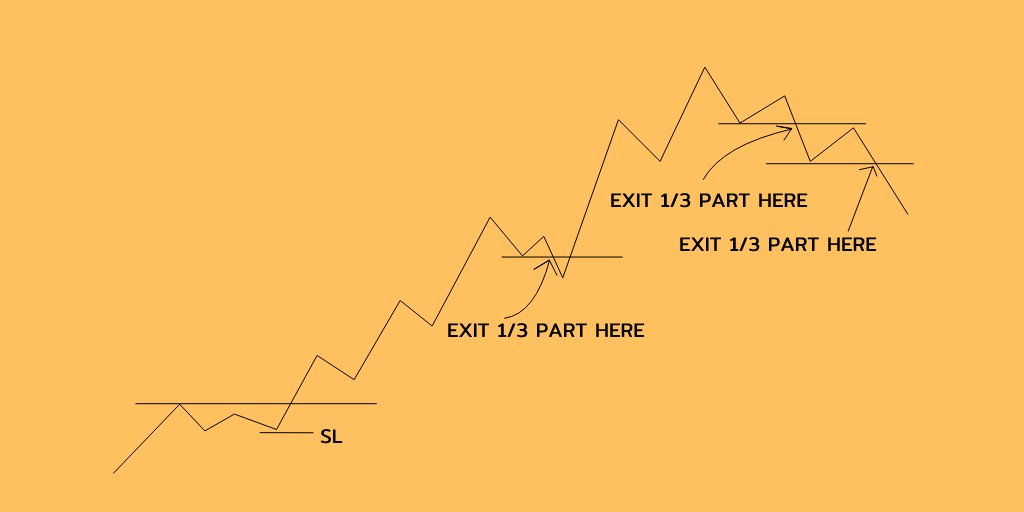

2. Exiting using swing points -

• In this method we will exit 1/3 part every time when stock breaks below swing points.

• In this method we will exit 1/3 part every time when stock breaks below swing points.

Now we know how can we use this method, now lets see how it plays out in different scenarios.

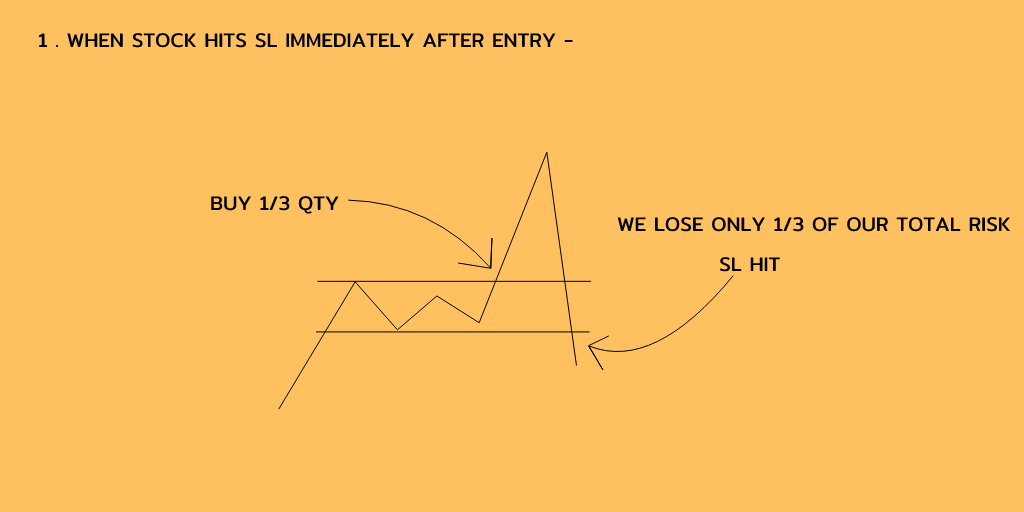

SCENARIO 1 - When stock hits our sl after entry.

• In this case we will only loose 1/3 of the total risk we are willing to take on a trade.

SCENARIO 1 - When stock hits our sl after entry.

• In this case we will only loose 1/3 of the total risk we are willing to take on a trade.

SCENARIO 2 - When stock moves in our direction initially but then go against us.

• In this case we will exit the 1/3 qty when stock shows weakness, break of swing low, etc.

• Exit 1/3 qty again when it breaks swing low.

• In this case we will exit the 1/3 qty when stock shows weakness, break of swing low, etc.

• Exit 1/3 qty again when it breaks swing low.

Now, I think you may have got the idea of what we are trying to do.

Basically we are adding on the strengths and exiting portion of the positions when the stock shows some weakness.

Now, lets look at some Important points when using this method -

Basically we are adding on the strengths and exiting portion of the positions when the stock shows some weakness.

Now, lets look at some Important points when using this method -

• SMALL LOSERS -

Because we are entering only with portion of our risk, initially we are risking very low, and you can check that most of your trades go wrong immediately after you take them.

Because we are entering only with portion of our risk, initially we are risking very low, and you can check that most of your trades go wrong immediately after you take them.

• MORE WINNERS -

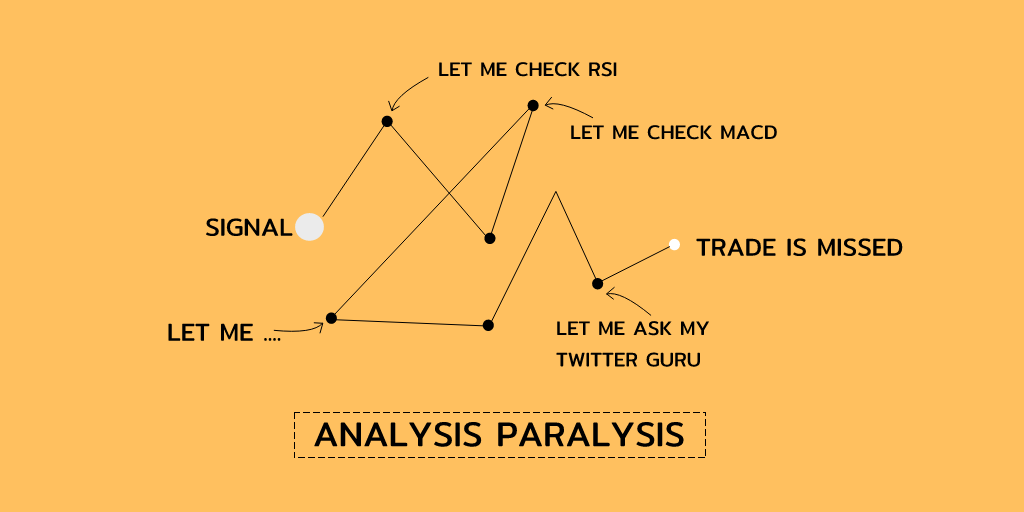

When you exit your positions at one point when you use the ALL- OUT method, Many times again the stock moves in our favor, and not everyone can do re-entry,

When you exit your positions at one point when you use the ALL- OUT method, Many times again the stock moves in our favor, and not everyone can do re-entry,

but when you use this you only exit part positions at once , So even after exiting part positions you can still ride the winners.

• Not Necessarily more profitable -

• Not Necessarily more profitable -

It is used to keep your equity curve more smoother as when you use ALL - out method you will have great fluctuations in your equity curve as you have to use wider sl to ride winners .

• Need High discretion, I have only seen discretionary traders to use this method.

• Need High discretion, I have only seen discretionary traders to use this method.

These are only my views and not necessarily be yours.

Cheers,

TRADER KNIGHT

Cheers,

TRADER KNIGHT

I think @SunderjiJB sir use similar kind of method and he mostly trades intraday if I am not wrong.

• • •

Missing some Tweet in this thread? You can try to

force a refresh