$IPOE/@sofi -- the company helping you "get your money right" on the pursuit of financial independence w/a complete suite of tools to:

-- borrow

-- save

-- invest

-- spend

Why @Sofi might just be so fine 🤷♂️... a thread 👇

-- borrow

-- save

-- invest

-- spend

Why @Sofi might just be so fine 🤷♂️... a thread 👇

Sofi's products:

a) For B2C:

-- home/personal/student loans & refi (@NerdWallet's personal loan score below)

-- credit

-- banking

-- investing

Targets "high earners not well served" (HENWS)

b) For B2B:

-- API open to enterprise clients (more later)

nerdwallet.com/reviews/loans/…

a) For B2C:

-- home/personal/student loans & refi (@NerdWallet's personal loan score below)

-- credit

-- banking

-- investing

Targets "high earners not well served" (HENWS)

b) For B2B:

-- API open to enterprise clients (more later)

nerdwallet.com/reviews/loans/…

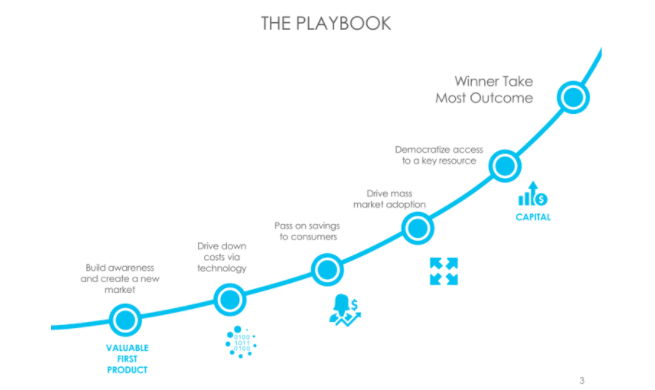

Sofi aims to:

a) Be a consumer's "one-stop shop" for digital fin services

b) Be the $AMZN/@awscloud of fintech (their comp not mine 🙂)

-- AKA dominate both B2B & B2C fintech landscapes

c) Pass savings from digitization onto users to drive scale

d) Be the "winner take most"

a) Be a consumer's "one-stop shop" for digital fin services

b) Be the $AMZN/@awscloud of fintech (their comp not mine 🙂)

-- AKA dominate both B2B & B2C fintech landscapes

c) Pass savings from digitization onto users to drive scale

d) Be the "winner take most"

Sofi's edge: (1/3)

a) “Fastest way to do everything"

-- borrow $

-- trade stock (others are as fast)

-- bank

-- bill/transact

b) Quality & quantity of selection -- offerings for all user types

-- unique terms (nothing cookie-cutter)

-- personalized benefits

--❗️GENEROUS rates❗️

a) “Fastest way to do everything"

-- borrow $

-- trade stock (others are as fast)

-- bank

-- bill/transact

b) Quality & quantity of selection -- offerings for all user types

-- unique terms (nothing cookie-cutter)

-- personalized benefits

--❗️GENEROUS rates❗️

Sofi's edge: (2/3)

c) Convenience

-- any time/platform/place

d) Social/financial integration w/Sofi's "home feed"

-- personal feed of fin news/advice

-- added 15% to sales

e) Content

-- education

-- credit score & budgeting

-- remote access to CFPs

sofi.com/learn/content/…

c) Convenience

-- any time/platform/place

d) Social/financial integration w/Sofi's "home feed"

-- personal feed of fin news/advice

-- added 15% to sales

e) Content

-- education

-- credit score & budgeting

-- remote access to CFPs

sofi.com/learn/content/…

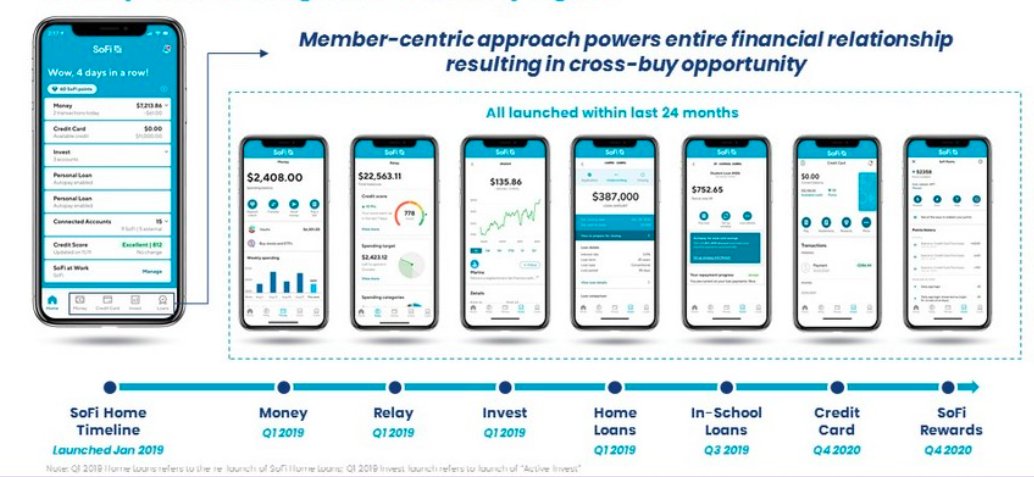

Sofi's edge (3/3) -- summing it up

Full loan stack built w/innovation focus

-- enabled 5 product launches in 1 year

-- enables B2B expansion (more later)

Creates a feedback loop (sorry for the cliché)

-- more iterations

-- lower cost

-- actionable data to feed more improvement

Full loan stack built w/innovation focus

-- enabled 5 product launches in 1 year

-- enables B2B expansion (more later)

Creates a feedback loop (sorry for the cliché)

-- more iterations

-- lower cost

-- actionable data to feed more improvement

Sofi philosophy -- "Create the fin services productivity loop (FSPL)"

Meaning? It's a land & expand approach:

-- build loyalty w/1st product

-- build products so they're "better together"

-- leverage leading LTV/CAC to fuel growth

Similar to $LMND's insurance playbook.

Meaning? It's a land & expand approach:

-- build loyalty w/1st product

-- build products so they're "better together"

-- leverage leading LTV/CAC to fuel growth

Similar to $LMND's insurance playbook.

Cross-selling feeds this loop:

1 money product:

-- $250 revs

-- 34% profit margin

-- $40 CAC

Money + loan product w/cross-selling

-- $2311 revs

-- 80% profit margin

-- $40 CAC

24% of new sales to existing users.

Boosts LTV/CAC.

Justifies more investment in growth.

1 money product:

-- $250 revs

-- 34% profit margin

-- $40 CAC

Money + loan product w/cross-selling

-- $2311 revs

-- 80% profit margin

-- $40 CAC

24% of new sales to existing users.

Boosts LTV/CAC.

Justifies more investment in growth.

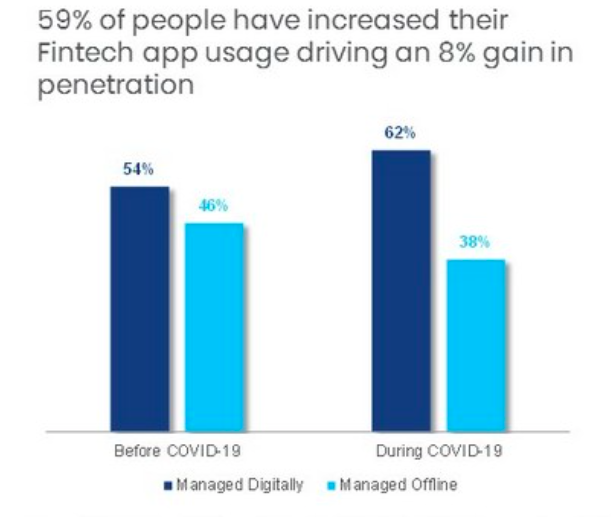

COVID-19's impact on fin services

a) Greatly accelerated fin-tech app usage (see chart below)

b) 87% of these evolving consumers say they'll stick w/digital banking due to

-- selection

-- service

-- convenience

-- flexibility

-- security

-- less fees

a) Greatly accelerated fin-tech app usage (see chart below)

b) 87% of these evolving consumers say they'll stick w/digital banking due to

-- selection

-- service

-- convenience

-- flexibility

-- security

-- less fees

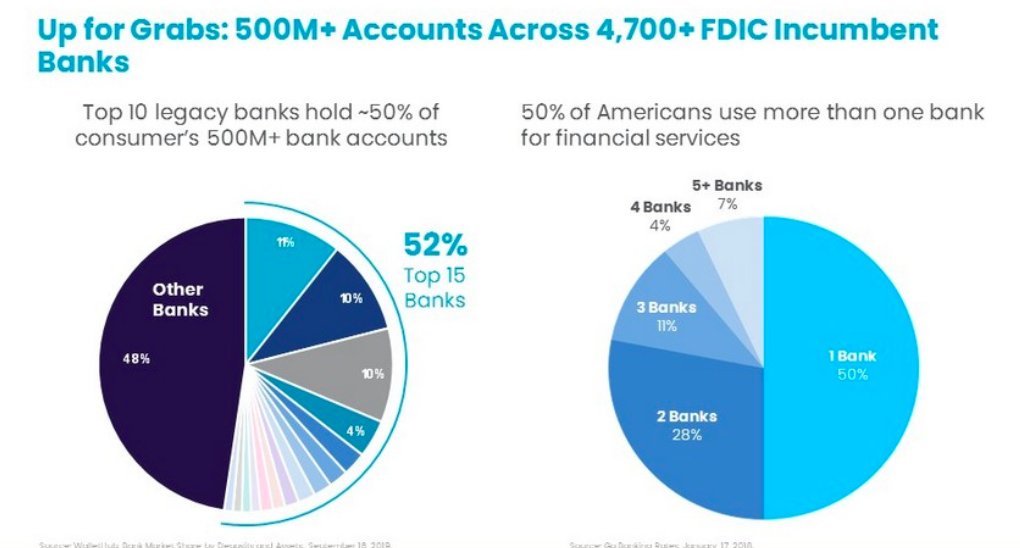

Sofi's industry dynamics:

a) Top 15 banks = 52% legacy acct market share

-- fragmented

b) 50% of us use more than 1 bank

-- 80% of us do so because no 1 bank has everything

-- Sofi is "only one-stop shop for digital financial services" according to the company

a) Top 15 banks = 52% legacy acct market share

-- fragmented

b) 50% of us use more than 1 bank

-- 80% of us do so because no 1 bank has everything

-- Sofi is "only one-stop shop for digital financial services" according to the company

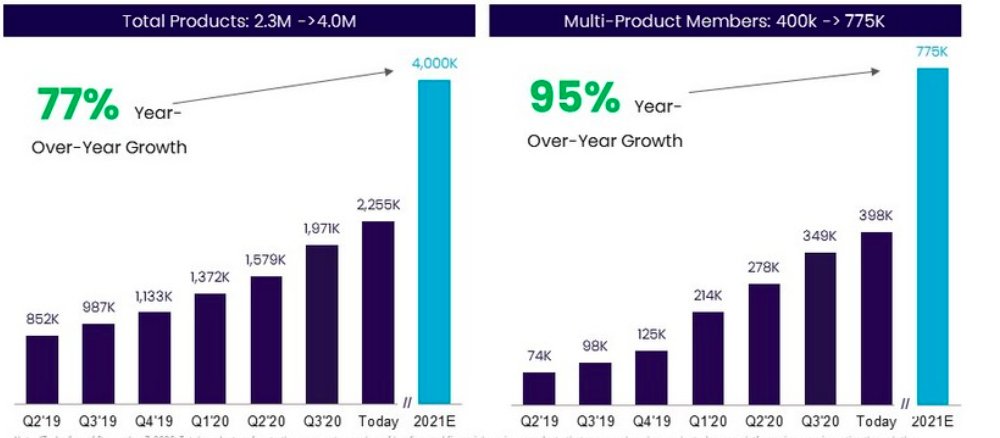

Demand looks good:

a) Users are growing -- that is expected

b) More importantly -- user growth has been & is continuing to accelerate

-- positive derivative points to strong momentum

c) Multi-product user base is growing rapidly too

a) Users are growing -- that is expected

b) More importantly -- user growth has been & is continuing to accelerate

-- positive derivative points to strong momentum

c) Multi-product user base is growing rapidly too

Secret sauce -- Galileo (1/3)

a) 2020 Sofi buys Galileo -- Sofi's B2B arm

-- $1.2B deal

b) Galileo

-- application programming interface (API) for payments & more fin services

-- "enables critical functionality w/an open API"

c) @RobinhoodApp @Chime @RevolutApp built using it

a) 2020 Sofi buys Galileo -- Sofi's B2B arm

-- $1.2B deal

b) Galileo

-- application programming interface (API) for payments & more fin services

-- "enables critical functionality w/an open API"

c) @RobinhoodApp @Chime @RevolutApp built using it

Secret sauce -- Galileo (2/3)

d) This B2B branch of Sofi offers:

-- account set-up/funding

-- direct deposit

-- bill pay

-- transaction notifications

-- point of sale authorization

& so much more

Sofi can also help legacy banks improve tech stacks w/Galileo -- win win

d) This B2B branch of Sofi offers:

-- account set-up/funding

-- direct deposit

-- bill pay

-- transaction notifications

-- point of sale authorization

& so much more

Sofi can also help legacy banks improve tech stacks w/Galileo -- win win

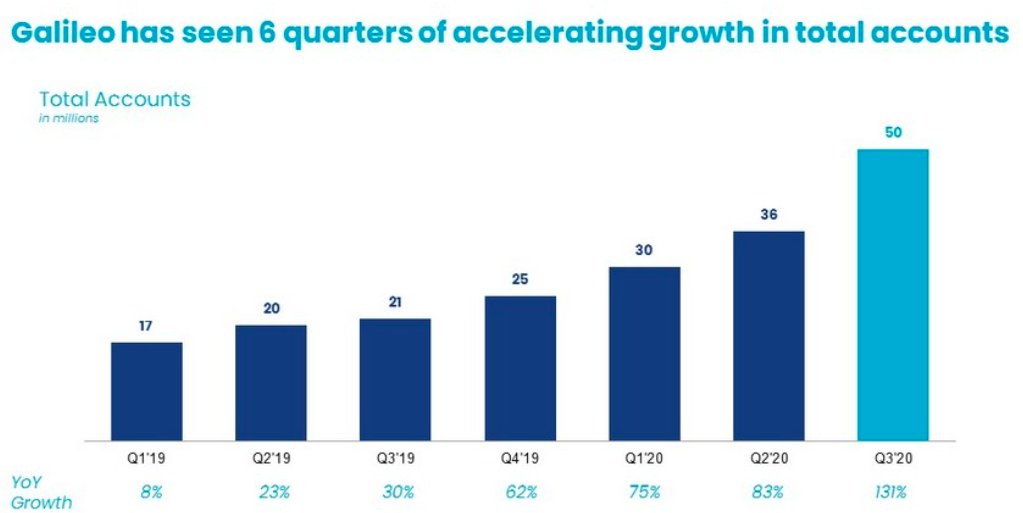

Secret sauce -- Galileo (3/3)

e) Galileo allows Sofi to

-- fuel direct deposit relationships

-- offer products to 50M new users

-- expand into new products & countries

f) Galileo owns 1/6 of Apex Clearing -- digital clearing house API

g) Galileo demand is accelerating 👍👇

e) Galileo allows Sofi to

-- fuel direct deposit relationships

-- offer products to 50M new users

-- expand into new products & countries

f) Galileo owns 1/6 of Apex Clearing -- digital clearing house API

g) Galileo demand is accelerating 👍👇

Financial forecasts -- NOT certain

2020:

-- revs up 38% to $621M

-- -11% adj EBITDA margin

-- -35.4% GAAP NI margin

2021:

-- revs up 57% to $980M

-- 2.7% adj EBITDA margin

-- -24.2% GAAP NI margin

2025:

-- 43% rev CAGR to $3.67B

-- 32% adj EBITDA margin

-- 17.3% GAAP NI margin

2020:

-- revs up 38% to $621M

-- -11% adj EBITDA margin

-- -35.4% GAAP NI margin

2021:

-- revs up 57% to $980M

-- 2.7% adj EBITDA margin

-- -24.2% GAAP NI margin

2025:

-- 43% rev CAGR to $3.67B

-- 32% adj EBITDA margin

-- 17.3% GAAP NI margin

SPAC deal:

a) Shares

-- 865.1M shares

-- 28.1M shares in warrants

-- 122.5M share PIPE

-- 80.5M IPOE shares

= ~1.1B shares

b) $

-- $1.9B on hand

c) valuation @ $19/share

= $20.9B cap - $1.9B in cash

= $19B fully diluted EV

d) 39X fully diluted EV/2023 EBITDA

a) Shares

-- 865.1M shares

-- 28.1M shares in warrants

-- 122.5M share PIPE

-- 80.5M IPOE shares

= ~1.1B shares

b) $

-- $1.9B on hand

c) valuation @ $19/share

= $20.9B cap - $1.9B in cash

= $19B fully diluted EV

d) 39X fully diluted EV/2023 EBITDA

A boost to operations:

In October 2020, Sofi was granted preliminary approval for a U.S. bank charter

This will enable:

-- a lower cost of capital

-- more net interest margin from longer loan holding periods

-- a boost to lending growth

👍

In October 2020, Sofi was granted preliminary approval for a U.S. bank charter

This will enable:

-- a lower cost of capital

-- more net interest margin from longer loan holding periods

-- a boost to lending growth

👍

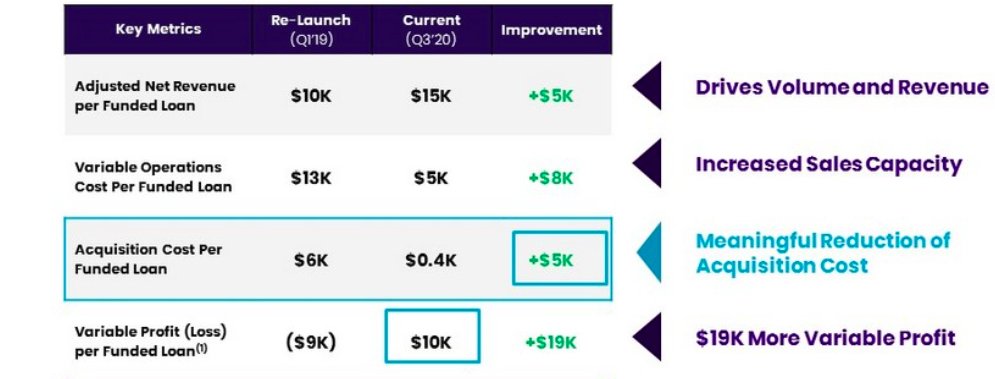

Summarizing Sofi's 3 rev streams:

1) Fin Services (digital banking)

-- 153% CAGR to 2025

-- "on path to profitability"

2) Lending (most mature segment)

-- 25% CAGR to 2025

-- 58% contribution margin

3) Tech platform (B2B, Galileo)

-- 55% CAGR to 2025

-- 62% contribution margin

1) Fin Services (digital banking)

-- 153% CAGR to 2025

-- "on path to profitability"

2) Lending (most mature segment)

-- 25% CAGR to 2025

-- 58% contribution margin

3) Tech platform (B2B, Galileo)

-- 55% CAGR to 2025

-- 62% contribution margin

Management: (1/3)

a) CEO Anthony Noto (NOT a founder)

-- COO & CFO $TWTR

-- co-head of TMT $GS

-- CFO @NFL

-- West Point grad

b) CFO Chris Lapointe

-- head of corporate FP&A $UBER

-- VP of TMT $GS

c) Head of product Assaf Ronen

-- VP of Voice @ $AMZN

-- GM @ $MSFT

a) CEO Anthony Noto (NOT a founder)

-- COO & CFO $TWTR

-- co-head of TMT $GS

-- CFO @NFL

-- West Point grad

b) CFO Chris Lapointe

-- head of corporate FP&A $UBER

-- VP of TMT $GS

c) Head of product Assaf Ronen

-- VP of Voice @ $AMZN

-- GM @ $MSFT

Management: (2/3)

d) CMO Lauren Webb

-- marketing VP $INTU

-- brand manager $PG

e) Head of ops Micah Heavener

-- managing director $C

-- Infantry Captain in the US Army

f) Head of people Anna Avalos

-- Former HR leader $TSLA

-- Director of human resources $SYK

d) CMO Lauren Webb

-- marketing VP $INTU

-- brand manager $PG

e) Head of ops Micah Heavener

-- managing director $C

-- Infantry Captain in the US Army

f) Head of people Anna Avalos

-- Former HR leader $TSLA

-- Director of human resources $SYK

Management: (3/3)

g) CEO/co-founder Mike Cagney stepped down in 2017 amid sexual harassment allegations

-- obviously never good

-- why Noto & his team's sparkling resumes are vital

-- bloomberg.com/news/articles/…

h) @Glassdoor ratings are pretty average

-- glassdoor.com/Reviews/SoFi-R…

g) CEO/co-founder Mike Cagney stepped down in 2017 amid sexual harassment allegations

-- obviously never good

-- why Noto & his team's sparkling resumes are vital

-- bloomberg.com/news/articles/…

h) @Glassdoor ratings are pretty average

-- glassdoor.com/Reviews/SoFi-R…

Risks:

a) Crowded

-- fintech entrants abundant

b) Estimating a big growth boost -- not certain & needs to happen

c) $SQ $PYPL

-- could offer everything Sofi does

-- larger user bases

d) Rates

-- NIM compression if yield curve flattens

-- rate hikes = lower loan affordability

a) Crowded

-- fintech entrants abundant

b) Estimating a big growth boost -- not certain & needs to happen

c) $SQ $PYPL

-- could offer everything Sofi does

-- larger user bases

d) Rates

-- NIM compression if yield curve flattens

-- rate hikes = lower loan affordability

Chamath's Investor call notes:

-- "churn better than any other fintech we met"

-- 90% of new neobank accts run on Sofi tech

-- modern tech stack enables B2B expansion like $AMZN w/AWS -- that's his game changer

-- complete suite of products stands out among individual solutions

-- "churn better than any other fintech we met"

-- 90% of new neobank accts run on Sofi tech

-- modern tech stack enables B2B expansion like $AMZN w/AWS -- that's his game changer

-- complete suite of products stands out among individual solutions

Noto's Investor call notes:

-- "better economics than any other DTC tech company I have seen"

-- Galileo acquisition improves economics of Sofi's money product by 20%

-- will soon launch social portfolios so users can invest w/people on the platform they follow

-- "better economics than any other DTC tech company I have seen"

-- Galileo acquisition improves economics of Sofi's money product by 20%

-- will soon launch social portfolios so users can invest w/people on the platform they follow

Plan:

I love the products from experience & the path/mgmt from digging in.

Will start a SMALL position tomorrow.

The forecasted boost in growth MUST happen. If it doesn't occur I'll be out & posting a swing & miss gif.

Leash is shorter on this one.

Will be long @Sofi

I love the products from experience & the path/mgmt from digging in.

Will start a SMALL position tomorrow.

The forecasted boost in growth MUST happen. If it doesn't occur I'll be out & posting a swing & miss gif.

Leash is shorter on this one.

Will be long @Sofi

• • •

Missing some Tweet in this thread? You can try to

force a refresh