$ROKU crushed👊2020 and has been flying high✈️ in 2021.

1) Here's a quick look under the hood:

#Investing #stocks #StocksToWatch #stockpicks2021

1) Here's a quick look under the hood:

#Investing #stocks #StocksToWatch #stockpicks2021

2) Basics:

➡️Listing: NASDAQ

➡️Segment: TV streaming platform and hardware provider

➡️Mkt Cap: $50.7B

➡️Listing: NASDAQ

➡️Segment: TV streaming platform and hardware provider

➡️Mkt Cap: $50.7B

3) Elevator 🛗 Pitch: ‘Roku has won the streaming war, now the leading TV streaming platform in the US. Roku allows you to watch paid & free content such as Netflix, Amazon, Hulu, YouTube, etc. All Roku devices & TV need is an internet connection to get going’

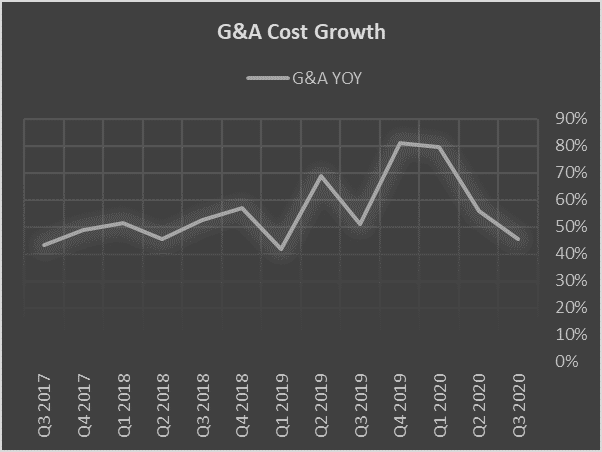

4) Mission Statement: ‘To be the TV streaming platform that connects the entire TV ecosystem around the world’

5) Revenues - generated from:

➡️Ads & Commission: Ad sales, subscription & transaction revenue share, branded channel buttons on remotes and licensing arrangements with TV brands & operators.

➡️Devices & Accessories: Hardware i.e. streaming players, sound bars etc.

➡️Ads & Commission: Ad sales, subscription & transaction revenue share, branded channel buttons on remotes and licensing arrangements with TV brands & operators.

➡️Devices & Accessories: Hardware i.e. streaming players, sound bars etc.

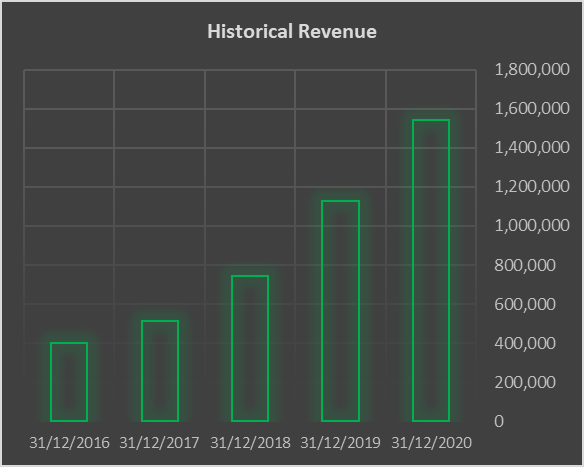

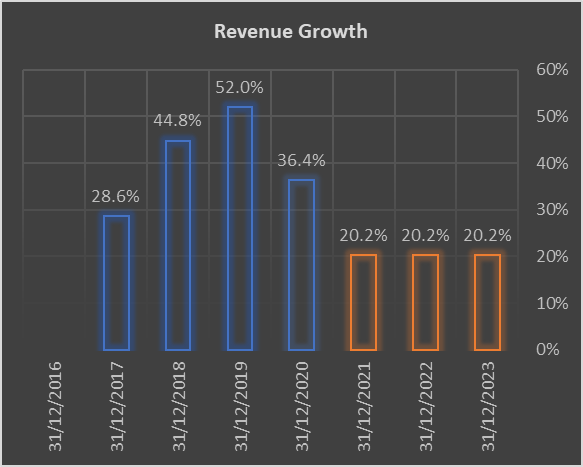

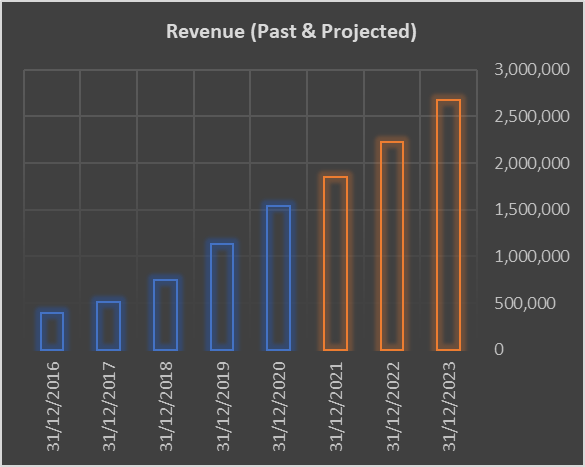

6) Revenues continued:

Revenue grew📈at 41% YOY from 2016 - 2020.

Using a conservative growth rate (20% YOY), it’s reasonable to expect ROKU to deliver $2.7B in revenue by 2023 end.

Revenue grew📈at 41% YOY from 2016 - 2020.

Using a conservative growth rate (20% YOY), it’s reasonable to expect ROKU to deliver $2.7B in revenue by 2023 end.

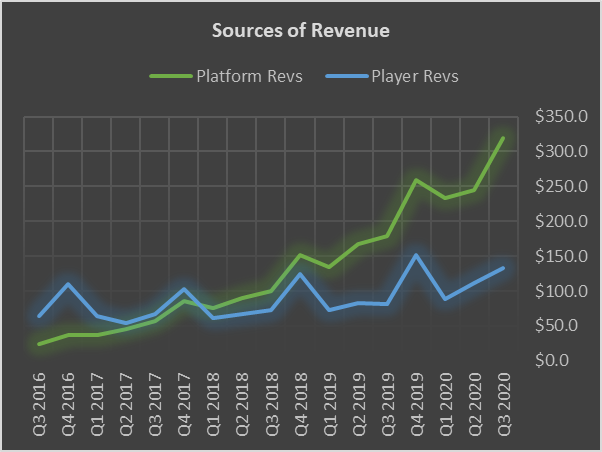

7) Revenue Engines⚙️: Platform Revenue now comfortably outstripping hardware & devices sold, which is unsurprising given the inelastic (and often discounted) price of devices used to build Roku’s network base:

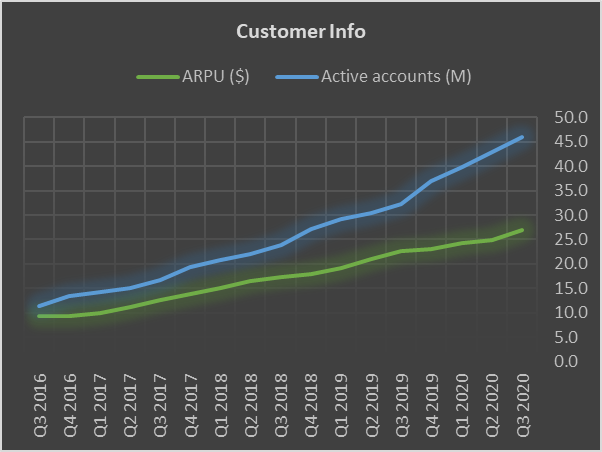

8) Customers & Income📈: Active accounts growing strongly, ARPU (Average Revenue per User) also growing – these trends combined are a big boost for top line growth:

9) Runway🛫: The key questions here are👇

➡️How big is the pie🥧(Mkt size, growth)?

➡️How much can ROKU capture (Mkt share)?

➡️How big is the pie🥧(Mkt size, growth)?

➡️How much can ROKU capture (Mkt share)?

10) The market:

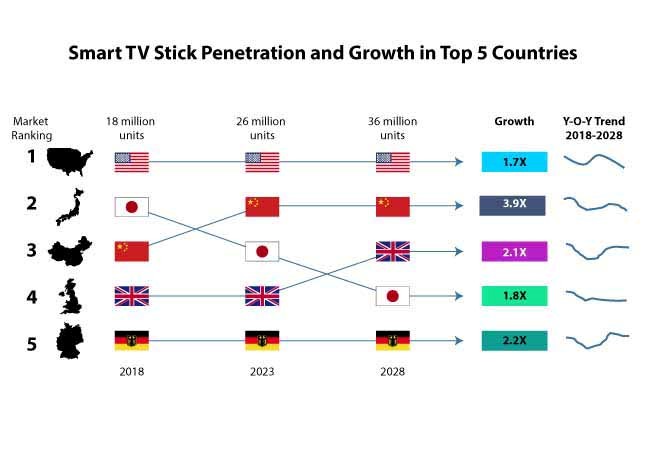

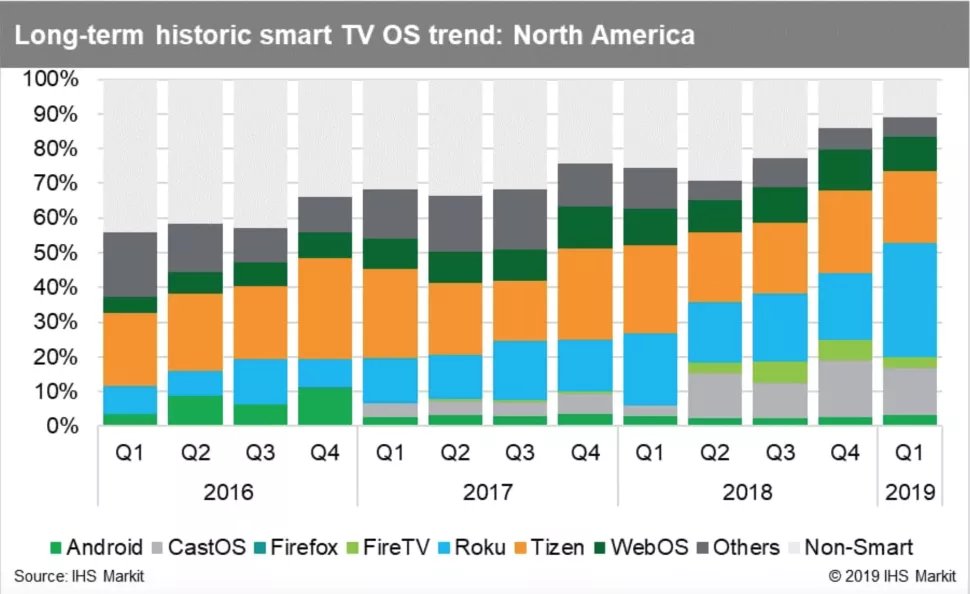

✅North America most mature market but with growth capacity remaining.

✅APAC region has biggest future potential. ROKU has an agreement with Hisense / TCL of China to provide its OS on smart TV’s and entered the UK market in late 2019:

✅North America most mature market but with growth capacity remaining.

✅APAC region has biggest future potential. ROKU has an agreement with Hisense / TCL of China to provide its OS on smart TV’s and entered the UK market in late 2019:

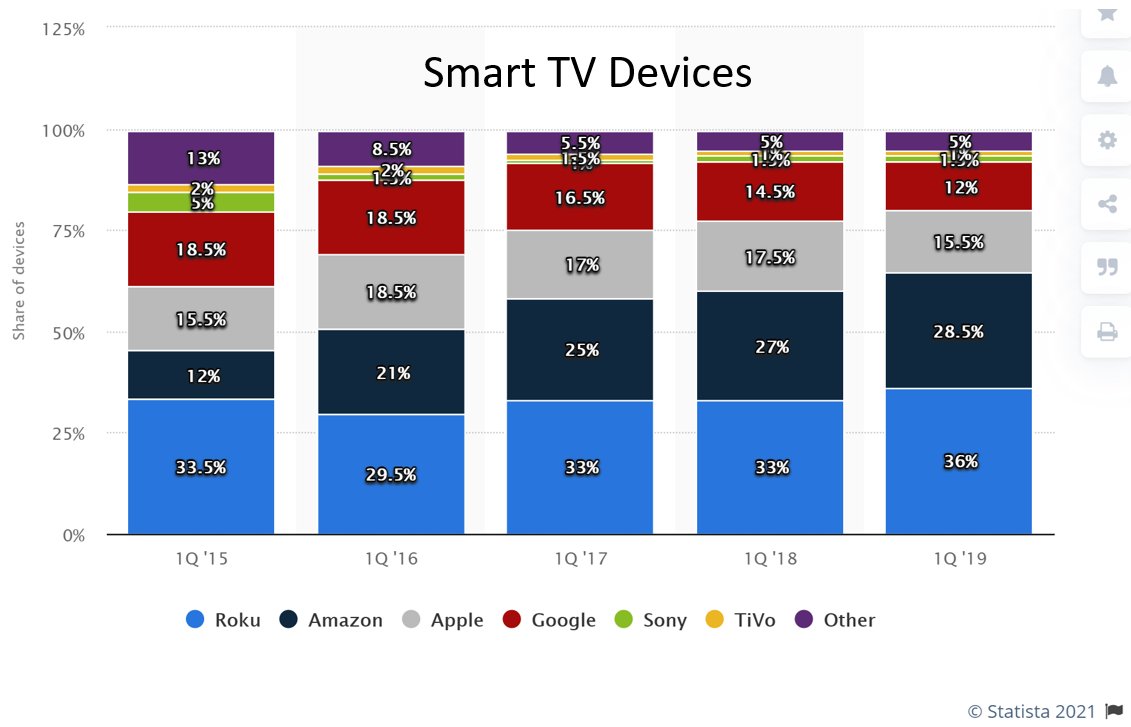

11) Mkt Share: In the US, ROKU has established a dominant position in media streaming players, with 36% of market share as of 1Q 2019:

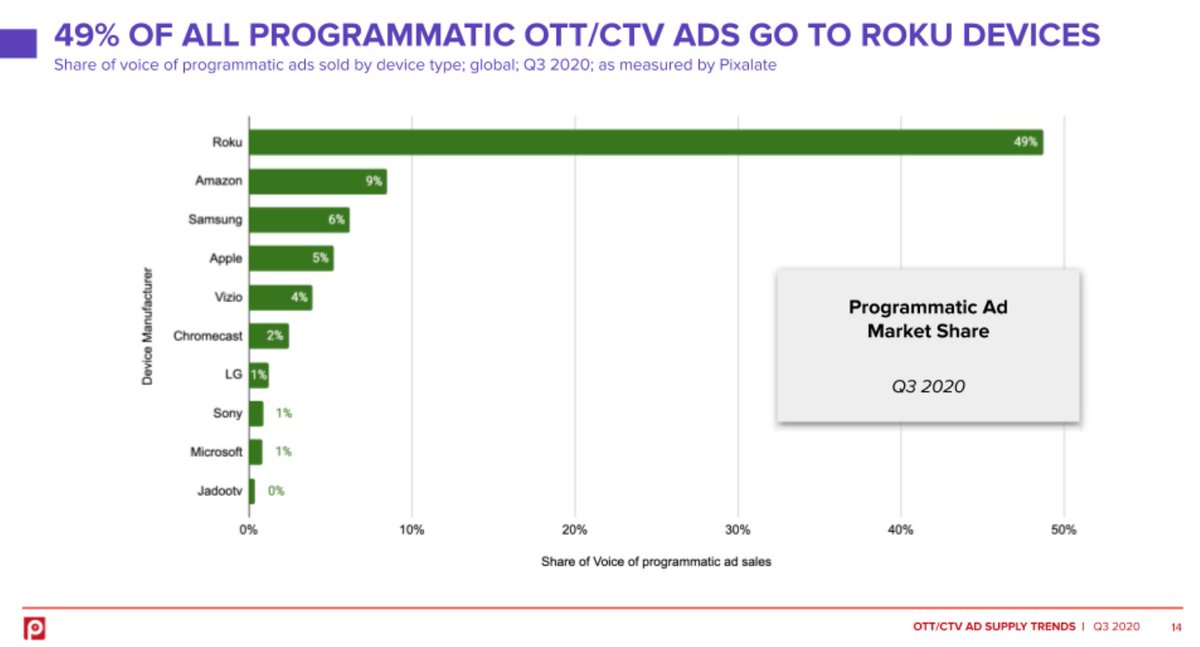

12) Mkt Share Continued: ROKU has captured 49% of all OTT (Over the top - bypasses cable, broadcast, and satellite TV) adverts – another extremely bullish metric👇

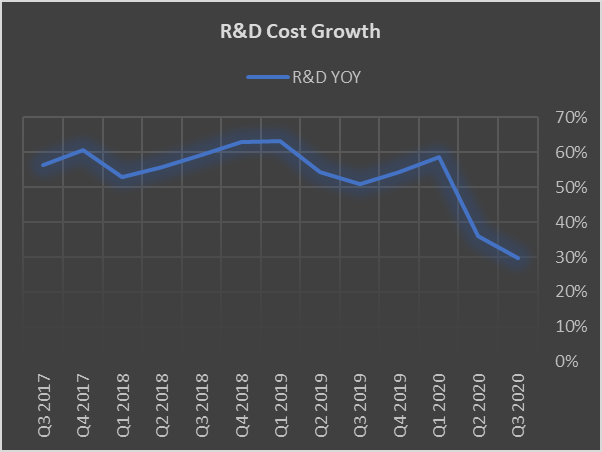

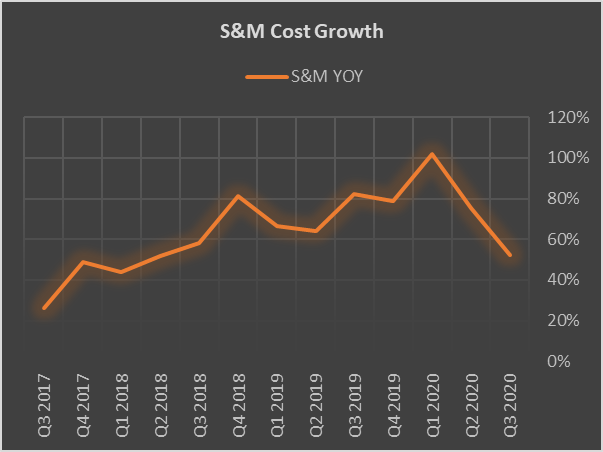

13) Costs💲: We’ve seen the trend of increasing income🔼, now let’s look at outgoings🔽:

✅R&D and S&M (78% of operating cost) show clear reduction across 2020, which coupled with exploding Revs bodes well for profitability👇

✅R&D and S&M (78% of operating cost) show clear reduction across 2020, which coupled with exploding Revs bodes well for profitability👇

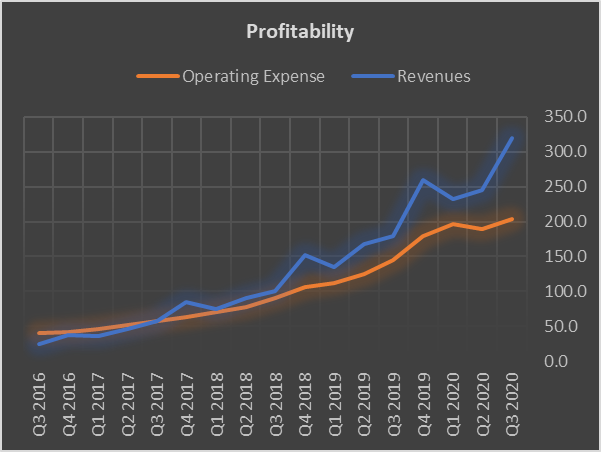

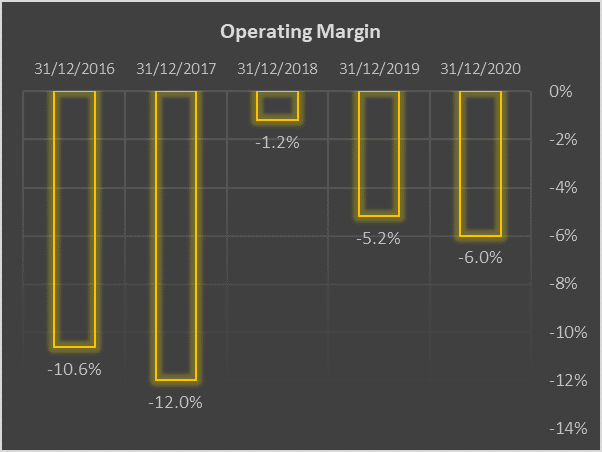

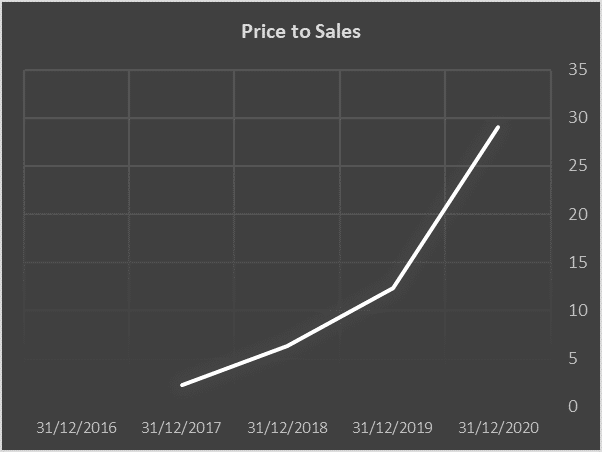

14) Ratios & Margins:

Revs now outstrip operating expense – bullish sign, gap likely to widen in 2021.

Operating Margin – though negative - is trending, suggesting profitability is near.

P/S has exploded recently, with ROKU’s quality and prospects being priced in:

Revs now outstrip operating expense – bullish sign, gap likely to widen in 2021.

Operating Margin – though negative - is trending, suggesting profitability is near.

P/S has exploded recently, with ROKU’s quality and prospects being priced in:

15) Share Price:

Traded in upward channel from Mar – Oct ‘20. Price broke out thereafter, rising post Q3 results on 5th Nov.

Q4 continued this upward trend, indicating significant price support. SP is outstripping top line sales on expectation of continued strong growth.

Traded in upward channel from Mar – Oct ‘20. Price broke out thereafter, rising post Q3 results on 5th Nov.

Q4 continued this upward trend, indicating significant price support. SP is outstripping top line sales on expectation of continued strong growth.

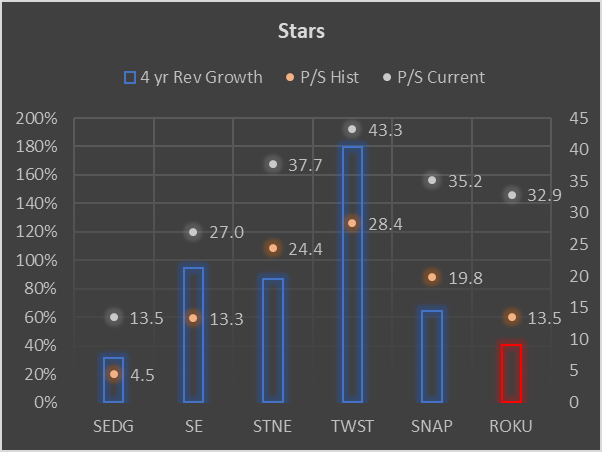

16) Is ROKU a Star🌟pick?

➡️Revenue growth – although impressive – is outstripped by other picks $TWST, $SE, $STNE and $SNAP, with only $SEDG bettered.

➡️Otherwise ROKU does not appear cheap or expensive vs the rest:

➡️Revenue growth – although impressive – is outstripped by other picks $TWST, $SE, $STNE and $SNAP, with only $SEDG bettered.

➡️Otherwise ROKU does not appear cheap or expensive vs the rest:

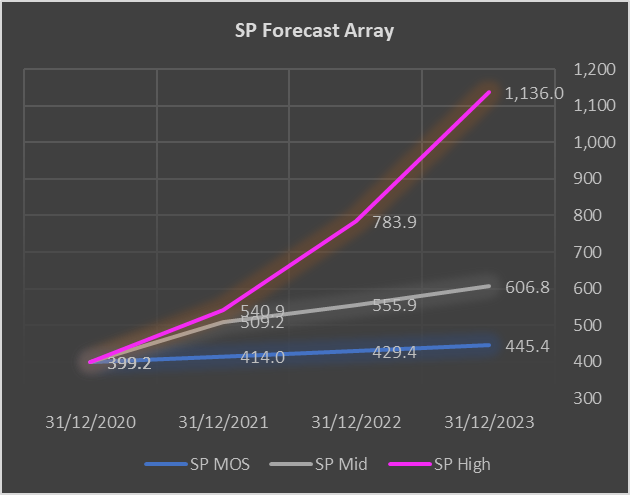

17) Price Potential (Low) - with reasonable MoS (50% of historical Rev growth rate, share dilution and tapered P/S values):

⭐Target of $445 per share at 2023 end is reasonable. (+12% on today’s price of $399)

⭐Target of $445 per share at 2023 end is reasonable. (+12% on today’s price of $399)

18) Price Potential (Mid) – using historical Rev growth rate, share dilution and current P/S values:

⭐Target of $607 per share at 2023 end is reasonable. (+52% on today’s price of $399)

⭐Target of $607 per share at 2023 end is reasonable. (+52% on today’s price of $399)

19) Price Potential (High) – If ARPU and Active users grow per recent trends (turbocharging Rev growth), and with a conservative view on Player Revs, a compelling High case is possible:

⭐Target of $1,136 per share at 2023 end is reasonable. (+185% on today’s price of $399)

⭐Target of $1,136 per share at 2023 end is reasonable. (+185% on today’s price of $399)

20) Conclusion: Growth to date has been phenomenal, underpinned by strong fundamentals. Revs accelerating & costs falling a big tailwind for 2021.

Recent price action diluted the value proposition – good opportunity to buy ROKU on any pullback.

Recent price action diluted the value proposition – good opportunity to buy ROKU on any pullback.

@threadreaderapp "unroll"

• • •

Missing some Tweet in this thread? You can try to

force a refresh