last year, @nssylla and I warned that France & G20 are planting budgetary time bombs in Africa through a conveyor belt that transfers their fiscal resources to institutional investors in the Global North.

https://twitter.com/DanielaGabor/status/1342039164687183873

news from Kenya today about one critical element of that conveyor belt - Public Private Partnerships through which state guarantees private profits.

The IMF estimated those derisking commitments to be around 8% of GDP in 2019 (and stressed this is a significant underestimate)

The IMF estimated those derisking commitments to be around 8% of GDP in 2019 (and stressed this is a significant underestimate)

today, under IMF pressure (and as it finally joined the DSSI club), Kenyan Treasury accepted to include those PPP derisking commitment in public debt numbers

https://twitter.com/kopalo/status/1348506142285160451?s=20

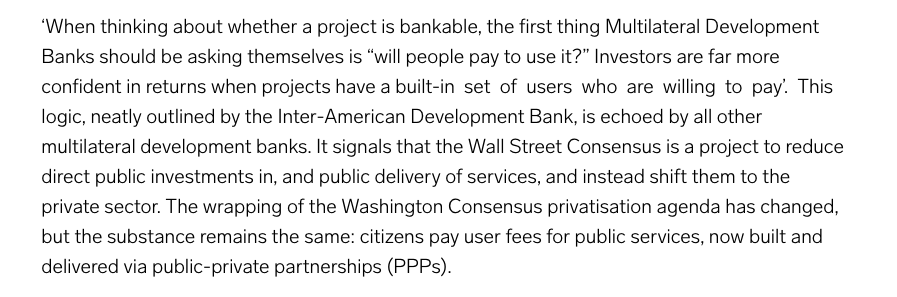

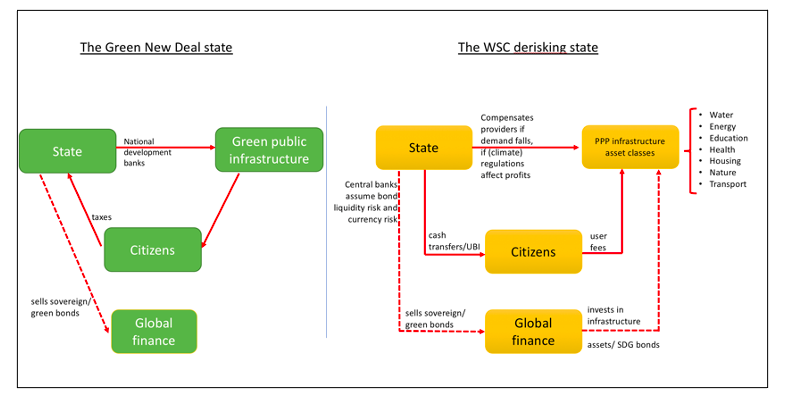

this could be welcome news: contingent liabilities should be counted into public debt numbers to prevent the state from throwing itself into mega-infrastructure projects in the name of constructing development assets for institutional investors.

but is it really? the political arithmetic of public debt, as @dmugge would put, cannot be separated from the overall push for infrastructure as a development asset class.

So what we may get instead is even less quality public investment, and more PPP derisking.

So what we may get instead is even less quality public investment, and more PPP derisking.

👀👀👀👀👀👀👀👀

at the long-end of this expensive PPP highway stands the French asset manager Meridiam, Macron's key partner in development as derisking infrastructure asset classes project h/t @crystalsimeoni

at the long-end of this expensive PPP highway stands the French asset manager Meridiam, Macron's key partner in development as derisking infrastructure asset classes project h/t @crystalsimeoni

https://twitter.com/DavidNdii/status/1311019088119029765?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh