1) Let's talk about my favourite video platform Bilibili. What is it, what it isn't and and how it makes money. It's been called the Chinese YouTube that that framing lacks imaginary.

The $bili stock also 5x in 2020 - who knew weebs could be so lucrative

The $bili stock also 5x in 2020 - who knew weebs could be so lucrative

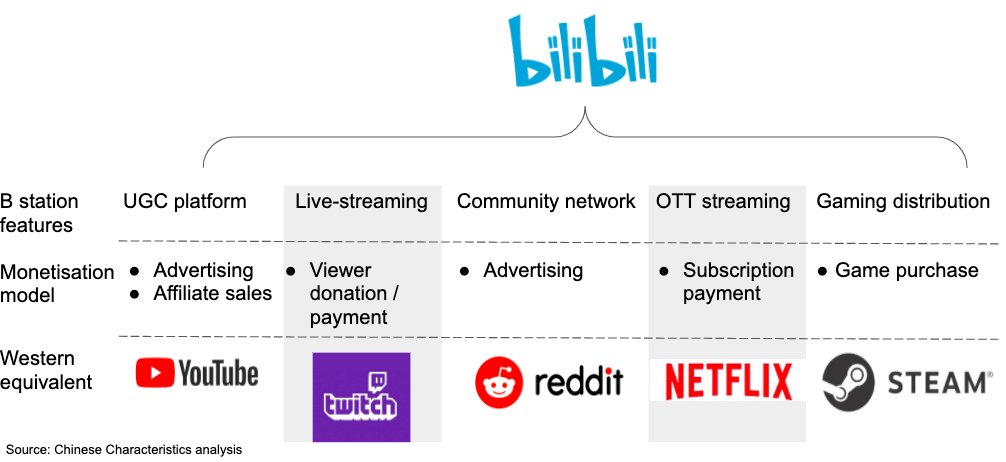

2) Grossly simplified, it's the Chinese equivalent of Youtube. Except it's not. It's like if Youtube, Twitch, Steam, Patreon, TokyoPop and Netflix had a CRISPR-baby, and that baby was a weeb, but that weeb is also super down with Chinese Gen Z

3) Bilibili was founded in 2010 by avid Anime, Gaming and Comics (AGC) fan Yi Xu from a frustration that the mainstay Chinese anime platform kept crashing with no consistent access to his beloved vocaloid Miku

4) Serial entrepreneur Rui Chen went from an angel investor to CEO, having obtained Yi Xu's trust by correctly identified the origin of Bilibili as from the anime "A Certain Scientific Railgun". Anime knowledge is life.

5) Currently it's the biggest mainstream portal for the Chinese Gen Z with user-generated video sharing, live streaming, mobile gaming, online comics and event ticketing. It’s also diversified its content coverage with coverage on beauty, e-sports, pop culture and many others.

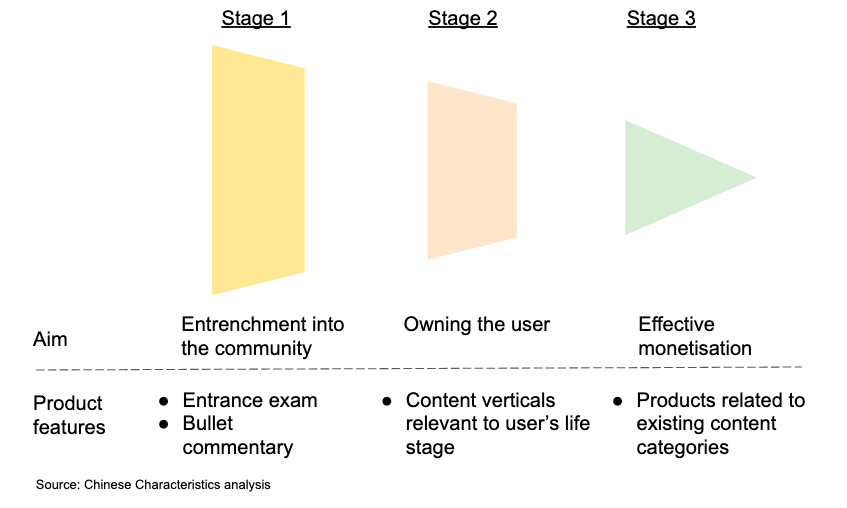

6) I think Bilibili has an incredibly interesting strategy for product and monetisation. Which I lay out here

7) Stage 1: Entrenchment into the community by creating an in-group

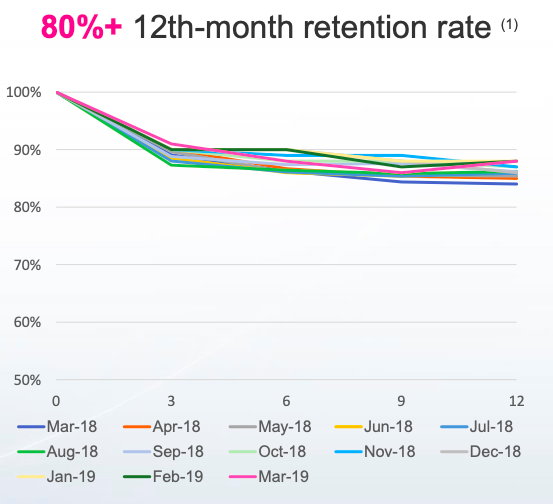

Bilibili has an incredibly sticky and engaged community, and it does so by cultivating buy-in into an internet sub-culture that from the outside seems bizarre. I think the bizarreness is a feature, not a bug.

Bilibili has an incredibly sticky and engaged community, and it does so by cultivating buy-in into an internet sub-culture that from the outside seems bizarre. I think the bizarreness is a feature, not a bug.

8) While videos are free to view on the platform, the registration process to be a commentator for Bilibili is perhaps the most demanding one for any social media platform today. It involves passing a 100 multi-choice questions test with at least 60 correct answers within an hour

9) Bilibili’s process seems counter-intuitive until you factor in that its aim is sustainable growth. Sustainable growth means that they want to let in dedicated members who will engage earnestly with the content, and having a pretty time-consuming quiz does filter for that.

10) Stage 2: Owning the user by capturing a stage of life rather than a field of interest

Relative to western consumer tech companies, who tend to focus on “serving a function” as their core mission, Chinese companies tend to focus on “owning the user” as their core mission

Relative to western consumer tech companies, who tend to focus on “serving a function” as their core mission, Chinese companies tend to focus on “owning the user” as their core mission

11) Suppose we view Bilibili's product strategy as being focused on owning the user rather than engaging all users who have a specific functional need. In that case, their choice of expanding into verticals with less relevance to UGC makes a lot more sense.

12) What other things does an anime-and-games-UGC-watching Chinese Gen Z like to do for fun? They probably like anime, like non-moving anime aka manga, like playing games,etc

13) I also think there's a lot more bi-directional influence between monetisation and product development choices than what I've highlighted so far. It's entirely probable that the most easily monetisable products are adjacent products rather than deeper UGC platform offerings

14) Stage 3: Effective monetisation of the user while still retaining the other stakeholders

They started the commercialisation “journey” by being the Chinese game distributor for Fate / Grand Order in 2017 and has only begun to branch out into other channels.

They started the commercialisation “journey” by being the Chinese game distributor for Fate / Grand Order in 2017 and has only begun to branch out into other channels.

15) Arguable their golden years are ahead of them for when the Gen Zs hit their earning stride and there's still a lot of time for things to change and for Bilibili to pivot until then.

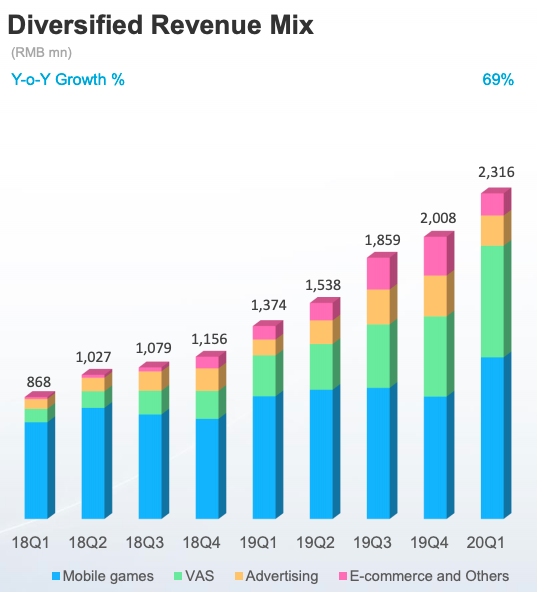

16) So the first thing to note is that unlike Youtube, Bilibili is not dependent on advertising. The most compelling reason for this is that Bilibili does not want to alienate the community as it pursues monetisation.

17) Value-added services is the fastest growing revenue segment, at a whopping 171.9% increase yoy, the bulk of which is coming from membership fees that allow users to access premium content. This revenue stream has led to increased investments into proprietary content

18) Bilibili's story is far from over and is by no means a qualified success. I think they are a very interesting counterexample of how to grow, curate and monetise a community. It goes against a lot of the well-trodden paths western tech companies have taken and continue to make

I left out a bunch of stuff but here's my longer piece if you're interested. My best work is my substack.

I'll be doing these threads for the rest of Jan, follow if you want these to spam your TL

lillianli.substack.com/p/an-introduct…

I'll be doing these threads for the rest of Jan, follow if you want these to spam your TL

lillianli.substack.com/p/an-introduct…

• • •

Missing some Tweet in this thread? You can try to

force a refresh