We all love Atlassian ... the $60B SaaS leader that came out of Australia, not SF ... with 2 co-CEOs ... that was basically bootstrapped ... that spends its $$$ on R&D, not sales

Atlassian has now crossed $2B in ARR

5 Interesting Learnings about where Atlassian is now:

Atlassian has now crossed $2B in ARR

5 Interesting Learnings about where Atlassian is now:

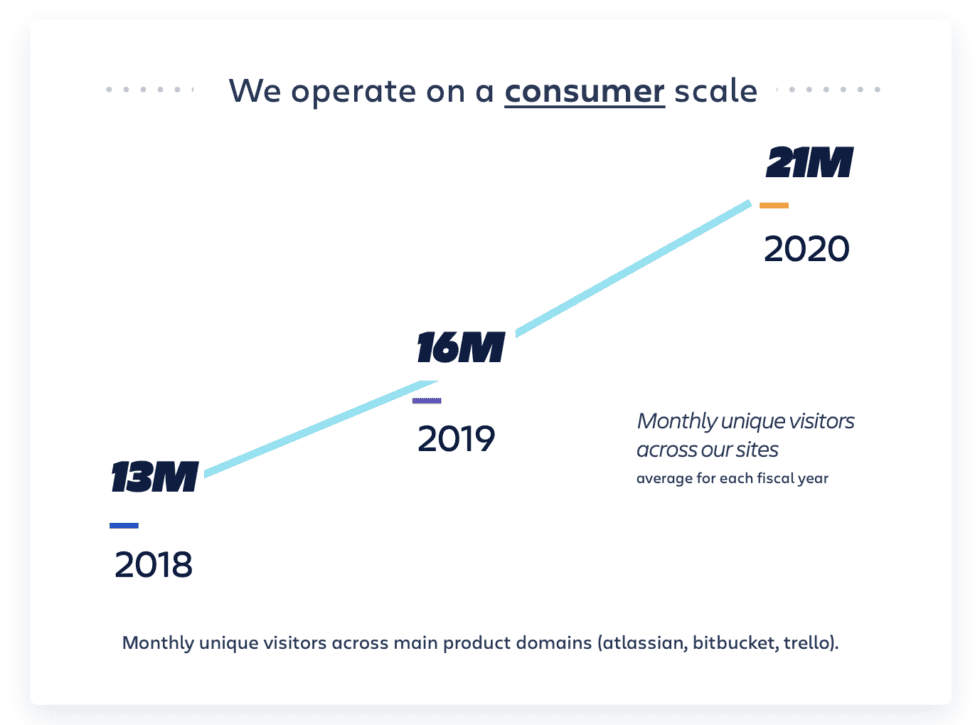

#1. SEO, brand and content continue to work at scale.

Atlassian had 21m unique viewers to its website last year, up 30% year-over-year.

A vivid reminder that investments in content and brand pay dividends … forever.

Atlassian had 21m unique viewers to its website last year, up 30% year-over-year.

A vivid reminder that investments in content and brand pay dividends … forever.

#2. It’s never too late to add a Free edition -- if it's great

Atlassian was relatively late to adding free editions for some of its products, starting in March 2020 (!). But it’s working now. Sign-ups tripled

Atlassian sees Free as key engine of growth for the next decade

Atlassian was relatively late to adding free editions for some of its products, starting in March 2020 (!). But it’s working now. Sign-ups tripled

Atlassian sees Free as key engine of growth for the next decade

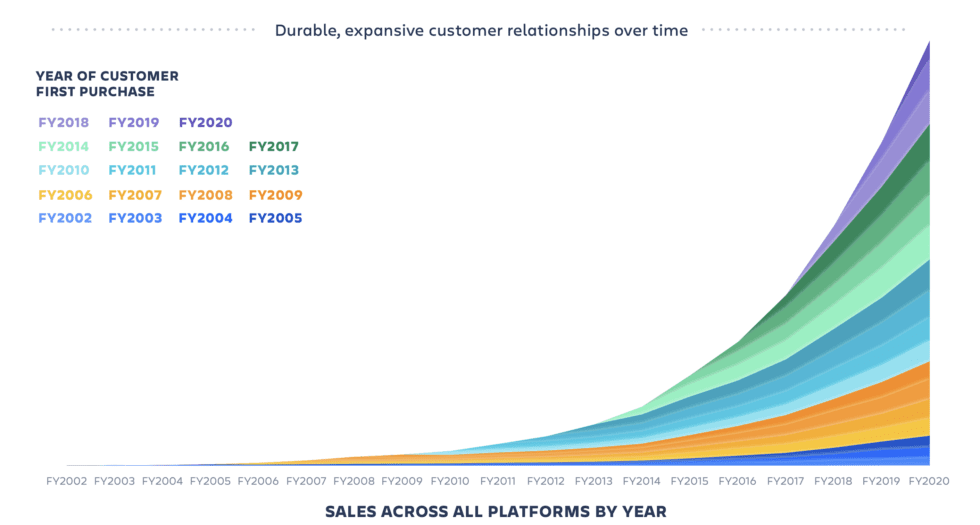

#3. 121% NRR overall, 130% in enterprise segment (their fastest growing).

These numbers aren’t a surprise, but they are still top-tier ... and what you should aim for as well if you sell similar products.

These numbers aren’t a surprise, but they are still top-tier ... and what you should aim for as well if you sell similar products.

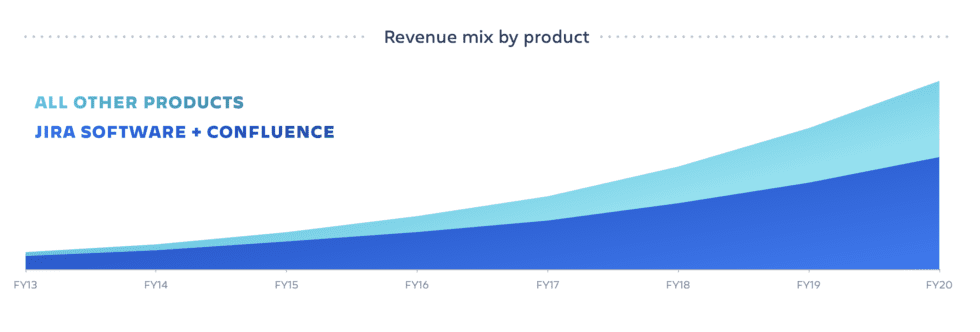

#4. A long path to multi-product revenue streams, but today, 40% of Atlassian's revenue comes from newer products, not Jira+Confluence — & that’s growing

A top learning from this series is that to continue strong growth past $1B in ARR, you probably need >1 core product

A top learning from this series is that to continue strong growth past $1B in ARR, you probably need >1 core product

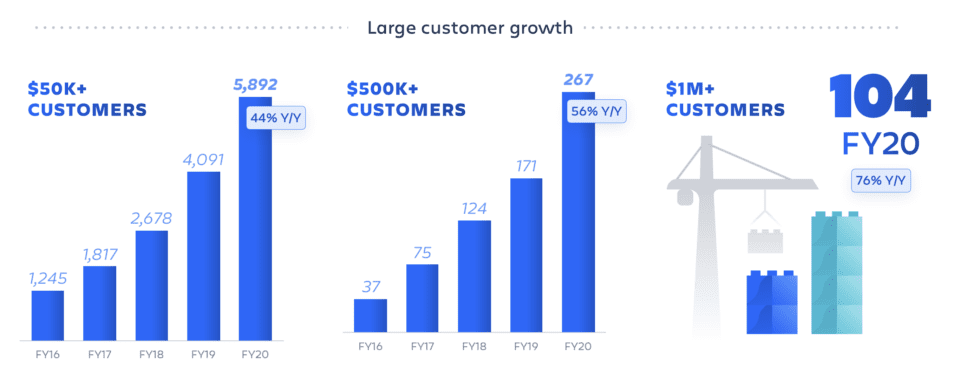

#5. Atlassian, too, is going more enterprise now. One of the biggest changes from IPO to $2B ARR is just how enterprise Atlassian has gone.

$50k+ customers are growing 44%

$500k+ customers are growing 56%

$1m+ customers are growing 76%.

$50k+ customers are growing 44%

$500k+ customers are growing 56%

$1m+ customers are growing 76%.

They now have over 100 $1M+ ACV customers.

We’ve seen Slack, Asana, PagerDuty and Zoom all go much more enterprise post-IPO.

We’ve seen Slack, Asana, PagerDuty and Zoom all go much more enterprise post-IPO.

Two bonus points:

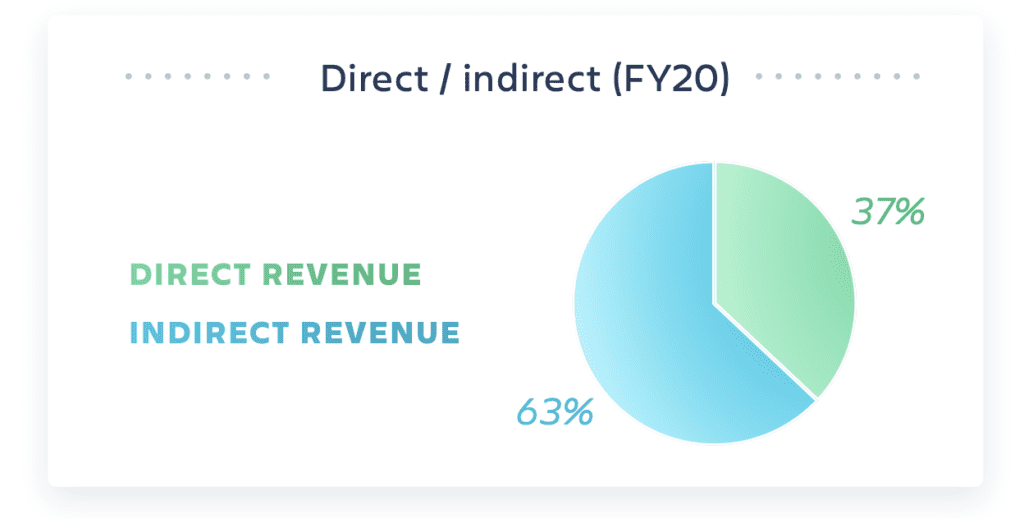

#6. Channel partners drive 63% of revenue (!)

A lot of Atlassian’s sales efficiency is driven by its channel partners doing the heavy lifting on sales — and it’s still working well at $2B in ARR. Atlassian only spends 15% of its revenue on sales & marketing.

#6. Channel partners drive 63% of revenue (!)

A lot of Atlassian’s sales efficiency is driven by its channel partners doing the heavy lifting on sales — and it’s still working well at $2B in ARR. Atlassian only spends 15% of its revenue on sales & marketing.

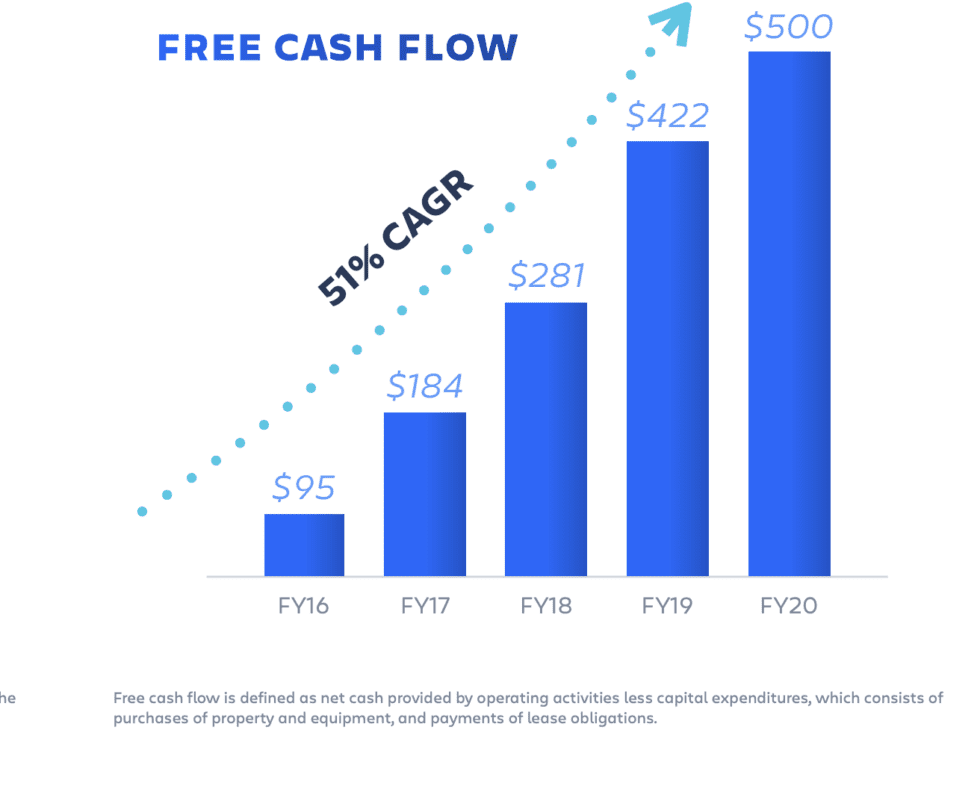

#7. Atlassian is a cash-generating machine.

Yes, it can be done in SaaS, especially companies that are very efficient in sales and marketing like Atlassian and Zoom.

Atlassian is generating $500m+ a year in free-cash flow:

Yes, it can be done in SaaS, especially companies that are very efficient in sales and marketing like Atlassian and Zoom.

Atlassian is generating $500m+ a year in free-cash flow:

A deeper dive, our a look back at our convos with @mcannonbrookes, @jaysimons + @michaelpryor here:

saastr.com/5-interesting-…

saastr.com/5-interesting-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh