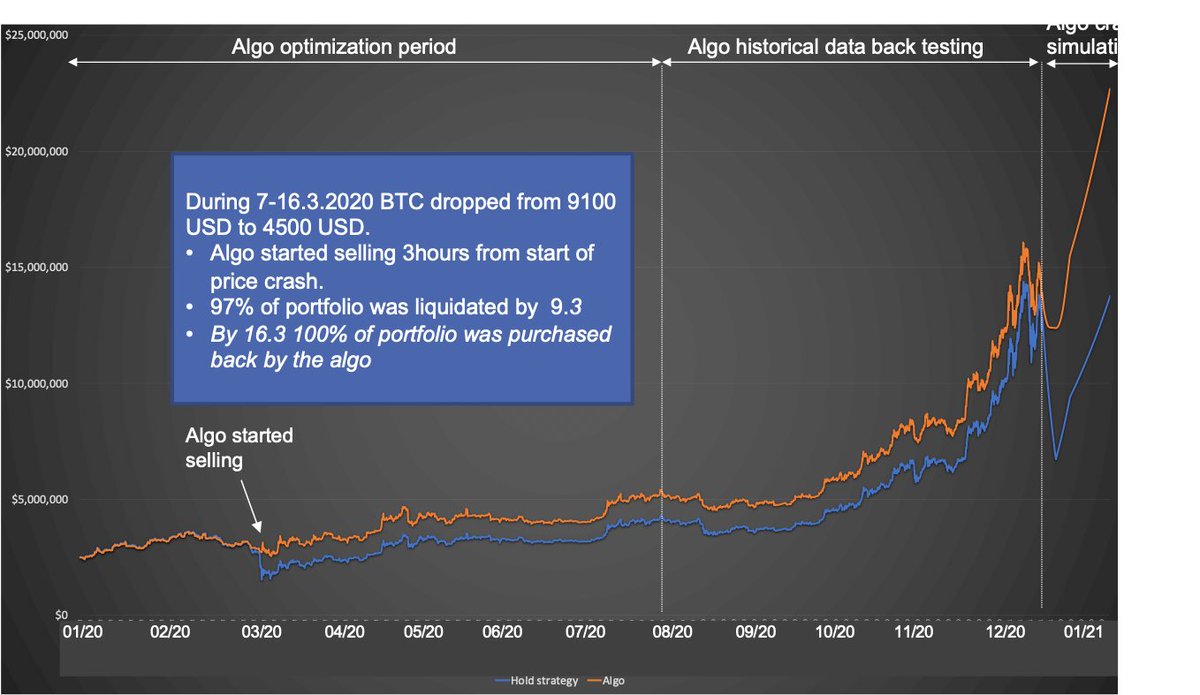

Every investor should be using algorithms nowadays. It simply is very difficult for humans to beat algos. In the pic you can see how algo used for Bitcoin trading would have been able to avoid 2020 march crypto crash with fast portfolio liquidation. #BTC #investments #Algorithms

This algo, which I have been developing would have liquidated 97% of portfolio in two days from beginning of the March crash and at the bottom it had already bought the portfolio back. (Note: this is with historical data)

Here is some background for my work. I am building an investor platform for tokenised assets (lohkowallet.com). Idea with Lohko wallet is that investor can freely manage and decide their asset allocation, but each asset “basket” is managed by conservative algo.

Investor can have both wide diversification with full independence but “sleep well” knowing that the algo “has got his back”

Lohkowallet already works with physical gold bars. We tokenise gold bars and investors hold a digital ownership certificate in their wallets (ERC720 token) while the actual gold bar is stored in vault in Singapore.

In the autumn a friend of mine told me that investor platforms must have algo nowadays, so I thought to give it a try myself first and then later work with an expert. It was really good to first build the strategy phase yourself as I had an own vision how the algo should work.

I wanted to build algo for for long term macro fund type of investments dealing with gold, silver, other commodities and crypto. The main target of the algo was that it would protect investors from market crashes. So this is not for day trading.

I have some background from optimisation from my doctoral thesis days 20 years ago and I am pretty experienced model builder, but I am more a business guy than algo builder. I have used Matlab but I actually found Excel to be really good tool for algo strategy development phase.

I wanted to build a simple algo, with just a few variables. The simplier, more trustworthy. Basic idea was to build model where algo accelerates sales and buys when the market trend turns strongly up or down.

I first simulated the basic algo model with gold, silver and BTC and then gave a more detailed try with Bitcoin using hourly data of 2020.

I used 7 first months of 2020 for algo parameter optimisation and the last 5 months testing the model with real data. Then for January 2021 I also ran a market crash test simulation.

The model worked surprisingly well with Bitcoin as it was able to reach quickly for market crashes but remained in hold position otherwise, as I had programmed it in away that it would only react in big market movements.

For 2020 the algo produced 1.2x better results than hold strategy a which is pretty good for strategy phase. There is a lot to improve and fine-tuning and additional safety measures are needed.

My main finding is that this kind of Algo gives investors extra protection for market crashes. I don’t believe that human would have had a chance to behave as cool-headedly like Algo did during March crypto crash, especially a team decision would have been needed.

Next steps with the Algo work is live testing, integration to exchanges and start piloting with small investment amounts.

• • •

Missing some Tweet in this thread? You can try to

force a refresh