1/10: Do you want to know a little secret regarding how I build conviction during my #startup diligence process? Do you want to know something that I spend time on that many early stage #VCs brush under the rug as silly and unnecessary? Short thread:

2/10: The answer --- I spend time digesting a company’s financial forecast and then review it thoroughly with the Founding team. “Team + TAM rule!” investors think I’ve lost my mind and that it’s a pure waste of time. Hogwash I say. Why ignore a great learning opportunity?

3/10: To set the context, I rarely focus on going forward projections during the first or second meeting because I need to understand the opportunity at a pretty deep level before running through the forecast. More on this here:

https://twitter.com/fintechjunkie/status/1308849139288084480?s=20

4/10: To gain real insights, reviewing the forecast shouldn’t be an exercise in ticking and tying numbers but rather approached as an opportunity to see how a Founder thinks about his/her business and what lies ahead.

5/10: At its core, a financial plan is a description of how the Founder sees the future playing out. It's the perfect excuse to discuss a host of "what if" questions because there's precisely a zero percent chance that the future will unfold the way it's crafted in the plan.

6/10: If managed well, the discussion of the forecast can surface how a Founder thinks. It can reveal what they think they know and with what certainty. It can be a great pop quiz regarding how well a Founder will absorb new information and how they’ll behave when challenged.

7/10: Which leads me to a major mistake made by Founders in the forecast review process. It’s a fatal mistake when a Founder thinks of his/her financial plan as a “will happen” plan and tries to convince me (as an Investor) that it’s conservative and certain!

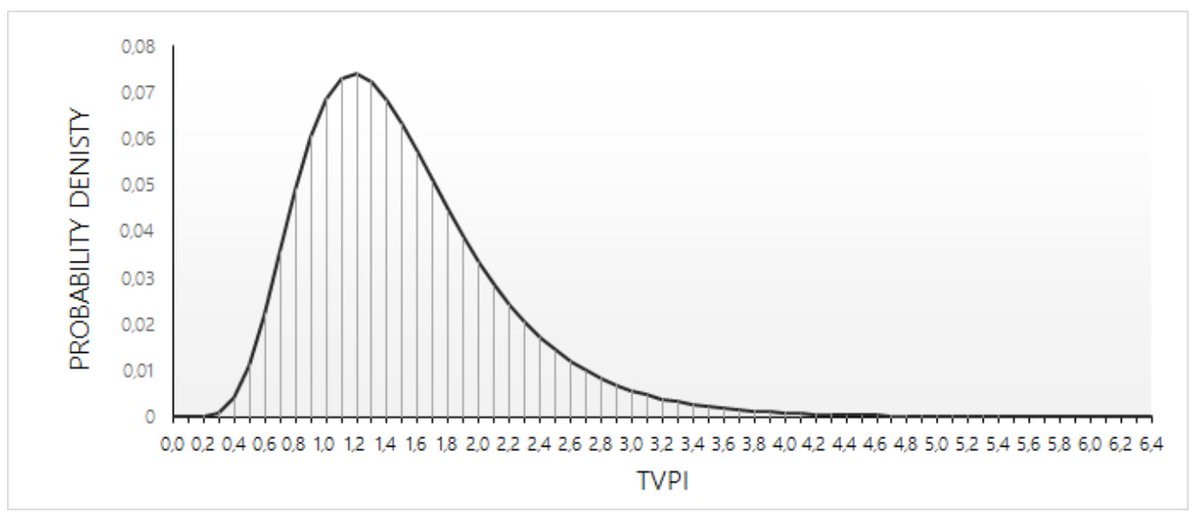

8/10: The best Founders understand that their plans are merely articulations of what they expect to happen and are prone to error. Ask any Venture Partner and he/she will tell you that 90%+ of their early stage companies miss their forecasts.

9/10: The best Founders are receptive to feedback about their plans as well as flexible enough to adjust their plans as results materialize. They can live in a world of multiple futures and talk fluently in the language of uncertainty.

10/10: So to the “Team and TAM rule!” investors I say “you do you” and “I’ll do me”. I’m going to use every opportunity I can to get to know a Founder and his/her business better. If the bear is there, why not poke it?

• • •

Missing some Tweet in this thread? You can try to

force a refresh