How to become a SUCCESSFUL investor: a guide 1/n

1) Diversify but don’t. Diversification is for idiots, but it is also a free lunch.

2) Stay consistent but don’t. Have a consistent repeatable process, but also adapt to changing markets.

3) Read outside research but don’t. The best investors think for themselves and are lone wolves but they also talk to others to learn and copy ideas.

4) Use the sell-side but don’t. Your time is valuable and using the sell-side saves time, but it is also low quality and will add needless noise – don’t use them.

5) Talk to management but don’t. Meet with management and learn, but don’t let management influence your thinking because management is promotional.

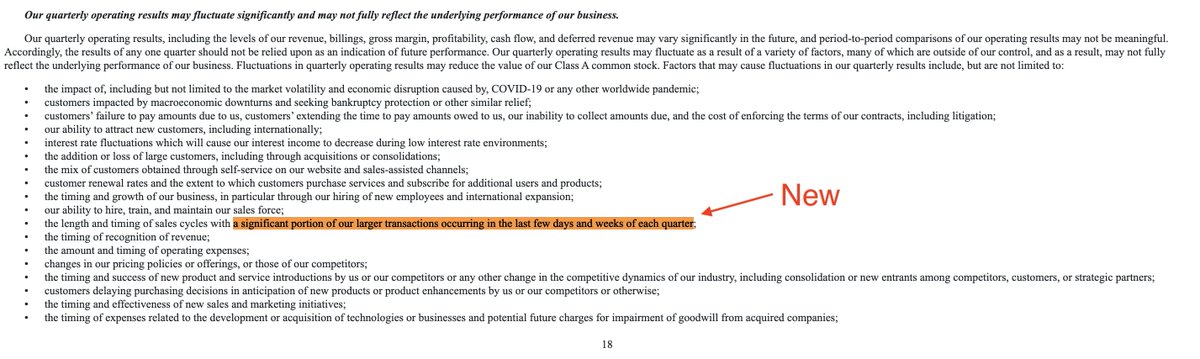

6) Play the quarters but don’t. Stay up to date on current information and model every quarter, but also focus on the five-year performance and hold.

7) Ignore macro but don’t. Analyze individual companies because macro evens out over time, but macro also drives most of the returns so always understand the bigger trends.

8) Average down but don’t. If you like it and it falls buy more, but losers average losers so don’t.

9) Trade a lot but don’t. Stay active and move in and out of positions as new information comes in, but don’t trade too much.

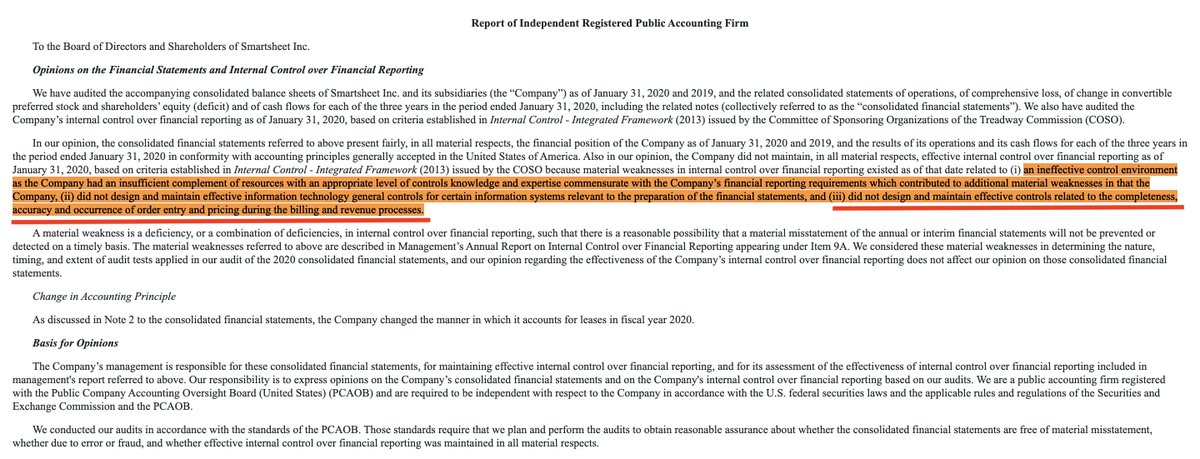

10) Have a margin of safety but don’t. Make sure the balance sheet is strong enough to prevent any permanent capital impairment, but also buy high-quality businesses at fair multiples.

11) Short but don’t. Shorting is a great way to get more long, but longs make more $$$ and are less controversial so focus on them.

My point is that every great investor is different and you can’t break down success into a few quotes. This thread is inspired by:

https://twitter.com/MaartenvSmeden/status/1350397377966993408

• • •

Missing some Tweet in this thread? You can try to

force a refresh