Metropolis acquisition update conference call was on 18th Jan 2021

"Acquisition of Hi-tech Diagnostics will make Metropolis 2nd largest Diagnostics company in India."

Amazing Concall to understand Diagnostic business.😎

Here are the Key takeaways 🧵👇

#concall

"Acquisition of Hi-tech Diagnostics will make Metropolis 2nd largest Diagnostics company in India."

Amazing Concall to understand Diagnostic business.😎

Here are the Key takeaways 🧵👇

#concall

Overview of acquisition strategy

- Current acquisition is strongly aligned with overall strategy.

- Indian diagnostics industry offer tremendous opportunity given the need of the consumer.

- During the pandemic it has amplified more and has leas to consolidation of industry.

- Current acquisition is strongly aligned with overall strategy.

- Indian diagnostics industry offer tremendous opportunity given the need of the consumer.

- During the pandemic it has amplified more and has leas to consolidation of industry.

- M&A is important pillars of the company's growth strategy.

- Current acquisition will help strengthen the leadership position and help them to enter a new market, have a consumer reach too.

- Acquired company is a debt free company.

- Current acquisition will help strengthen the leadership position and help them to enter a new market, have a consumer reach too.

- Acquired company is a debt free company.

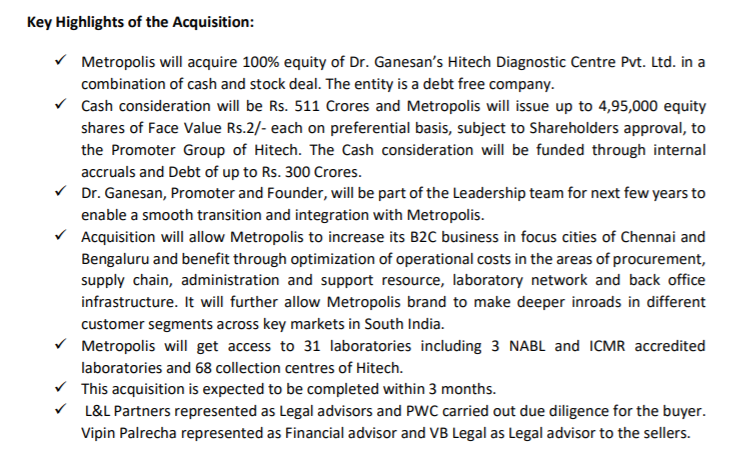

- Acquisition is in cash and stock. Cash being Rs. 511 crores and stock being 495000 share of metropolis share on preferential basis.

- Cash consideration would be funded with debt upto Rs. 300 Crores. (6% cost of debt)

- Acquisition will be completed within 3 months.

- Cash consideration would be funded with debt upto Rs. 300 Crores. (6% cost of debt)

- Acquisition will be completed within 3 months.

- Company will have 30% market share in Chennai. And will strengthen position in Bangalore.

- Company will be able to capture mid market segment of the market, increase B2C revenue contribution and leverage scale benefit.

- Company has completed 23 acquisition in the past.

- Company will be able to capture mid market segment of the market, increase B2C revenue contribution and leverage scale benefit.

- Company has completed 23 acquisition in the past.

Overview of Hi-tech Diagnostics

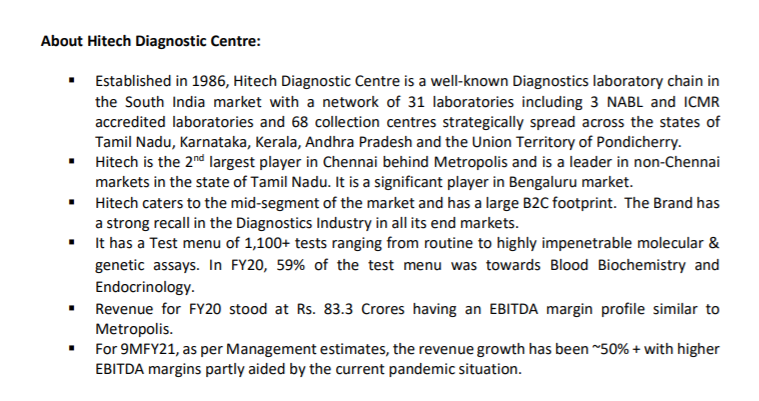

- Hi-tech has scaled up its business in last 3 decades by providing highest quality pathology services.

- Hi-tech has a network of 31 labs including 3 NABL & ICMR lab for Covid crises.

- Test menu consists of 1100+ tests.

- Hi-tech has scaled up its business in last 3 decades by providing highest quality pathology services.

- Hi-tech has a network of 31 labs including 3 NABL & ICMR lab for Covid crises.

- Test menu consists of 1100+ tests.

- Revenue growth has been 50% yoy in last 9 months.

- Metropolis will be able expand the addressable market size and make way to enter tier 2 & 3 cities of south India.

- Next 2-3 years company expects a good revenue uptick and synergy in cost in the areas of procurement.

- Metropolis will be able expand the addressable market size and make way to enter tier 2 & 3 cities of south India.

- Next 2-3 years company expects a good revenue uptick and synergy in cost in the areas of procurement.

Synergies from acquisition

- Benefit is that company will go deeper into the tier 2&3 cities which will fill the lab with more samples. this enables Productivity and efficiency in the back end.

- There will be certain B2B overlap. but not on B2C side

- Benefit is that company will go deeper into the tier 2&3 cities which will fill the lab with more samples. this enables Productivity and efficiency in the back end.

- There will be certain B2B overlap. but not on B2C side

- In B2B side, there are large hospitals, small nursing homes such B2B cohort is broken up in sub cohort and the kind of customer both the companies will be catering will mostly be different.

- In terms of the central and lab optimization even on procurement there would be savings.

- It will deepen the presence in the focus market which will elevate the profitability.

- It will deepen the presence in the focus market which will elevate the profitability.

Test menu synergy

- In terms of tests, metropolis has the largest test menu, acquisition will not help in adding new tests.

- However out of 4k test menu, 400 types of tests are done in Chennai. Rest are sent to Mumbai coz there are low volume hence becomes unviable financially

- In terms of tests, metropolis has the largest test menu, acquisition will not help in adding new tests.

- However out of 4k test menu, 400 types of tests are done in Chennai. Rest are sent to Mumbai coz there are low volume hence becomes unviable financially

- Acquisition of hi-tech helps in expanding the test menu from 400 to 800 variety to be done locally and outsource less number of test.

- This will help in Report delivery to patient faster without causing any loss of margin

- This will help in Report delivery to patient faster without causing any loss of margin

- 60% of test menu consists of routine and rest 40% consists of specialized in Hi- tech diagnostics

Covid impact on diagnostics

- Other infection testing are still the part of the contributions. Different seasons bring different types of growth.

- Out of the 50% growth in last 9 months a significant portion has come form Covid and will come form covid in next 1-2 years.

- Other infection testing are still the part of the contributions. Different seasons bring different types of growth.

- Out of the 50% growth in last 9 months a significant portion has come form Covid and will come form covid in next 1-2 years.

- We cannot separate covid and non covid.

- Esp for the middle level labs (top 15 labs): covid has actually added significant base to the revenue coz non covid bases are not that large.

- Some of the growth will continue & frequency and intensity of covid testing has declined.

- Esp for the middle level labs (top 15 labs): covid has actually added significant base to the revenue coz non covid bases are not that large.

- Some of the growth will continue & frequency and intensity of covid testing has declined.

- However, relationship has been built due to the covid testing and many clients have been added in this covid period.

Acquisition process

- In the past, metropolis couldn't complete the deal for acquisition few years ago. Last year, Hi-tech approached Metropolis for the partnership.

- In the past, metropolis couldn't complete the deal for acquisition few years ago. Last year, Hi-tech approached Metropolis for the partnership.

Question by @LuckyInvest_AK sir😀

Acquisition looks pricey, Financial logic for acquisition as 600 cr. has been paid for 100 cr. of sales. At EBITDA level it looks like 25 times of EBITDA

Answer

- Company is more focused on strategic & business aspects of acquisition

(Contd.)

Acquisition looks pricey, Financial logic for acquisition as 600 cr. has been paid for 100 cr. of sales. At EBITDA level it looks like 25 times of EBITDA

Answer

- Company is more focused on strategic & business aspects of acquisition

(Contd.)

- There are 2-3 percent, as organised market is only 10-15% of overall industry which is going to move towards 35 to 40% in coming years.

- For long term perspective, company will have expansion in margins as it will go deeper in the cities which will establish brand name

- For long term perspective, company will have expansion in margins as it will go deeper in the cities which will establish brand name

Gross margin comparison

- Gross margin of middle level labs tends to be lesser than top level labs because the procurement cost tend to be different.

- On the other costs like admin cost, national lab sometimes have higher cost than middle level labs as middle level labs.

- Gross margin of middle level labs tends to be lesser than top level labs because the procurement cost tend to be different.

- On the other costs like admin cost, national lab sometimes have higher cost than middle level labs as middle level labs.

Growth levels of market size

- No 3rd party data is not there. Company's assumption is specialized test which come out of southern market can be reasonably significant because the market has a reasonable amount of infection.

- No 3rd party data is not there. Company's assumption is specialized test which come out of southern market can be reasonably significant because the market has a reasonable amount of infection.

- But the population is also educated and have a higher GDP per capita therefore the company tends to get reasonably priced test and sample from the southern market.

- There has been a significant growth in southern market.

But company looks the industry in terms of city perspective than the regional perspective. & Chennai and Bangalore have lot of potential to grow at a good pace.

But company looks the industry in terms of city perspective than the regional perspective. & Chennai and Bangalore have lot of potential to grow at a good pace.

- Chennai market penetration is reasonably sufficient and in rest of Tamil Nadu there is an opportunity to grow. similarly with the Bangalore there is opportunity to grow.

- Market leadership in Chennai to grow significantly as market share is going to organized players

- Market leadership in Chennai to grow significantly as market share is going to organized players

- There are 3-4 players at the top 15 players in the middle and 10k player at the bottom. To acquire middle player, company is interested.

- Industry growth has been 10-11% in last year. Few players including Metropolis has been growing at the faster rate.

- Group growth is around 15-16% in last few years.

- 50 to 75 crores will be gross block addition due to acquisition rest will be goodwill.

- Group growth is around 15-16% in last few years.

- 50 to 75 crores will be gross block addition due to acquisition rest will be goodwill.

Checklist for acquisition

- If business is valued more than the company's value then it will be a big no.

- If there is no synergy value then such acquisition will not take place.

- If the quality of business is not upto the mark

- If business is valued more than the company's value then it will be a big no.

- If there is no synergy value then such acquisition will not take place.

- If the quality of business is not upto the mark

Market share

- Reaching 30% market share in a particular city can be a saturation point in that market. But such has not been seen in the industry.

- Certain growth is still possible in such markets too.

- Reaching 30% market share in a particular city can be a saturation point in that market. But such has not been seen in the industry.

- Certain growth is still possible in such markets too.

Physical infra overlaps

- Metropolis has 3 labs in Chennai & hi-tech has 8 labs in Chennai.

- Tamil Nadu is divided in 37 districts and with the acquisition, the brand will be able to cover 8 districts.

- Both the brands cater to different customers.

- Metropolis has 3 labs in Chennai & hi-tech has 8 labs in Chennai.

- Tamil Nadu is divided in 37 districts and with the acquisition, the brand will be able to cover 8 districts.

- Both the brands cater to different customers.

• • •

Missing some Tweet in this thread? You can try to

force a refresh