ICICI General Insurance conference call was at 7:30 pm.

"Industry seeing steady growth post new normal"

@dmuthuk @darshanvmehta1 @datta_arvind @ms89_meet

Here are the Key takeaways of the call 😃👇

#concall

"Industry seeing steady growth post new normal"

@dmuthuk @darshanvmehta1 @datta_arvind @ms89_meet

Here are the Key takeaways of the call 😃👇

#concall

Business Updates:

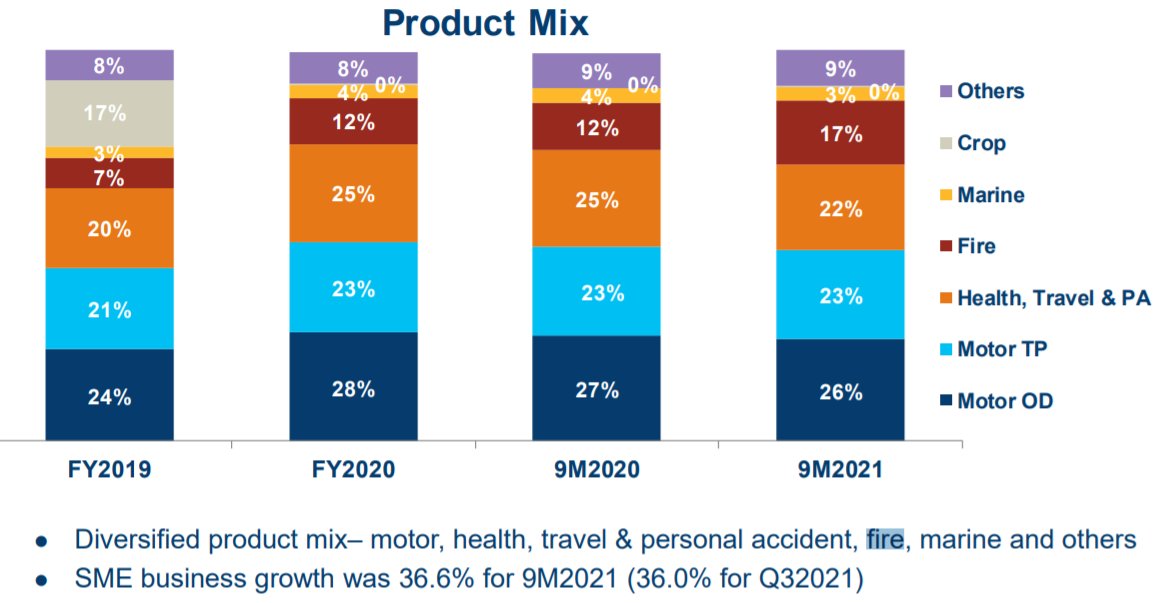

• Most of the business segment has shown good pick up.

• Motor insurance delivered good growth.

• Commercial Segment- Fire Insurance showed good growth and Marine is also moving in good direction.

See Product mix performance in image.

• Most of the business segment has shown good pick up.

• Motor insurance delivered good growth.

• Commercial Segment- Fire Insurance showed good growth and Marine is also moving in good direction.

See Product mix performance in image.

• Motor has reaced to previous level

• Health sector has reached to pre-covid level.

• New covid in the recent quarter has seen slight stabilization.

• Launched a website for SME for buying and claiming for insurance.

• Around 65% of the policy came digitally this year.

• Health sector has reached to pre-covid level.

• New covid in the recent quarter has seen slight stabilization.

• Launched a website for SME for buying and claiming for insurance.

• Around 65% of the policy came digitally this year.

Performance:

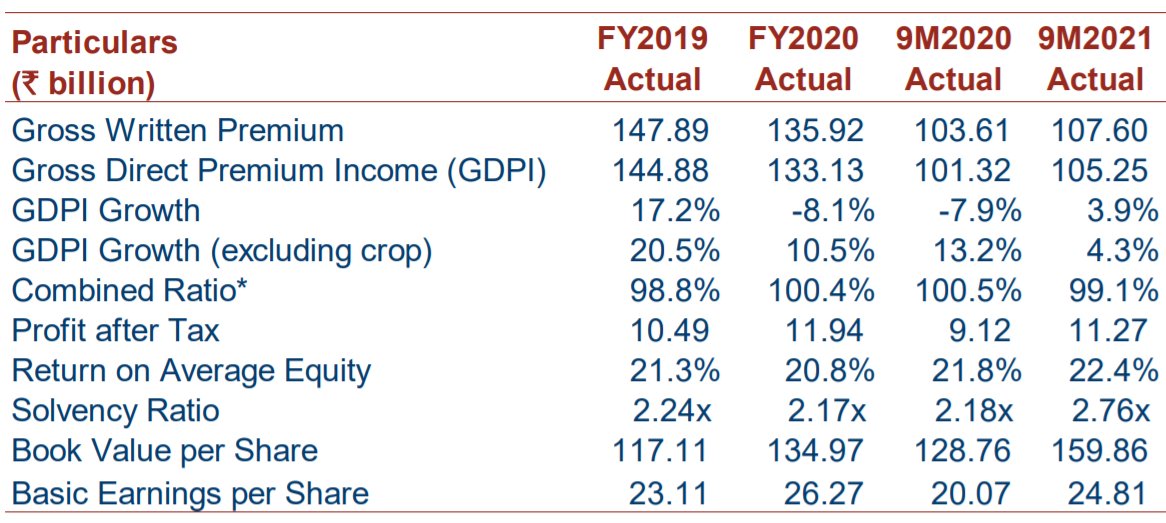

• Combine Ratio remained at 99.1%, and excluding the impact of cyclone and flood losses Combined ratio was around 97.7% this year.

• Realized Return this year stayed at 5.9%.

• Solvency Ration remain stable this year.

• Combine Ratio remained at 99.1%, and excluding the impact of cyclone and flood losses Combined ratio was around 97.7% this year.

• Realized Return this year stayed at 5.9%.

• Solvency Ration remain stable this year.

Indemnity (Health) Business

• Indemnity business see growth of 29% reaching to 639 cr.

• Loss Ratio of Indemnity product remained at around 82%.

• Indemnity business comes with very high loss ratio, but the cost remains at bit higher.

• Indemnity business see growth of 29% reaching to 639 cr.

• Loss Ratio of Indemnity product remained at around 82%.

• Indemnity business comes with very high loss ratio, but the cost remains at bit higher.

• Most of the claim intimation this quarter has come back, and is expected to be back to normal.

• Combine Ratio over normal case is expected to be around 100% for health segment.

• Combine Ratio over normal case is expected to be around 100% for health segment.

• In any quarter where we have high growth with respect to past quarter the revenue is already split as the premium comes through a year. Mgmt believe tremendous growth in policy for motor insurance overt this quarter.

Investment Leverage declined to 4.05:

• Some of the older policy where the claim settlement was left, that big amount came this quarter.

• As the dividends were not paid numerator got impacted and due to the sudden crop failure that payment did take the hit in the denominator

• Some of the older policy where the claim settlement was left, that big amount came this quarter.

• As the dividends were not paid numerator got impacted and due to the sudden crop failure that payment did take the hit in the denominator

NEP/NWP Ratio- There was decline in the ratio over past quarter due to covid situation, however as new policy is was increasing in the past quarter and the earned part is realised now the NEP / NWP ratio is going up. And this may turn in this manner with respect to past quarter.

Motor Insurance:

• As mentioned previously motor insurance will not be diversify over one Quarter in to order to be conservative for receiving premium.

• Pre-covid level Combine ratio was 110% due to stiff competition. After covid players did take a price correction.

• As mentioned previously motor insurance will not be diversify over one Quarter in to order to be conservative for receiving premium.

• Pre-covid level Combine ratio was 110% due to stiff competition. After covid players did take a price correction.

• Company is also seeing the stability in the pent up demand of policy in Quarter2.

• October month had good growth, and new policy in health sector was brought in November, of which result was observe in December.

• This made mgmt believe Indemnity in health to remain stable

• October month had good growth, and new policy in health sector was brought in November, of which result was observe in December.

• This made mgmt believe Indemnity in health to remain stable

Acquisition:

• Whenever growths starts to come back, premium comes at good rate for which acquisition is paid immediately, but the premium is divided over a year.

• Hence the cost in the inital quarter comes up while the revenue of the same is divided over next few quarter

Con

• Whenever growths starts to come back, premium comes at good rate for which acquisition is paid immediately, but the premium is divided over a year.

• Hence the cost in the inital quarter comes up while the revenue of the same is divided over next few quarter

Con

• Opex Ratio came down to 25% from 27% and the commission ratio came down to 29% from 35%.

• While Acquisition of Bharti Axi was 39 crores divided over 9 months, hence over quarter few ratio are going up over this quarter, which will be visible in other player as well.

• While Acquisition of Bharti Axi was 39 crores divided over 9 months, hence over quarter few ratio are going up over this quarter, which will be visible in other player as well.

Investment:

• Duration of the book increased to 4.05 and the call co. took early this year shifting to medium term securities from short maturity are overpriced. Hence co. shifted to medium to longer term.

• Mgmt expect interest rate to remain range bound over next few quarter.

• Duration of the book increased to 4.05 and the call co. took early this year shifting to medium term securities from short maturity are overpriced. Hence co. shifted to medium to longer term.

• Mgmt expect interest rate to remain range bound over next few quarter.

• • •

Missing some Tweet in this thread? You can try to

force a refresh