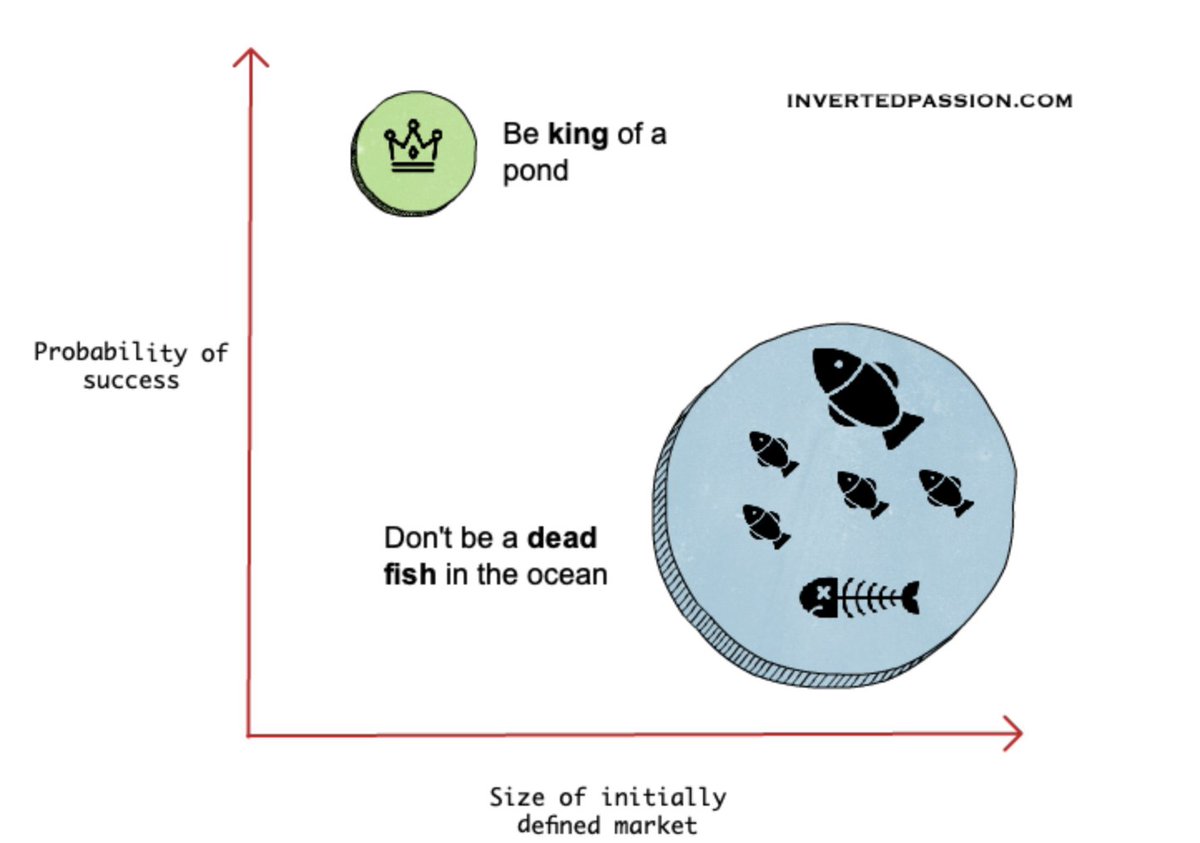

Be the king of a pond, rather than a dead fish in the ocean.

(a short thread on this mental model)

🔥 It's also the 8th chapter of my book invertedpassion.com/define-your-ma…

(a short thread on this mental model)

🔥 It's also the 8th chapter of my book invertedpassion.com/define-your-ma…

1/ It’s common for entrepreneurs to cast a wide net early on and imagine their market to be huge.

The logic goes something like this: if the market is worth a hundred billion dollars, then even if 1% of it is captured, the company will be making a billion dollars.

The logic goes something like this: if the market is worth a hundred billion dollars, then even if 1% of it is captured, the company will be making a billion dollars.

2/ All this sounds good in theory but in practice, it never works this way.

Why would the market leader – the big fish in the ocean – let you take even 1% of the market?

Why would the market leader – the big fish in the ocean – let you take even 1% of the market?

3/ In fact, as soon as your startup shows the first signs of success, the big fish will do whatever it can to crush you and snatch whatever market share you may have won by that time.

4/ That is why -->

To avoid head-on competition with the big fish and getting eaten by it, a smart entrepreneur defines the initial market as narrowly as possible.

To avoid head-on competition with the big fish and getting eaten by it, a smart entrepreneur defines the initial market as narrowly as possible.

5/ To define the market size, instead of going top-down and taking an arbitrary percentage of it, you need to go bottom-up and actually count the number of customers that your startup is uniquely positioned to capture.

6/ Facebook’s initial customer base was a few thousand Harvard University students.

Their product initially was a perfect-fit just for Harvard University, and therefore displaced the incumbent Myspace in that market pretty soon.

Their product initially was a perfect-fit just for Harvard University, and therefore displaced the incumbent Myspace in that market pretty soon.

7/ Investors like entrepreneurs who show them a big vision but they like entrepreneurs who show specificity even more.

8/ All big markets have niches that are underserved by established market leaders because their products try to serve large markets. invertedpassion.com/jobs-to-be-don…

A product initially targeted on these niches can replace established products by providing superior value.

A product initially targeted on these niches can replace established products by providing superior value.

9/ Such niches are also often called beachhead markets because they provide an entry point into the large market and provide an initial shielding from competitors as market leaders discount such opportunities as too small for them to care.

10/ Beyond providing a laser-sharp product-focus, a narrow market also allows for laser-sharp distribution and marketing

Think about it. If the entirety of your potential market is Harvard University students, to get the word out, you can simply stick posters all over the campus

Think about it. If the entirety of your potential market is Harvard University students, to get the word out, you can simply stick posters all over the campus

11/ But what if the entire world is your potential user base.

Where would you start sticking the posters and would you have enough posters doing that anyway?

Where would you start sticking the posters and would you have enough posters doing that anyway?

12/ A common fear that entrepreneurs have is that if they define their market narrowly, they’ll undershoot and build a small business.

This fear is unfounded.

A number 1 position in any market, no matter how narrow, often translates into a big enough business.

This fear is unfounded.

A number 1 position in any market, no matter how narrow, often translates into a big enough business.

13/ Not all businesses have to and can be Google or Amazon. They are an exception, not the norm.

What usually happens is that most businesses keep on using their #1 position in a narrow market to expand into adjacent markets and hence always keep on growing at a steady pace.

What usually happens is that most businesses keep on using their #1 position in a narrow market to expand into adjacent markets and hence always keep on growing at a steady pace.

14/ Ask yourself would you rather have a business that makes money and grows steadily or a dream of a huge business that has low chances of happening?

15/ 🧠 Remember:

It’s better to be king of a niche than a nobody in a vast ocean.

It’s better to be king of a niche than a nobody in a vast ocean.

17/ I'm posting ~1 new mental model for entrepreneurs every week.

Here's the entire list of 60+ mental models that I'll cover in a year or so: invertedpassion.com/free-book-ment…

Make sure you sign up for email updates on the book page.

Here's the entire list of 60+ mental models that I'll cover in a year or so: invertedpassion.com/free-book-ment…

Make sure you sign up for email updates on the book page.

18/ Revisit the previous mental model here:

https://twitter.com/paraschopra/status/1338382277416341505

• • •

Missing some Tweet in this thread? You can try to

force a refresh