Gateway Distriparks conference call was today at 5:00 PM 😀

"Parent Company of Snowman Logsitics"

Here are the Key takeaways 👇🧵

#concall

"Parent Company of Snowman Logsitics"

Here are the Key takeaways 👇🧵

#concall

Business Updates:

• Improvement in rail freight made the highest TEU over past quarter

• Expansion plans are work in progress.

• New facility are expected to come up with expansion in untapped region.

• Expansion has been made in new cities which will be announced soon.

• Improvement in rail freight made the highest TEU over past quarter

• Expansion plans are work in progress.

• New facility are expected to come up with expansion in untapped region.

• Expansion has been made in new cities which will be announced soon.

Sustainability of Rail Business:

• There was improved turned around time as most of the railways was slowed down, which made the utlisation good

• Indian Rail gives 5% of discount (rebate) currently for certain region transportation.

• There was improved turned around time as most of the railways was slowed down, which made the utlisation good

• Indian Rail gives 5% of discount (rebate) currently for certain region transportation.

Volume Growth:

• Volume growth will transfer to reduce the halt charges, which will lead to increase in margins.

• Company expects to increase the volume of the business.

• Volume growth will transfer to reduce the halt charges, which will lead to increase in margins.

• Company expects to increase the volume of the business.

Changes after Dedicated Freight Corridor

• Operational of DFC was already expected by the management.

• Operational Excellence has been improved leading to decrease in turnaround time with implementation o DFC.

• Operational of DFC was already expected by the management.

• Operational Excellence has been improved leading to decrease in turnaround time with implementation o DFC.

• With this certain certain customers near to shipping port such as Mundra Port may shift to service provider which can benefit company.

Route Optimization

• DFC runs from New Rewari Junction to Palanpur. There is one split goes to Mundra and one splits to Surendranagar.

Route Optimization

• DFC runs from New Rewari Junction to Palanpur. There is one split goes to Mundra and one splits to Surendranagar.

There is a triangle formation

• Routes from Palanpur to Piparav is expected to be ready in September 2021.

• These may help improve the better route mapping reaching to different customers.

• Routes from Palanpur to Piparav is expected to be ready in September 2021.

• These may help improve the better route mapping reaching to different customers.

Price- There is expectation of price correction as well however majorly prices remain stable

Rail Share Improvement- Doing same volume in shorter period of time, leads to excess space availability and this further increases volume. Improvement in EXIM is also favorable part

Rail Share Improvement- Doing same volume in shorter period of time, leads to excess space availability and this further increases volume. Improvement in EXIM is also favorable part

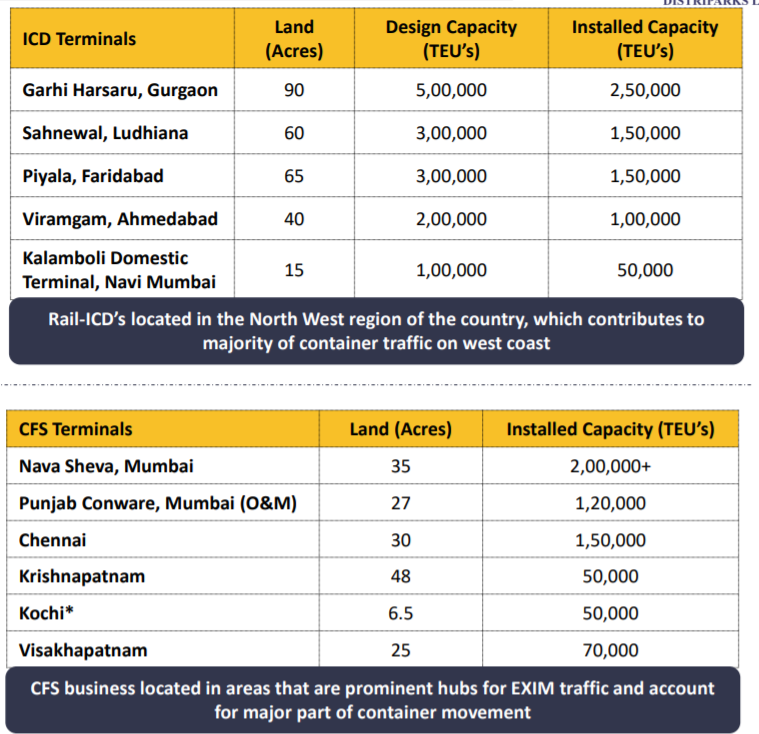

CAPEX:

• ICD will have continuous investment for next 2-3 years. This would have 25-30 acres spaces.

• 200 cr will be invested over next 2 years. This will increase train time moving every 30 mins.

• ICD will have continuous investment for next 2-3 years. This would have 25-30 acres spaces.

• 200 cr will be invested over next 2 years. This will increase train time moving every 30 mins.

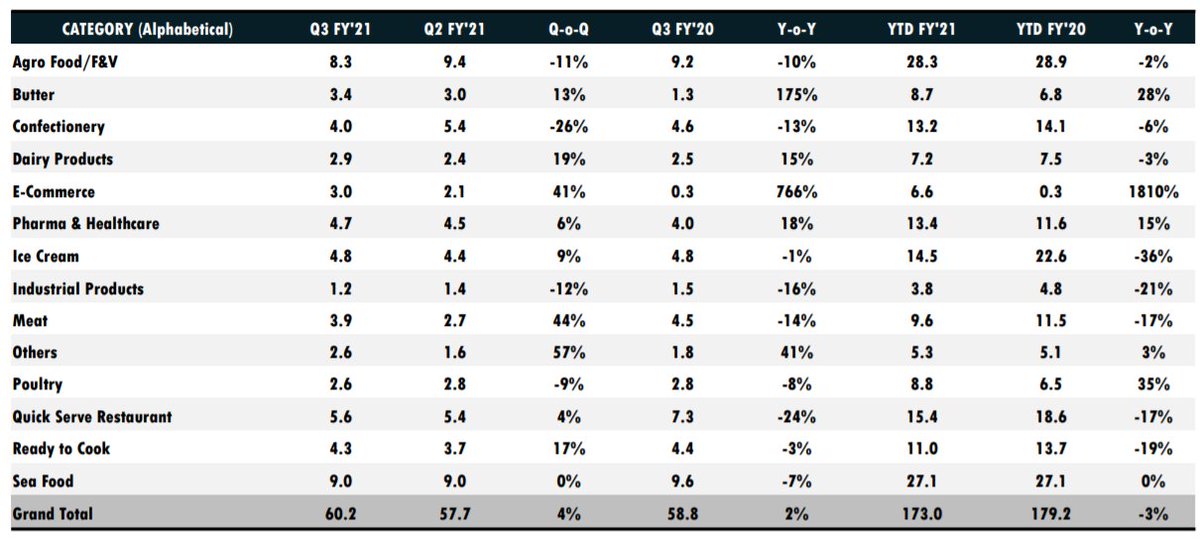

Snowman:

• Current Capacity Utlisation stands at 85%.

• Current facility has been restructured which has led to increase in capacity utlization.

Focus- Focus will remain on every segment both food and pharma for the near future.

• Current Capacity Utlisation stands at 85%.

• Current facility has been restructured which has led to increase in capacity utlization.

Focus- Focus will remain on every segment both food and pharma for the near future.

Snowman Growth:

• Expansion in side warehousing is expected to turn-well

• In next 2-3 months company is expecting to increase in utilization by around 12-13%

• Future growth is expected to be from the volume growth, and price growth is expected to around 5-6%

Segment Revenue

• Expansion in side warehousing is expected to turn-well

• In next 2-3 months company is expecting to increase in utilization by around 12-13%

• Future growth is expected to be from the volume growth, and price growth is expected to around 5-6%

Segment Revenue

CFS business:

• There is theories like shipping do don't like double shipping, which may bring the volume back to normal. However DFC and hiterland moving to Mundra will have big change for the business.

• There is theories like shipping do don't like double shipping, which may bring the volume back to normal. However DFC and hiterland moving to Mundra will have big change for the business.

Growth:

• Expected growth in ICD business is around 5-6%.

• Port business which has not seen that much growth, it is expected to be around early 2 digit growth in the coming year.

• Business from the Palanpur to Nava Sheva is expected to drive well.

• Expected growth in ICD business is around 5-6%.

• Port business which has not seen that much growth, it is expected to be around early 2 digit growth in the coming year.

• Business from the Palanpur to Nava Sheva is expected to drive well.

Do read our detail analysis on Snowman here. 😀

https://twitter.com/tycoonmindset05/status/1340297340016443393

• • •

Missing some Tweet in this thread? You can try to

force a refresh