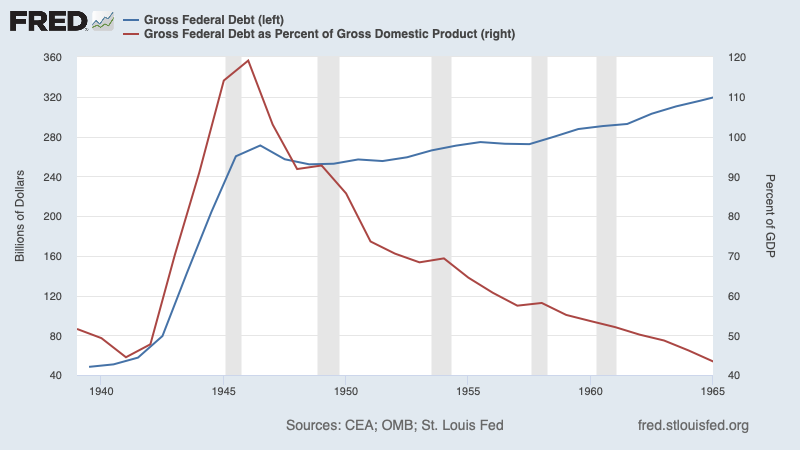

Still getting anxious mail from people who worry about how America will pay down its debt. Folks, we don't have to pay it down. Here's what happened after WWII: 1/

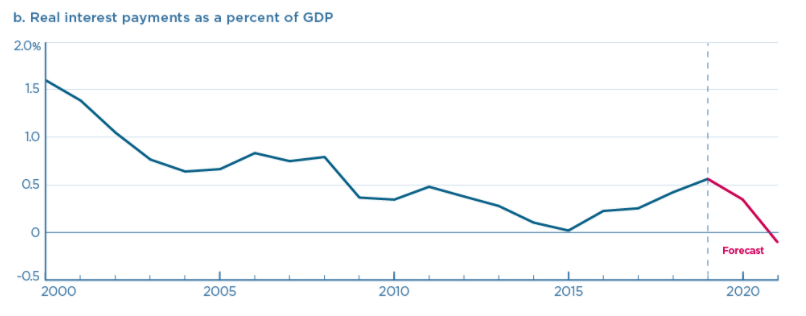

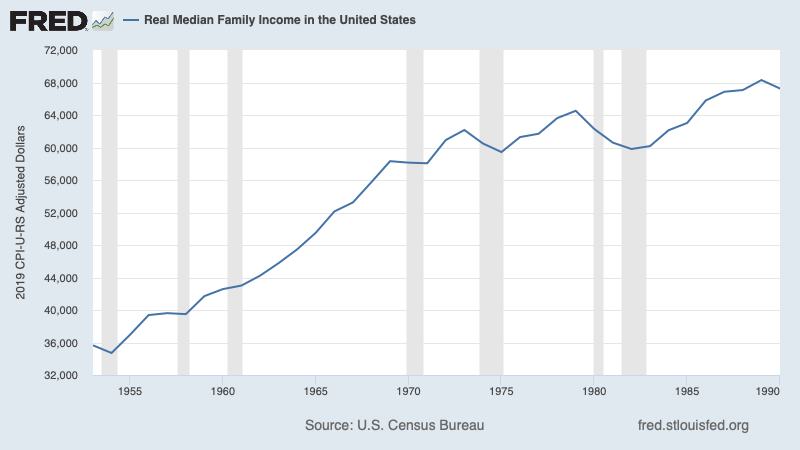

America never repaid its war debt. It just issued new debt as the old debt came due. But because of inflation and growth, debt as a share of GDP declined steadily, so that by the 60s the war debt was negligible in economic terms 2/

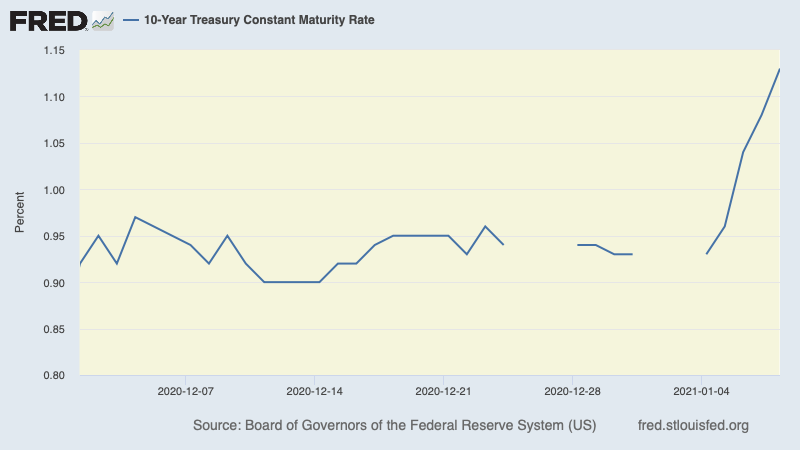

Today, we have an economy where dollar GDP can be expected to grow 3-4% a year, while the feds can borrow at ~1%. This means that debt tends to melt away as a share of GDP unless we run really huge deficits 3/

The usual suspects try to shout down this arithmetic by playing Dr. Evil: We have 24 TRILLION DOLLARS in debt. But if you analyze the numbers instead of hyping them, there isn't any visible problem 4/

• • •

Missing some Tweet in this thread? You can try to

force a refresh