1/7

Today is the time for another piece from the DeFi governance games.

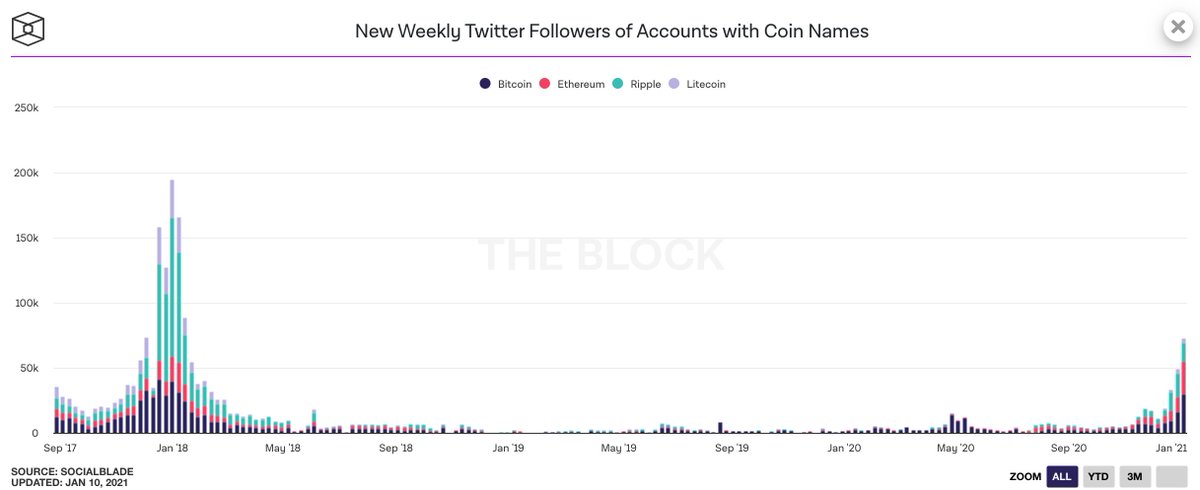

And since the gas price is breaking another all-time-high, it's time to discuss how gasless voting and Snapshot work.

theblockcrypto.com/genesis/90887/…

Today is the time for another piece from the DeFi governance games.

And since the gas price is breaking another all-time-high, it's time to discuss how gasless voting and Snapshot work.

theblockcrypto.com/genesis/90887/…

2/7

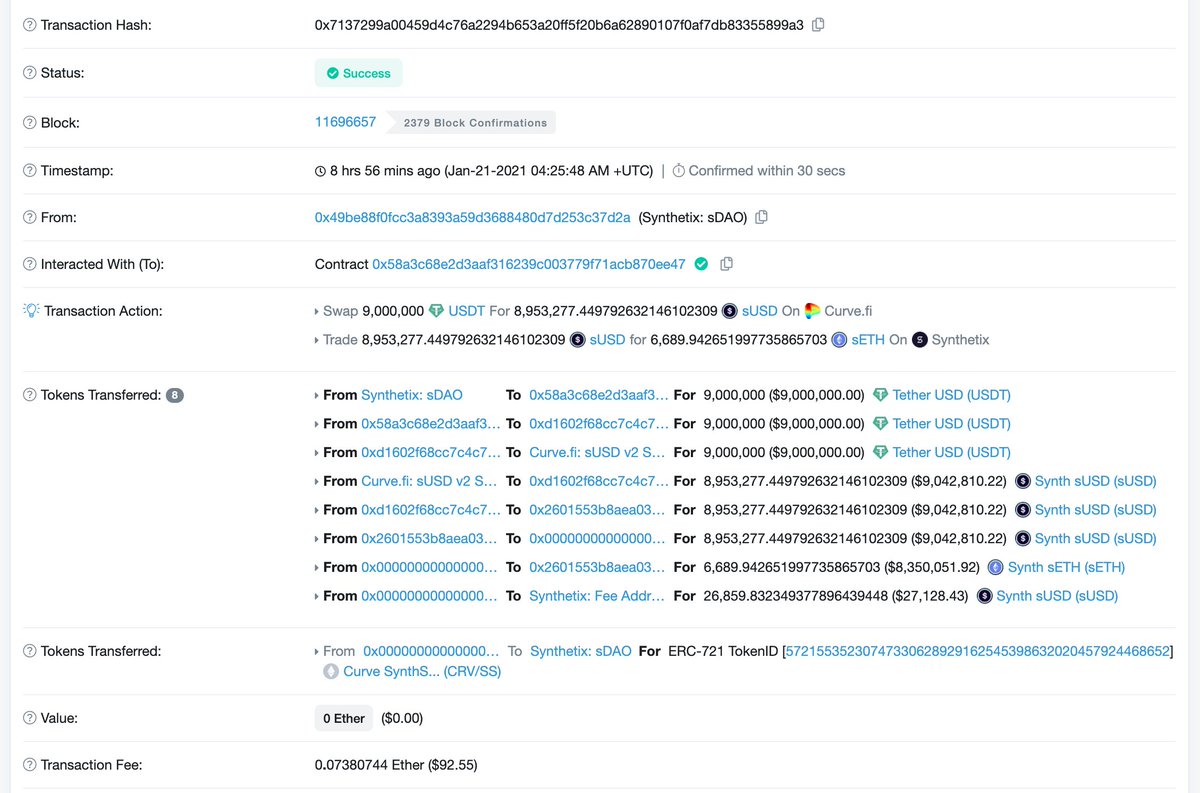

Just look at the cost of governance participation for the protocols discussed in the previous series.

Do token holders really have any incentive to participate if they are spending $10+ on voting, which they may not be interested in at all?

I don’t think so

Just look at the cost of governance participation for the protocols discussed in the previous series.

Do token holders really have any incentive to participate if they are spending $10+ on voting, which they may not be interested in at all?

I don’t think so

3/7

Earlier, it was already mentioned that Compound governance framework provides an opportunity to perform gasless voting using EIP-712.

However, the infrastructure using these signatures for governance is just beginning to evolve.

Earlier, it was already mentioned that Compound governance framework provides an opportunity to perform gasless voting using EIP-712.

However, the infrastructure using these signatures for governance is just beginning to evolve.

4/7

Snapshot is a good half-measure, but it does not guarantee the correct voting result on-chain.

One solution could be Optimistic Snapshot from Aragon, but it will most likely be costly in gas fees.

Snapshot is a good half-measure, but it does not guarantee the correct voting result on-chain.

One solution could be Optimistic Snapshot from Aragon, but it will most likely be costly in gas fees.

5/7

For 349 projects on Snapshot at the time of data collection, about 15 proposals are created per day.

It’s not surprising that most of the proposals are created by community members, not by the core team.

For 349 projects on Snapshot at the time of data collection, about 15 proposals are created per day.

It’s not surprising that most of the proposals are created by community members, not by the core team.

6/7

The top 15 projects with a median number of voters for Core proposals have familiar names: yearn, Aave, PoolTogether, BadgerDAO.

Each of them has 100+ voters, and it is unlikely that their own on-chain governance would have achieved this participation level after launch.

The top 15 projects with a median number of voters for Core proposals have familiar names: yearn, Aave, PoolTogether, BadgerDAO.

Each of them has 100+ voters, and it is unlikely that their own on-chain governance would have achieved this participation level after launch.

7/7

Regardless of gas prices, gasless voting solutions will evolve.

And since someone will still have to pay for voting, it seems fair to use a tiny fraction of the cash flow so that the fees don’t lie on the token holders’ shoulders.

Regardless of gas prices, gasless voting solutions will evolve.

And since someone will still have to pay for voting, it seems fair to use a tiny fraction of the cash flow so that the fees don’t lie on the token holders’ shoulders.

• • •

Missing some Tweet in this thread? You can try to

force a refresh