1/8

Due to the high gas price, Ethereum fees are higher than ever.

My latest research piece focuses on one of the ways to reduce fees — gas tokens.

As usual, the piece contains many insights and charts, but here are a couple of thoughts.

Enjoy👇

theblockcrypto.com/genesis/91670/…

Due to the high gas price, Ethereum fees are higher than ever.

My latest research piece focuses on one of the ways to reduce fees — gas tokens.

As usual, the piece contains many insights and charts, but here are a couple of thoughts.

Enjoy👇

theblockcrypto.com/genesis/91670/…

2/8

Gas tokens work by reducing the gas amount used by a transaction (gas refund).

The mechanics are as follows: a smart contract is created at a low gas price together with a token, which is then destroyed at a high gas price.

Gas tokens work by reducing the gas amount used by a transaction (gas refund).

The mechanics are as follows: a smart contract is created at a low gas price together with a token, which is then destroyed at a high gas price.

3/8

Until recently, the most popular gas token was GST2.

Token creation and destruction peaked in March 2020, when the market reached a local bottom.

This peak can be explained by the widespread use of this token by arbitrageurs and 1inch.

Until recently, the most popular gas token was GST2.

Token creation and destruction peaked in March 2020, when the market reached a local bottom.

This peak can be explained by the widespread use of this token by arbitrageurs and 1inch.

4/8

In May 2020, 1inch released a more optimized version of GST2 — CHI.

Due to the Summer of DeFi, gas prices rise, which provokes the tokens minting by speculative traders and arbitrageurs.

At the moment, CHI has already surpassed GST2 in popularity and is not going to stop.

In May 2020, 1inch released a more optimized version of GST2 — CHI.

Due to the Summer of DeFi, gas prices rise, which provokes the tokens minting by speculative traders and arbitrageurs.

At the moment, CHI has already surpassed GST2 in popularity and is not going to stop.

5/8

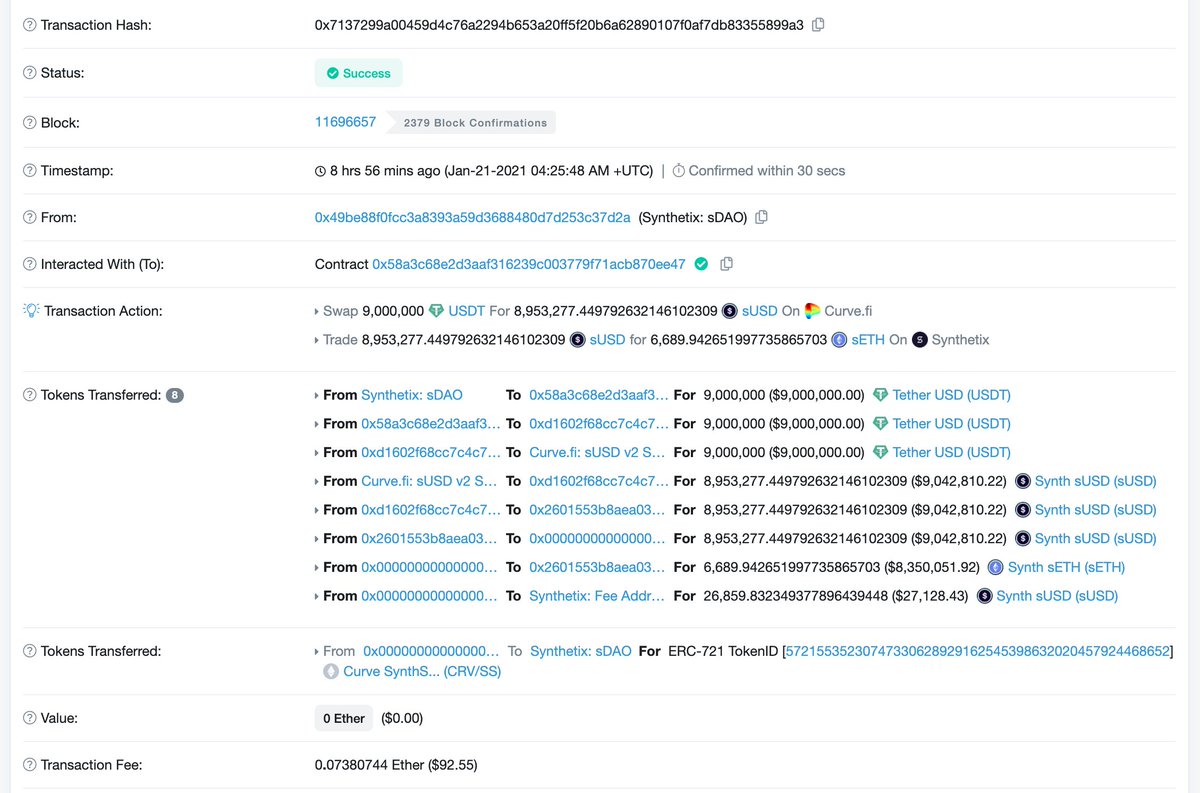

However, it’s not necessary to use tokens to receive a gas refund.

The main thing is to add the mechanics of creating and destroying contracts to any smart contract.

Many professional arbitrageurs are doing exactly this, reducing the gas amount to create smart contracts.

However, it’s not necessary to use tokens to receive a gas refund.

The main thing is to add the mechanics of creating and destroying contracts to any smart contract.

Many professional arbitrageurs are doing exactly this, reducing the gas amount to create smart contracts.

6/8

Earlier concerns were raised that gas tokens could corner the Ethereum fee market.

But right now, less than half a percent of all gas is used for creating refund contracts, indicating an insufficient positive feedback-loop for negative consequences.

Earlier concerns were raised that gas tokens could corner the Ethereum fee market.

But right now, less than half a percent of all gas is used for creating refund contracts, indicating an insufficient positive feedback-loop for negative consequences.

7/8

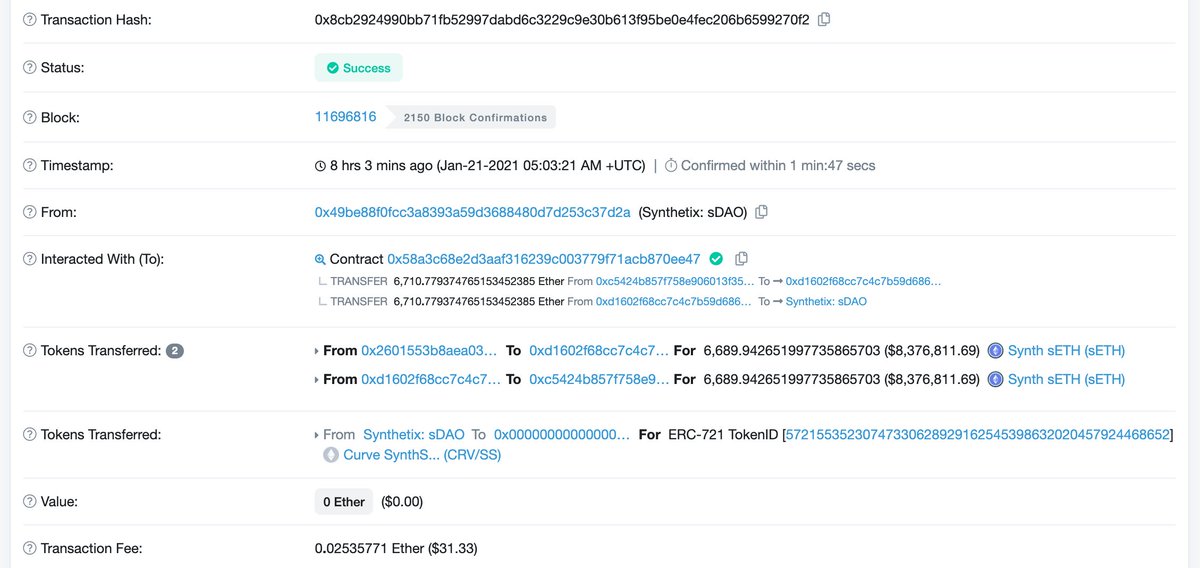

At the same time, earnings on gas tokens are real.

There is a decent number of traders who issue and sell CHI tokens in a single transaction.

Also, during times of high gas price volatility, CHI is often traded below fair value.

At the same time, earnings on gas tokens are real.

There is a decent number of traders who issue and sell CHI tokens in a single transaction.

Also, during times of high gas price volatility, CHI is often traded below fair value.

8/8

The gas refund is essential for on-chain traders to remain competitive, and the most successful ones are mentioned in this piece.

It is unlikely that after EIP-1559, something will change for traders since the fee still depends, among other things, on the gas spent.

The gas refund is essential for on-chain traders to remain competitive, and the most successful ones are mentioned in this piece.

It is unlikely that after EIP-1559, something will change for traders since the fee still depends, among other things, on the gas spent.

• • •

Missing some Tweet in this thread? You can try to

force a refresh