Syngene concall was today at 3:00 PM

"Good growth and good business prospects are still on line"

Here are the key highlights of the call 😀👇

@unseenvalue @punitbansal14 @saketreddy @MarketScientist @drprashantmish6

"Good growth and good business prospects are still on line"

Here are the key highlights of the call 😀👇

@unseenvalue @punitbansal14 @saketreddy @MarketScientist @drprashantmish6

Business Updates:

• Company has managed to maintain the new normal and looking for steady growth.

• Business has returned to new normal.

• Second wave of covid has lesser impact

• Over past 3 months company has maintained operational efficiency

• Company has managed to maintain the new normal and looking for steady growth.

• Business has returned to new normal.

• Second wave of covid has lesser impact

• Over past 3 months company has maintained operational efficiency

• Collaborated with Deerfield Discovery and Development (3DC) to advance integrated drug discovery projects

• Co. has also collaborated with virtual system in order to communicate with the clients easily.

• Expansion Hyderabad facility will increase the operational aspect

• Co. has also collaborated with virtual system in order to communicate with the clients easily.

• Expansion Hyderabad facility will increase the operational aspect

• 135 scientist were already and the expansion will add another 90 scientist.

• Delay in capex will not impact the operational aspect of the business

• Company has not delayed or ignored any inspection process and maintained all the production process as per the standards

• Delay in capex will not impact the operational aspect of the business

• Company has not delayed or ignored any inspection process and maintained all the production process as per the standards

• Company has constantly maintained the compatibility hence Syngene is full ready with the introspection as well.

• Hydrebad facility is fully booked and is mentioned in the CAPEX in cash flow, and this has increased the capacity by 50%

• Hydrebad facility is fully booked and is mentioned in the CAPEX in cash flow, and this has increased the capacity by 50%

Financial Updates:

• Margins for the quarter remains stable at 32%.

• Cost of material has been a increased a bit of 1%.

• staff cost has increase about 11%, which was last lag of increase for this year.

• Liquidity over this quarter has been maintain efficiently.

• Margins for the quarter remains stable at 32%.

• Cost of material has been a increased a bit of 1%.

• staff cost has increase about 11%, which was last lag of increase for this year.

• Liquidity over this quarter has been maintain efficiently.

Structural Change with Customer:

• Nature and discussion with the customer has not being changed, and the only change is the meeting is online now.

• Outside customer who are dependent on us have remained with us.

• Nature and discussion with the customer has not being changed, and the only change is the meeting is online now.

• Outside customer who are dependent on us have remained with us.

Operational Work

• Operational there is bit of problem connection via zoom or all but this is very small with the respect to he business.

Clinical Trails: Clinical trials has slow down in the business and has been back to normal which was high during the past 2 quarters.

• Operational there is bit of problem connection via zoom or all but this is very small with the respect to he business.

Clinical Trails: Clinical trials has slow down in the business and has been back to normal which was high during the past 2 quarters.

Cost of Manglore facility:

• Facility has diluted margins by about 2%.

• Out of total OPEX it would be around 3% of the total cost once operational

• Facility has diluted margins by about 2%.

• Out of total OPEX it would be around 3% of the total cost once operational

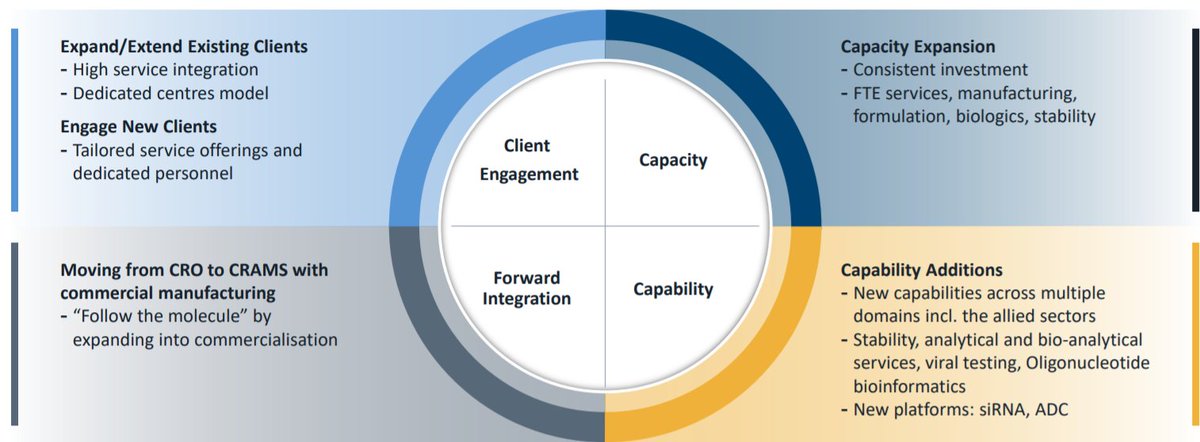

Partnership Model

3DC Partnership

• For every partnership model, co. initially shows the operational benefit they can give to the customer in terms of service and the same is witnessed by the company. 3DC approved the partnership because of the good service provided by Syngene.

3DC Partnership

• For every partnership model, co. initially shows the operational benefit they can give to the customer in terms of service and the same is witnessed by the company. 3DC approved the partnership because of the good service provided by Syngene.

• So basically all the past customer needs is betters service and when you deliver those in line you have good partnership.

Mangalore Facility:

• Mangalore facility is not viewed by the mgmt for the 1-2 year a good pick up, but company do has good vision in future even for the Mangalore facility and want to explore it with the future horizon for around 10-20 years

• Mangalore facility is not viewed by the mgmt for the 1-2 year a good pick up, but company do has good vision in future even for the Mangalore facility and want to explore it with the future horizon for around 10-20 years

• CAPEX investment of 100 Million last year has been invested majorly in Magalore facility, which will be commercialized over this year.

• Mangalore capacity is not a one year gain. Company has very long vision for the business and is expecting generate the gain over 5-6 year.

• Mangalore capacity is not a one year gain. Company has very long vision for the business and is expecting generate the gain over 5-6 year.

• While investment of biologics and is already generating profit.

Growth over this quarter- Growth at constant currency is about 10%

Growth over this quarter- Growth at constant currency is about 10%

• • •

Missing some Tweet in this thread? You can try to

force a refresh