A basic premier on the banking sector, demystifying commonly used terms,

CASA

Wholesale Banking

Net Interest Income (NII)

Cost of Liability

Advances Growth

Gross v/s Net NPA

Provisions

SLR/CRR

Capital Adequacy Ratio

Net Interest Margin (NIM)

Do hit the 're-tweet' (1/n)

CASA

Wholesale Banking

Net Interest Income (NII)

Cost of Liability

Advances Growth

Gross v/s Net NPA

Provisions

SLR/CRR

Capital Adequacy Ratio

Net Interest Margin (NIM)

Do hit the 're-tweet' (1/n)

Banking, as a business is simple to understand, you borrow money (liability for the bank as the bank needs to pay back) and lend (asset for the bank as the bank is expected to receive it bank), the difference between the borrowings & lending is banks income (2/n)

Where all can they borrow from?

(a) Savings Account (SA)

(b) Current Account (CA)

(c) Fixed Deposit (FD)

(d) Recurring Deposit (RD)

(e) Certificate of Deposits (CD)

(f) Bonds etc. (3/n)

(a) Savings Account (SA)

(b) Current Account (CA)

(c) Fixed Deposit (FD)

(d) Recurring Deposit (RD)

(e) Certificate of Deposits (CD)

(f) Bonds etc. (3/n)

Whom do they lend?

(a) Retail - Housing loan, auto loan, personal loan etc.

(b) Wholesale (Institutional Lending) – Commercial Papers (CP) & other Corporate Loans

P.S. – “HDFC Bank is now increasing focus on wholesale lending”, hope you now understand what that means (4/n)

(a) Retail - Housing loan, auto loan, personal loan etc.

(b) Wholesale (Institutional Lending) – Commercial Papers (CP) & other Corporate Loans

P.S. – “HDFC Bank is now increasing focus on wholesale lending”, hope you now understand what that means (4/n)

How does the bank profit?

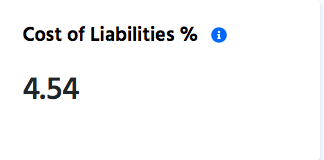

So lets say the average borrowing cost of the bank (also know as the cost of liabilities) is 4.54% & average lending cost is 8.54%, the difference 8.54% - 4.54% = 4% is called the Net Interest Income (NII). HDFC Banks Cost of Liability is 4.54% (5/n)

So lets say the average borrowing cost of the bank (also know as the cost of liabilities) is 4.54% & average lending cost is 8.54%, the difference 8.54% - 4.54% = 4% is called the Net Interest Income (NII). HDFC Banks Cost of Liability is 4.54% (5/n)

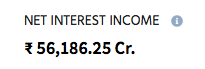

HDFC Banks NII is roughly 56,186.25 cr. Analysts track the growth in NII very closely as this is the main business of the bank. The higher the growth the better it is. (6/n)

What’s the margin in the banking business?

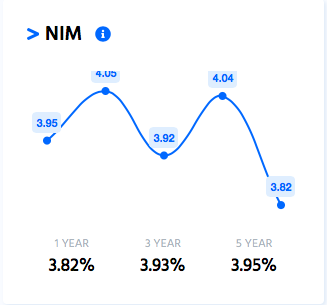

NIM helps us understand the margin in banking business

NIM = NII/Average interest earning asset

i.e. What is the net interest income generated by the bank/the amount of lending done

Margins of HDFC bank has been at close to 3.9%(7/n)

NIM helps us understand the margin in banking business

NIM = NII/Average interest earning asset

i.e. What is the net interest income generated by the bank/the amount of lending done

Margins of HDFC bank has been at close to 3.9%(7/n)

How can the banks business/profit/NII grow?

(a) Reducing the cost of liabilities (borrowings)

and/or

(b) Increasing lending/Giving out more loans (8/n)

(a) Reducing the cost of liabilities (borrowings)

and/or

(b) Increasing lending/Giving out more loans (8/n)

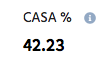

(a) How can banks keep the cost of liabilities lower?

Answer - CASA

CASA stands for current account & savings account (9/n)

Answer - CASA

CASA stands for current account & savings account (9/n)

You would observe, it’s the cheapest form of borrowing for the banks. SA – 3%, current account - 0%. Which is why banks want more and more CASA. The cheaper the banks are able to borrow (cost of liability), more the profits they can make (NII). (10/n)

P.S. - As a strategy, any new bank would generally offer a higher CASA to attract customers to open banking accounts. IDFC, Bandhan, Yes, Kotak all used the same strategy. Over a period of time, the rates are reduced, i.e. Kotak. (11/n)

HDFC banks CASA % of 42.23 means that out of the total 100 rupees of deposits the bank has, 42.23 rupees have been through CASA. Higher the number, better it is. (12/n)

(b) Increase in Lending also called as Advances Growth

It shows the YoY loan/advances growth by the bank. HDFC bank has been able to grow their loan book at 21.27%. Ofcourse the bank will make more NII by borrowing cheap & lending more, only if it is able to control NPA (13/n)

It shows the YoY loan/advances growth by the bank. HDFC bank has been able to grow their loan book at 21.27%. Ofcourse the bank will make more NII by borrowing cheap & lending more, only if it is able to control NPA (13/n)

What is an NPA?

When you miss 3 consecutive EMIs (90 days), the outstanding loan you owe the bank will be termed as an NPA (Non Performing Asset). In technical language, when you are paying EMIs on time, it’s called a standard asset & when you don’t, its called slippages (14/n)

When you miss 3 consecutive EMIs (90 days), the outstanding loan you owe the bank will be termed as an NPA (Non Performing Asset). In technical language, when you are paying EMIs on time, it’s called a standard asset & when you don’t, its called slippages (14/n)

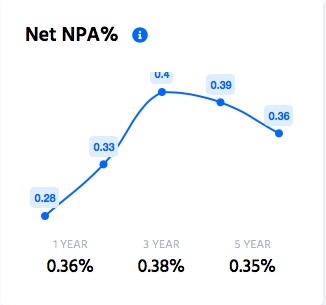

What’s the difference between Gross & Net NPA?

-Gross NPA means all the loans that have not been able to pay 3 consecutive EMIs, like explained above

-Net NPA means = Gross NPA – Provisions (15/n)

-Gross NPA means all the loans that have not been able to pay 3 consecutive EMIs, like explained above

-Net NPA means = Gross NPA – Provisions (15/n)

What r provisions?

When the bank knows that a particular loan account is finding it difficult 2 pay back, banks keep a % of the loan outstanding 2 the bank aside 2b able 2 build some reserves if the loan actually defaults. This makes sure that d banks financial health is in check

When the bank knows that a particular loan account is finding it difficult 2 pay back, banks keep a % of the loan outstanding 2 the bank aside 2b able 2 build some reserves if the loan actually defaults. This makes sure that d banks financial health is in check

So net NPAs are the NPAs for which no provisioning is done by the banks and hence lower the number better it is.

HDFC banks Net NPA of 0.36% means that of the total advances/loans, only 0.36% of the loans are not provided for. (17/n)

HDFC banks Net NPA of 0.36% means that of the total advances/loans, only 0.36% of the loans are not provided for. (17/n)

If the NPA ⬆️ steeply, can the bank go burst?

Its RBIs job 2 make sure the banking system is healthy & hence RBI has checks & balances in place 2 make sure banks don’t go burst. The common 1s u would have heard r the SLR–Statutory Liquidity Ratio & CRR–Cash Reserve Ratio (18/n)

Its RBIs job 2 make sure the banking system is healthy & hence RBI has checks & balances in place 2 make sure banks don’t go burst. The common 1s u would have heard r the SLR–Statutory Liquidity Ratio & CRR–Cash Reserve Ratio (18/n)

What is SLR & CRR?

So all deposits that the bank receives from various channels, is called NDTL in the banking language. Net Demand & Time Liability. It is nothing but the total deposits with the bank. (19/n)

So all deposits that the bank receives from various channels, is called NDTL in the banking language. Net Demand & Time Liability. It is nothing but the total deposits with the bank. (19/n)

Demand liability is CASA, investor can come and ask for the monies anytime and FD is Time liability, liability occurs after a point in time. Together, you call it NDTL = Total liability (20/n)

Imagine a bank with 100 of NDTL, SLR@21.5% & CRR@3%. This means,21.5 will have 2b compulsorily used 2 buy GSec,SDL,Tbills & 3 will have 2b kept with RBI. This leaves 75.5 with the bank 2 lend. What banks end up lending is even lower 4 various reasons, ‘provisions’ being 1 of them

So SLR, CRR does not allow the banks to lend the full deposits and that’s the first cushion amongst others and hence you see banking stocks go up when SLR, CRR is reduced, as they would have more monies to lend. (22/n)

Also u can track banks Capital Adequacy Ratio (CAR) 2 understand the banks health

CAR in simple terms mean that the bank is expected 2 have a minimum 11.5% capital against all the risky lending’s that bank has done. It’s somewhat like the provisioning thing we spoke about earlier

CAR in simple terms mean that the bank is expected 2 have a minimum 11.5% capital against all the risky lending’s that bank has done. It’s somewhat like the provisioning thing we spoke about earlier

If banks gave a loan to the government, no additional capital is required, if banks lent to RIL, some capital is required to be earmarked and if banks lent to DHFL, more capital is required by the bank. (24/n)

So if the banks do a lot of risky lending, banks CAR will fall and hence the banks will have the need to raise more capital from the market, sell equity or perpetual or Tier 2 bonds. HDFC banks CAR is a good 18.52% vs the RBI mandate of minimum 11.5% (25/n)

A detailed thread explaining CAR was written in the past explaining what happened in Yes Bank & Lakshmi Villas Bank bonds, you might find it an interesting read (26/n)

https://twitter.com/kirtan0810/status/1334697428113522693?s=20

This thread only focuses on the banking business and hence I purposely dint cover valuation and ratios around it, will write a separate thread on the same (27/n)

Hope the thread added value :) Hit the 're-tweet' and help us reach more investors. We have written multiple similar educative threads on personal finance. You can find them as a pinned tweet on my profile or click the link below (**END**)

https://twitter.com/kirtan0810/status/1337953717274832896?s=20

Primer*

• • •

Missing some Tweet in this thread? You can try to

force a refresh