The AUM of Mutual Fund Industry grew at the rate of 24% CAGR from the year 2014.

AUM has increased to 30 trillion from less than 10 trillion 5 Years ago and slated to grow to 100 trillion by 2030.

In India there are total 44 AMCs, and only 4 are listed companies.

AUM has increased to 30 trillion from less than 10 trillion 5 Years ago and slated to grow to 100 trillion by 2030.

In India there are total 44 AMCs, and only 4 are listed companies.

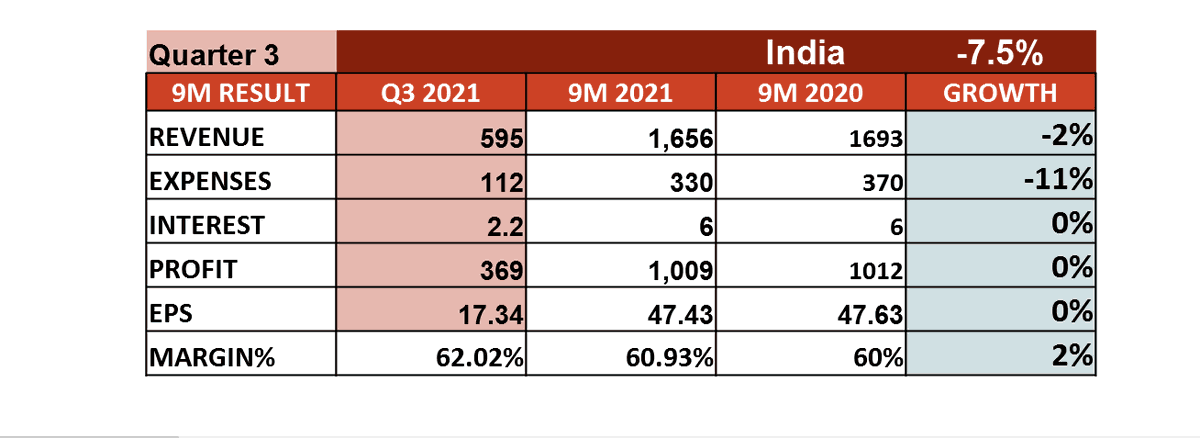

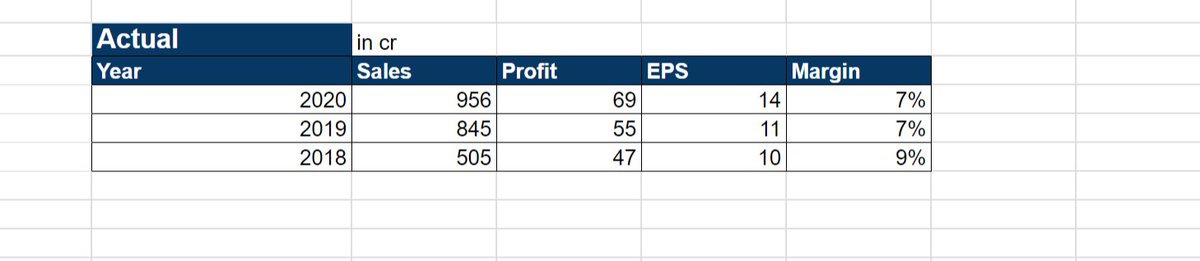

HDFC AMC Future projection :

2030 Revenue : 8,670 cr

2030 Profit : 7,814 cr

2030 EPS : 368 rs/share

2030 CMP : 15k to 18k

2030 Revenue : 8,670 cr

2030 Profit : 7,814 cr

2030 EPS : 368 rs/share

2030 CMP : 15k to 18k

• • •

Missing some Tweet in this thread? You can try to

force a refresh