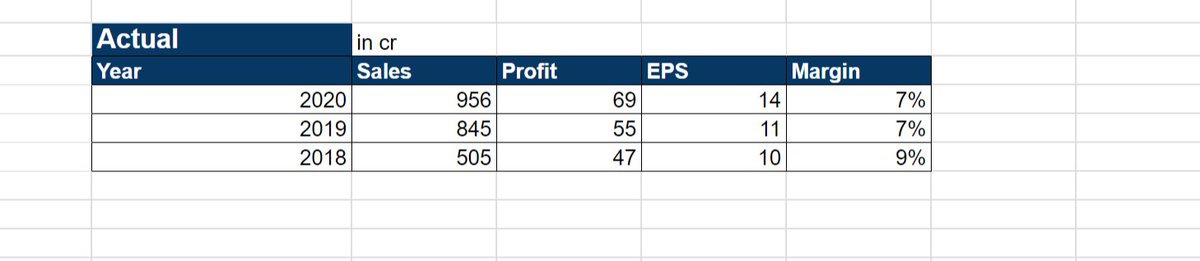

SALES :

2018 sales : 505 cr

2020 sales : 956 cr

3Y Sales growth : 38% CAGR

PROFIT :

2018 profit : 47 cr

2020 profit : 69 cr

3Y Profit Growth : 21% CAGR

2018 sales : 505 cr

2020 sales : 956 cr

3Y Sales growth : 38% CAGR

PROFIT :

2018 profit : 47 cr

2020 profit : 69 cr

3Y Profit Growth : 21% CAGR

Promoter's equity investment : 57 cr

Current reserves (shareholder's equity) : 492 cr

Debt : 4 cr

ROE : 14%

Current reserves (shareholder's equity) : 492 cr

Debt : 4 cr

ROE : 14%

Future Projection :

2030 Sales : 7,631cr

2030 Profit : 822 cr

2030 EPS : 165 rs/share

2030 CMP : 4117 rs

2030 Sales : 7,631cr

2030 Profit : 822 cr

2030 EPS : 165 rs/share

2030 CMP : 4117 rs

Verdict : ROE is mediocre, relative to peers (InfoEdge, IndiaMart, Affle)

If you have to, then hold not more than 1.5% weight it the portfolio. Route can be disrupted by other messaging alternatives.

I'd prefer to fatten Info Edge & India Mart instead of diluting the portfolio.

If you have to, then hold not more than 1.5% weight it the portfolio. Route can be disrupted by other messaging alternatives.

I'd prefer to fatten Info Edge & India Mart instead of diluting the portfolio.

• • •

Missing some Tweet in this thread? You can try to

force a refresh