SVP Global concall was at 22nd jan.

"Fastest growing multinational in cotton yarn manufacturing"

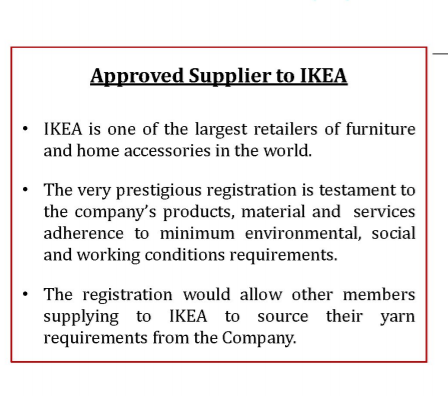

" SVP global is approved supplier of IKEA "

Here are the key takeways 😃

"Fastest growing multinational in cotton yarn manufacturing"

" SVP global is approved supplier of IKEA "

Here are the key takeways 😃

Overview

- The quarterly earnings concall is done after a long time.

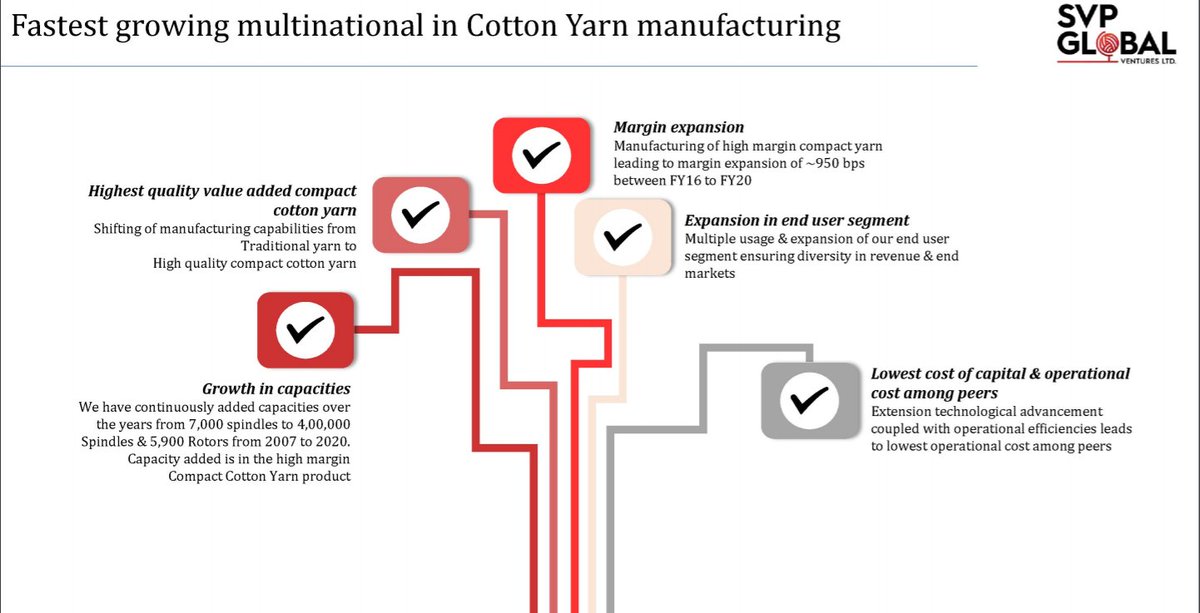

- Company is India's leading manufacturer of compact cotton yarn.

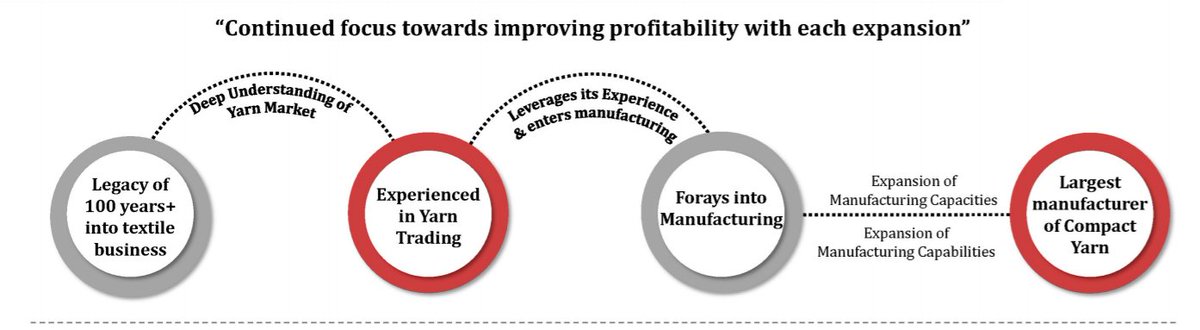

- Company has evolved from trading company to manufacturer of highest quality of cotton yarn

- The quarterly earnings concall is done after a long time.

- Company is India's leading manufacturer of compact cotton yarn.

- Company has evolved from trading company to manufacturer of highest quality of cotton yarn

- Has a legacy of more than 100 years in textile business & more than 200 years of combined experience of promoters in textile business.

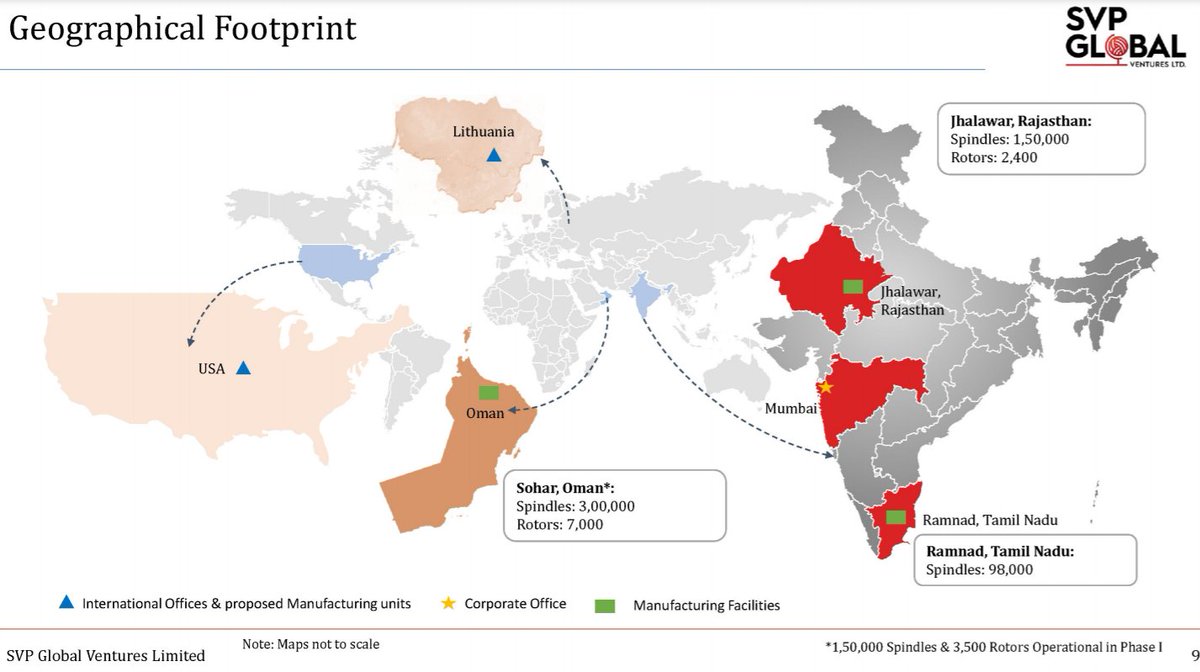

- Has expanded the units to Oman, middle east.

- Has expanded the units to Oman, middle east.

Manufacturing plans

1) Ramnad Plant, Tamil Nadu

- Yarn manufacturing capacity 98000 spindles, manufacturing cotton blended yarn.

- Strategy is focused on exiting low margin cotton yarn business and capacity expansion in high margin compact cotton yarn.

1) Ramnad Plant, Tamil Nadu

- Yarn manufacturing capacity 98000 spindles, manufacturing cotton blended yarn.

- Strategy is focused on exiting low margin cotton yarn business and capacity expansion in high margin compact cotton yarn.

- Reducing Tamil Nadu operations and increasing Oman capacity which has resulted in margin expansion with stable topline revenue.

2) Jhalawar plant, Rajasthan

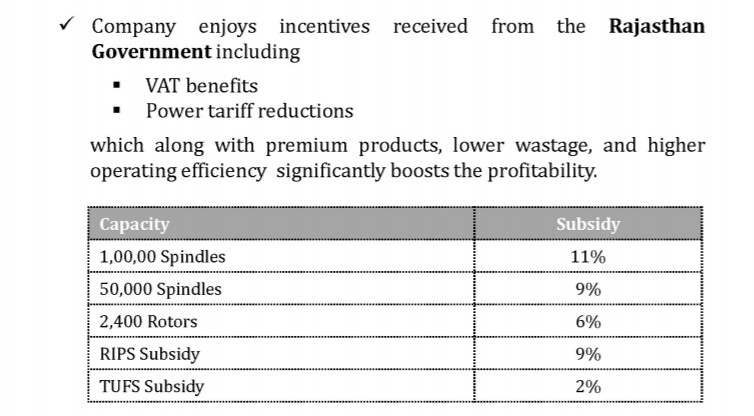

- State of art facility with an installed capacity of 1.5 lac spindle and 2.4k rotors.

- Jhalawar Plant has manufacturing capabilities of high quality compact yarn along with open end yarn and blended yarn.

- State of art facility with an installed capacity of 1.5 lac spindle and 2.4k rotors.

- Jhalawar Plant has manufacturing capabilities of high quality compact yarn along with open end yarn and blended yarn.

- It is in close proximity with MP, Gujarat which enables efficient raw material procurement.

- Multiple state and central level subsidies to support the company's operation in Rajasthan.

- Multiple state and central level subsidies to support the company's operation in Rajasthan.

3) Oman facility

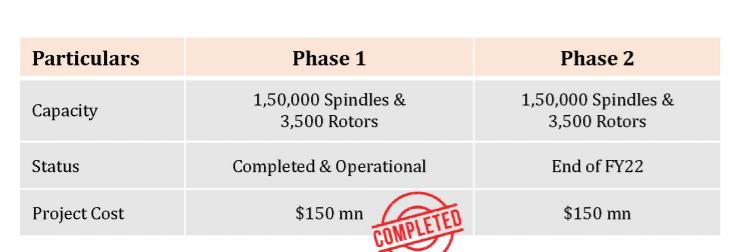

- Sohar freezone project is of 300 millions $

- Phase 1 to be scaled up fully by March 2021, it is already operational with 1.4lac spindles and 3.5k rotors.

- Phase 2 expansion project cost would be 150 millions $. Financed debt equity 70:30.

- Sohar freezone project is of 300 millions $

- Phase 1 to be scaled up fully by March 2021, it is already operational with 1.4lac spindles and 3.5k rotors.

- Phase 2 expansion project cost would be 150 millions $. Financed debt equity 70:30.

- Equipped with most equipped state of the art technology and will enable easy access to market like turkey and Pakistan.

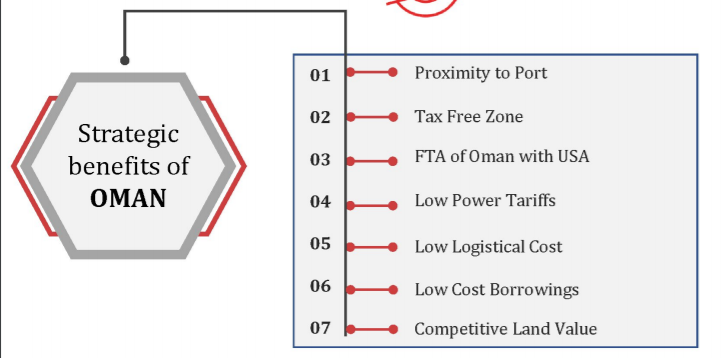

- Oman project has proximity to the port and is a tax free zone.

- Also has an FTA with USA.

- Power price are almost half.

- Oman project has proximity to the port and is a tax free zone.

- Also has an FTA with USA.

- Power price are almost half.

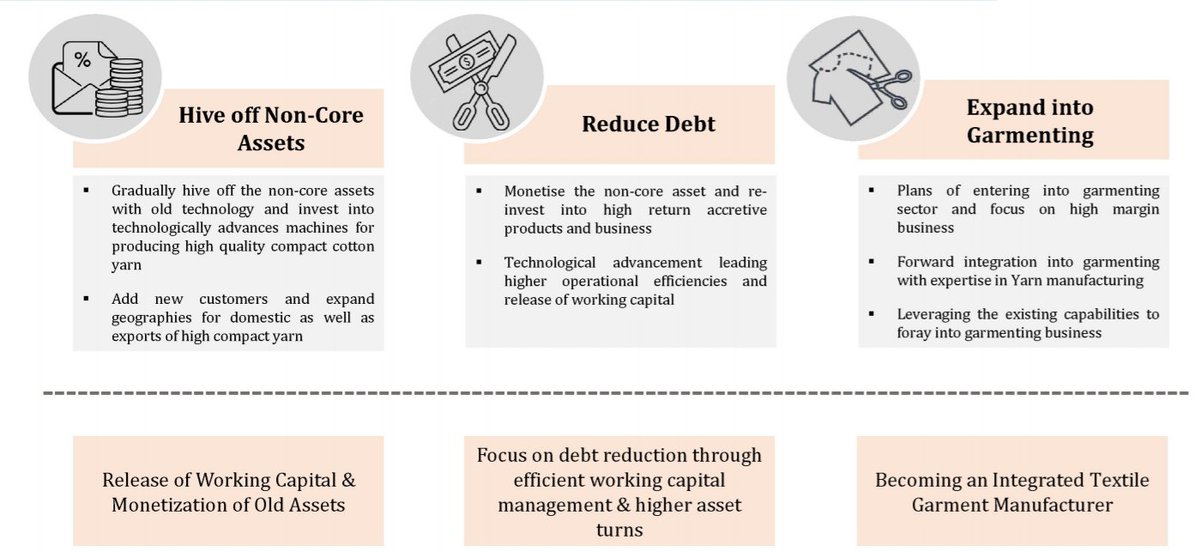

Next plans

- Become Integrated textile garment manufacturer present across the entire value chain.

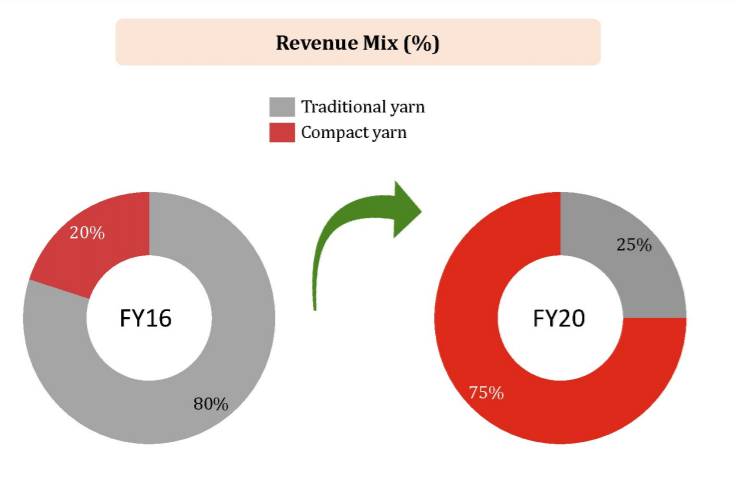

- Transformation from trading to manufacturing has led to the shift of product mix to high margin compact yarn & has increased ebitda margin from 3.7% in FY16 to 13.2% in FY20.

- Become Integrated textile garment manufacturer present across the entire value chain.

- Transformation from trading to manufacturing has led to the shift of product mix to high margin compact yarn & has increased ebitda margin from 3.7% in FY16 to 13.2% in FY20.

Financial performance

- Opening up of economy has witnessed a strong demand in yarn market and demand is back to the pre-covid level.

- Revenue mix from radiational and compact yarn is 16:84.

- Operational capacity more than 95%

- There is healthy order book.

- Opening up of economy has witnessed a strong demand in yarn market and demand is back to the pre-covid level.

- Revenue mix from radiational and compact yarn is 16:84.

- Operational capacity more than 95%

- There is healthy order book.

PLI scheme for textile

- Scheme is not directly linked to the company Company. But such scheme would increase the demand of yarn.

Margin differential form compact to traditional yarn

- Margin difference is of 6% to 8%

- Scheme is not directly linked to the company Company. But such scheme would increase the demand of yarn.

Margin differential form compact to traditional yarn

- Margin difference is of 6% to 8%

Debt position

- Total debt of 2300 crores (as of 31st Dec 2020)

- Secured debt is 1770 crores.

- Borrowing cost is relatively lower due to subsidies given by government

- Company is focusing on debt reduction over next 1-2 years.

- Total debt of 2300 crores (as of 31st Dec 2020)

- Secured debt is 1770 crores.

- Borrowing cost is relatively lower due to subsidies given by government

- Company is focusing on debt reduction over next 1-2 years.

New Technology advantage

- It has reduced the labors cost tremendously

- Power consumption is much lesser

- Quality it produces is far superior and wastage of cotton has reduced significantly.

- It has reduced the labors cost tremendously

- Power consumption is much lesser

- Quality it produces is far superior and wastage of cotton has reduced significantly.

Garment segment

- Proposed Garment project in Oman. Aim is to become an integrated manufacturing player.

- This will be more on the Apparel side used in Oman and European markets.

- Proposed Garment project in Oman. Aim is to become an integrated manufacturing player.

- This will be more on the Apparel side used in Oman and European markets.

• • •

Missing some Tweet in this thread? You can try to

force a refresh