APL Apollo conducted their earnings con-call today at 2:00 pm

"Vision of capacity of 4 Million Tone till 2025"

@hiddengemsindia @gvkreddi

Here are the key highlights 😀👇

"Vision of capacity of 4 Million Tone till 2025"

@hiddengemsindia @gvkreddi

Here are the key highlights 😀👇

Business Updates:

• Net Working Capital Remains under 10 days which is best in the building material

• Continue expanding rural region.

• Added 15 new distributors.

• Value added products contributed 50-60% of the topline.

Revenue breakup

• Net Working Capital Remains under 10 days which is best in the building material

• Continue expanding rural region.

• Added 15 new distributors.

• Value added products contributed 50-60% of the topline.

Revenue breakup

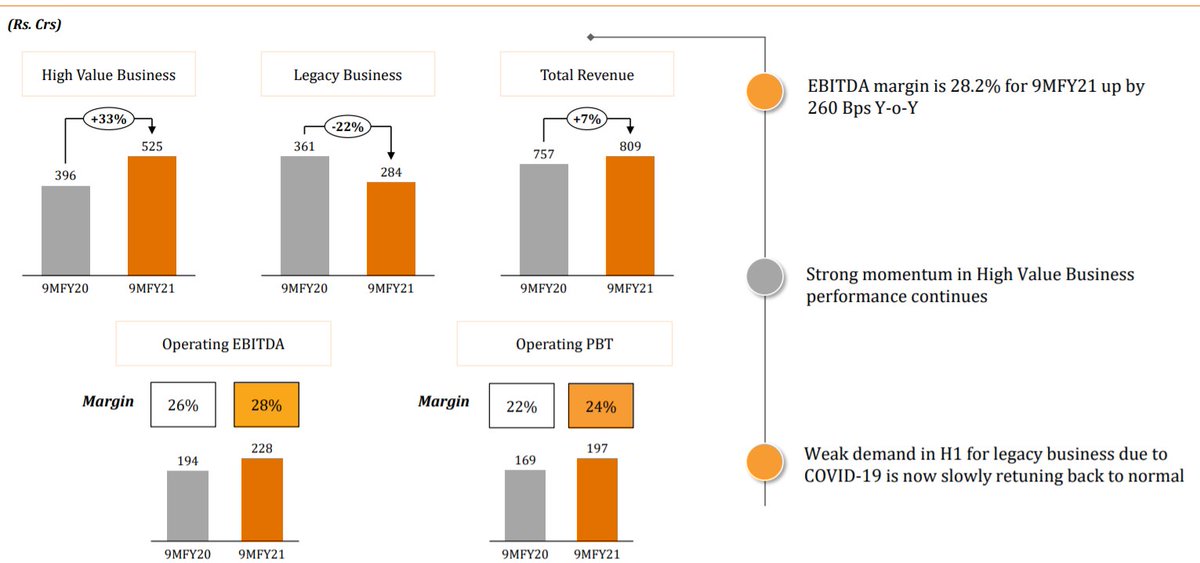

• EBIDTA Margin Improvement: This was mainly because of cost structarize and better operational

• Working Capital Cycle as per mgmt should remain sustainable

• Blue Ocean: Company owns 100% subsidiary which contributes nothing but own property where corporate office is there

• Working Capital Cycle as per mgmt should remain sustainable

• Blue Ocean: Company owns 100% subsidiary which contributes nothing but own property where corporate office is there

Improvement in Net Selling Realization:

• With expanding capacities at 2.6Million Tones and utlization of 75%, scalability has been affected.

• While the prices of steel has gone by by around 35%, due to shortage of steel.

• With expanding capacities at 2.6Million Tones and utlization of 75%, scalability has been affected.

• While the prices of steel has gone by by around 35%, due to shortage of steel.

• Apl Apollo being the dominant player past connection with steel companies worked well.

• Steel tubes supply from China is shrinking.

• Hence the discounting factor while selling the products has went away.

• Steel tubes supply from China is shrinking.

• Hence the discounting factor while selling the products has went away.

Apollo Pipes benefit from APL:

• APL apollo is not providing any benefit to Apollo Pipes

• Though they are sister companies but advertisement of APL is around 50-60 crores while their is around 10-20 crores

• APL will not enter their business while they will not APL's business

• APL apollo is not providing any benefit to Apollo Pipes

• Though they are sister companies but advertisement of APL is around 50-60 crores while their is around 10-20 crores

• APL will not enter their business while they will not APL's business

On Stores manufacturing :

• Company has started the stores in Uttranchal for Door Frame

• Company also coming up with the other service providing and also planning for shops where service can be provided easily.

• Company has started the stores in Uttranchal for Door Frame

• Company also coming up with the other service providing and also planning for shops where service can be provided easily.

• Company did got stuck this year in Raw Material which was reason in decline in volume.

• Mgmt did expect to grow 20% for the next year.

Adv: Company wants to make brand more visible, hence online marketing will be focus.

• There are no expansion plans as of now for Tricoat

• Mgmt did expect to grow 20% for the next year.

Adv: Company wants to make brand more visible, hence online marketing will be focus.

• There are no expansion plans as of now for Tricoat

• Company did got BIS for electrical solutions and this market is very big in India.

• But the company will soon design the strategy for electric solution.

• Company has low impact on steel price as they only have inventory days of less than 20

• But the company will soon design the strategy for electric solution.

• Company has low impact on steel price as they only have inventory days of less than 20

Raipur Facility:

• Raipur factory process got slowed but now taken its pace.

• More than 90% is difficult to go, but the capacity is 2 Lakh tone.

• Raipur factory process got slowed but now taken its pace.

• More than 90% is difficult to go, but the capacity is 2 Lakh tone.

Sales diversification:

• Almost 85% of the sales is from distribution sales.

• Trade system of the market has been replaced which will cut down the inventory levels by 30-35%.

• Almost 85% of the sales is from distribution sales.

• Trade system of the market has been replaced which will cut down the inventory levels by 30-35%.

Cash utlization:

• First Debt will be paid off

• Second would be for expansion

• Next would be for dividend and buyback. After this quarter company will be planning for dividend policy

• First Debt will be paid off

• Second would be for expansion

• Next would be for dividend and buyback. After this quarter company will be planning for dividend policy

New Product:

• Company is bringing new color pipe where company is planning for coloring the pipe.

• Company has succeeded the technology for this and this would eventually turns favorable.

• 500 square pipes, where high rise building will be much favourable to get the use

• Company is bringing new color pipe where company is planning for coloring the pipe.

• Company has succeeded the technology for this and this would eventually turns favorable.

• 500 square pipes, where high rise building will be much favourable to get the use

Unique strategy

• Company has set up DSV which helped the invetory.

• Company has developed warehousing and is planning to improve the supply chain. Company aims for supplying to customer in 24 hours.

• Company has set up DSV which helped the invetory.

• Company has developed warehousing and is planning to improve the supply chain. Company aims for supplying to customer in 24 hours.

Expansion:

• Started 2 galvanizing line in Raipur and 1 more will be started in March-April

• Next is to start 1 Lakh Tone capacity for Pipes in Raipur which will be for next year.

• Started 2 galvanizing line in Raipur and 1 more will be started in March-April

• Next is to start 1 Lakh Tone capacity for Pipes in Raipur which will be for next year.

• Color Pipe will be helpful to customer in many ways. Hence this will benefit to customer in many ways.

• Color Pipe will not increase the WC as company is planning to squeeze the WC more and there wont be increase in inventory days.

• Color Pipe will not increase the WC as company is planning to squeeze the WC more and there wont be increase in inventory days.

Next Quarter:

• Main focus would be be EBIDTA Margin.

• There may be ups-down in the next quarter but main objective would be to improve organizational structure.

• Next 4-5 year vision remains (2025 vision) remain at 4 Million Tones.

• Main focus would be be EBIDTA Margin.

• There may be ups-down in the next quarter but main objective would be to improve organizational structure.

• Next 4-5 year vision remains (2025 vision) remain at 4 Million Tones.

Key Focus

• Focus on R&D and improving the product mix

• Widen organisation structure

• 9 to 19 levels are inputs of people from good employees

• Inhouse vacancy system.

• Work on Value Added Product.

• Focus on R&D and improving the product mix

• Widen organisation structure

• 9 to 19 levels are inputs of people from good employees

• Inhouse vacancy system.

• Work on Value Added Product.

Expansion on New Product:

• There won't be not expansion on new product.

• There wont be any CAPEX on commodity purpose.

• Company is focusing on outsourcing business model

• There has been change in the working capital structure which made the operational very well.

• There won't be not expansion on new product.

• There wont be any CAPEX on commodity purpose.

• Company is focusing on outsourcing business model

• There has been change in the working capital structure which made the operational very well.

IT and Data

• Company already has SAP which make digitization process easy.

• Company is coming up with an app which will improve real time information of instant contacting with customer distributors and maintaining the product.

• Company already has SAP which make digitization process easy.

• Company is coming up with an app which will improve real time information of instant contacting with customer distributors and maintaining the product.

Retail Growth:

• There has huge demand growth pending in the East region. Warehousing over there has been set up over there and expansion over there is still pending where company can see 15-20 growth easily over next few years.

• There has huge demand growth pending in the East region. Warehousing over there has been set up over there and expansion over there is still pending where company can see 15-20 growth easily over next few years.

Advertisement From Amitabh Bacchhan:

• Company has rough survey where 15-20% of the business growth is due to advertisement.

• 30% Fabricators have been known with the product due to advertisement.

• Company has rough survey where 15-20% of the business growth is due to advertisement.

• 30% Fabricators have been known with the product due to advertisement.

Fear of management:

• Main fear remains is to make this growth stable, and manage this growing enterprise.

• WC will always be managed.

• Main fear remains is to make this growth stable, and manage this growing enterprise.

• WC will always be managed.

Apollo Tricoat:

• Focus remains to increasing the EBIDTA margins and maintaining the business.

• Tricoat has 3 key product has been manufactured first time (while Cahukat and Elangant is world wide), this innovation were very strong.

• Focus remains to increasing the EBIDTA margins and maintaining the business.

• Tricoat has 3 key product has been manufactured first time (while Cahukat and Elangant is world wide), this innovation were very strong.

• • •

Missing some Tweet in this thread? You can try to

force a refresh