Polycab India conducted their earnings con-call today at 2:00 pm

Here are the key highlights 😀👇

@drprashantmish6 @nid_rockz @karansharma_09 @saketreddy

Here are the key highlights 😀👇

@drprashantmish6 @nid_rockz @karansharma_09 @saketreddy

Business Updates:

• Good broad based recovery.

• construction and Infrastructure has been picked up, while retails segment has shown good bounced back.

• Sudden increase in demand increased the price of of raw material and the price of the end product.

• Good broad based recovery.

• construction and Infrastructure has been picked up, while retails segment has shown good bounced back.

• Sudden increase in demand increased the price of of raw material and the price of the end product.

• Certain key raw material increase by almost 50-60% for which the company has also increased the price.

• Project Udaan has been progressing well and the many new initiatives had been fructified with hope that until Q2 of FY 2021 there will be good contribution.

• Project Udaan has been progressing well and the many new initiatives had been fructified with hope that until Q2 of FY 2021 there will be good contribution.

• B2C Wire ahs seen good growth with B2B wires are recovering.

• Export business has been declined by 33% YoY, however continue to see good performance.

• Project bandhan has led to 178000 electrician and 58000 retailer

• Export business has been declined by 33% YoY, however continue to see good performance.

• Project bandhan has led to 178000 electrician and 58000 retailer

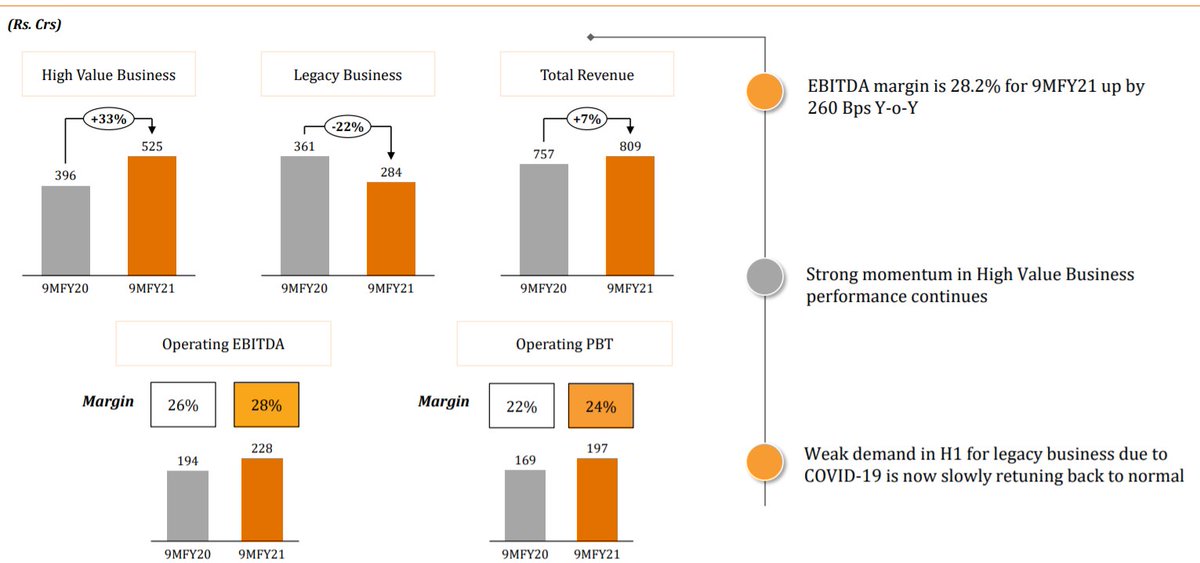

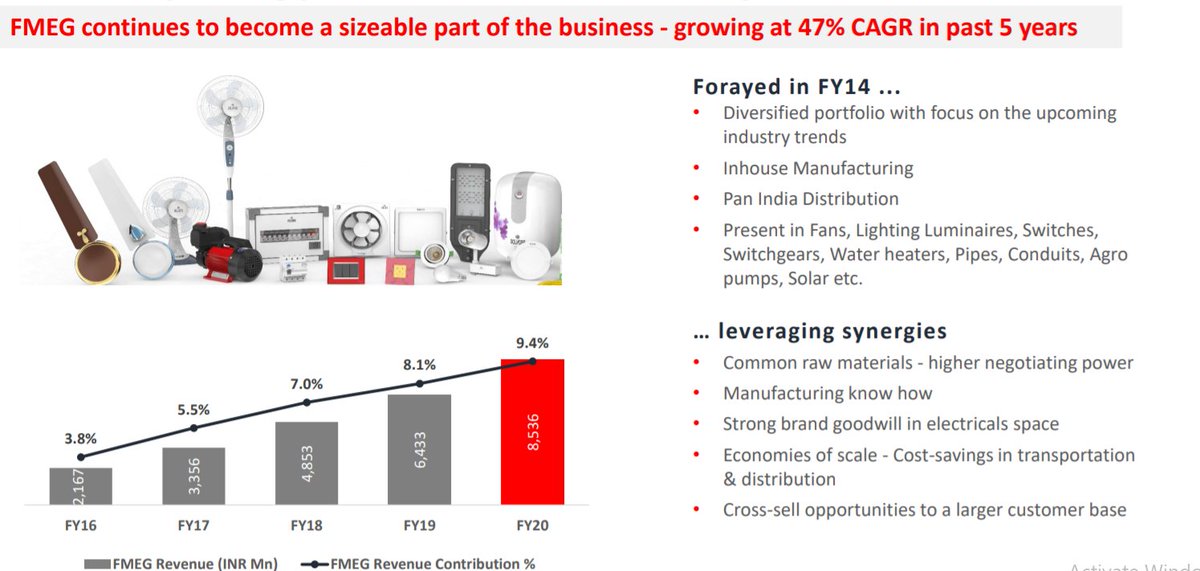

FMEG:

• FMEG business has seen good growth with raw material power remain in the hand of the company.

• Company continuous to expect good growth from the segment.

Reason for highest growth- Competitive intensity remains the key reason, but the margins remains the next priority

• FMEG business has seen good growth with raw material power remain in the hand of the company.

• Company continuous to expect good growth from the segment.

Reason for highest growth- Competitive intensity remains the key reason, but the margins remains the next priority

Financial Update:

• Finance cost remain on line.

• D/E remain at same level with net cash increased 2x

• Inventory optimization has been continuous resulting in balance in inventory.

• IPL related expenses remain as per the target

• Finance cost remain on line.

• D/E remain at same level with net cash increased 2x

• Inventory optimization has been continuous resulting in balance in inventory.

• IPL related expenses remain as per the target

Gross Margin decline

• This was mainly because of increase in raw material. Copper and Aluminium has been increased by 15%

• Overall cost has been increased high T's and company has increased the price low T making the delta, however company predicts FMEG margin will go 2 digit

• This was mainly because of increase in raw material. Copper and Aluminium has been increased by 15%

• Overall cost has been increased high T's and company has increased the price low T making the delta, however company predicts FMEG margin will go 2 digit

Metal Procurement:

• Metal are bought on 0 credit. Hence there instant payment.

• Imported products are stated in acceptance where the payment will be made as the delivery is received.

• Metal are bought on 0 credit. Hence there instant payment.

• Imported products are stated in acceptance where the payment will be made as the delivery is received.

Copper Price:

• Company will continue to take the price hike but will simultaneously see that the margins remain on line.

• Go-to-market strategy has remain to target in semi urban, lower region town

• Company will continue to take the price hike but will simultaneously see that the margins remain on line.

• Go-to-market strategy has remain to target in semi urban, lower region town

Channel Financing

• Channel financial for cable has been 60-65% and FMEG channel financing is around 15-18%.

• Company with the help of channel financing tries to keep the Net receivable equals to the payable

• Channel financial for cable has been 60-65% and FMEG channel financing is around 15-18%.

• Company with the help of channel financing tries to keep the Net receivable equals to the payable

Speedy Growth:

• Company has been market leader and continuous to remain.

• There are certain segment where company can enter and do well, but with certain other constraints on the product such as (global supply, labor issues) company is not entering.

• Company has been market leader and continuous to remain.

• There are certain segment where company can enter and do well, but with certain other constraints on the product such as (global supply, labor issues) company is not entering.

However current growth management expects to be very much aggressive growth and expects to remain same.

Dangote: Company has received the follow up order and the first order has been already supplied. There are no significant order on the next big order.

Dangote: Company has received the follow up order and the first order has been already supplied. There are no significant order on the next big order.

Growth strategy:

• Good Pricing and Quality which management estimates to bee the key growth drivers and company targets to continue deliver the same.

• Export market will be remain to be the next growth strategy and company wants to expand its products globally as well.

• Good Pricing and Quality which management estimates to bee the key growth drivers and company targets to continue deliver the same.

• Export market will be remain to be the next growth strategy and company wants to expand its products globally as well.

• Pipes and Agro continuous to remain topline growth. Over the next 1-2 years company expects FMEG to lead the good growth part of the company.

• B2C contributes at 40% revenue which was 30% last year.

• B2C contributes at 40% revenue which was 30% last year.

Price Increase

• Copper business which has lesser margins but in Q3 there was time lag between increase in the price of raw material and increase in the price hike. But co. RM price to remain stable next Q

• but company does not expect the same hike in the price of raw mateiral

• Copper business which has lesser margins but in Q3 there was time lag between increase in the price of raw material and increase in the price hike. But co. RM price to remain stable next Q

• but company does not expect the same hike in the price of raw mateiral

New Product:

• Almost all the new brands will be manufactured by the company only, however certain products such as fans, where company has low facility will be outsourced.

• Almost all the new brands will be manufactured by the company only, however certain products such as fans, where company has low facility will be outsourced.

Utlization of cash.

• Dividend policy will remain same.

• Utilization of the surplus will be used in inorganic expansion.

• While remaining cash company to been in hand only to take advantage of short term opportunities.

• Dividend policy will remain same.

• Utilization of the surplus will be used in inorganic expansion.

• While remaining cash company to been in hand only to take advantage of short term opportunities.

Ryker:

• Ryker has capacity of 2x of the current demand.

• Company has been planing for scalability and decreased the cost.

• Company has two chance- Get the third part ties up or to go for backward integration.

• Ryker has capacity of 2x of the current demand.

• Company has been planing for scalability and decreased the cost.

• Company has two chance- Get the third part ties up or to go for backward integration.

• Company is planning for both of these plans as company wants backward integration to remain on line with good tie ups

• Fan is around 40% of topline, Lighting around 30

• Fan is around 40% of topline, Lighting around 30

IoT:

• IoT based will help company to bring its product online

• Co. is still exploring where they can sell the product. Initially it will be only sold online on the company website, but this will be where consumer can gauge the product online entirely and then on other website

• IoT based will help company to bring its product online

• Co. is still exploring where they can sell the product. Initially it will be only sold online on the company website, but this will be where consumer can gauge the product online entirely and then on other website

Highest Driver:

• East region has been highest driver.

• In Fan Product category Fan has been the highest growth driver, then Lighting has been the next growth driver.

• Switch Gear business has seen 100% of growth due to the realignment of plant.

• East region has been highest driver.

• In Fan Product category Fan has been the highest growth driver, then Lighting has been the next growth driver.

• Switch Gear business has seen 100% of growth due to the realignment of plant.

For more stock market discussion do join our telegram channel:

t.me/thetycoonminds…

t.me/thetycoonminds…

• • •

Missing some Tweet in this thread? You can try to

force a refresh