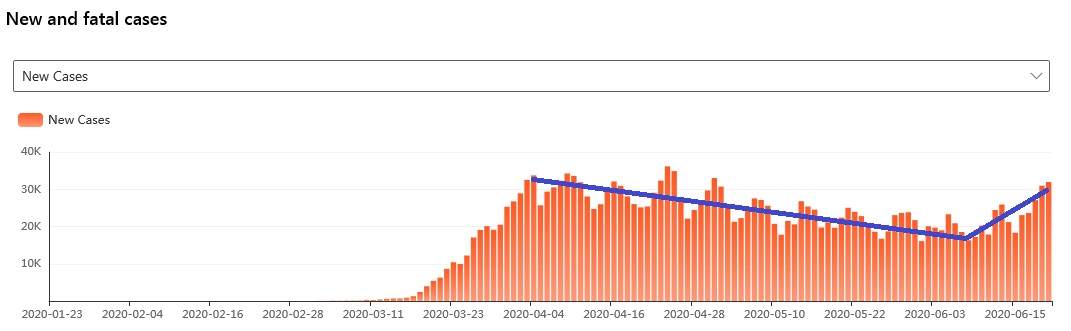

1/ Futures down tonight. 2 things. 1) I don't like big gaps near the high. Odds favor it is recovered. 2) No break until the lower blue line breaks. As long as the gap down stays above this, watch for rally to fill gap.

2/ That said, this is the final segment in the wedge and there is likely a lot of overlap but no more than 3 clear waves. once gap fills, that may be it so a terminal end is upon us.

3/ Once the lower wedge breaks though, next should be the lower parallel line here. We are seeing downside moves appear swiftly and this may continue to hold true with little time to react. I suspect that lower lines proves to be another bounce point tho.

4/ But we're not done yet. After the channel bounce ~3725, I expect us to break to the next channel line. Near 3500. And yet another probably bounce point tho it may be the last before a 3rd wave segment takes hold.

• • •

Missing some Tweet in this thread? You can try to

force a refresh