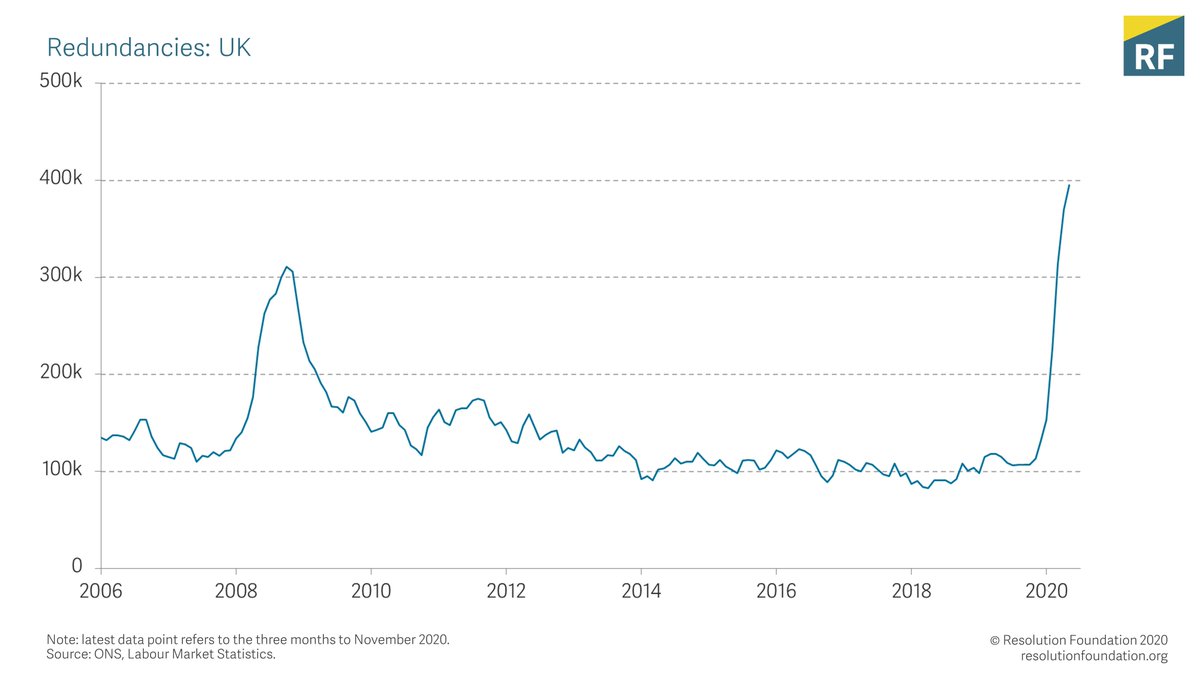

This morning’s @ONS data shows the labour market continuing to weaken last autumn, with redundancies reaching a record high in the three months to November. But timely data for November and December offers more of a mixed picture. (Full reaction thread)

In headline terms, the main story is one of ongoing weakening towards the end of 2020. The unemployment rate reached 5 per cent in the three months to November (for the first time since 2016).

The Labour Force Survey continues to have some measurement challenges. There is a group who describe themselves as employed but who aren’t working and aren’t being paid. Adding them to the unemployment count takes the rate closer to 6 per cent.

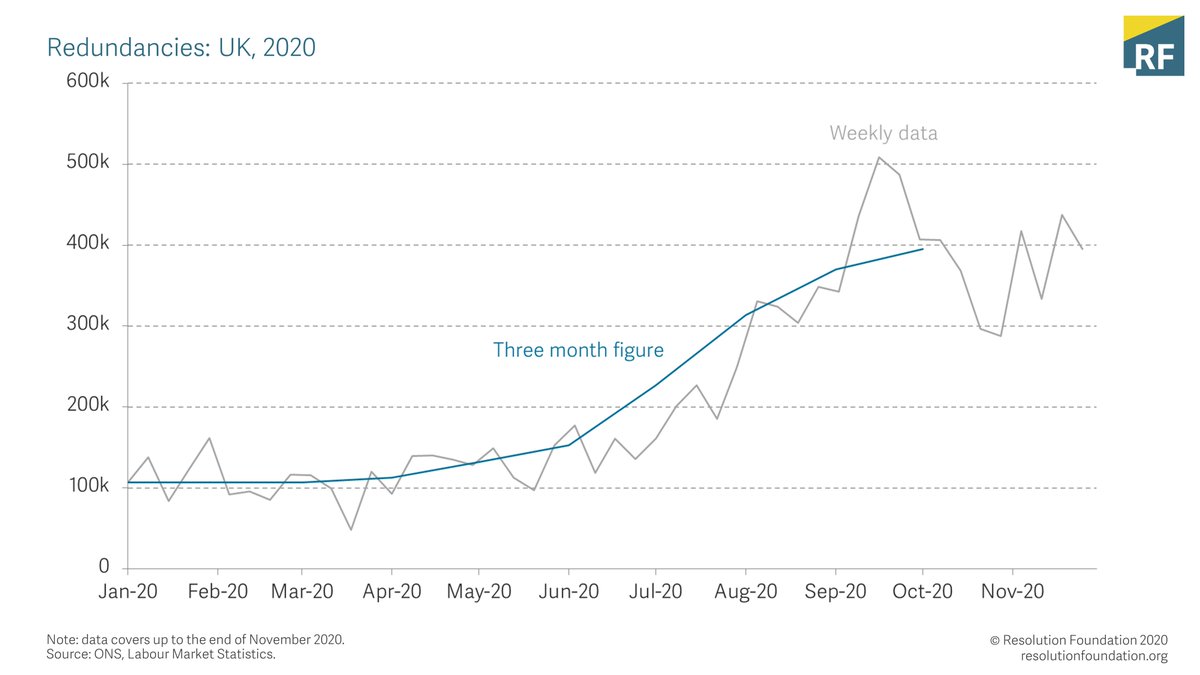

In a crisis changing as quickly as this one, three-monthly data has its limitations. And there are some cases where the most timely data gives a slightly different picture (although it is also more volatile data, so needs to be treated with caution).

For example, the three monthly redundancy figure reached a new high of 395k in the three months to November, suggesting ongoing weakening...

... But the weekly redundancies data shows redundancies falling through October but rising again in November - more of a mixed picture.

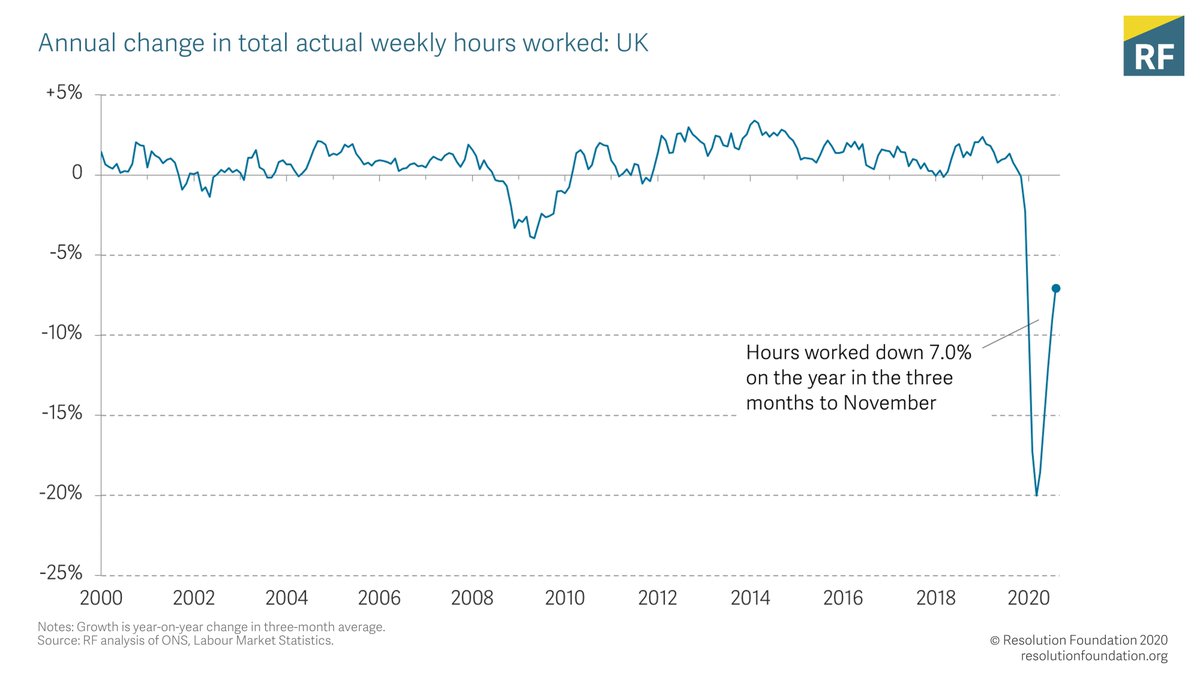

On the other hand, total hours worked have continued to show some recovery in the three months to November, with hours up 15% on the previous three months (June-August) - but hours are still 7% lower than a year earlier.

Strikingly, the recovery in hours worked has continued even as GDP fell in the November lockdown (though it’s worth remembering that the latest hours worked figure covers the three months from September-November, whereas GDP is single-month)

Similarly, the monthly and weekly data unemployment data suggest that things stopped worsening in November.

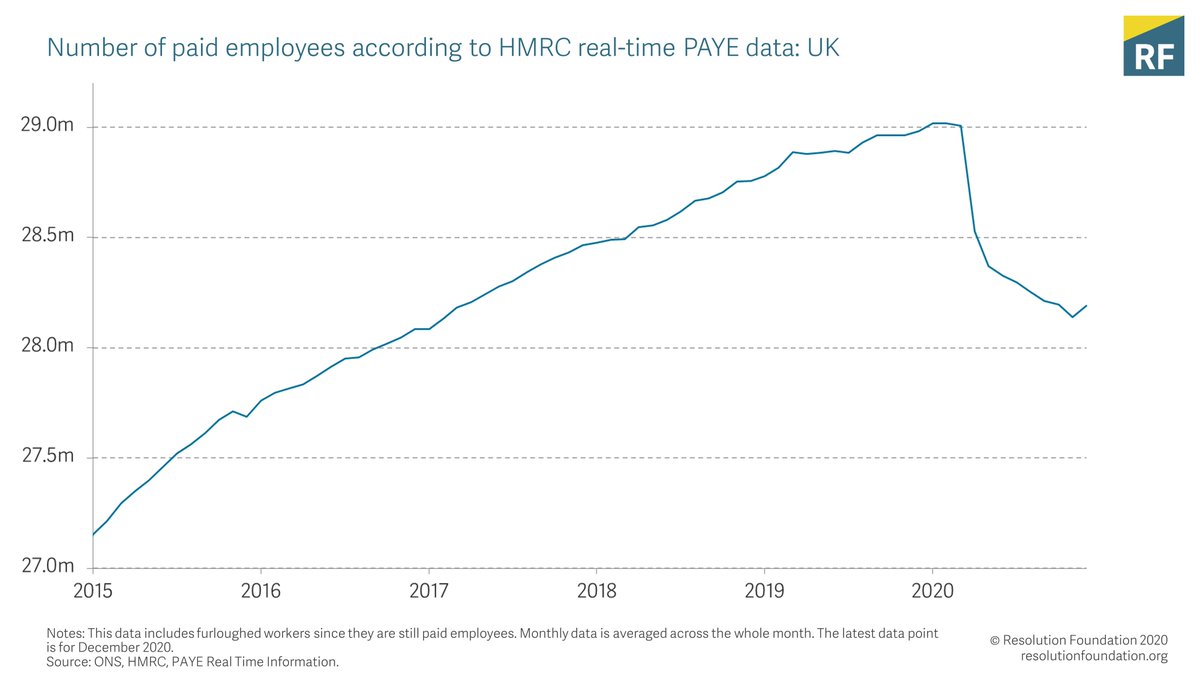

HMRC’s count of paid employees shows a slight improvement in December, as the country came out of lockdown. Although don’t forget the big picture - employee jobs are down 830k on pre-crisis.

The number of people temporarily away from work (including furloughed workers) rose to 4.8 million in early November as the lockdown set in - but this fell back to 3.7 million in the second half of the month, and was far lower than the 9 million seen in the first lockdown

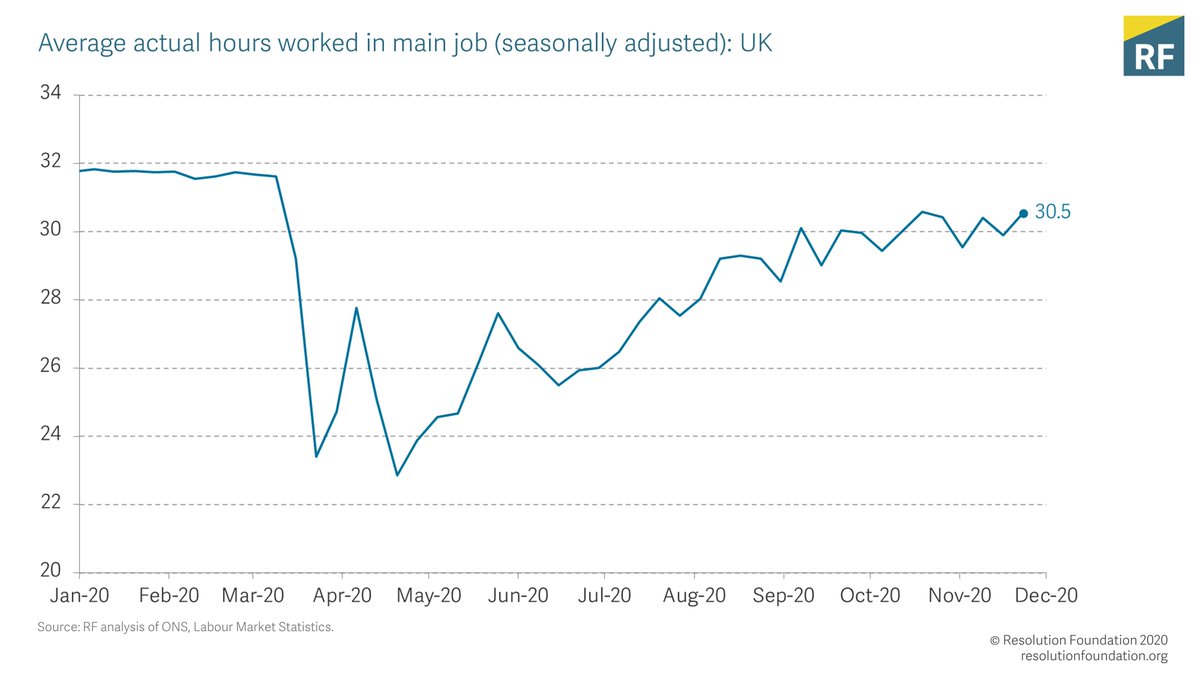

But the impact of the November lockdown is not obvious from average hours worked. Average weekly hours have remained fairly stable since mid-October and stood at 30.5 in late November - up from a low of 22.9 in April but still below their pre-crisis average of 31.7

The most timely vacancies data shows the number of vacancies fell in both November and December, having been on a recovery path since May.

This remains an intensely sector specific crisis. Conditions in Hospitality continued to be very tough. The number of paid employee jobs in December was down 343k (-17%) compared to February.

While vacancies in Hospitality in December were at a quarter of their pre-crisis levels. Vacancies also remained very low in Leisure and Retail.

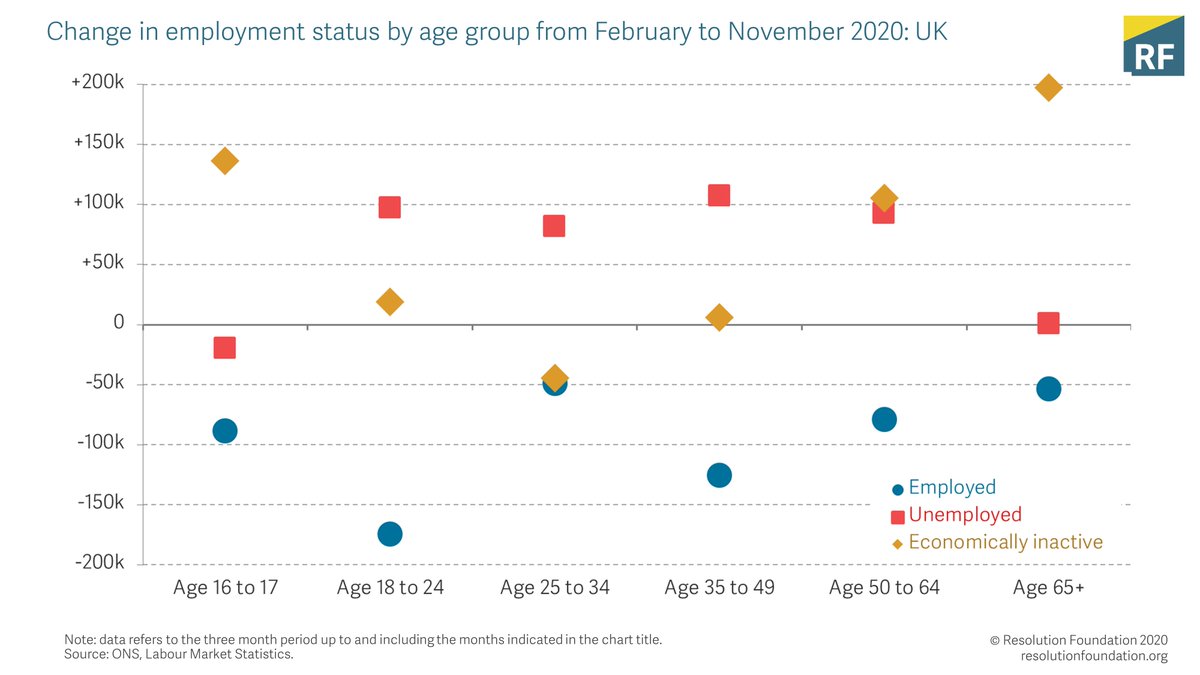

On age, there was some positive news in the latest data in that the youth unemployment rate stopped rising. Although the bigger picture is that young people (age <25) still account for around half (46%) of the total fall in employment since the start of the crisis.

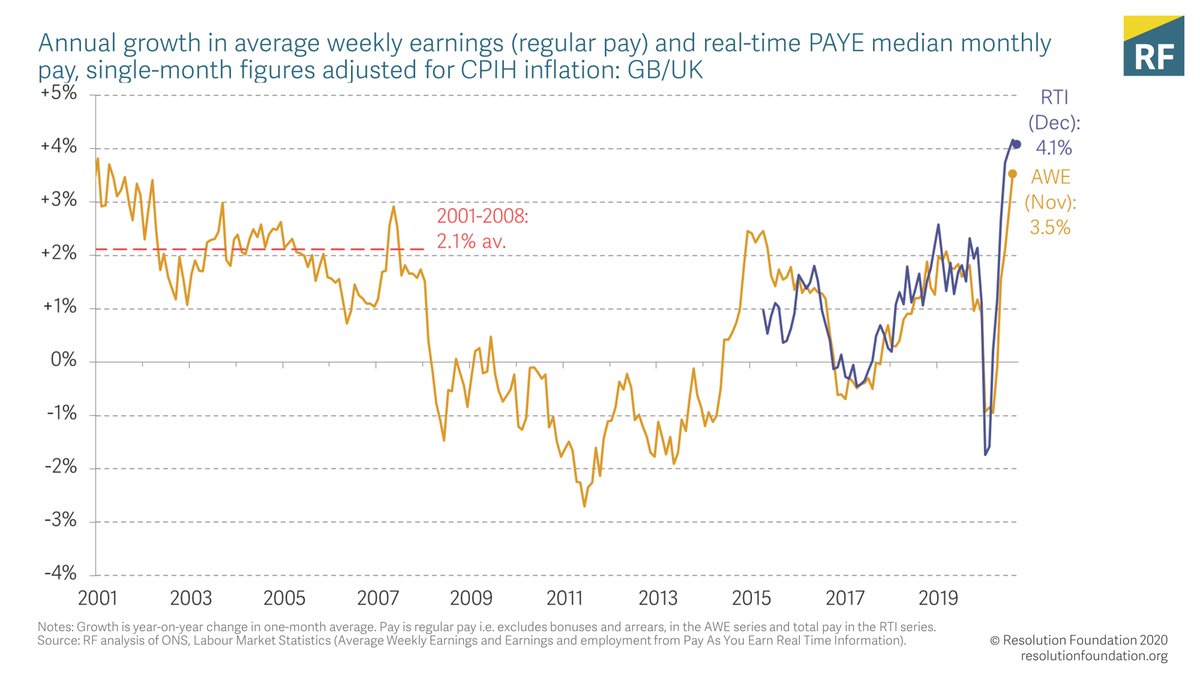

On pay, average weekly earnings have continued to rise, growing by 3.5% in real terms in the year to November.

Timely real-time data from HMRC shows a similar story, with median employee pay rising by 4.1% in the year to December.

This is at least partly due to compositional effects. Our research has shown that average pay has risen as the relative number of people in lower-paying occupations, with fewer qualifications and working part-time has fallen: resolutionfoundation.org/publications/e…

And most sectors are now seeing rises in average pay, with arts, entertainment and recreation seeing the biggest rise of 9.4%, followed by the ‘other services’ sector (including hair/beauty and repairs, for example).

• • •

Missing some Tweet in this thread? You can try to

force a refresh