Today’s BBC report highlights the big hit to self-employed workers in the Covid-19 crisis. Our research has shown that the self-employed have faced a huge income shock – but support is poorly targeted. A thread…

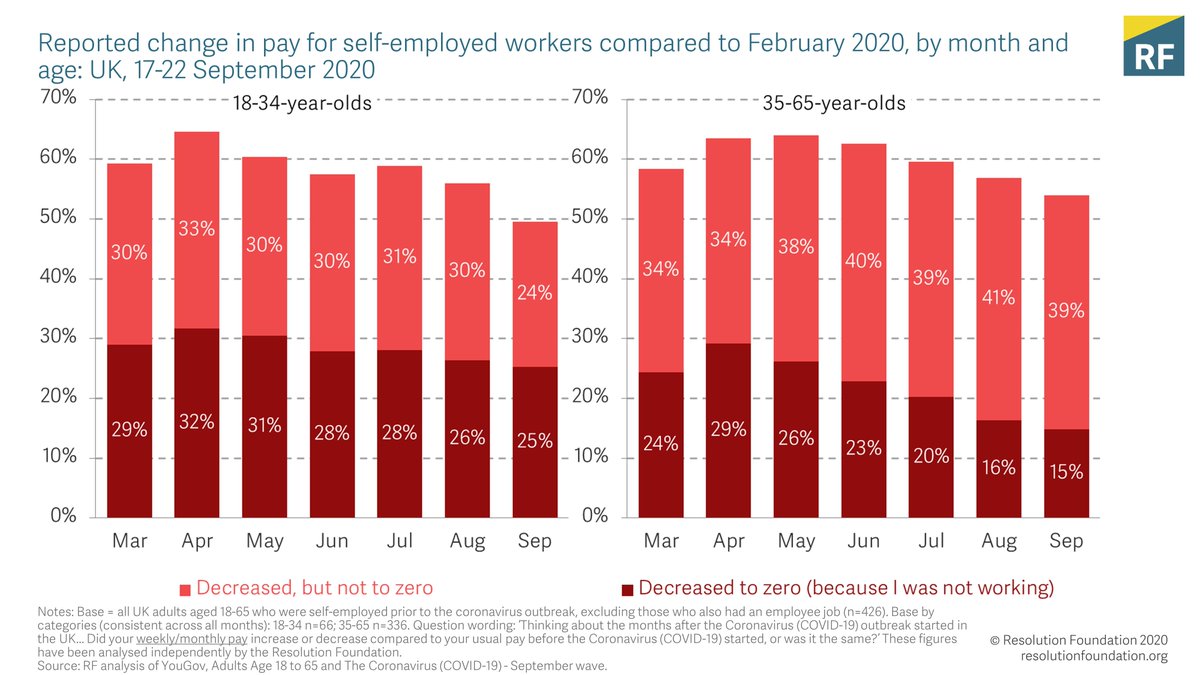

At the height of last spring’s lockdown, three-in-ten self-employed people were left entirely without work. And even when the economy was opening up in September, more than half still had a lower income than before the crisis, and one-in-six were still without work.

All groups of self-employed workers have been impacted, but the young most of all – in September, a quarter of 18-34-year-olds self-employed workers didn’t have any work.

That didn’t just reflect a deeper hit – it took young people longer to recover from the initial impact. The share of 35-65-year-olds without work halved between April and September, but 18-34-year-olds’ work picked up far more slowly.

Some have left self-employment entirely. The latest ONS data shows a fall in self-employment of 537,000 since the start of 2020 – and three-in-five people who left self-employment between April and September last year stopped working entirely (with the rest becoming employees).

The main source of support for the self-employed has been the Self-Employed Income Support Scheme – but this has been terribly targeted. Close to 500,000 workers who were without work in September received no support, while others who hadn’t lost income got grants regardless.

Our report in October argued that the SEISS needs to be much better targeted, giving support to all those who need it while compensating only for genuine falls in income. resolutionfoundation.org/publications/j…

Many self-employed workers who miss out on SEISS rely on Universal Credit. UC data is patchy, but in August, 746,000 self-employed workers were claiming UC – equivalent to one-in-six self-employed people at the time.

When the crisis hit, the Chancellor rightly suspended the Minimum Income Floor, a requirement that self-employed UC claimants earn at least as much as they would in a minimum wage position. But current policy is still to reinstate the MIF this spring. resolutionfoundation.org/publications/s…

A self-employed single parent could be £770 a month worse off due to the Minimum Income Floor when it’s reinstated in May. Government should ease the re-introduction of MIF while self-employed businesses get back on their feet, to avoid unnecessarily putting them out of business.

• • •

Missing some Tweet in this thread? You can try to

force a refresh