A simple thread to understand relationship between US Dollar and Emerging Markets.

The relationship between the performance of Emerging Market stocks and the US Dollar is one of the tightest macro relationships that exists in investing.

1/15

The relationship between the performance of Emerging Market stocks and the US Dollar is one of the tightest macro relationships that exists in investing.

1/15

The weekly return correlation between US Dollar and MSCI Emerging Market Index is -0.70 over last 10 years. Which means when US Dollar weakens, Emerging Market stocks rally and vice versa.

2/15

2/15

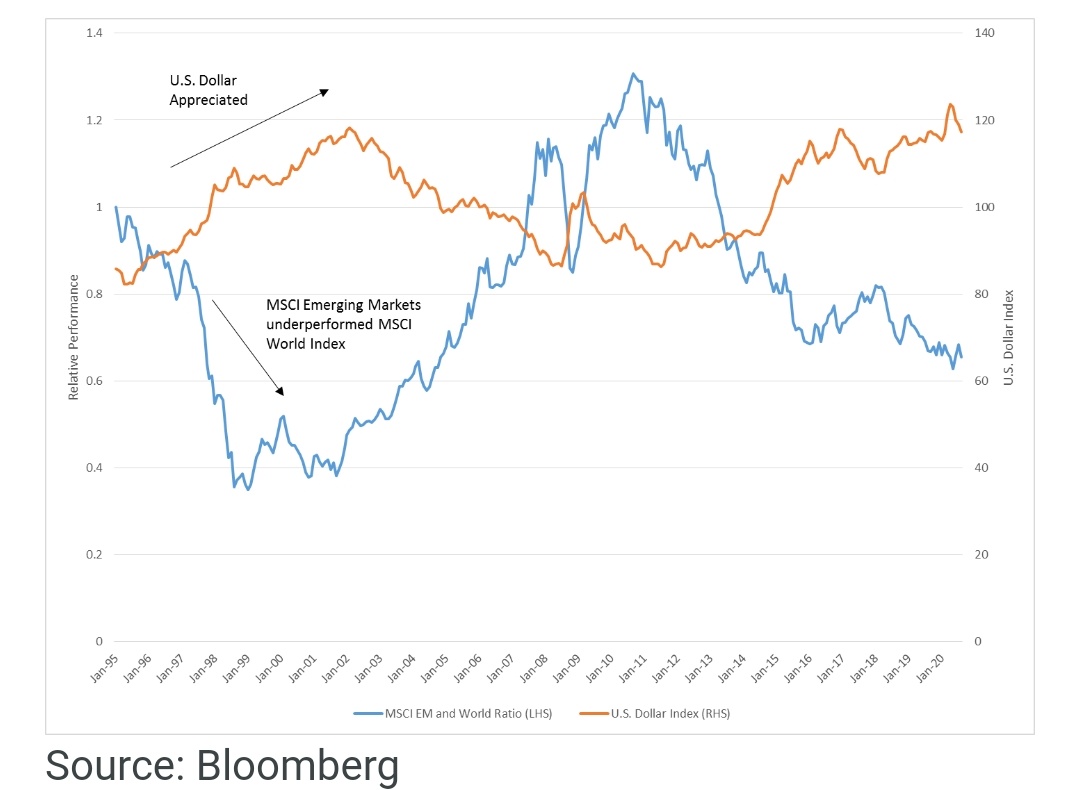

As seen in this chart, the MSCI EM Index and the MSCI World Index ratio and the US Dollar Index are negatively-correlated.

When US Dollar weakens, EM index outperform World Index and when US Dollar strengthens EM index underperform World index.

3/15

When US Dollar weakens, EM index outperform World Index and when US Dollar strengthens EM index underperform World index.

3/15

From 1995 to 2000, the USD appreciated over 30%, while the MSCI EM Index underperformed the MSCI World Index by over 15% annualised.

Then from 2001 to 2010, the U.S. dollar depreciated over 18% while the MSCI EM Index outperformed the MSCI World Index by 14% annualised.

4/15

Then from 2001 to 2010, the U.S. dollar depreciated over 18% while the MSCI EM Index outperformed the MSCI World Index by 14% annualised.

4/15

Then from 2011 to 2020, the U.S. dollar appreciated over 30%, while the MSCI EM Index underperformed the MSCI World Index by 7% annualized.

Overall, from 1995 to 2020, this relationship has a correlation of -0.35.

5/15

Overall, from 1995 to 2020, this relationship has a correlation of -0.35.

5/15

Let's understand why weak US Dollar is good for Emerging Market stocks?

A weaker dollar allows Emerging Market countries more freedom to provide fiscal stimulus without fearing negative implications for their own economies.

6/15

A weaker dollar allows Emerging Market countries more freedom to provide fiscal stimulus without fearing negative implications for their own economies.

6/15

For instance, an emerging market government might feel more comfortable with fiscal easing if its currency is rising, dampening the potential for an inflationary shock.

As case with India, government will be more comfortable to push fiscal stimulus now when INR is stable.

7/15

As case with India, government will be more comfortable to push fiscal stimulus now when INR is stable.

7/15

US Dollar is also a safe heaven during times of crisis. However, when USD starts depreciating, investors often flock towards risky assets for better returns.

Emerging markets are a natural choice as they tend to benefit from weakening dollar and grow faster than DMs.

8/15

Emerging markets are a natural choice as they tend to benefit from weakening dollar and grow faster than DMs.

8/15

Weaker dollar is usually accompanied by stronger commodity prices, which boosts growth and trade surplus for some EMs who are commodities exporters.

9/15

9/15

Weakening USD is also good for countries who heavily rely on foreign investments. When dollar weakens, investor chase high-yielding EM countries and money flows in these countries to fund local investments.

10/15

10/15

Now let's understand why and when US Dollar depreciate ?

Easy monetary policy weakens the dollar and leads to its depreciation. Since U.S. dollar is a fiat currency, meaning that it is not backed by gold, it can be created anytime easily.

11/15

Easy monetary policy weakens the dollar and leads to its depreciation. Since U.S. dollar is a fiat currency, meaning that it is not backed by gold, it can be created anytime easily.

11/15

When more money (US Dollar) is created through US Fed expanding its Balance Sheet, the law of supply and demand kicks in, making existing money (US Dollar) less valuable.

12/15

12/15

Also, investors often chase highest yielding investments. If the Fed cuts rates, U.S. Treasuries, which are bonds, tend to follow suit and their yields fall.

13/15

13/15

With lower rates in the U.S. investors transfer their money out of the U.S. into other countries that offer higher interest rates. The result is a weakening of the dollar versus the currencies of the higher-yielding countries, mainly Emerging Markets.

14/15

14/15

Summing up..

Since US Fed has expanded its Balance Sheet at record speed, US Dollar may go through a weak patch.

Taking cue from multiple cycles in the past, if US Dollar continues to weaken, Emerging Market stocks may outperform.

Watch this trend closely!

15/15 End

Since US Fed has expanded its Balance Sheet at record speed, US Dollar may go through a weak patch.

Taking cue from multiple cycles in the past, if US Dollar continues to weaken, Emerging Market stocks may outperform.

Watch this trend closely!

15/15 End

2 funds from @EdelweissMF to play this trend.

Edelweiss Emerging Market Opportunities Equity Offshore Fund

edelweissmf.com/types-of-mutua…

Edelweiss Greater China Equity Offshore Fund

edelweissmf.com/types-of-mutua…

Edelweiss Emerging Market Opportunities Equity Offshore Fund

edelweissmf.com/types-of-mutua…

Edelweiss Greater China Equity Offshore Fund

edelweissmf.com/types-of-mutua…

• • •

Missing some Tweet in this thread? You can try to

force a refresh