Thread on the good things that have come from WSBs yolos:

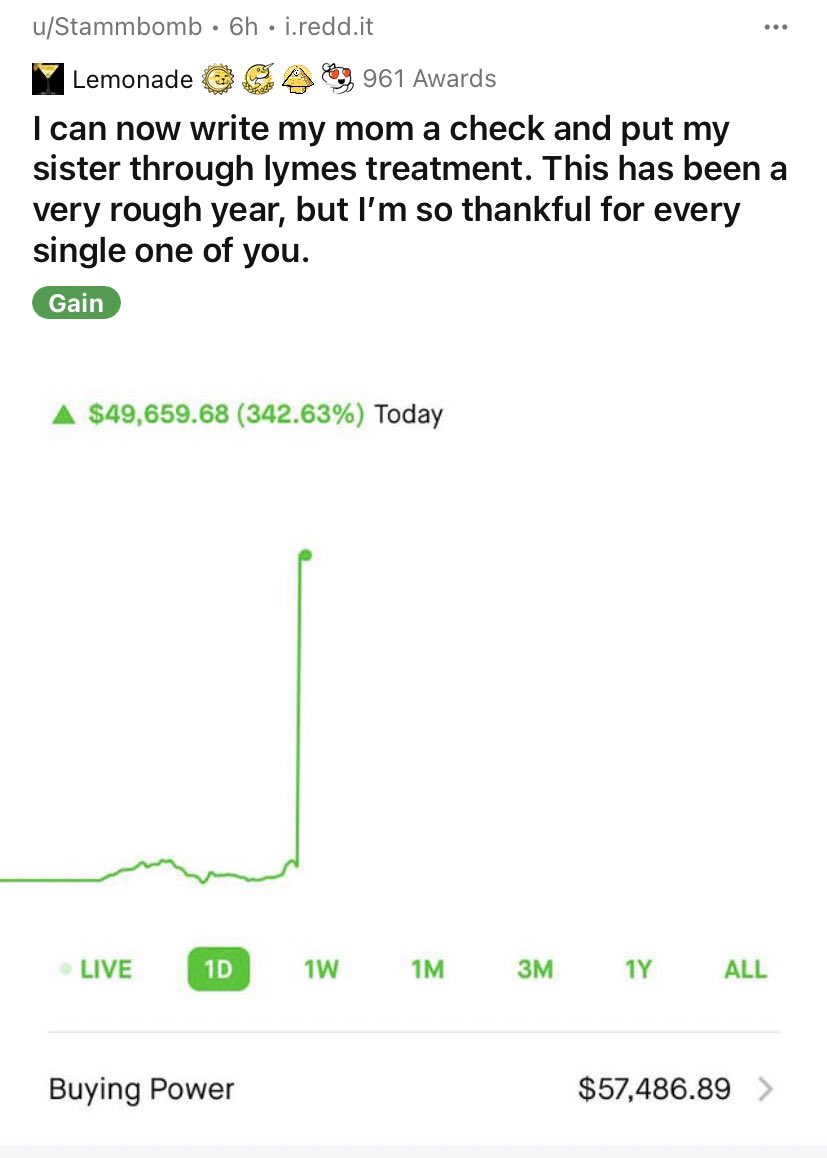

Kid helps his mom pay for his sisters Lyme Disease treatment:

Kid helps his mom pay for his sisters Lyme Disease treatment:

Donating to Charity with your winnings is actually a huge thing on WSBs, several posts about that, even list of good charities that do go work.

Feel free to add more. Please include a screenshot.

• • •

Missing some Tweet in this thread? You can try to

force a refresh