🚨 @RayDalio finally releases the Daily Observation on Bitcoin.

Here's your about what the largest hedge fund in the world thinks about $BTC.

Here's your about what the largest hedge fund in the world thinks about $BTC.

1/ First - what you came here for, the investment view.

RD likens Bitcoin to a long-duration option - the type where you wouldn't mind losing ~80% of your principal. Scenario analysis suggests 160% is conservative upside pending a few things.

That's a good start!

RD likens Bitcoin to a long-duration option - the type where you wouldn't mind losing ~80% of your principal. Scenario analysis suggests 160% is conservative upside pending a few things.

That's a good start!

2/ Is Bridgwater invested?

Nope, but there is a alt-cash fund being worked on that offers alternative storeholds of wealth as part of BW's "cash is trash" outlook.

Bitcoin will be considered.

Nope, but there is a alt-cash fund being worked on that offers alternative storeholds of wealth as part of BW's "cash is trash" outlook.

Bitcoin will be considered.

3/ RD acknowledges that Bitcoin has probably passed the point where it will stick around and retain some value.

Recognizes that Bitcoin, while finite in supply, has infinite competition (anyone can mint a coin).

Still finding conviction around why BTC has a moat.

Recognizes that Bitcoin, while finite in supply, has infinite competition (anyone can mint a coin).

Still finding conviction around why BTC has a moat.

4/ RD thinks that since most people likely won't bother with cold storage, custody is an issue and security is a real risk as well.

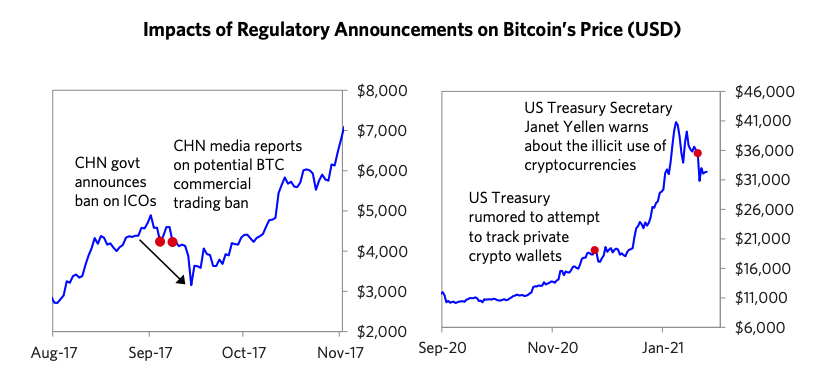

5/ RD thinks that nation states have the incentive to curtail the use of Bitcoin and prevent it from being a better money than fiat money.

He believes govs can de-anonymize UTXOs and possibly use it as a venue to curtail Bitcoin usage.

He believes govs can de-anonymize UTXOs and possibly use it as a venue to curtail Bitcoin usage.

6/ However, BW sees macro tailwinds beneficial for alternative storeholds of wealth like $BTC:

e.g. gov bonds no longer offering same return/ diversification benefits, currencies facing risk of depreciation.

e.g. gov bonds no longer offering same return/ diversification benefits, currencies facing risk of depreciation.

7/ BW likes 2 things about $BTC

- Finite supply, which they liken to gold which performs well during stagflation, a probable outcome

- Globally accessible and "most portable Sov". Notes that $BCH, $LTC, $XMR have similar features but have less history and underperformed $BTC

- Finite supply, which they liken to gold which performs well during stagflation, a probable outcome

- Globally accessible and "most portable Sov". Notes that $BCH, $LTC, $XMR have similar features but have less history and underperformed $BTC

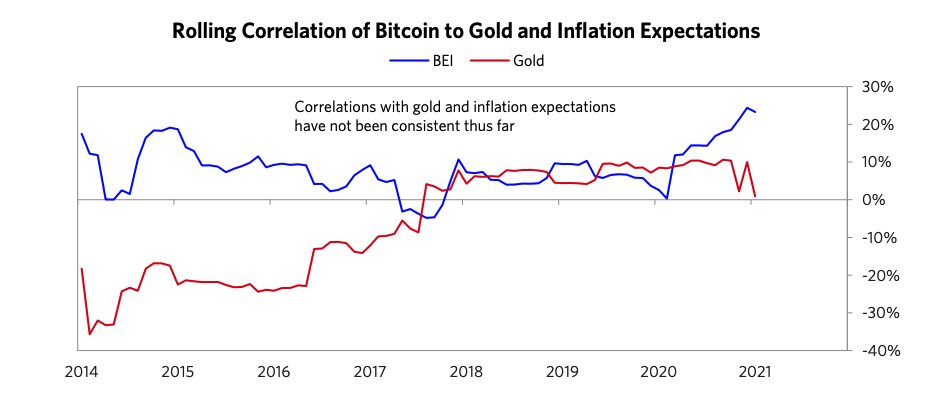

8/ BW is not sure if $BTC will provide portfolio diversification.

A decade is short in finance so there's not enough data to make a diversification case.

Historically $BTC appreciates with rising inflation expectations, but long term correlation with inflation and gold = weak.

A decade is short in finance so there's not enough data to make a diversification case.

Historically $BTC appreciates with rising inflation expectations, but long term correlation with inflation and gold = weak.

9/ Conclusion for above is that so far, $BTC's ability to offer diversification is more theory - meme if you will - than historical fact

10/ BW acknowledges a lot of institutional participation is speculative in nature, so $BTC feels more like an option (a proto-gold?) than digital gold.

Signs: total share of accumulation accounts remain low, turnover is high relative to signs of long-term risk taking.

Signs: total share of accumulation accounts remain low, turnover is high relative to signs of long-term risk taking.

11/ BW acknowledges that this cycle so far seems less frothy than 2017's retail ICO bubble.

BW notes that rapid price growth, bullish sentiment and rising leverage all indicate bubble risk, but acknowledge these dynamics can last for a long time.

BW notes that rapid price growth, bullish sentiment and rising leverage all indicate bubble risk, but acknowledge these dynamics can last for a long time.

12/ $BTC realized vol since inception is higher than most storeholds of wealth, but BW acknowledges this can change materially over time.

13/ BW sees regulation as a key determinant of the participation of Large Institutional Investors.

Cites Lagarde + Yellen's recent quote about money-laundering.

For the $XRP longs in the back who can't read, here's a picture.

Cites Lagarde + Yellen's recent quote about money-laundering.

For the $XRP longs in the back who can't read, here's a picture.

14/ BW thinks clearer regs are key to further upside.

Recent inflows into $BTC are driven by larger tx vs. the smaller, retail dominated tx in 2017.

If institutions participate more meaningfully, BW sees a 160% upside from here (should $BTC take 50% of BTC and gold share).

Recent inflows into $BTC are driven by larger tx vs. the smaller, retail dominated tx in 2017.

If institutions participate more meaningfully, BW sees a 160% upside from here (should $BTC take 50% of BTC and gold share).

15/ BW acknowledges that the estimate is conservative and does not factor into liquidity and reflexivity.

e.g. If CBs shift gold exposure to Bitcoin, or BTC ETF launches that can have material impact on prognostications

e.g. If CBs shift gold exposure to Bitcoin, or BTC ETF launches that can have material impact on prognostications

fin/ that's all!

• • •

Missing some Tweet in this thread? You can try to

force a refresh