🚨 This week: the rise of the DeFi "super app"

@AlphaFinanceLab is one of the projects I'm most excited for in DeFi today.

Founder @tascha_panpan joins me to talk all things $ALPHA.

apple.co/3ogto4K

spoti.fi/36sHFVL

@AlphaFinanceLab is one of the projects I'm most excited for in DeFi today.

Founder @tascha_panpan joins me to talk all things $ALPHA.

apple.co/3ogto4K

spoti.fi/36sHFVL

.@AlphaFinanceLab is a team of young and driven DeFi coders + operators focusing on shipping synergistic products.

Imo this is where many DeFi protocols are heading, culminating in the rise of DeFi "super apps".

More on this in a bit.

1/x

Imo this is where many DeFi protocols are heading, culminating in the rise of DeFi "super apps".

More on this in a bit.

1/x

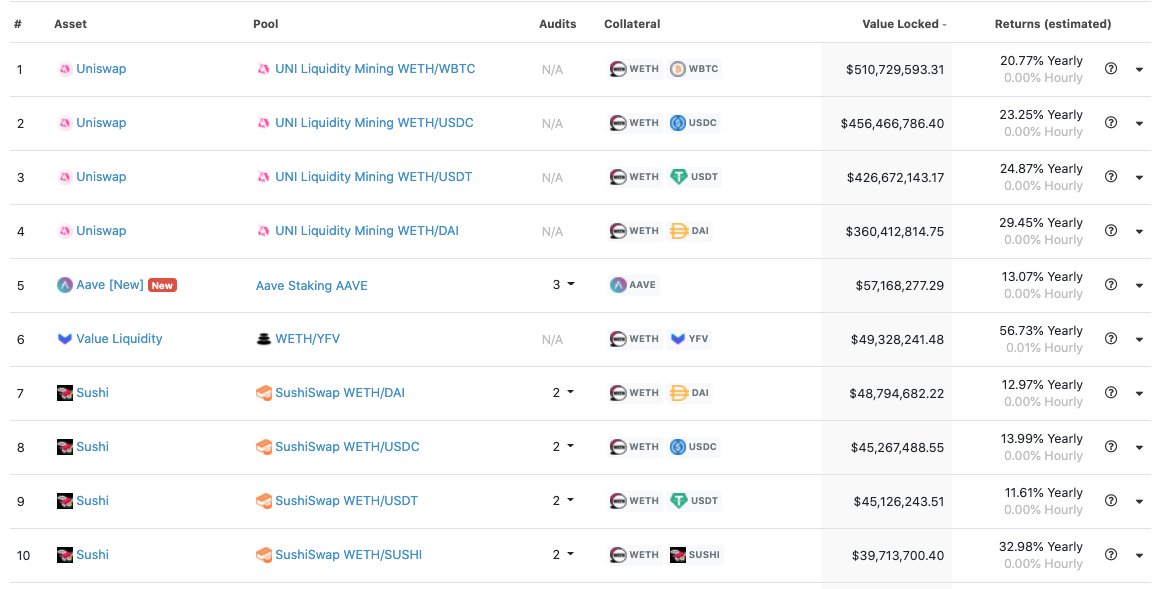

Alpha first came to market with a simple product: a way for people to lever up on their DeFi yields.

With Alpha Homora, users can lever up 3x to farm assets like $SUSHI and $UNI.

2/x

With Alpha Homora, users can lever up 3x to farm assets like $SUSHI and $UNI.

2/x

Side note: this proved to be quite attractive for projects like @Kp3r1Network, which voted to use Alpha Homora to manage its treasury earlier this week.

blog.alphafinance.io/9-270-eth-migr…

3/x

blog.alphafinance.io/9-270-eth-migr…

3/x

The leverage comes from people borrowing from Alpha's user-contributed $ETH pools.

However, as users of Alpha Homora are de facto short ETH, there needs to be a way to hedge in case $ETH goes on a lunar mission...

4/x

However, as users of Alpha Homora are de facto short ETH, there needs to be a way to hedge in case $ETH goes on a lunar mission...

4/x

That's part of the reason why the next Alpha product is an onchain perpetual swap protocol.

With a few clicks, users can hedge their ETH risk by placing an offsetting long on Alpha. Beyond hedging, perpetuals are also a massive market in CeFi today.

5/x

With a few clicks, users can hedge their ETH risk by placing an offsetting long on Alpha. Beyond hedging, perpetuals are also a massive market in CeFi today.

5/x

In the future, Alpha has plans to create volatility markets for LPs in various protocols to hedge out their impermanent losses as well.

So where is this all leading to...?

6/x

So where is this all leading to...?

6/x

While Alpha takes advantage of DeFi's composability (e.g. using @UniswapProtocol and @SushiSwap , integrating with @AaveAave today), it chose to vertically integrate products in house.

This enables faster execution and ease of implementing value capture later on.

7/x

This enables faster execution and ease of implementing value capture later on.

7/x

If successful, I can see Alpha being home to a suite of products, all of which produce fees that accrue to $ALPHA holders.

Enriching early adopters and users can be a good way to create network effects.

8/x

Enriching early adopters and users can be a good way to create network effects.

8/x

Imo this trend of vertical integration is already taking place in DeFi:

@1inchExchange started as an aggregator, now building its own AMM (and other products)

@SushiSwap started as an AMM, now incorporating margin trading and lending.

9/x

@1inchExchange started as an aggregator, now building its own AMM (and other products)

@SushiSwap started as an AMM, now incorporating margin trading and lending.

9/x

My hypothesis is that the "one project = one product" idea in DeFi will be challenged by the all-in-one super app familiar to Chinese mobile users.

Projects will still GTM with one product, but will be forced to vertically integrate when scaling.

10/x

Projects will still GTM with one product, but will be forced to vertically integrate when scaling.

10/x

@tascha_panpan and I explore some of these ideas on @theBlockcrunch - and cover more details around $ALPHA.

You can tune in to our 30m convo here:

apple.co/3ogto4K

spoti.fi/36sHFVL

11/x

You can tune in to our 30m convo here:

apple.co/3ogto4K

spoti.fi/36sHFVL

11/x

• • •

Missing some Tweet in this thread? You can try to

force a refresh