Went down the rabbit hole on the oldest online trading community and the trading gurus that rose in the 1990's.

"Everything old is new again."

"Everything old is new again."

https://twitter.com/WallStCynic/status/1354098939285434368

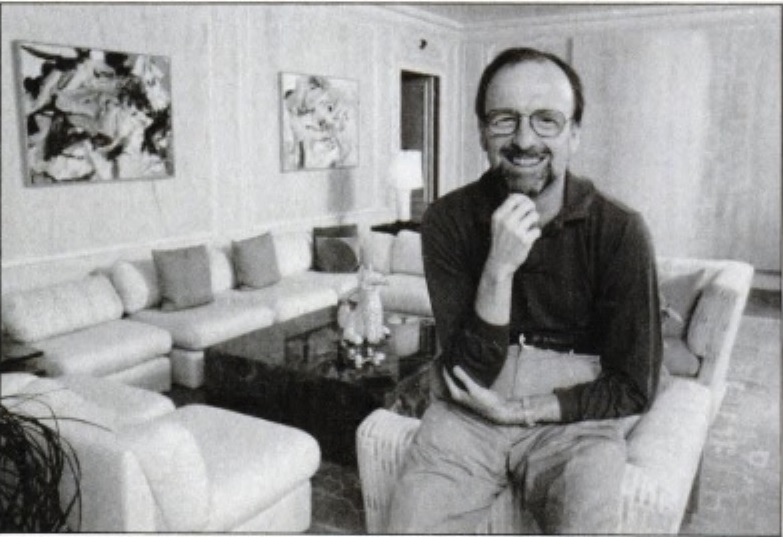

The first community was Silicon Investor which got started in 1995, even before the launch of the Netscape browser. Eventually others came around like the yahoo message boards, ragingbull, motley fool.

Some notable investors started on SI, including @DanielSLoeb1 and @michaeljburry who both joined in 1996

Valuewalk collected some old posts by Michael Burry

valuewalk.com/2014/04/michae…

Valuewalk collected some old posts by Michael Burry

valuewalk.com/2014/04/michae…

The most prominent members eventually started their own newsletters and chatrooms.

"Once you get a following," says Pristine's Oliver Velez, "it takes no special skill to move a stock."

"Once you get a following," says Pristine's Oliver Velez, "it takes no special skill to move a stock."

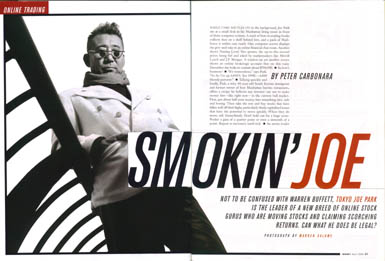

Two stories stand out: "Tokyo Joe" and Anthony Elgindy. Both colorful. One with a happy ending, kind of. The other one really dark.

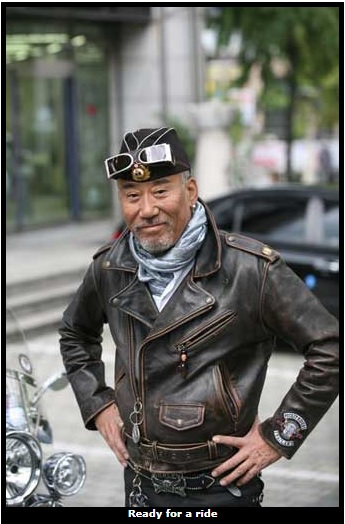

First "Tokyo Joe"/"TokyoMex"

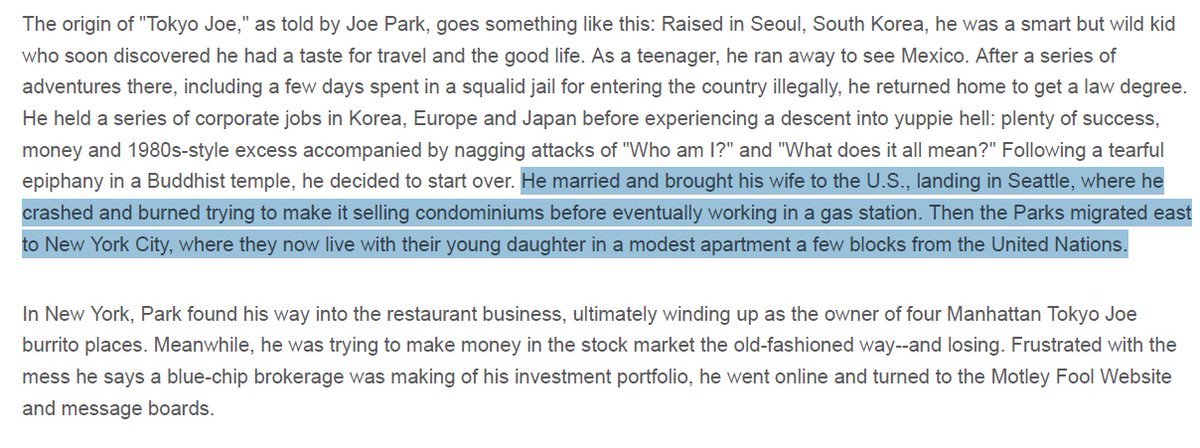

Yun Soo Oh Park grew up in South Korea and traveled the world early, running away to Mexico as a teenager.

After jobs all over the world and flipping condos in Seattle he eventually found himself in NYC running four burrito shops.

Yun Soo Oh Park grew up in South Korea and traveled the world early, running away to Mexico as a teenager.

After jobs all over the world and flipping condos in Seattle he eventually found himself in NYC running four burrito shops.

He started trading stocks and posting on Motley Fool. Got involved in Iomega, first long then short.

The craze and subsequent crash were an epiphany:

"Hype, man. Hype moved the f---ing stock... The Internet is not investment. This is hype, and everybody should know that."

The craze and subsequent crash were an epiphany:

"Hype, man. Hype moved the f---ing stock... The Internet is not investment. This is hype, and everybody should know that."

Fundamentals were yesterday's news

"I realized the Motley Fools are fools indeed, because they don't know when to sell.... [T]hey pump stocks-even when they are going down-based on fundamentals."

"I realized the Motley Fools are fools indeed, because they don't know when to sell.... [T]hey pump stocks-even when they are going down-based on fundamentals."

"Who gives a s--- about fundamentals? It's market sentiment. No matter how good a company's fundamentals are, if market sentiment says it's going down, it's going down. You do not fight the ticker. That's when I became a day-trader."

He switched to Silicon Investor and discovered that being controversial helped build an audience.

"Park trading insults and ridicule with a rotating cast of antagonists--"Deeber, you are a #@&head"--to the applause of his large amen corner--"TokyoMex is a Prodigy!!!."

"Park trading insults and ridicule with a rotating cast of antagonists--"Deeber, you are a #@&head"--to the applause of his large amen corner--"TokyoMex is a Prodigy!!!."

"Admired and reviled online in about equal measure, Tokyo Joe--extremely shrewd, occasionally charming, frequently arrogant and invariably profane--is a kind of Matt Drudge for investors, the most influential of a small but growing counter-establishment of Internet stock gurus."

Now it was time to get paid.

"when I bought something, I sent e-mails out and the volume went up and the price went bonkers. I had no desire to make any money; it just happened, you know? But then some members started saying to me, 'Mex, you should start charging people, man."

"when I bought something, I sent e-mails out and the volume went up and the price went bonkers. I had no desire to make any money; it just happened, you know? But then some members started saying to me, 'Mex, you should start charging people, man."

He built his own chatroom: Societe Anonyme. 800 members, $100 a month.

Amazingly, parts of his website are still online, including old testimonials.

"Date: Tue, 28 Dec 1999 21:42:02 EST

Subject: Up 2000% for the year!!!"

tokyojoe.com/public/indexph…

Amazingly, parts of his website are still online, including old testimonials.

"Date: Tue, 28 Dec 1999 21:42:02 EST

Subject: Up 2000% for the year!!!"

tokyojoe.com/public/indexph…

Things got weird

"we do get some information that comes out before the rest of the world knows about it." A member tipped him off to J.C. Penney's bid to buy Genovese Drug Stores, four days before the news became public. "So we got in at $25.25," he says. "We sold at $30, $31."

"we do get some information that comes out before the rest of the world knows about it." A member tipped him off to J.C. Penney's bid to buy Genovese Drug Stores, four days before the news became public. "So we got in at $25.25," he says. "We sold at $30, $31."

"He will sometimes take a position and recommend it to his Societe Anonyme and anyone else who will listen. When buying drives up the price he sells."

"Everybody knows that I'm buying before you buy, and I'm selling when you're buying. Otherwise, what am I? A charity?"

"Everybody knows that I'm buying before you buy, and I'm selling when you're buying. Otherwise, what am I? A charity?"

Things were good: "A year ago, he says, he had $20,000 in the market. Now he is up more than $1.6 million."

"We're the new blood, man."

"We're the new blood, man."

Until the SEC came knocking, "alleging that he used his vast influence to pump up the price of stocks"

https://twitter.com/ArtkoCapital/status/1353918581038174208

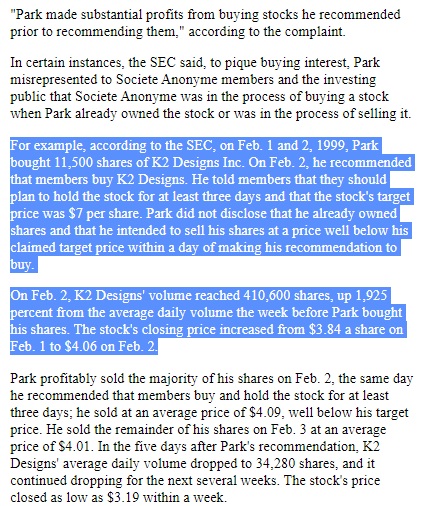

"Park made substantial profits from buying stocks he recommended prior to recommending them"

sec.gov/litigation/lit…

sec.gov/litigation/lit…

In 2001 he paid $754k of penalties and ill-gotten gains

"Park attracts new members by posting numerous effusive testimonials as well as false and misleading performance data...and fails to include losing trades."

sec.gov/litigation/lit…

"Park attracts new members by posting numerous effusive testimonials as well as false and misleading performance data...and fails to include losing trades."

sec.gov/litigation/lit…

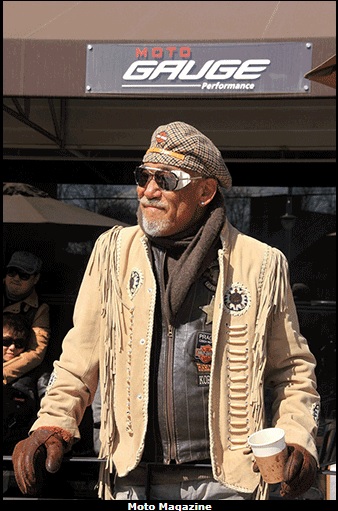

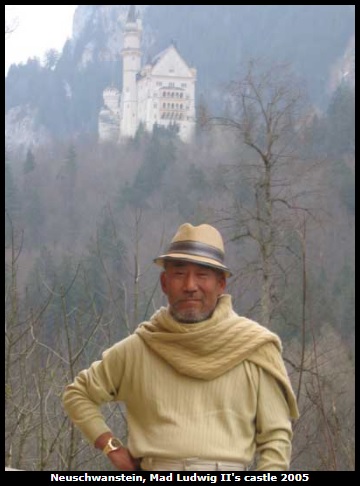

He's still living his best life. Gotta admit, the man has style.

"The stock market is all hype," he told me, "whether you are a daytrader or Merrill Lynch. One hypes on the Internet, one in a Brooks Brothers suit."

tokyojoe.com/public/indexph…

"The stock market is all hype," he told me, "whether you are a daytrader or Merrill Lynch. One hypes on the Internet, one in a Brooks Brothers suit."

tokyojoe.com/public/indexph…

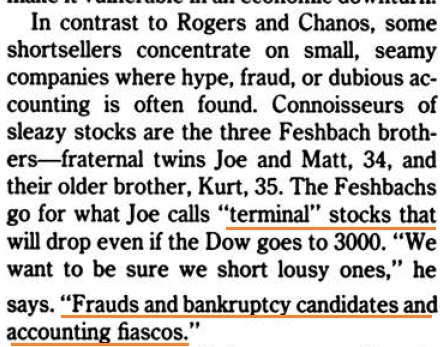

Let's switch gears. Anthony Elgindy who was born in Egypt and started working at boiler room brokerages in the late 80's.

When his employer Armstrong McKinley was investigated for pumping stocks Elgindy cooperated with prosecutors and became a short seller.

When his employer Armstrong McKinley was investigated for pumping stocks Elgindy cooperated with prosecutors and became a short seller.

He focused on pump 'n' dumps schemes and fraudulent companies pushed by boiler room brokers.

In 1999 he set up his own firm, Pacific Equity Investigations.

wired.com/2000/04/dumb/

In 1999 he set up his own firm, Pacific Equity Investigations.

wired.com/2000/04/dumb/

Subscriptions work for him, too:

"Two hundred and fifty amateurs each pay $600 a month to follow Anthony's trades. When he moves, they move."

"Two hundred and fifty amateurs each pay $600 a month to follow Anthony's trades. When he moves, they move."

This was a man of strong opinions.

"Wall Street is the most manipulated scam and corrupt marketplace on earth right now." The more disorderly the markets, he says, the easier it is for the big players to take advantage of the amateurs.

"Wall Street is the most manipulated scam and corrupt marketplace on earth right now." The more disorderly the markets, he says, the easier it is for the big players to take advantage of the amateurs.

"The public is there for one reason and one reason only, they are there to absorb the risk. Brokers, broker-dealers, professional traders, they are not interested in any kind of risk whatsoever. They're interested in covered profits and arbitrage."

"Today a major broker put out a buy recommendation. You know they were shorting all of these stocks. They are on the other side of your trade."

Some grade A trolling:

"Anthony has been following the buy recommendations from Vik Grover, the Internet analyst at Kaufman Bros. When Grover recommends a stock, Anthony puts it on his list as a possible short"

"I call Vik Grover all the time to yell at him. He's so stupid!"

"Anthony has been following the buy recommendations from Vik Grover, the Internet analyst at Kaufman Bros. When Grover recommends a stock, Anthony puts it on his list as a possible short"

"I call Vik Grover all the time to yell at him. He's so stupid!"

"'owner of a Pacific Rim focused (B2B) Internet company, with a presence in China.' These were magic words, because business-to-business is the latest craze, and China offers a big, untapped market about which amateur traders know nothing. (This allows them to dream freely.)"

Anthony Elgindy and Tokyo Joe knew each other. You could say they had a falling out.

"Anthony had been asking his fans for incriminating stories about Tokyo Joe, and before the complaint was issued he volunteered more than 2,000 pages of critical testimony to the SEC"

"Anthony had been asking his fans for incriminating stories about Tokyo Joe, and before the complaint was issued he volunteered more than 2,000 pages of critical testimony to the SEC"

Now, at some point Elgindy wanted more of an edge. Real edge. So he partnered with an FBI agent who provided him with information about ongoing investigations.

I don't know if the FBI would have found out if it hadn't been for 9/11. Someone tipped the FBI off that Elgindy had had advance knowledge of the attacks. They found no evidence of that. But they did uncover his FBI informant.

Elgindy was convicted of insider trading in 32 stocks which included the scheme to use information from FBI and SEC investigations. In 2005 he was sentenced to 11 years in prison. He was released in 2013 and committed suicide in 2015.

• • •

Missing some Tweet in this thread? You can try to

force a refresh