A good time to revisit that time when legendary trader Bob Wilson got caught in a short squeeze called Resorts International (which Forbes at the time called “the most catastrophic short play in modern times”)

Wilson was a child of the Great Depression and bought his first stocks at 29 after working some years at a bank's trust department. He put his money into two stocks: IBM and Houston Lightning & Power. On 75% margin, the maximum allowed then.

There was a small crash in 1956 and his portfolio was closed out by his broker. His money was gone and helplessly he watched the stocks recover quickly.

After that experience he decided to never be unhedged again.

After that experience he decided to never be unhedged again.

In 1958 he started again with $15,000. By 1986 he would be worth $230 million. And $800 million by the year 2000 (he gave it all away to charity before his death).

Wilson was very focused on getting rich: "The only office title I am interested in around here is millionaire."

He wanted 80% leverage which wasn't allowed under margin rules. So he borrowed money offshore in Switzerland where he traveled three times a year to see his bankers.

He wanted 80% leverage which wasn't allowed under margin rules. So he borrowed money offshore in Switzerland where he traveled three times a year to see his bankers.

The brokerage where he worked became increasingly uncomfortable so he went out on his own and set up a small hedge fund in 1968.

In 1970 the portfolio dropped in 35% and most clients left. So he decided to just compound his own capital, using the leverage.

In 1970 the portfolio dropped in 35% and most clients left. So he decided to just compound his own capital, using the leverage.

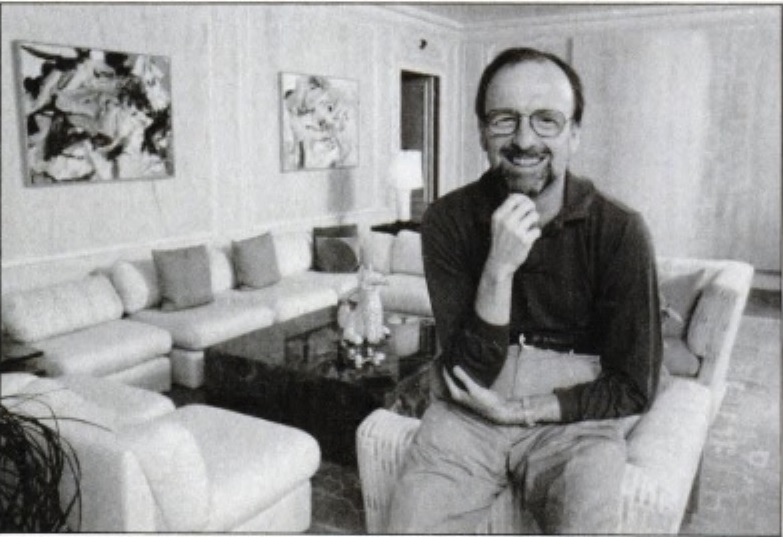

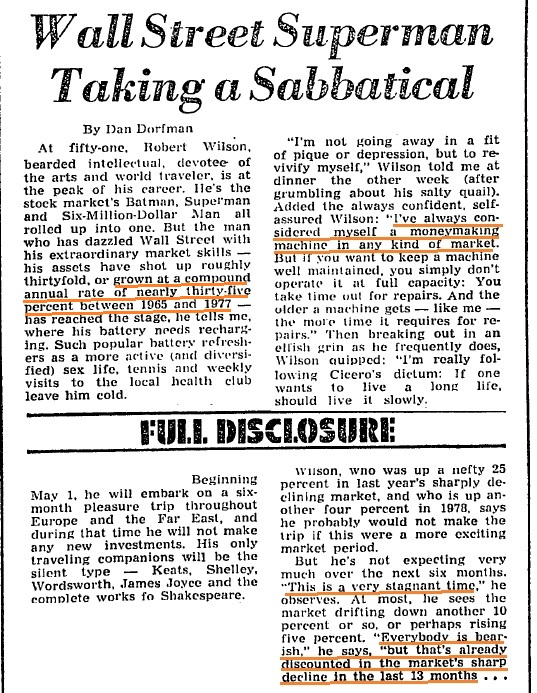

By the late 70's he "considered himself a moneymaking machine": he had compounded at 35% from 1965-1977.

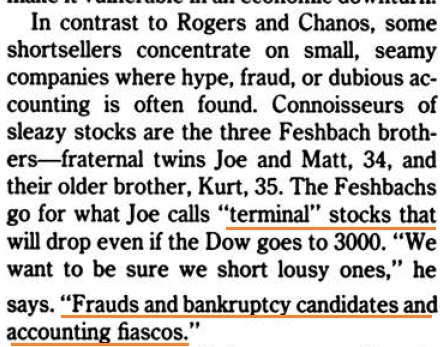

The short side had been very good to him: "I had God-like success on the short side in the 1970s. I shorted about a thousand stocks, and maybe five went up."

The short side had been very good to him: "I had God-like success on the short side in the 1970s. I shorted about a thousand stocks, and maybe five went up."

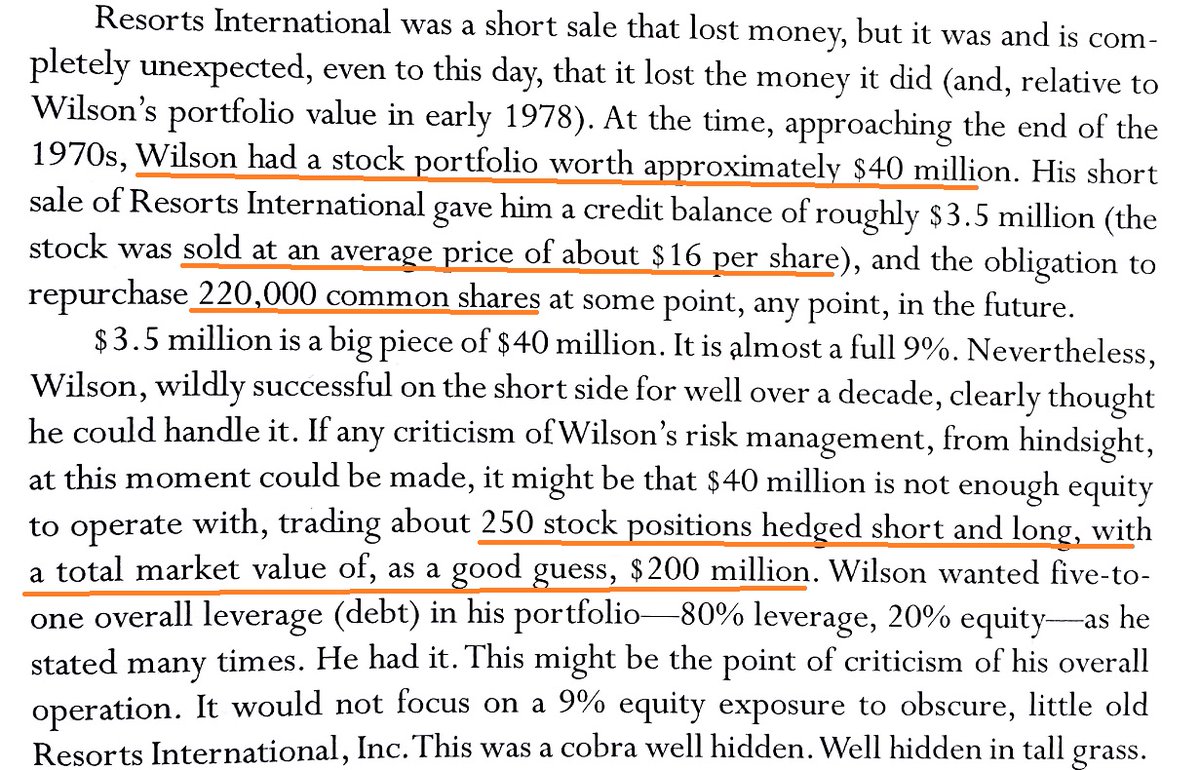

By 1978, he had a $40 million in equity and was running an estimated $200 million portfolio.

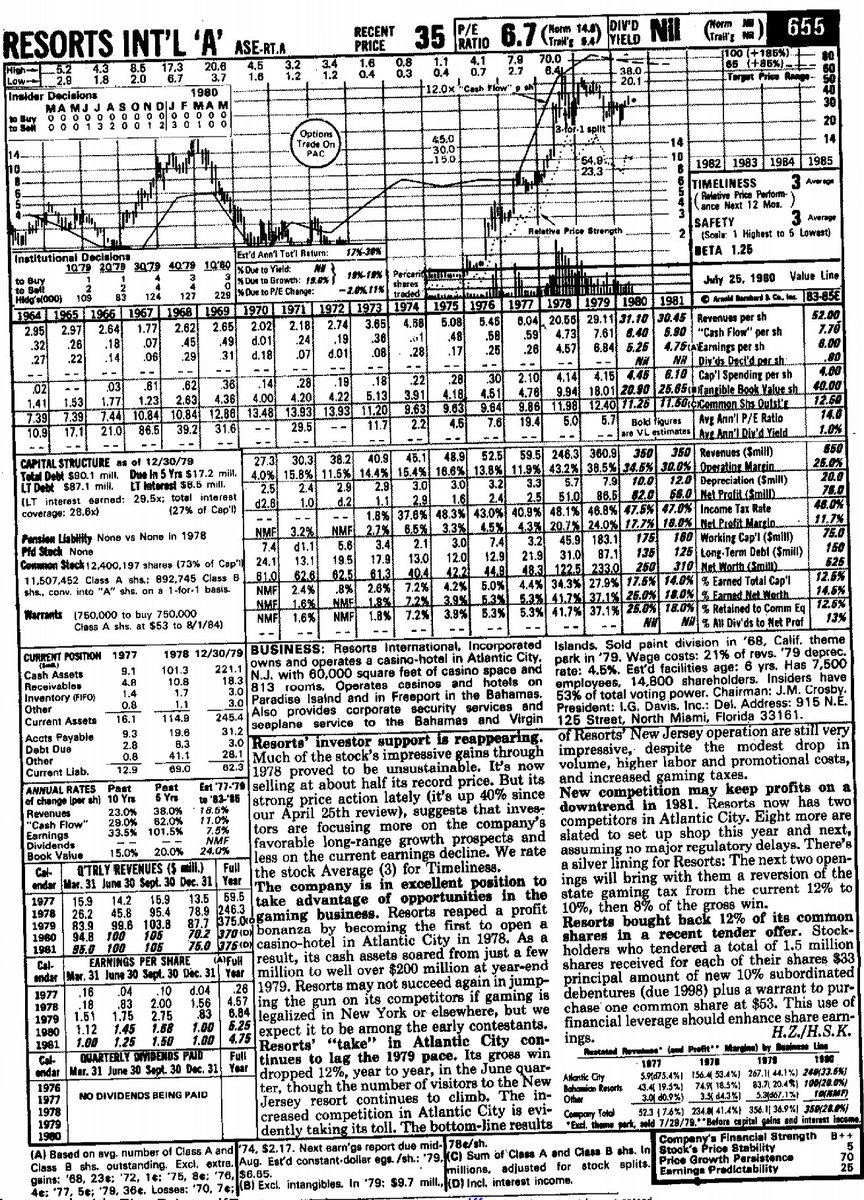

That year he decided to short Resorts International, an operator of hotels "earning a phony million dollars a year" that was developing the first casino in New Jersey.

That year he decided to short Resorts International, an operator of hotels "earning a phony million dollars a year" that was developing the first casino in New Jersey.

Wilson believed NJ with its mediocre weather couldn't compete with Las Vegas and that the project would be a bust. He started shorting at $9 and stopped at $20 for an average entry of $16.

A $3.5 million short against his $40 million of equity.

A $3.5 million short against his $40 million of equity.

At the same time he felt quite burned out and "needed time out for repairs." He scheduled a six month trip around the world!

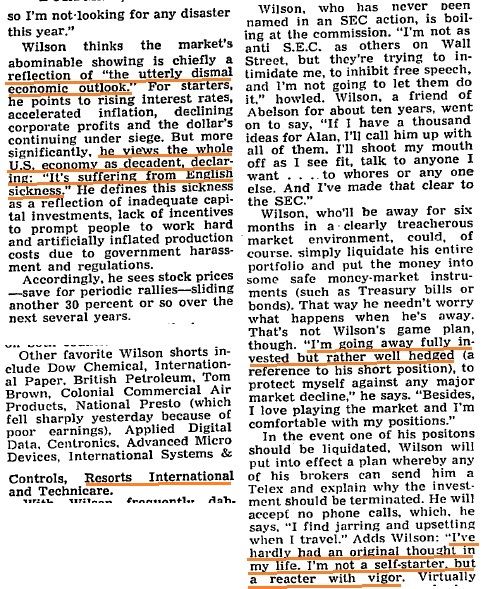

He didn't think the market would do much: "this is a very stagnant time" and left "fully invested but rather well hedged."

He didn't think the market would do much: "this is a very stagnant time" and left "fully invested but rather well hedged."

He was a well known speculator and made no secret out of his long trip. He was even happy to talk about his "favorite shorts" before he left.

Do not try this at home..

Do not try this at home..

There was of course a bull case for Resorts: the first casino in New Jersey was exciting and practically a local monopoly. And of course it had full support from the government

(and perhaps some others?)

(and perhaps some others?)

When Wilson left the stock was creeping up. The casino was going to open soon, excitement was building. Wilson quipped he "was getting crucified but might short some more" before he boarded the plane for Europe.

When the casino opened there were lines around the block and the stock took off. While Wilson strolled through the streets of Oslo, Resorts moved from $20 to $60.

Wilson tried to enjoy his vacation and didn't want to be bothered: "The only calls I take on vacation are margin calls."

Well, funny you should mention.

Well, funny you should mention.

When the stock hit $80 his brokers at Neuberger reached him and convinced him to cover some.

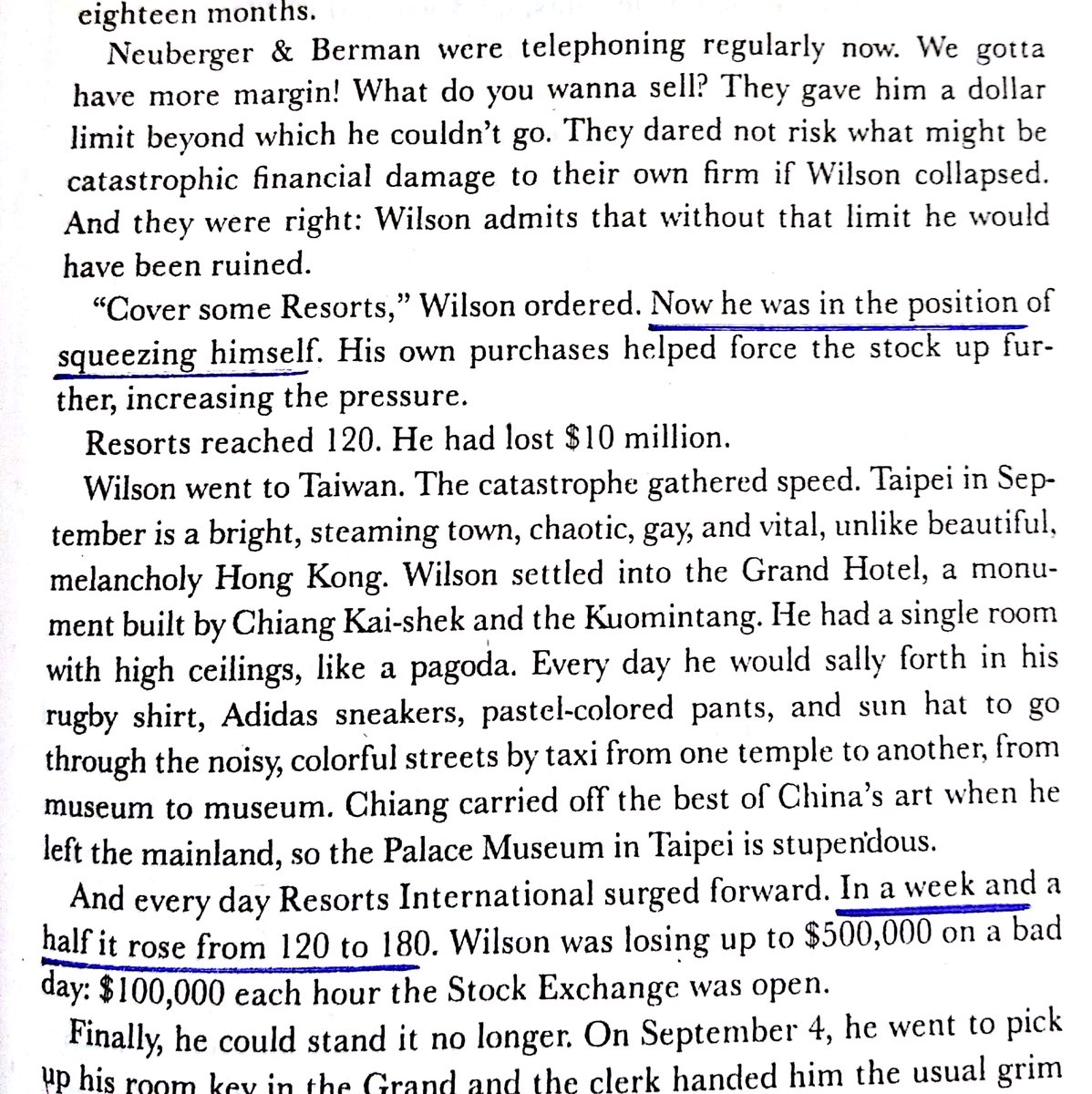

"We gotta have more margin! What do you wanna sell?" They were getting worried about their own balance sheet.

As he left for Asia, the stock hit $100.

"We gotta have more margin! What do you wanna sell?" They were getting worried about their own balance sheet.

As he left for Asia, the stock hit $100.

His brokers were freaking out and Wilson agreed to a stop-loss. "Cover some Resorts!"

But now he was squeezing himself as he covered. In July and August the stock went from $120 to $180 in a week and a half. He was losing $100,000 every hour the market was open.

But now he was squeezing himself as he covered. In July and August the stock went from $120 to $180 in a week and a half. He was losing $100,000 every hour the market was open.

Wilson thought it was insanity, a new tulip mania.

But he called it quits. He covered the entire short and bought his last shares at $187. The Resorts short had cost him a total of $24 million (though he had made $6 million on other stocks that year).

But he called it quits. He covered the entire short and bought his last shares at $187. The Resorts short had cost him a total of $24 million (though he had made $6 million on other stocks that year).

"I slipped on a banana peel. I've done it before, and I'll do it again. It's the nature of the business."

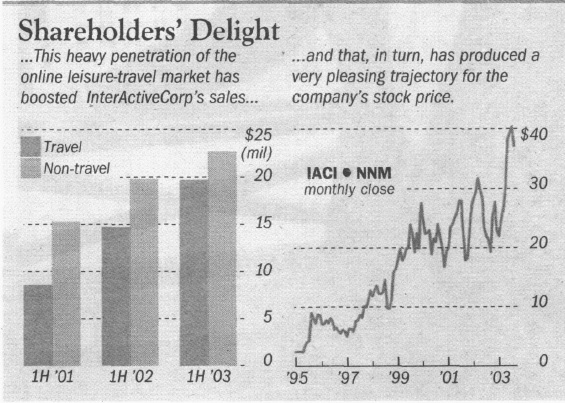

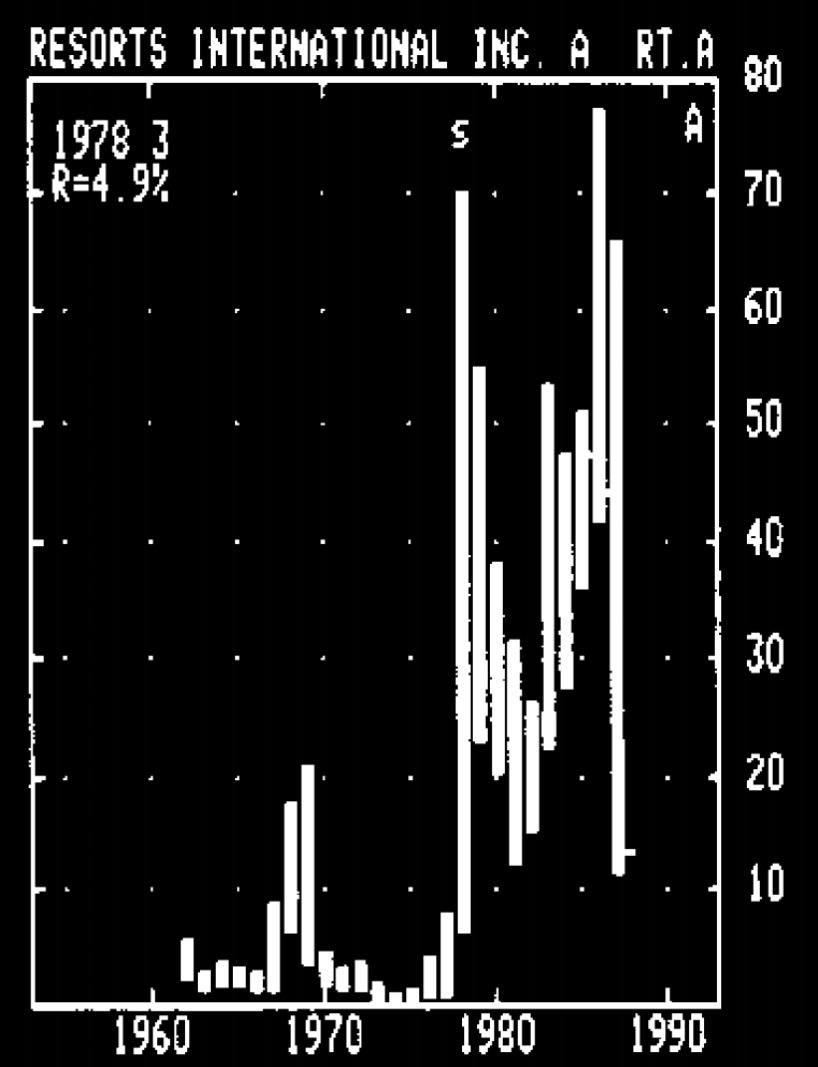

(Chart reflects a 3:1 split)

(Chart reflects a 3:1 split)

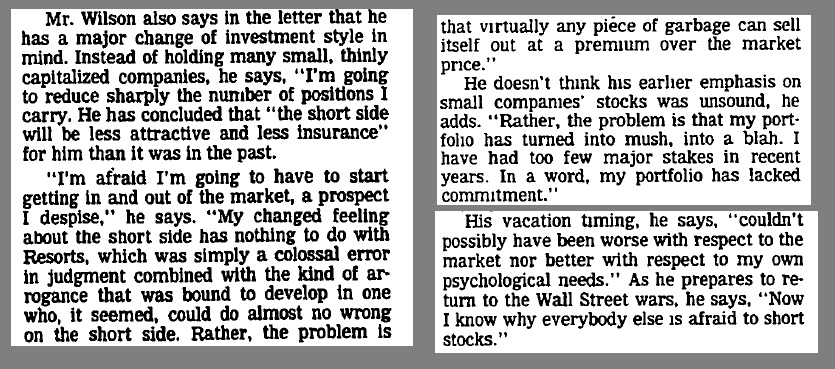

"Resorts was simply a colossal error in judgement combined with the kind of arrogance that was bound to develop in one who, it seemed, could do almost no wrong on the short side."

It was a huge loss. But also a much-needed mental reset.

Wilson said his vacation timing "could not have been worse with respect to the market nor *better* with respect to my psychological needs."

Wilson said his vacation timing "could not have been worse with respect to the market nor *better* with respect to my psychological needs."

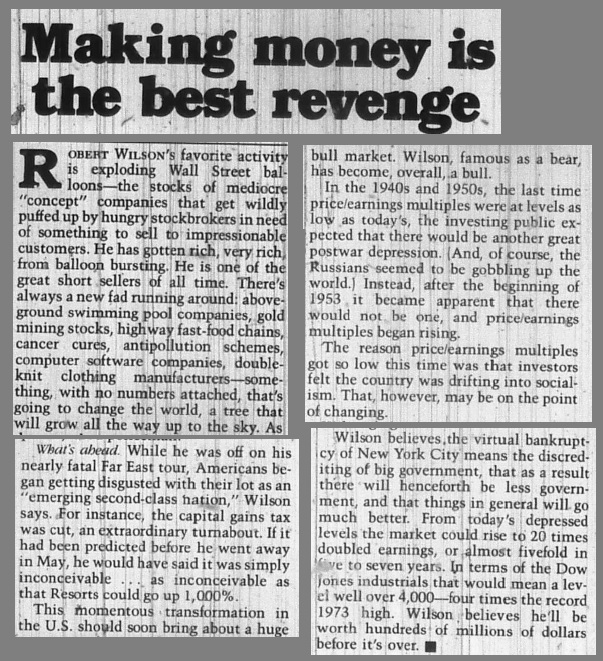

"My portfolio has turned into a mush. It has lacked commitment." He made big changes, turning into a massive bull, "U-Turn Wilson," and made a killing on the new bull market that was developing.

The piece on his comeback was titled: "Making money is the best revenge."

The piece on his comeback was titled: "Making money is the best revenge."

• • •

Missing some Tweet in this thread? You can try to

force a refresh