1/ New update for @fraxfinance will have the protocol yield farm with reserves

This is a pretty major positive change that increases the resiliency of the system and can see other reserve-based algo stablecoins adopting this mechanism as well

This is a pretty major positive change that increases the resiliency of the system and can see other reserve-based algo stablecoins adopting this mechanism as well

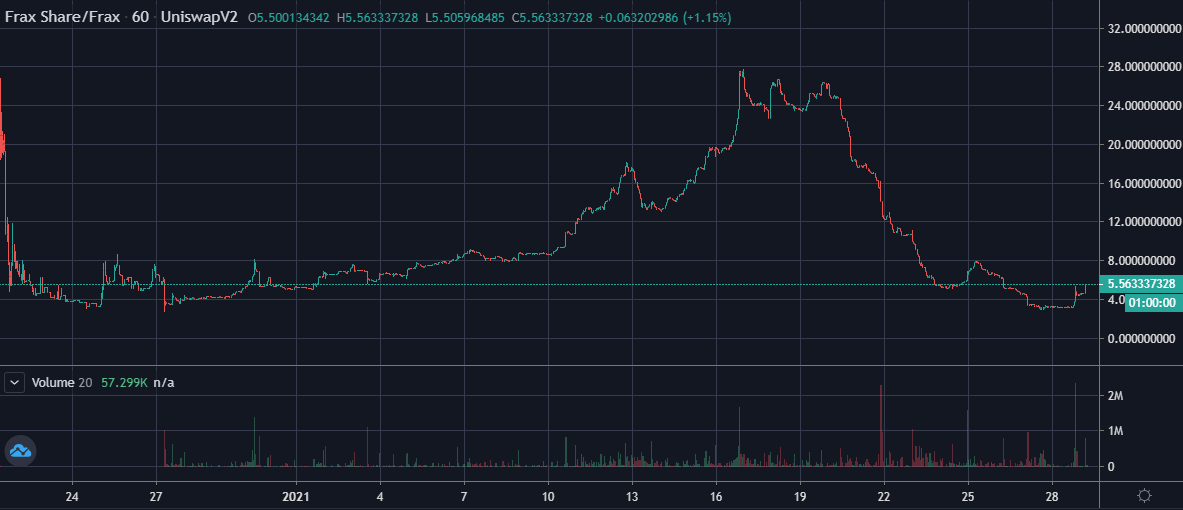

2/ The issue with all algo stablecoins is that the supply of the stablecoins are too interconnected with the price of the share token

The reflexivity works in both directions - both up and down

Higher price🔄 More Supply

Lower price🔄 Less Supply

The reflexivity works in both directions - both up and down

Higher price🔄 More Supply

Lower price🔄 Less Supply

3/ This reflexivity exists for as long as share tokens are used to reward those that hold the stablecoin (usually for LPs)

But using yield farming to *safely* yield farm can help to prevent death spirals as the yield can be used to build reserves, making users less likely to run

But using yield farming to *safely* yield farm can help to prevent death spirals as the yield can be used to build reserves, making users less likely to run

4/ If reserves are high enough, the yield can also be used to directly benefit share token ($FXS) holders by using proceeds to buy & burn

This also indirectly spurs supply growth/reverse as $FXS price rises

This also indirectly spurs supply growth/reverse as $FXS price rises

5/ To some, this might seem too dangerous

but this is no different from how banks/USDC/USDT make $ - by monetizing customer deposits

The difference is in DeFi, it is all done transparently on-chain for anyone to audit

but this is no different from how banks/USDC/USDT make $ - by monetizing customer deposits

The difference is in DeFi, it is all done transparently on-chain for anyone to audit

6/ Quick Math

75M USDC in reserves - 80% is used to farm (60M)

At conservative 10% net APY (after fees) if USDC went to USDCyearnV2 vault, that’s $6M annualized

That’s roughly 25% of current $22M circulating MC of FXS

75M USDC in reserves - 80% is used to farm (60M)

At conservative 10% net APY (after fees) if USDC went to USDCyearnV2 vault, that’s $6M annualized

That’s roughly 25% of current $22M circulating MC of FXS

7/ If the burn starts to have an effect and sends the system into another positive feedback loop then the amount of reserves sent out to farm could potentially reach mid 9 figures+ which would have a significant impact on TVL for @iearnfinance and its farms eg @CurveFinance

• • •

Missing some Tweet in this thread? You can try to

force a refresh