Tassal Group $TGR $TGR.AX are a Tier 1 #ASX aquaculture firm specialising in salmon and expanding into prawns. For 1.5 years their stock price has been beaten down and now have 2nd highest shorts on the ASX. But, the company continues growing. Let's do a deep dive.

1) Macro. Population growth (+1% CAGR) and shifting consumer preferences (2-3% CAGR) provide a tailwind for salmon production and consumption in Australia.

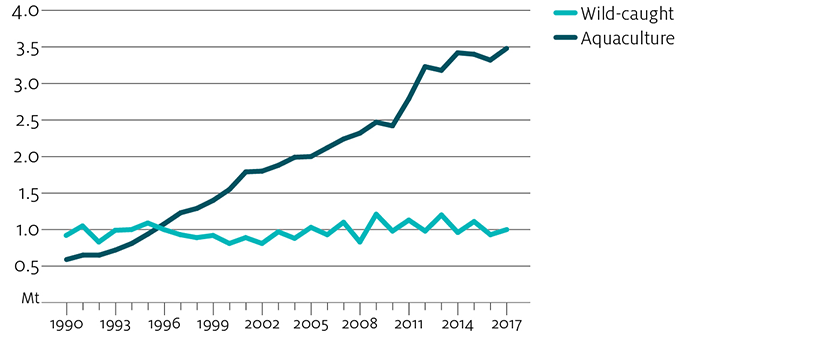

3) Macro. The transition to aquaculture for prawns is just beginning, creating a growth engine for TGR who are expanding rapidly in this space with high quality black tiger prawns.

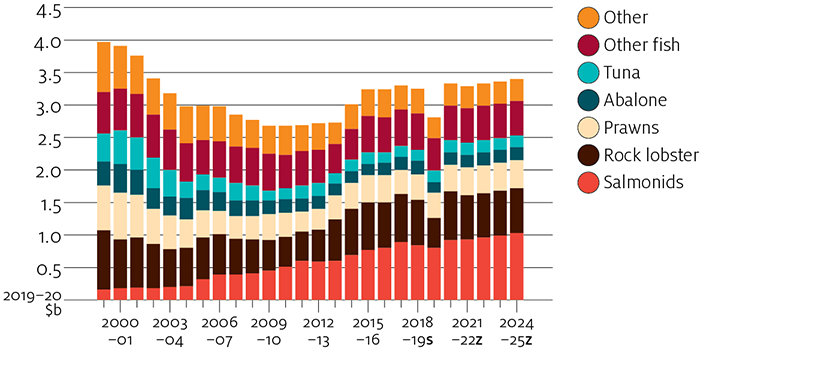

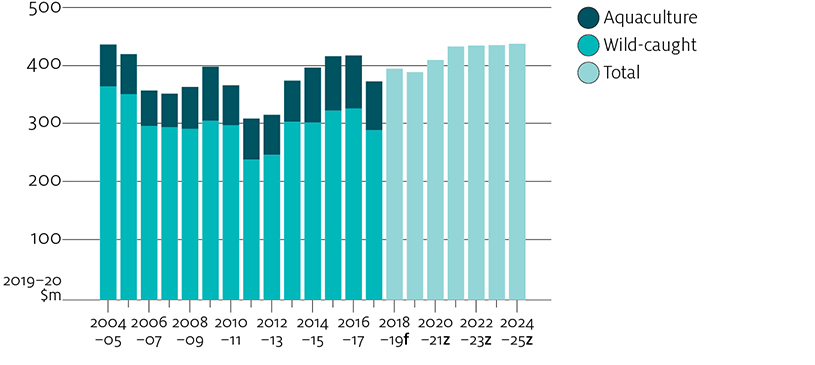

4) Growing revenues. TGR has consistently grown revenue since listing in 2003 by 11% CAGR. More fish being sold, year on year, as their production footprint continues to expand.

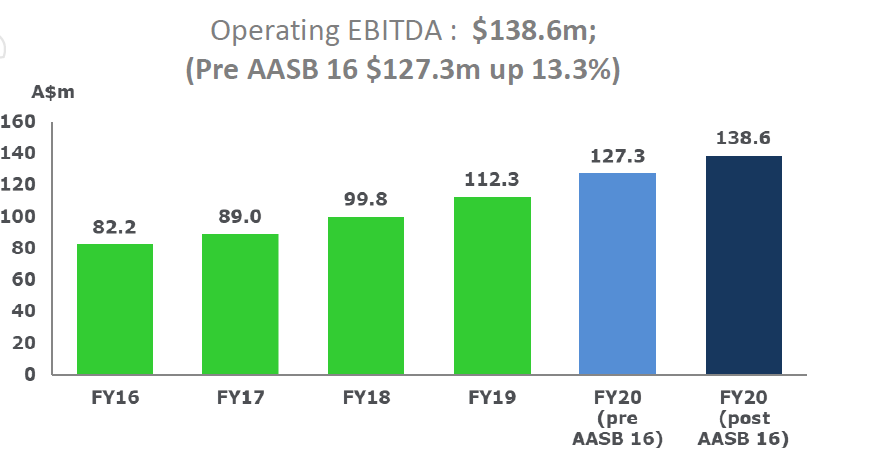

5) Growing earnings. Even more impressive, operating earnings have grown at 13.9% CAGR since listing as they get economies of scale, and prawns with higher margins come online.

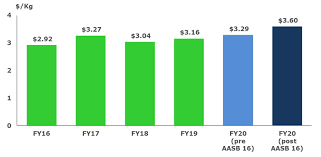

6) Strong and increasing margins. This has been driven by good marketing (despite pricing pressures with $WOW and $COL) and operating efficiencies.

7) Growth driver 🦐 - Tassal expanding their prawn production, with huge runway ahead. Increasing yield (from 8.1 to 9.1t / ha in 2020), increasing size (from 28.1 to 33.3g per prawn), and scaling production (240t FY18, 453t FY19, 2460t FY20, 4000t FY21f ... 20,000t FY23f?)

8) Capex - Funding the prawn capital requirements largely through FCF, though undertook $125m cap raising in FY20 to fund future growth. Acquired Fortune Group (2018), Exmoor (2019) & Billy Creek (2020) for prawn farming. Expect maintenance capex to overtake growth capex.

9) Consistent ROIC - Averaged around 12% ROIC, though has dropped in 2019/20 due to heavy capex requirement for prawns with delayed returned. With prawn at $6.10+ EBITDA/KG and production increasing, expect this to bounce up higher in FY22+

10) Compounding dividends. Current grossed up yield of 5.91% (18th on ASX), compounded by 11.8% since 2003. 52% payout ratio in 2020 which is low because of prawn growth capex. EPS = 34c in FY20, consensus 40c EPS by FY22 and potential dividend 20c+. Future dividend champion?

11) Great valuation. PE of 10, EV/EBITDA around 7. Historically low to moderate. Market likely to have too heavily discounted future earnings vs short term risks and capex requirement. Even without multiple expansion, plenty of compounding left on the table.

12) Insider buying. Since March 2020 lows, substantial insider buying (from $3 up to $3.60) and no selling. Most recently from directors: $350k @ $3.49 and $35k @ $3.51, in December 2020.

13) Diamond in the rough. Few analysts covering stock. Morningstar target $3.60. Goldman Sachs reckon 10% undervalued factoring in 20% margin compression and underestimating growth runway. Asymmetric bet with little downside and significant upside potential.

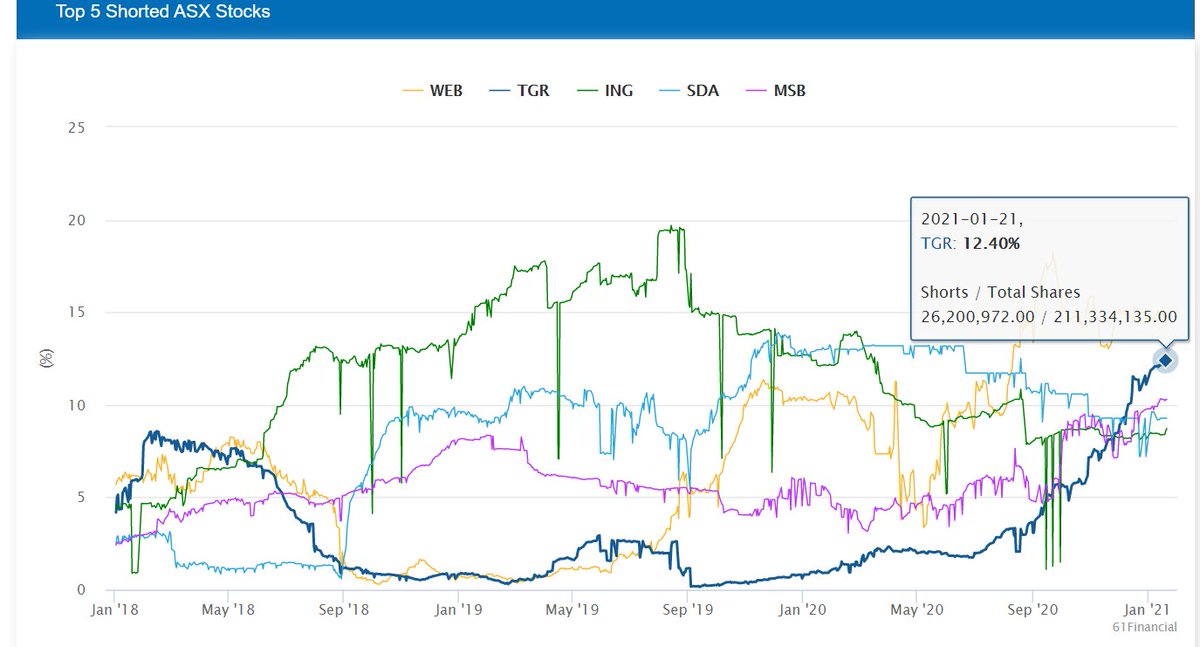

14) Non-consensus and right? TGR the 2nd most shorted stock on ASX with 12.5% of float (25m shares). Vol around 900k per day, so 25+ days to unwind. $GME likely to lead to some unwinding of shorts globally, possible tailwind?

15) Short thesis. At $4.50 they had a point, but at $3.40? Basis is margins under pressure due to $HUO.AX competition as they redirect from export to domestic; global salmon prices lower, and slower than expected prawn production. All real risks... but

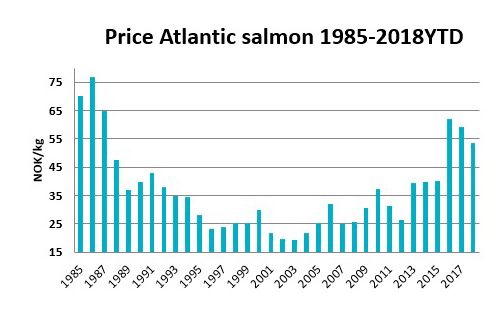

16) NASDAQ Salmon Index. Although prices dropped over past 12 months, not at historical lows and past 12weeks +13%. TGR have grown larger salmon (+price), reduced export exposures (16% of revenue) and experience relatively low correlation between EBITDA & NOK/KG

17) Stepwise Results. Market treats TGR as a cyclical stock, but it's results are "stalwart" like. Share price has a tendency to be more volatile than underlying earnings - significant stepwise movements in 2006-08 and 2012-14. Failed breakouts & consolidation since 2016. Next?

I'm long Tassal for fundamental reasons. At the current price I believe it shows good value as a long term hold in my portfolio. If it rerates great, if not it's a compounder. Patience is required. Do your own research. Beware of shorts and short-reports.

• • •

Missing some Tweet in this thread? You can try to

force a refresh