1/ Short interest # is not what you think when there is a massive option interest for ITM calls

2/ How do you exit your deep ITM GME calls, when bid-ask spread is crazy and GME is highly volatile itself (call prices not catching up as quickly as it should)?

You short sell GME to flatten your delta to 0. much better liquidity.

Also you can keep scalping gamma.

You short sell GME to flatten your delta to 0. much better liquidity.

Also you can keep scalping gamma.

3/ retail folks may or may not do this, but whales are sophisticated.

they could also sell an OTM put and short-sell more GME to get out completely.

they could also sell an OTM put and short-sell more GME to get out completely.

4/ on Friday, ITM calls alone could have contributed to 24MM-33MM shares of short interest of GME.

as a result, those headline short-interest number may be a lot less useful than you thought.

as a result, those headline short-interest number may be a lot less useful than you thought.

5/ (correction) In other words, these short GEM positions are net delta flat to the ITM GEM call holders, and won't be squeezed whatsoever.

One needs to track both GME position and option positions of customers and dealers to calculate the "squeezeable" short interest

One needs to track both GME position and option positions of customers and dealers to calculate the "squeezeable" short interest

6/ I have yet to seen any data that aggregate the option and underlying data together (including NYSE & NASDAQ).

so all the short interest number we have seen are likely an overestimate.

The overestimate was not a big issue two weeks ago, because not that many calls were ITM.

so all the short interest number we have seen are likely an overestimate.

The overestimate was not a big issue two weeks ago, because not that many calls were ITM.

p.s. this marks the end of my Saturday rant. Y'all have a good weekend. 🥳

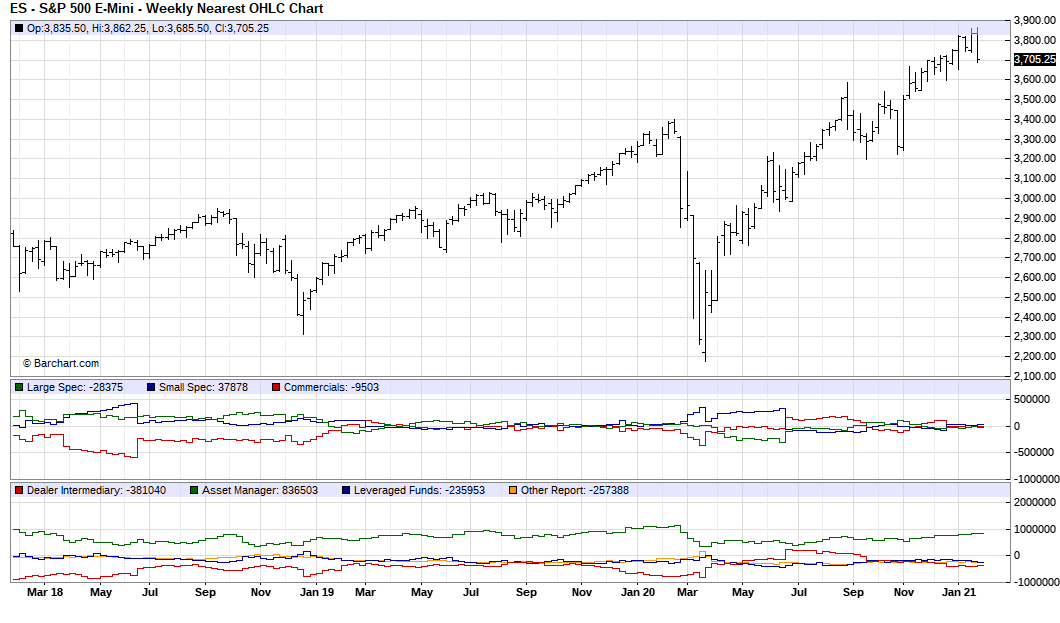

If someone could publish a COT report for single names AND segregate option dealer inventory from spec inventory, one could tell which inning we are in for a squeeze.

Like those published for future contracts.

That info is too valuable to be published though, IMO

Like those published for future contracts.

That info is too valuable to be published though, IMO

• • •

Missing some Tweet in this thread? You can try to

force a refresh