ServiceNow is a $100B (!) SaaS company most of us know only a little about

Its original product manages IT workflows in the enterprise

It's now at $5B in ARR, and >still< growing an incredible 32% YoY!

5 Interesting Learnings:

Its original product manages IT workflows in the enterprise

It's now at $5B in ARR, and >still< growing an incredible 32% YoY!

5 Interesting Learnings:

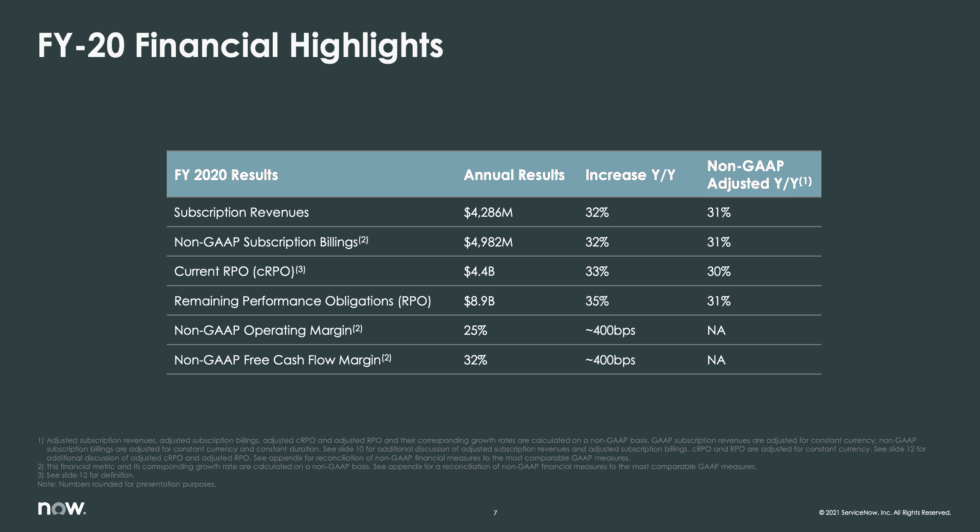

#1. Still growing 32% at $5B in ARR (!) This is pretty stunning, and justifies the $100B market cap.

Even at $5B in ARR, ServiceNow is still growing at 32% year-over-year.

This is as fast as Slack at $1B ARR.

Even at $5B in ARR, ServiceNow is still growing at 32% year-over-year.

This is as fast as Slack at $1B ARR.

To do this, ServiceNow has dramatically expanded its TAM, its deal size, and its product footprint over the years.

The "original" ServiceNow couldn't have gotten to $5B in ARR growing 32%.

Still, it shows TAM is what you make it.

The "original" ServiceNow couldn't have gotten to $5B in ARR growing 32%.

Still, it shows TAM is what you make it.

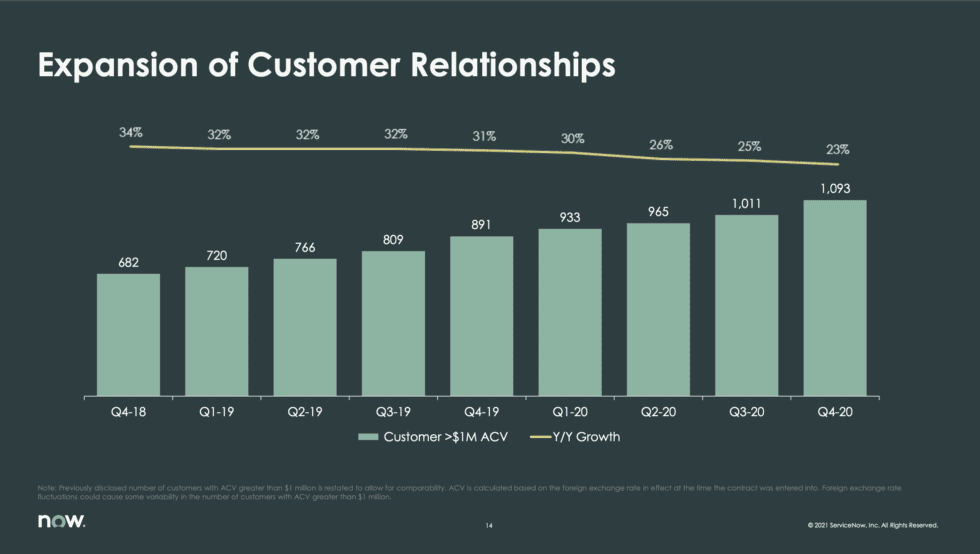

#2. 1,100 $1m+ ACV customers — and the customer count here is still growing 23%.

This is again pretty stunning.

And the momentum is continuing. $1m+ customers are growing 23% by logo!

ServiceNow has hardly maxed out its large customer base yet, even at $5B ARR.

This is again pretty stunning.

And the momentum is continuing. $1m+ customers are growing 23% by logo!

ServiceNow has hardly maxed out its large customer base yet, even at $5B ARR.

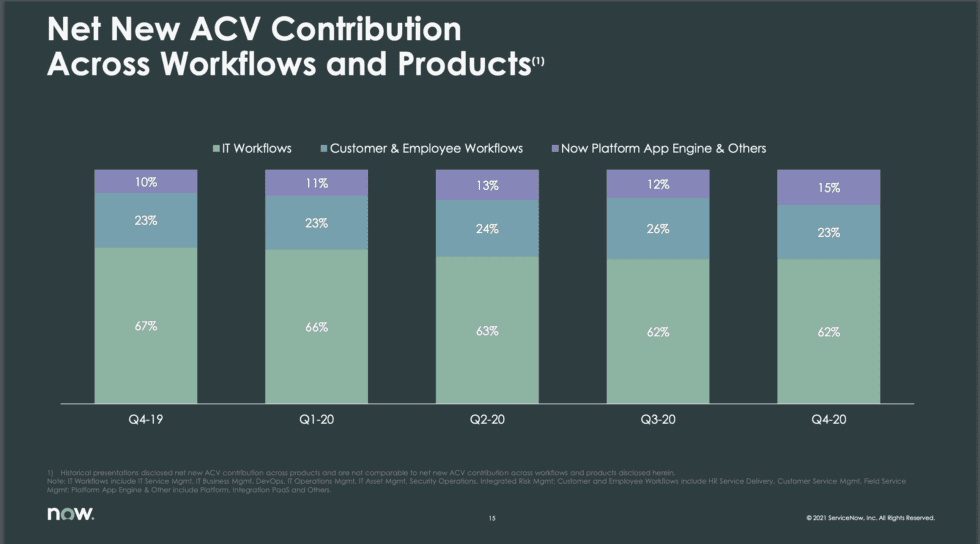

#3. New Products and Workflows Fuel Growth After $1B in ARR.

We've seen this again and again, with Box, Datadog, Veeva, Twilio, etc. The “core” product often takes you quite far — but at some side of $1B in ARR, you need another product to fuel growth from the customer base.

We've seen this again and again, with Box, Datadog, Veeva, Twilio, etc. The “core” product often takes you quite far — but at some side of $1B in ARR, you need another product to fuel growth from the customer base.

ServiceNow’s core IT workflow product is now just 62% of its total revenues.

Its expansion into customer and employee workflows now ~25% of revenues

And its platform revenue (partners) in now up to 15%, from just 10% a year back.

Its expansion into customer and employee workflows now ~25% of revenues

And its platform revenue (partners) in now up to 15%, from just 10% a year back.

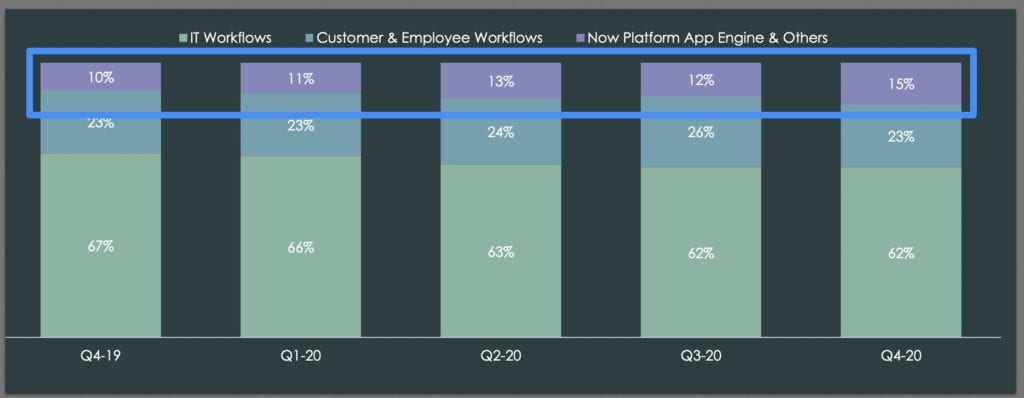

#4. Waited to monetize platform, like Shopify, Zendesk, etc.

ServiceNow’s revenues from its platform didn’t cross 10% of its overall revenue until 2019.

We see many SaaS leaders waiting before taking too much out of the pockets of their partners.

Don't rush it. Go long.

ServiceNow’s revenues from its platform didn’t cross 10% of its overall revenue until 2019.

We see many SaaS leaders waiting before taking too much out of the pockets of their partners.

Don't rush it. Go long.

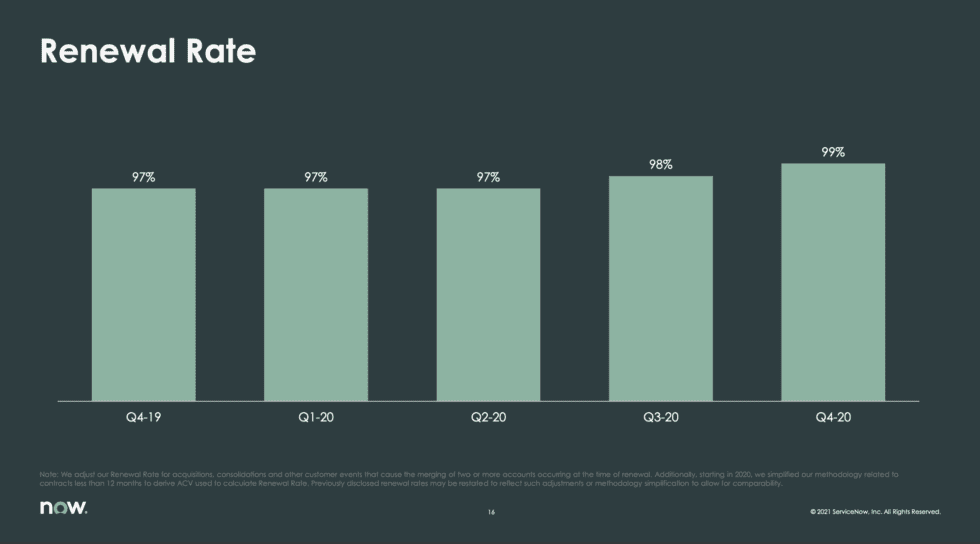

#5. A stunning 99% logo retention rate. 99% of their customers stay year after year!

Now as we’ll see next, they do sign 3+ year contracts :).

But still, it’s a stunning example of keeping enterprise customers for life.

Now as we’ll see next, they do sign 3+ year contracts :).

But still, it’s a stunning example of keeping enterprise customers for life.

Some bonus learnings:

#6. Only 5% of its revenues from professional services -- despite being very enterprise.

This is a bit of a surprise, and a big contrast to some other enterprise players like Qualtrics, Veeva, etc.

#6. Only 5% of its revenues from professional services -- despite being very enterprise.

This is a bit of a surprise, and a big contrast to some other enterprise players like Qualtrics, Veeva, etc.

The number is in some ways "artificially" low.

Like Salesforce, ServiceNow has built up a large ecosystem of partners to handle deployments, configuration, and other lower-margin professional services.

It’s still interesting to see it so low, however with $1m+ deals.

Like Salesforce, ServiceNow has built up a large ecosystem of partners to handle deployments, configuration, and other lower-margin professional services.

It’s still interesting to see it so low, however with $1m+ deals.

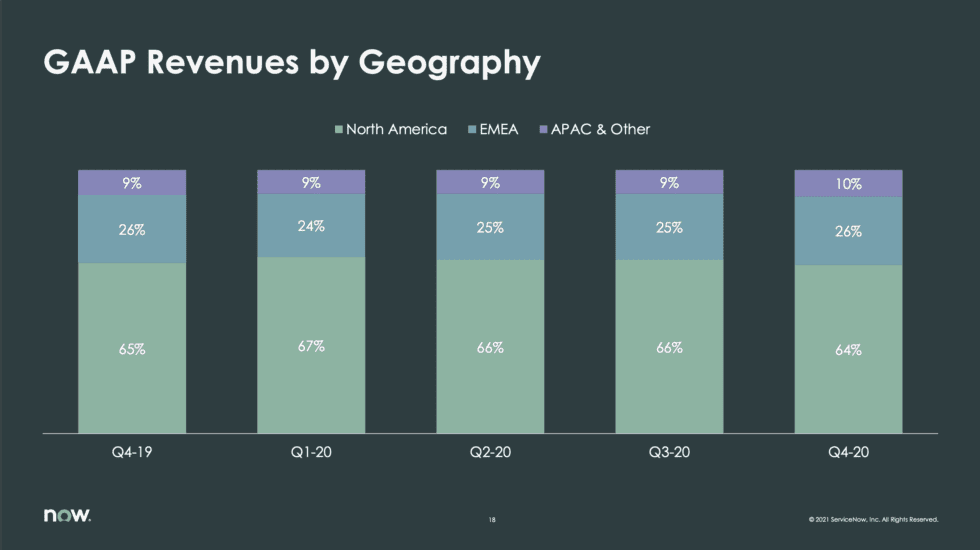

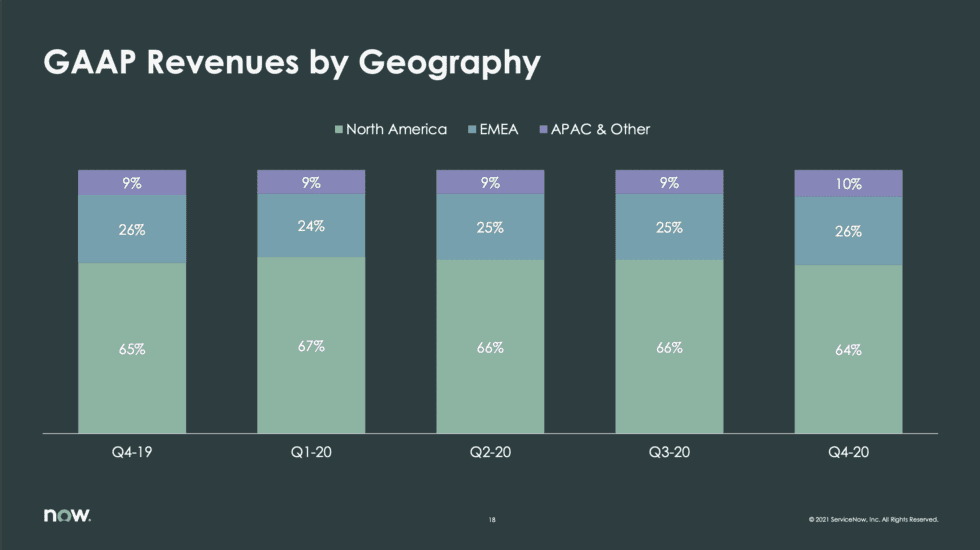

#7. 36% of Revenue from Outside North America.

Don’t be too U.S. focused, even in the early days. This is basically how most SaaS looks today. 60% or so of the revenue is still in the U.S. But 40% isn’t. If it does find you, don’t run from it. Embrace it.

Don’t be too U.S. focused, even in the early days. This is basically how most SaaS looks today. 60% or so of the revenue is still in the U.S. But 40% isn’t. If it does find you, don’t run from it. Embrace it.

Final bonus:

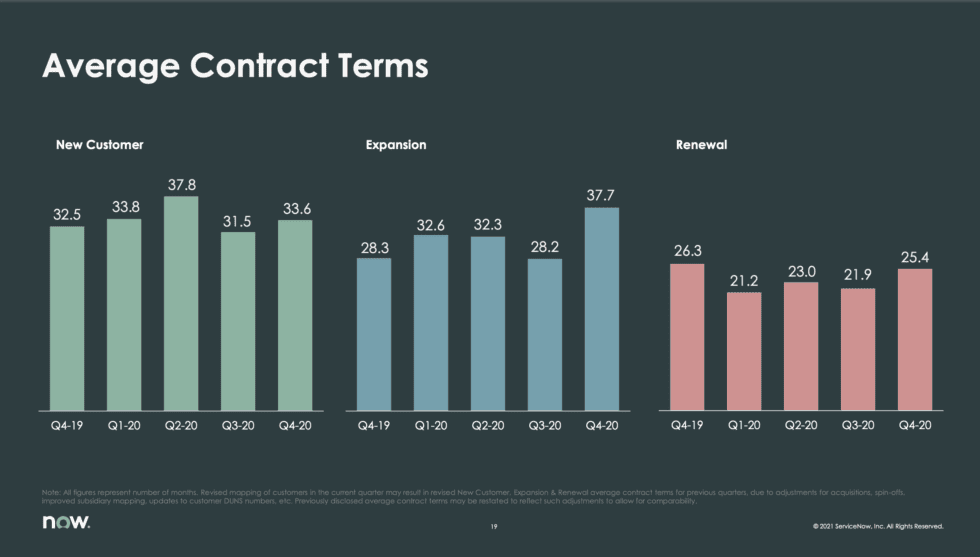

#8. New Customers Sign 3 Year Contracts, Renewals for 2 Years.

We’ve seen leaders like Qualtrics standardize on 1-year contracts, others like Zoom keep plenty of shorter-term customers.

Not ServiceNow. You sign a 3-year contract, then a 2-year renewal.

#8. New Customers Sign 3 Year Contracts, Renewals for 2 Years.

We’ve seen leaders like Qualtrics standardize on 1-year contracts, others like Zoom keep plenty of shorter-term customers.

Not ServiceNow. You sign a 3-year contract, then a 2-year renewal.

“If you want to go way upmarket, first get to a $1m TCV deal. That will teach you to get to a $1m ACV deal. Then, just make them happy.

After that, it’s off to the races.”

saastr.com/servicenow-clo…

After that, it’s off to the races.”

saastr.com/servicenow-clo…

• • •

Missing some Tweet in this thread? You can try to

force a refresh