So Rs want Biden to drastically scale back economic relief in the name of bipartisanship. Their offer is insultingly inadequate, and their claims that using reconciliation would "poison the well" are rich given how they rammed through the 2017 tax cut. But there's more 1/

Why, exactly, is bipartisanship something to be valued right now? When a political party by and large still won't accept Biden's legitimacy and embraces Jewish space laser people, why is it a virtue to cooperate with it? 2/

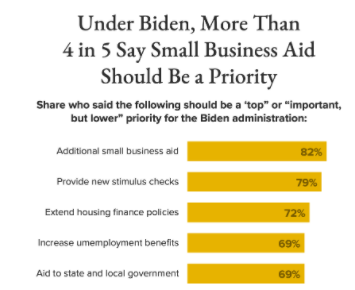

Also, the major items in the Biden proposal are very popular, generally with >60% approval. Why defer to a party that is lockstep opposed to what the public wants? 3/

And one particularly annoying point: Rs having the nerve to complain that the $1400 checks are poorly targeted. The 2017 tax cut delivered 79% of its benefits to people with >$100K income 4/ taxpolicycenter.org/model-estimate…

Public opinion. Why, exactly, pay attention to GOP objections? morningconsult.com/2021/01/19/bid…

• • •

Missing some Tweet in this thread? You can try to

force a refresh