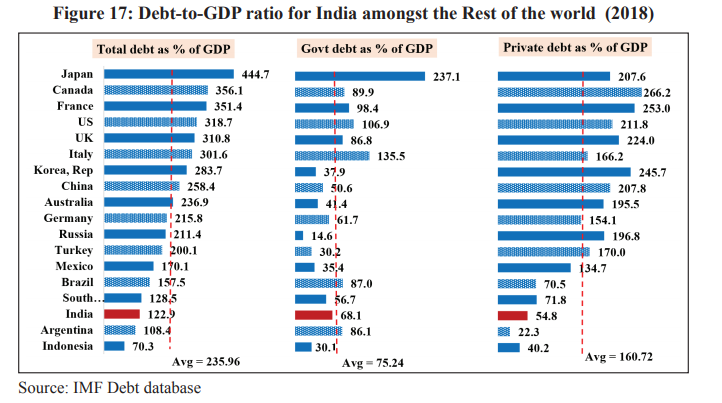

From the economic survey: India's debt situation isn't that horrible. Total debt, which includes debt taken from abroad, is about 122% of GDP - where government debt is 70%. Remember this - because most other countries have hiher govt debt and much higher private debt.

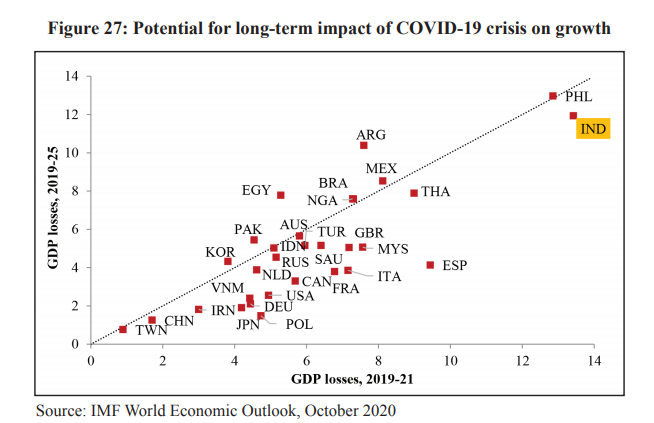

If Covid has hit us badly - and it has, even if markets are like what is wrong with you Deepak - we will recover the fastest. It's just math, though - just getting back from a steeper fall is a higher rate.

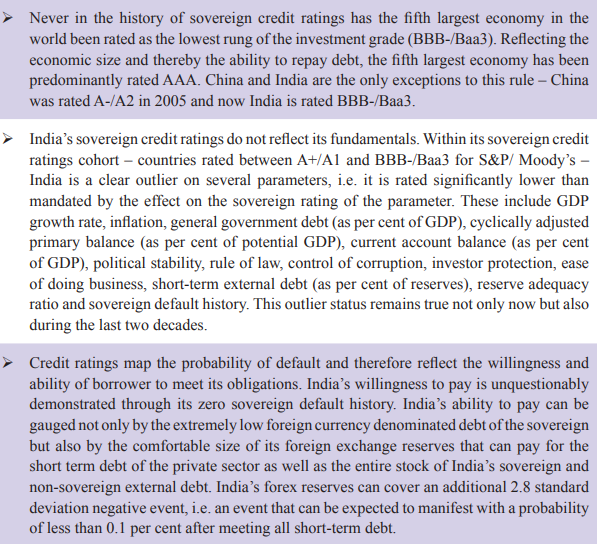

India's credit rating is unnaturally lower than the western economies, even when it's demonstrated that it deserves better. I so totally agree with this - my opinion is that the rating agencies are mostly incompetent in this regard.

Here's where I plug our podcast on why I think Credit Rating Agencies need to be made more irrelevant: capitalmind.in/2020/06/podcas…

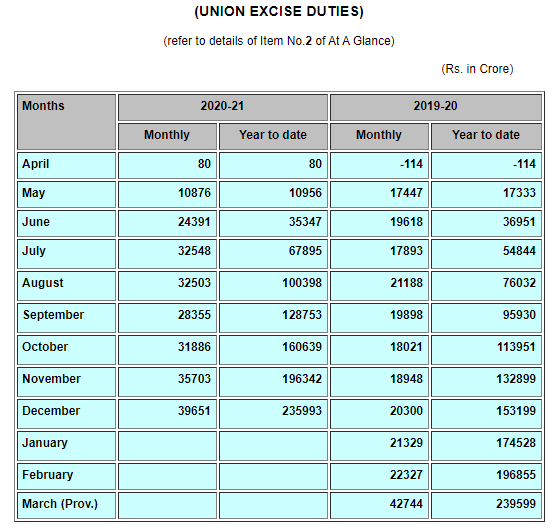

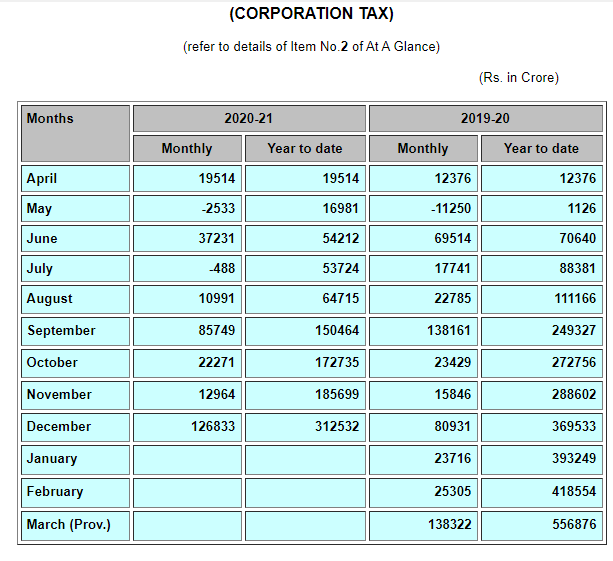

Where is the government today? In corporation tax, we have collected a lot more in December than we had last year (50% more!) but that's also because the year has been lousy so far.

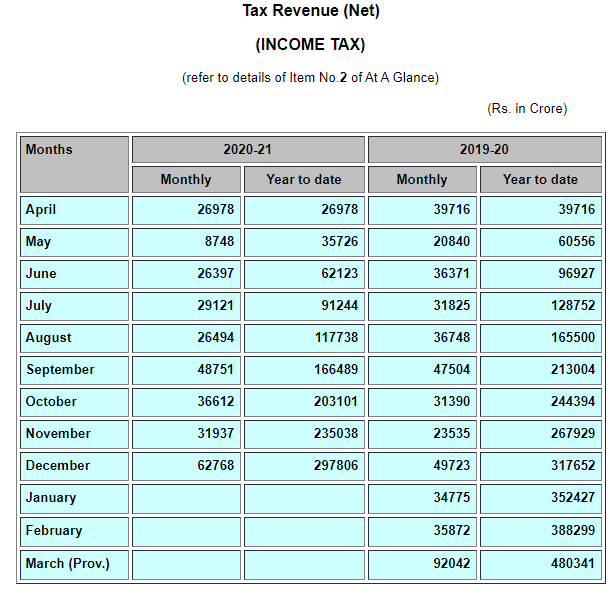

Personal taxes, though, are catching up very fast. In the last four months to December, Personal tax collections have been higher than last year. Dividend taxes, higher surcharges etc. would have added to this.

Could we have a bad bank? If we have a /r/IndianBadBankBets that just makes a few people buy the lousy debt....maybe. My view is: if you allow banks to dump "bad" debt into a publicly funded institution, every debt will attempt to become "bad" to get themselves free.

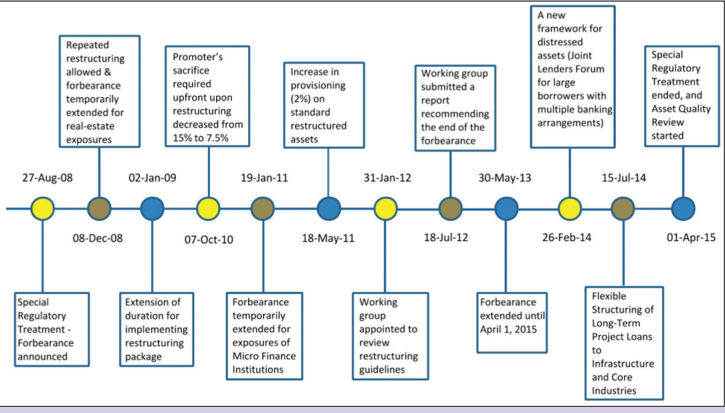

How much have banks been taking your trip since 2008: the official term is "regulatory forbearance".

The unofficial term is: "How much more can I pretend I have good loans to you stupid people before I ask for a bailout"

The unofficial term is: "How much more can I pretend I have good loans to you stupid people before I ask for a bailout"

And....it begins. #Budget2021

There are lots of things. Tagore. Cricket win at Australia etc. All good so far.

Lowest active cases of 134 million?

It's a digital budget. There will be lots of digits.

There is a Atmanirbhar swach bharat yojana. Till now our swach was not atmanirbhar, but now it will be!

Mission Potion 2.0! I cannot say how much I like this.

Sorry, there is Swasthya Bharat also. I was thinking it was pronunciation mistake. We have hajaar more alphabets than Swa - but we are being atmanirbhar.

Voluntary vehicle scrapping scheme - 15 years for commercial vehicles. This is nice, I wonder what the details will be.

35,000 cr. for Covid Vaccines. More if required. At Rs. 350 per vaccine, that's 100 cr. people vaccinated - should work for everyone other than children. Nice.

Moving on to infrastructure.

Manufacturing companies need to be part of global supply chain. PLI schemes announced - 1.97 lakh cr. over 5 years.

Seven textile parks over three years. Trying to push India as a clothing manufacturer. Big employment here, so not much surprise.

Push for infra: Long term debt financing through "professionally managed institution" - setting up "Development Financial Institution" with 20,000 cr. I don't really like this but okay nothing will happen.

Asset monetization: That word we like.

Wants to monetize infra assets (roads? bridge tolls?)

Wants to monetize infra assets (roads? bridge tolls?)

InvIT to be sponsored by NHAI - five roads of 5000 cr. Powergrid will put transmission assets into Invits. Airports to be monetized. Railways to monetise DFC (through InvITs I guess).

This is actually very good in a time of low interest rates.

Sharp increase in govt capex. 5.54 lakh cr. in capex in 2021-22 (45% increase!)

Above this 200,000 cr. to states for capex.

Above this 200,000 cr. to states for capex.

No one seems to be shouting. Yet.

11,000 km of national highways. Can someone rename Koramangala to be national highway please?

600 kms of highway work each in Kerala and West Bengal. Not related to elections coming up there, of course.

This speech comes with annexures where all the juicy details are.

Future Ready Railway system. Dedicated Freight Corridors by June 2022.

PPP model again. This is gonna bloody fail. Okay that's my opinion.

107,000 cr. for railways capex. This is par for the course - we have announced this two years back.

Some new "metro" technologies it seems. Bangalore will see this in 2099, extrapolating current speed of implementing the previous ones.

Promoting competition in power. Choose between distribution companies. Choices: no power between 2 and 4pm and no power between 4pm and 6pm. ("Ensuring your kids play outside!")

Just kidding. We have done great things in power. Choice is good.

Just kidding. We have done great things in power. Choice is good.

Hydrogen energy mission. This is crap. Elon musk's speech is useful here - solar to battery is far better than a massively combustible hydrogen. Anyhow.

Indian shipping companies will get subsidies. 1624 cr. over five years. I have no context on how good this is, but interesting.

There is no Hindi Translation? #Disappointed

Rationalizing all the market stuff at one code rather than indiv acts.

Corp bond market: Government to create institution to buy investment grade debt? What?

1000 cr. to Solar Energy corp. Very good here.

50% of directors resident indians in something - I need to read thi spart of the speech.

A Bad Bank - new AMC and ARC to be created to take bad debt, with an AIF approach.

FDI in insurance up to 74%. This is also good

Decriminalization of LLP act violations - thank goodness.

PSU bank recap at 20,000 cr. - this is probably a lower estimate.

One person company can grow without restriction! Folks: this is one way to get the lower 25% tax rate. (We'll see if that tax rate remains, later)

Much required mentions of AI, ML in MCA 3.0 which will have modules for e-[compliance, management, something else].

VCs can now fund the government, thankfully.

VCs can now fund the government, thankfully.

Two PSU banks and one PSU company to be divested. Hopefully not by other PSU banks or PSU companies.

*Not to

Mechanism to close horrible PSUs. Now some shouting happens. Some MLAs might have been employed there, maybe.

Someone's calling Bhatia. Bhatia, please respond.

Agriculture: She mentions farmer and everyone audibly sighs.

in 2013-14 we paid 33,000 cr. for buying too much wheat.

In 2019-20 it was 62,000 cr.

In 2020-21 it was 75,000 cr.

Still too much wheat.

In 2019-20 it was 62,000 cr.

In 2020-21 it was 75,000 cr.

Still too much wheat.

But this is now just showing off :)

1,72,000 cr. to buy wheat and rice, mostly. Cess-pool.

Another Swa* scheme for property rights to villagers.

Agri credit target is 16.5 lakh crore. Some interesting allocations - dairy and fisheries.

Fishing harbours in a bunch of places. "Something's fishy" is now a good thing.

Social security for platform workers. This is very very nice. ESIC too.

Min wages for gig workers too. Will see how this works.

"Reinvigorating Human Capital" is next. I'm ready.

100 new Sainik Schools to be made. There are other "umbrella" structures to be created for higher education. In case it rains.

There are lots of words like knowledge and education here. I am not qualified to translate.

1500 cr. for financial incentives for digital mode of trade. Excellent, if it helps the small trader.

Language translation mission - thank goodness. Details later I guess.

4000 cr. to understand the ocean. This is better than trying to understand mountains, I suppose.

Oh a way to reduce contract conflicts. I will wait for the fine print!

Fiscal position. Fiscal position.

34.50 lakh cr. expenditure. "Maintained quality of expenditure".

9.5% of GDP as fiscal deficit for FY21.

This is funded through govt borrowing and Small savings. Another 80,000 cr. needed in the next two months.

This is funded through govt borrowing and Small savings. Another 80,000 cr. needed in the next two months.

Exp in FY22 is 34.83 lakh cr.

5.4 lakh in Capex.

5.4 lakh in Capex.

Needs 12 lakh cr in gross borrowings. Oof.

Yields shot above 6.06% now.

3% state level deficit only by FY 23

Next year fisc is 6.8%. This is okay, but not that much.

NSSF loan to FCI gone! THis means direct lending to FCI by government. The NSSF is PPF etc.

Now for Part B! Translation: Tax idhar hai.

Shit, she starts with "serious challenge".

Our tax system should promote investments, yes please.

First poem: Tamil one. I was losing faith till now.

Direct tax: In 2020, 6.48 cr. people - doubled from 2014

Simplification: Senior citizens neednt file IT return for 75+ and only interest and pension income

Reducing time limit for reopening tax returns reduced to 3 years (from 6). Even in Serious fraud, only if tax concealed has evidence of 50 lakh+, can the term go beyond.

This is actually very very good.

This is actually very very good.

Faceless IT appeal with ITAT also. If you have felt you lost face, then remember, so has IT deparment.

(Kidding, this is good)

(Kidding, this is good)

NRIs - accrued incomes in foreign based retirement accounts is a pain. Some rules to help. (We'll know later)

Tax audit limits increased for a few people to 10 cr. Which is excellent.

Dividend payment to REIT and INVIT = no TDS.

Advance tax liability on dividend income is only after payment of dividend. This is good.

For FPIs, treaty rates will apply for TDS.

Advance tax liability on dividend income is only after payment of dividend. This is good.

For FPIs, treaty rates will apply for TDS.

Whoa. Zero coupon tax efficient bonds for Infra!!! This is brilliant. need to see the fine print.

Goodness. not more benefits for housing, please.

If you can afford your house, would you take a loan? #DefineAffordableHousing

Affordable rental housing - tax exemptions for such projects. Uhem. Okay.

Tax holiday for capital gains, for aircraft leasing and rental companies.

Pre-filling of returns: They'll tell you what they should have already known.

Details of capital gains, dividend income and interest from banks and post office will be pre-filled. Very interesting!

Some employers do not deposit EPF and ESI etc.

For employees, this is a mess. So they're saying we won't allow it as deduction to employer. Like such employers care.

For employees, this is a mess. So they're saying we won't allow it as deduction to employer. Like such employers care.

Extend capital gains exemption for LTCG into startups - for more year.

Thats it. No higher taxation? I hope it's not hidden somewhere

People getting excited about govt calculating capital gains automatically - note that they are guaranteed to get it wrong :)

review 400 old exceptions from customs duties?

Reducing customs duty on steel (semis, flats and bunch of others). Yayayay!

No ADD and CVD on certain steel products.

Gold and silver: Rationalizing this. She doesn't say how much it has gone to.

Solar lantern duties going up?

Withdrawing exceptions on tunnel boring machines. Sorry Elon Musk.

It's over, people.

Markets very happy. 3% on the Nifty. 6% on Bank Nifty.

Reversal of last week's rough sentiment.

Reversal of last week's rough sentiment.

Thanks for all the love, folks. I will try and respond as we get more detail.

Bond market hates it - 6.04% on the 2030 bond (from 5.9% yest)

Rupee flat at 73, marginally weaker.

Now we find: ULIPs, if you pay more than 2.5 lakh premium, total of all policies per year, will be taxed when you exit. Only for policies issued after Feb 1, 2021.

New change: EPF contributions of more than 2.5 lakh rupees will not see tax free interest - all such interest will be taxed.

Big change: Gold and Silver duties reduced to 10% from 12.5%. This is good to bring down effective prices of gold.

• • •

Missing some Tweet in this thread? You can try to

force a refresh