Starting a thread to summarize all the important #Budget announcements with Tata Mutual Fund (@ProfSimple).

Follow along 😀

Follow along 😀

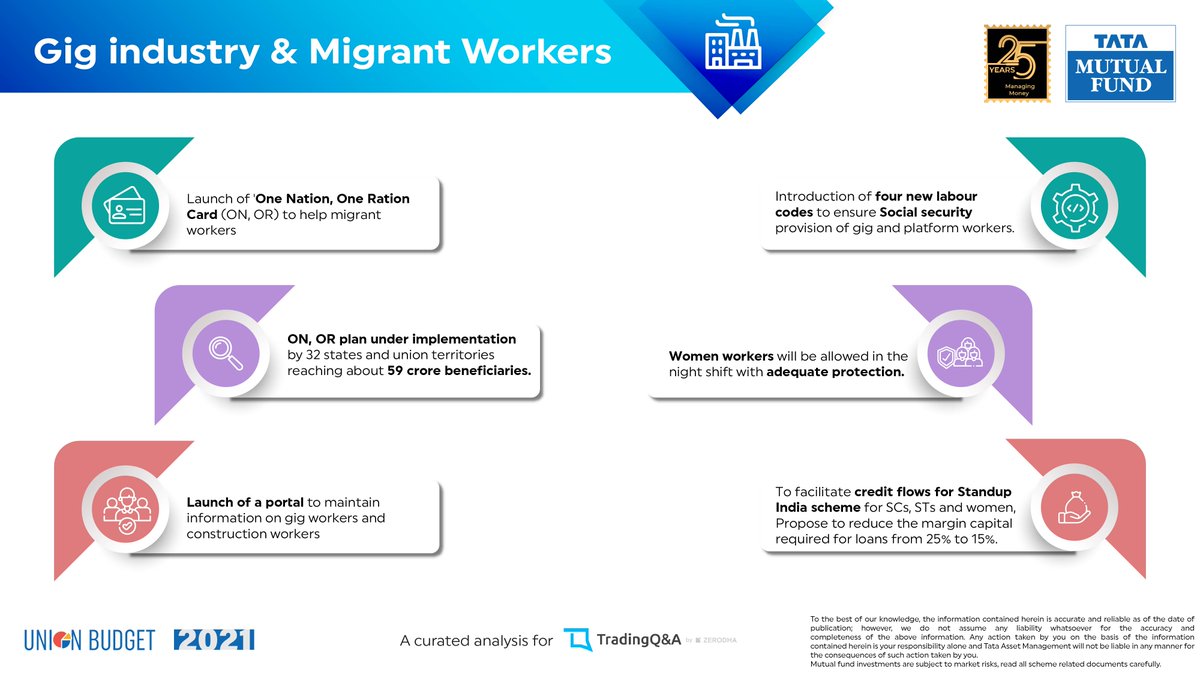

1. Budget aims to build on Aatmanirbhar Bharat mission amidst changing global dynamics, Six pillars include Health Infra, Physical Infra, Human Capital, Inclusive growth, innovation and Minimum Government - Maximum Governance.

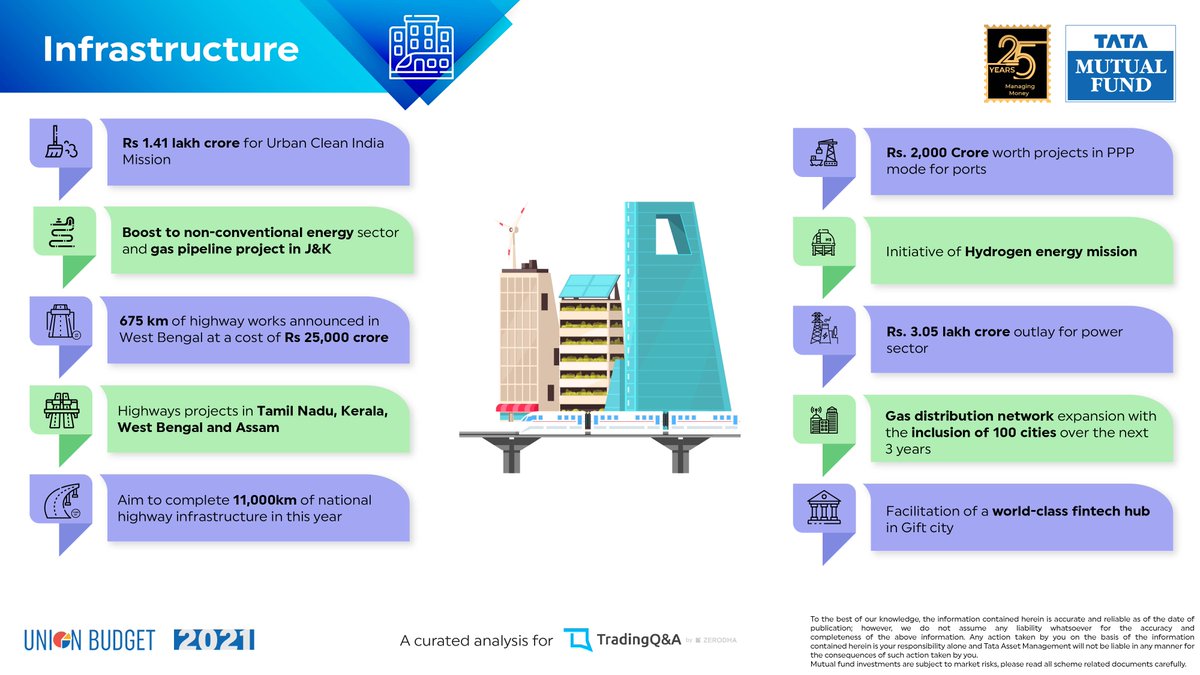

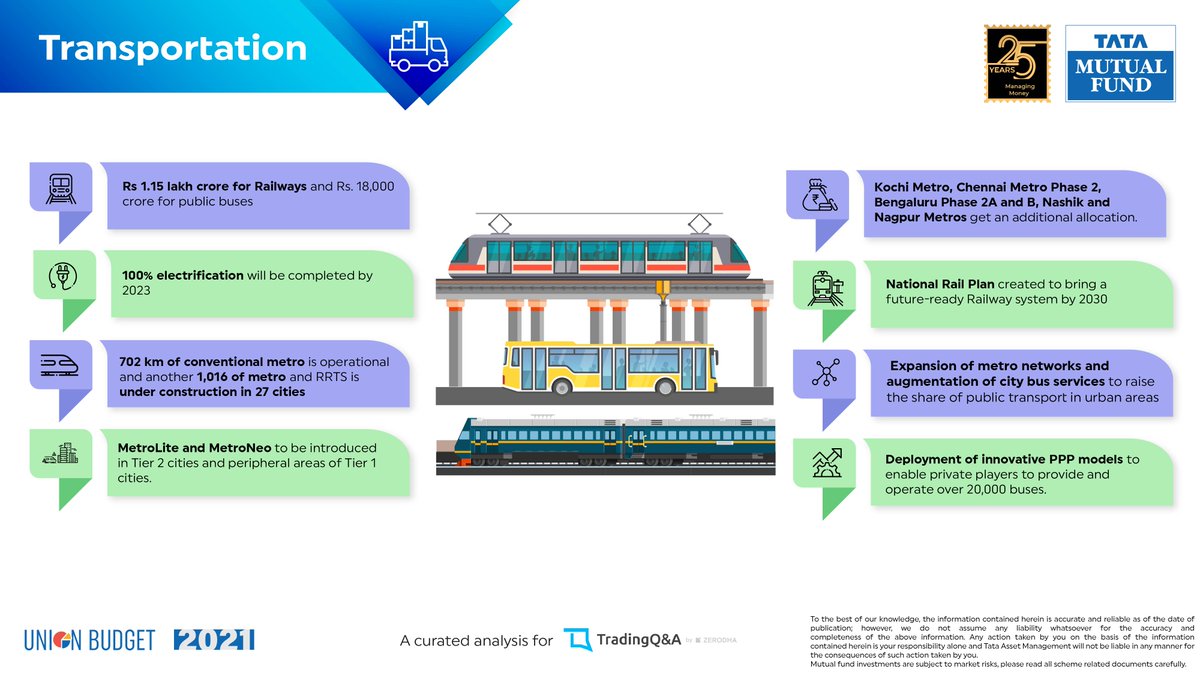

2. Big boost on capital expenditure for FY22. For funding, significant institutional setup planned to execute and monitor monetization of assets owned by PSUs or government undertaking.

3. Three key reforms for Financial Markets: Single securities market code, improve liquidity in Bond markets and increase in FDI limit to 74%, explains @rahsin102 of @TataMutualFund.

#Budget2021

#Budget2021

4. Big push on privatisation - 2 PSU banks and 1 general insurance company also likely to be privatised. More PSUs to be added to the list of privatisation and land monetisation also on the cards.

#Budget2021

#Budget2021

5. Budget thrust so far indicates a follow through from the Economic Survey suggestions of having a counter-cyclical fiscal policy for next 1 year till growth regains the 7% trajectory after FY22.

#Budget2021

#Budget2021

6. Fiscal deficit of 6.8% in FY22 BE is higher than expected but in sync with the strategy of counter-cyclical fiscal policy. Five year target to reduce it to 4.5%

#Budget2021

#Budget2021

7. No new cess on personal income tax. Simplification of tax filing and dispute resolution is a positive.

#Budget2021

#Budget2021

Overall, budget has provided for higher government spend without increase in personal and corporate taxes or cess. No changes in capital gains structure is also a sentiment positive. Positive for cyclical recovery in earnings at the expense of higher fiscal deficit.

#Budget2021

#Budget2021

• • •

Missing some Tweet in this thread? You can try to

force a refresh