Union budget proposed big rise in Capital Expenditure. What does does it mean?

A simple thread to understand Capital Expenditure vs Revenue Expenditure and its potential impact on the economy.

And why this may lead to rotation in sectoral winners.

1/n

A simple thread to understand Capital Expenditure vs Revenue Expenditure and its potential impact on the economy.

And why this may lead to rotation in sectoral winners.

1/n

The expenditure presented by the government is mainly defined in 2 ways

1. Expenditure which results in creation or acquisition of assets.

2. Expenditure on operational expenses that don't create any assets, but are routine spends.

2/n

1. Expenditure which results in creation or acquisition of assets.

2. Expenditure on operational expenses that don't create any assets, but are routine spends.

2/n

The 1st is called capital expenditure, and the 2nd one is revenue expenditure.

3/n

3/n

Revenue Expenditure:

1. It is incurred for normal running of government departments and maintenance.

2. It does not result in creation of assets.

3. It is recurring in nature and incurred regularly.

4/n

1. It is incurred for normal running of government departments and maintenance.

2. It does not result in creation of assets.

3. It is recurring in nature and incurred regularly.

4/n

4. It is short period expenditure.

5. For example, expenditure on medicines, salaries of government employees, subsidies and other freebies like loan waivers, etc..

Such Expenditure, if increased disproportionately, usually leads to cycles of higher inflation in the economy

5/n

5. For example, expenditure on medicines, salaries of government employees, subsidies and other freebies like loan waivers, etc..

Such Expenditure, if increased disproportionately, usually leads to cycles of higher inflation in the economy

5/n

Capital Expenditure:

1. It is incurred for acquisition of capital assets

2. It results in creation of assets

3. It is non-recurring in nature

4. It is generally a long period expenditure

5. For example, construction of hospitals, roads, dams, etc. is capital expenditure

6/n

1. It is incurred for acquisition of capital assets

2. It results in creation of assets

3. It is non-recurring in nature

4. It is generally a long period expenditure

5. For example, construction of hospitals, roads, dams, etc. is capital expenditure

6/n

Relevance of Capital Expenditure for the economy.

High capital expenditure usually means more investment by the government to create infrastructure and other assets that are strategically important for economic growth.

7/n

High capital expenditure usually means more investment by the government to create infrastructure and other assets that are strategically important for economic growth.

7/n

Capital expenditure has a multiplier effect on the economy.

The multiplier effect is a name for the fact that every rupee of government spending creates some additional amount of private sector spending.

8/n

The multiplier effect is a name for the fact that every rupee of government spending creates some additional amount of private sector spending.

8/n

For example, the government hires a person to build a road, that person goes out and spends money by consuming some goods and services, the manufacturer or service provider of which hires more workers with the money, and so on.

9/n

9/n

The size of this multiplier effect of government spending depends on how this money is spent.

If money is given directly to people through subsidies then it may just stay in their bank accounts or at best be spent to buy some goods. Here the multiplier may be smaller.

10/n

If money is given directly to people through subsidies then it may just stay in their bank accounts or at best be spent to buy some goods. Here the multiplier may be smaller.

10/n

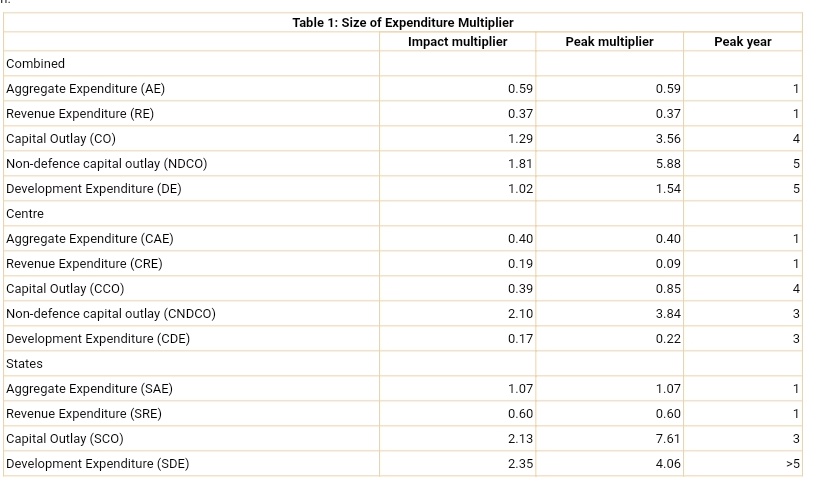

The below table from RBI shows multiplier of different kinds of government spending.

Capital outlay has highest multiplier effect.

11/n

Capital outlay has highest multiplier effect.

11/n

India experienced low growth rates for decades as it failed to spend more to develop physical and social infrastructure, the key to achieving high economic growth.

Rather, governments have spent more on subsidies which lead to sharp rise in demand.

12/n

Rather, governments have spent more on subsidies which lead to sharp rise in demand.

12/n

Sharp rise in demand in the short run without proportionate increase in supply leads to rise in prices and inflation spiral in the economy. Which we saw post 2008-09.

Such growth is unsustainable and non-inclusive.

13/n

Such growth is unsustainable and non-inclusive.

13/n

For many years, 85-90% of the Union government’s spending has been revenue spending.

High revenue expenditure of the Union government has often been blamed for lower than potential economic growth (output gap) and higher inflation.

14/n

High revenue expenditure of the Union government has often been blamed for lower than potential economic growth (output gap) and higher inflation.

14/n

This changed in budget 21 Government has proposed a sharp 34.5 per cent hike in capital expenditure to Rs 5.54 lakh crore in financial year 2022 in order to push growth.

This can kick start the investment cycle in the economy which has been lagging in recent years.

15/n

This can kick start the investment cycle in the economy which has been lagging in recent years.

15/n

When investment cycle kickstart Domestic Cyclical sectors tend to do well.

Sectors like materials, infrastructure, capital goods, construction, financials, etc are some of the domestic cyclical sectors that have done well in last cycle.

Watch out for this cycle!

16/end ***

Sectors like materials, infrastructure, capital goods, construction, financials, etc are some of the domestic cyclical sectors that have done well in last cycle.

Watch out for this cycle!

16/end ***

• • •

Missing some Tweet in this thread? You can try to

force a refresh