Shankara Building Products concall was today at 11:30 AM 😀

Here are the Key takeaways from the earning call 👇🧵

Here are the Key takeaways from the earning call 👇🧵

Business Updates:

• Q3 has seen uptick in the demand and co. is at its 80% of the pre-covid sales.

• There has been pick up in all the segment.

• Affordable Housing Segment has seen growth in the driver of business.

• Q3 has seen uptick in the demand and co. is at its 80% of the pre-covid sales.

• There has been pick up in all the segment.

• Affordable Housing Segment has seen growth in the driver of business.

Segments

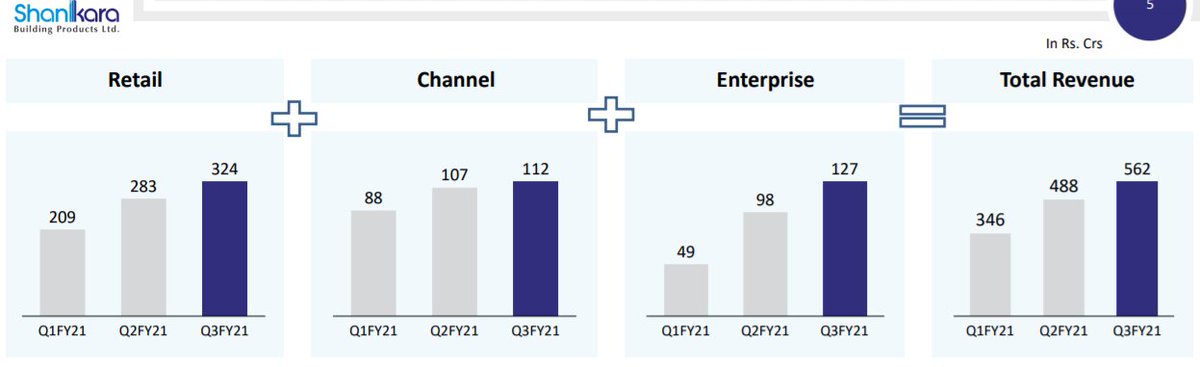

• Retail sector has seen 14% of the revenue growth. Revenue contribution 60%.

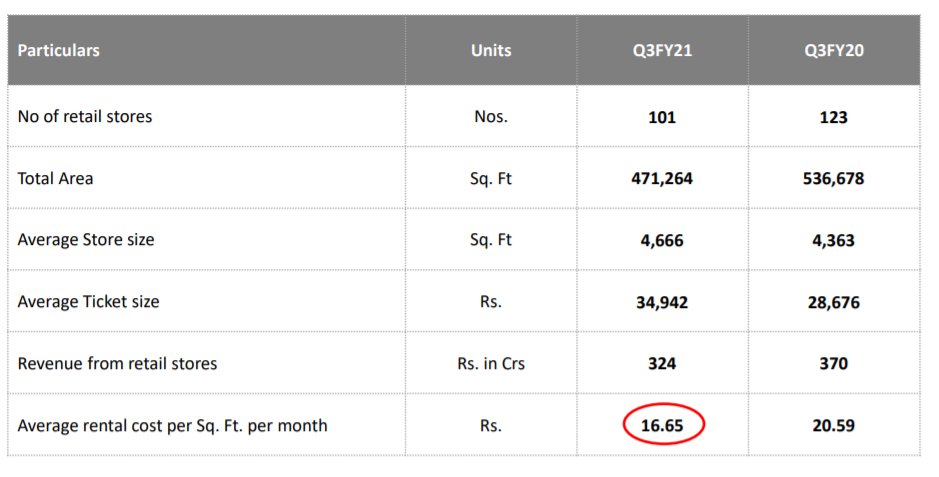

• Company has decreased the number of stores, as co. believes that they can work more efficiently with less number of stores.

• Avg ticket size of the company has been increased. (See image)

• Retail sector has seen 14% of the revenue growth. Revenue contribution 60%.

• Company has decreased the number of stores, as co. believes that they can work more efficiently with less number of stores.

• Avg ticket size of the company has been increased. (See image)

• Inventory gain: Approx around 10 crores

• Same store sales growth on YoY basis is negative, while from past quarter it positive. Mgmt expects more clarity after the end of the year.

• Shankara being in retail segment the growth in infra doesn't really benefited company.

• Same store sales growth on YoY basis is negative, while from past quarter it positive. Mgmt expects more clarity after the end of the year.

• Shankara being in retail segment the growth in infra doesn't really benefited company.

• Mgmt expect growth in Q4, as retail till now has not benefited

Credit Policy:

• Company has tightened the credit policy, based on the budget of the company

Store closure:

• Almost all the store closure has been done, there would be couple of stores which are left to close.

Credit Policy:

• Company has tightened the credit policy, based on the budget of the company

Store closure:

• Almost all the store closure has been done, there would be couple of stores which are left to close.

Footfalls:

• Footfalls has been low, however conversion is very high as co. is not getting majorly serious customer only.

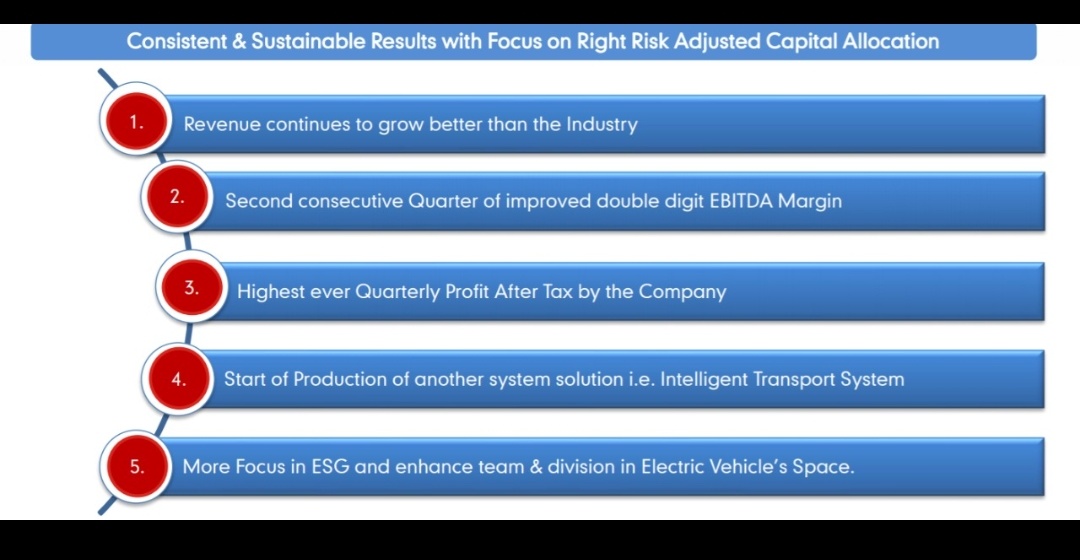

Growth- With current base, company is looking for growth of about 20-25% over next few year.

• Footfalls has been low, however conversion is very high as co. is not getting majorly serious customer only.

Growth- With current base, company is looking for growth of about 20-25% over next few year.

Growth with respect of real estate

• Co. sees over 3 types of sales

- New homes- Company caters to new building which are going to build up

- Constructor- Connecting to constructor where trust is important, hence this segment take time.

Hence pipeline generation should be strong

• Co. sees over 3 types of sales

- New homes- Company caters to new building which are going to build up

- Constructor- Connecting to constructor where trust is important, hence this segment take time.

Hence pipeline generation should be strong

- Upgradation- Customer who are refurbishing the housing for luxury homes.

Shankara has major focus on 1&2

Working Capital

• Creditor in Q1 was decreased, however this quarter creditor has increased from 30cr to 75cr.

• Net WC days remained at 62 days, making CFO of 101cr.

Shankara has major focus on 1&2

Working Capital

• Creditor in Q1 was decreased, however this quarter creditor has increased from 30cr to 75cr.

• Net WC days remained at 62 days, making CFO of 101cr.

Store closure:

• Thought process was pre-covid only.

• Growth and the profitability were the reason for the closure of stores.

• Nearby stores of recent closure store is also generating the sales of closed store. Hence per store profitability increased.

• Thought process was pre-covid only.

• Growth and the profitability were the reason for the closure of stores.

• Nearby stores of recent closure store is also generating the sales of closed store. Hence per store profitability increased.

CAPEX:

• Augmenting the warehousing, hence this would be nominal only.

• Share of steel over 4 year should come down to 60% while non share steel may rise.

• Augmenting the warehousing, hence this would be nominal only.

• Share of steel over 4 year should come down to 60% while non share steel may rise.

• • •

Missing some Tweet in this thread? You can try to

force a refresh