The Lifestyle product company "Vaibhav global" had their conference call on 2nd February around 5:30 pm

"A company which received best corporate governance award and best work space award. "

Here are the key takeaways😊

@VijayKedia1 @nid_rockz @Milind4profits

"A company which received best corporate governance award and best work space award. "

Here are the key takeaways😊

@VijayKedia1 @nid_rockz @Milind4profits

- Company is still taking excessive precautions when It comes to covid 19.

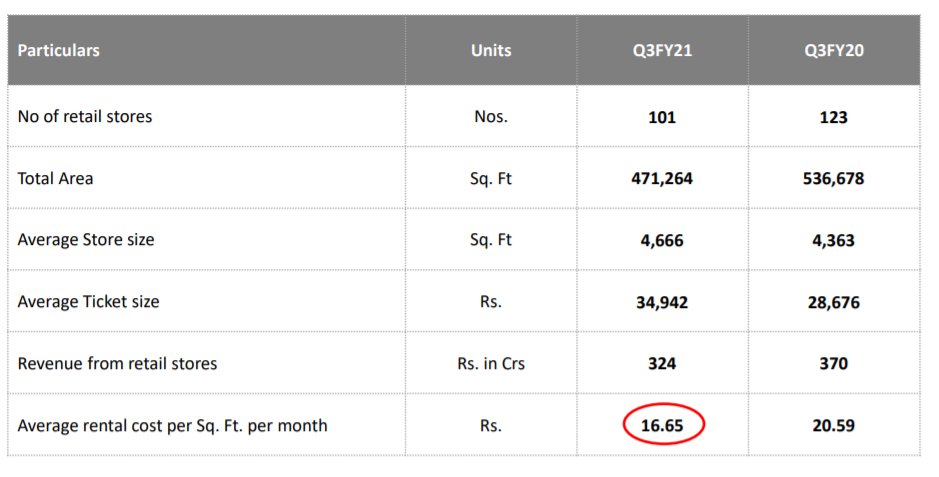

- Retail space have experienced a complete structural shift in the lock period.

- There was no major impact of Us elections on the business.

- Retail space have experienced a complete structural shift in the lock period.

- There was no major impact of Us elections on the business.

- Change in customer preference have led strong attraction on omnichannel retail pillers of company

- The company had an USP of having bottom cost and price discovery.

- Multiple platforms are been used to create demand.

- The company had an USP of having bottom cost and price discovery.

- Multiple platforms are been used to create demand.

Vaibhav lifestyle limited

- Launched in last December , to manufacture and export textile garments and related articles.

- Have synergy with its main business related to control over quality and price integration and likes.

- Launched in last December , to manufacture and export textile garments and related articles.

- Have synergy with its main business related to control over quality and price integration and likes.

- The company is into a Technology driven business where IT have a very critical role.

- To have better management and increased effeciency various innitiative were done like:-

Wallet integration

New ERP

Artificial intelligence capability

Market automation

Warehouse automation

- To have better management and increased effeciency various innitiative were done like:-

Wallet integration

New ERP

Artificial intelligence capability

Market automation

Warehouse automation

- Partnered with maverick an all in one digital marketing program.

- Customer loyalty program is also been launched and have seen a great response.

- The companies part have been declared carbon neutral for the period 19-20.

- Customer loyalty program is also been launched and have seen a great response.

- The companies part have been declared carbon neutral for the period 19-20.

- Other customer oriented business is also taken care off.

- The company provides its products in each and every platform available.

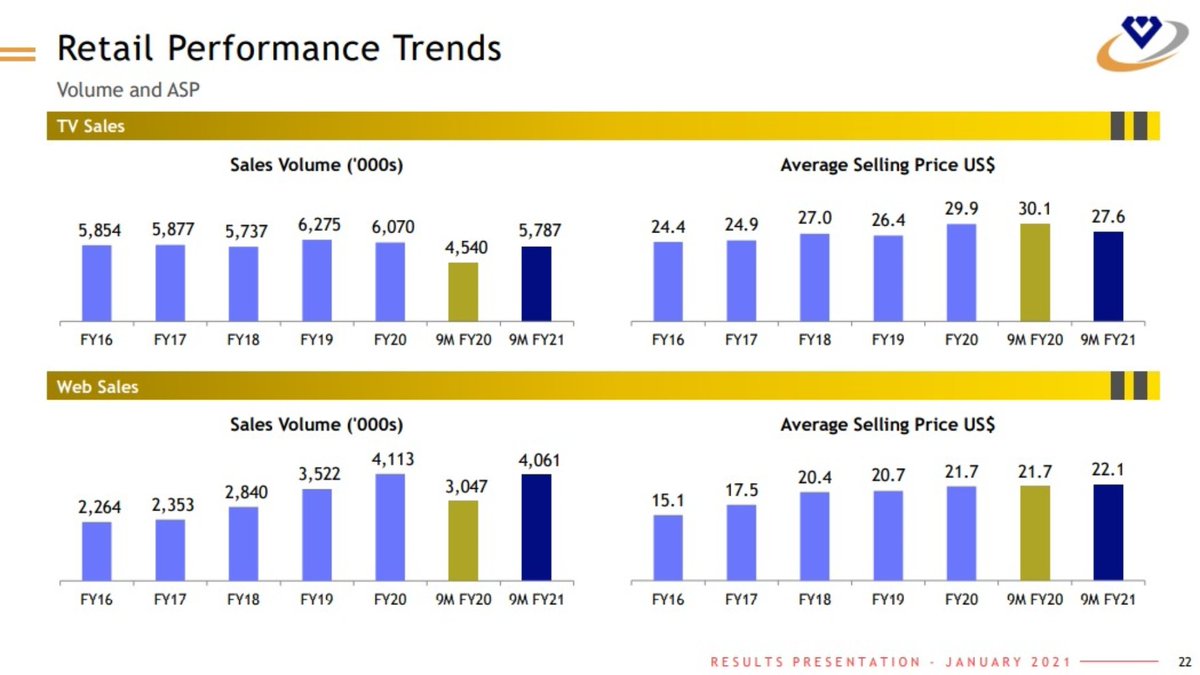

- The company witnessed a lower demand on TTM basis compared to previous year.

- The retension rate from online have increased.

- The company provides its products in each and every platform available.

- The company witnessed a lower demand on TTM basis compared to previous year.

- The retension rate from online have increased.

- The company has been one certified as vhv4 firm at platinum level.

- Under the companies flagship program grear kid meal supply is been given.

- On medium term basis 15 percent constant currency revenue growth is expected.

- Under the companies flagship program grear kid meal supply is been given.

- On medium term basis 15 percent constant currency revenue growth is expected.

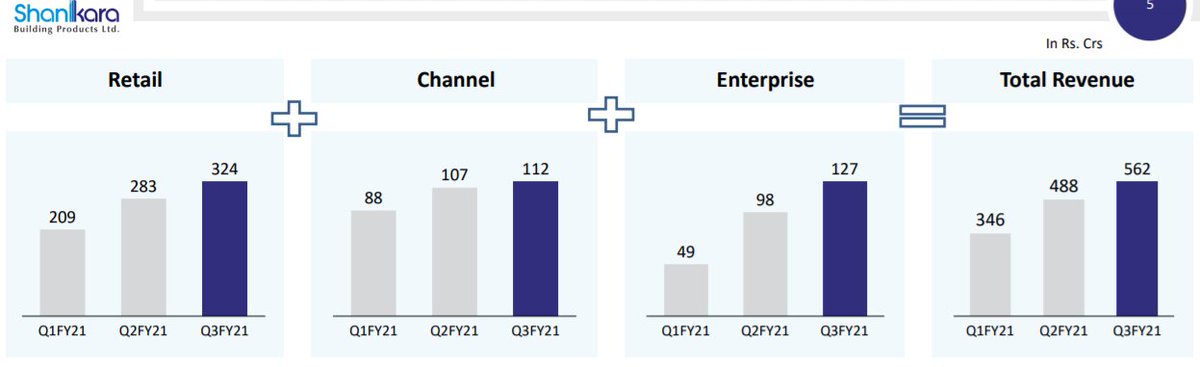

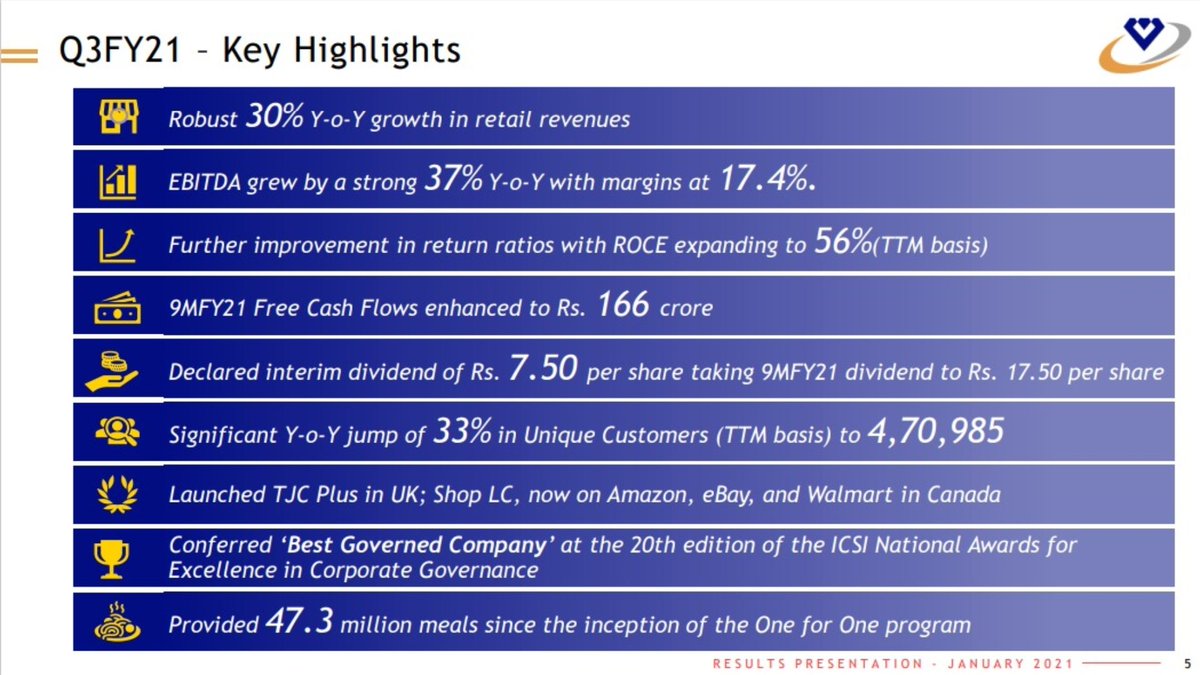

- 28.7% revenue growth was seen on YOY basis.

- Compared to tv and web , web revenue have increased at a higher rate.

- The company in last quarter witnesses a great surge in non- jewellery products demand.

- Compared to tv and web , web revenue have increased at a higher rate.

- The company in last quarter witnesses a great surge in non- jewellery products demand.

Budget pay

- Budget pay allows people to buy at Emi.

- In 9 months it's over all contribution to retail revenue came up around 36%.

- Now Company have a major focus towards B2C business compared to B2B business.

- Budget pay allows people to buy at Emi.

- In 9 months it's over all contribution to retail revenue came up around 36%.

- Now Company have a major focus towards B2C business compared to B2B business.

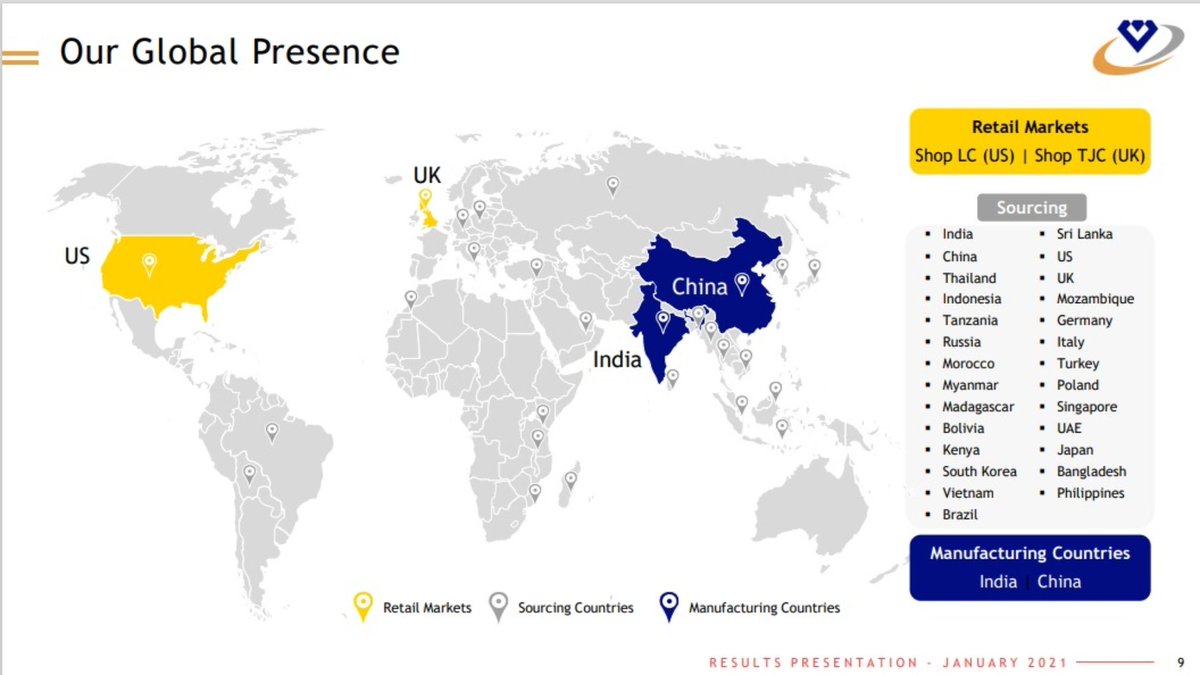

- Due to deep sourcing network Company is able to get better margins and also available operating leverage advantage as well.

- low Capex business of Company have given them advantage to plan better use of cash.

- low Capex business of Company have given them advantage to plan better use of cash.

Company made a few investment with 32 crores in following areas:-

Solar power projects

Studio improvement

Warehouse improvement

ERP and other IT Investments

Plant and machinery

And

Mobile app upgrades.

Solar power projects

Studio improvement

Warehouse improvement

ERP and other IT Investments

Plant and machinery

And

Mobile app upgrades.

- The company have a rule to give 20 to 30 percent of income back to stakeholders.

- The major concern factor for Company is related to competition, service channels and missing out opportunity.

- Company are covering test to cover new areas for better growth prospects.

- The major concern factor for Company is related to competition, service channels and missing out opportunity.

- Company are covering test to cover new areas for better growth prospects.

- The company is more comfortable to take calculated risk on a larger scale.

- Company incure good investment over their employees related to their procurement and retention in all sorts of manner.

- Company incure good investment over their employees related to their procurement and retention in all sorts of manner.

- The company still believes huge demand will still come from TV area.

- Customer acquisition cost is measured with help of SEO and other mechanics as there is no similarly in every space.

- Customer acquisition cost is measured with help of SEO and other mechanics as there is no similarly in every space.

- @LuckyInvest_AK from lucky investment

For 15 to 17 percent growth rate what does it translates?

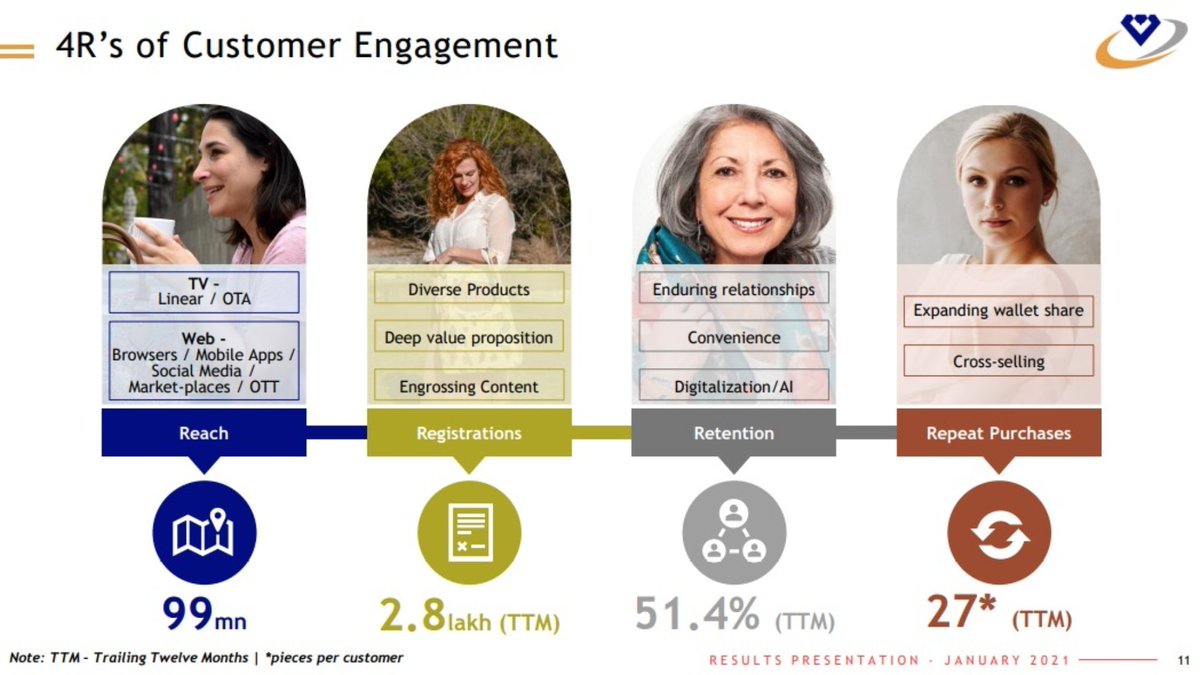

Ans - The company have Targets sent on their 4 R's along with geography expansion to meet the growth demand. Along with that major online support is also been provided.

For 15 to 17 percent growth rate what does it translates?

Ans - The company have Targets sent on their 4 R's along with geography expansion to meet the growth demand. Along with that major online support is also been provided.

For retention company have a great sales force and cloud support with new services and innovative helps a company a lot.

- The company works in a manner in which they get all their work done.

- The company works in a manner in which they get all their work done.

- More expansion can be seen by company related to social media platforms great is going on in us and uk.

- Experiments which worked were

In Market place Company witnessed great sales on online platforms but customer transition was not so great.

Company witnessed tremendous success in OTA and social deas areas.

In Market place Company witnessed great sales on online platforms but customer transition was not so great.

Company witnessed tremendous success in OTA and social deas areas.

- Company dosent work on subscriber basis, but on current level the customer count is 4.7 lakh , 1.2 lakh increase seen.

- In different areas ASP target is 50 percent of our peers.with 5% gaps.

- Company focused to acquire more and retain them for long for repeat purchases.

- In different areas ASP target is 50 percent of our peers.with 5% gaps.

- Company focused to acquire more and retain them for long for repeat purchases.

- Heavy distribution of earning were done to stakeholders as according to the present opportunity in the market.

- By Fy 23 Company expects their own digital media to be more then 50% of business.

- The company on tv platform are around kbc but on online place

- By Fy 23 Company expects their own digital media to be more then 50% of business.

- The company on tv platform are around kbc but on online place

They are far behind Amazon in terms of customer engagement.

- They are able to cater fast services in Uk and capturing market of big giants like Amazon.

- Demographic of company is great and are showing more effort to be at the larger markets.

- They are able to cater fast services in Uk and capturing market of big giants like Amazon.

- Demographic of company is great and are showing more effort to be at the larger markets.

- Pilot programs are already running in Japan and Germany. They might turn out to be bigger market for Company compared to parts of UK they work.

- Company have a positive approach on them then US.

- Company have a positive approach on them then US.

- Digital customers are costly as compared to web clients due to shipping cost.

- Shipping cost is a big part of the companies SGNA.

- Shipping cost is a big part of the companies SGNA.

• • •

Missing some Tweet in this thread? You can try to

force a refresh