Okta is one of the more interesting Cloud / SaaS leaders, growing from its early roots as one of several Cloud identity vendors, to break-out leader today

It's now approaching $1B in ARR, growing a stunning 43% (!) ... and even accelerating!

5 Interesting Learnings:

It's now approaching $1B in ARR, growing a stunning 43% (!) ... and even accelerating!

5 Interesting Learnings:

#1. Still growing 43% at Almost $1B in ARR.

This really is a stunning growth rate, even faster than Slack, Zendesk, Hubspot & more at $1B in ARR.

It shows the size and scale of Cloud continues to just shock us.

This really is a stunning growth rate, even faster than Slack, Zendesk, Hubspot & more at $1B in ARR.

It shows the size and scale of Cloud continues to just shock us.

#2. NRR at 123% -- And Going Up.

Okta's NRR is a solid 123%, and is actually the highest it has been since IPO, and up from 118% a year ago.

So, no, NRR doesn't have to come down as you scale. Not at all.

Okta's NRR is a solid 123%, and is actually the highest it has been since IPO, and up from 118% a year ago.

So, no, NRR doesn't have to come down as you scale. Not at all.

#3. New Logos / Customer Count Still Growing 27% at ~1B in ARR.

Like Slack, Okta shows that you don't have to rely primarily on existing customers to grow at scale.

Okta's customer count is still climbing 27% at $1B in ARR, at almost 10,000 total customers.

Like Slack, Okta shows that you don't have to rely primarily on existing customers to grow at scale.

Okta's customer count is still climbing 27% at $1B in ARR, at almost 10,000 total customers.

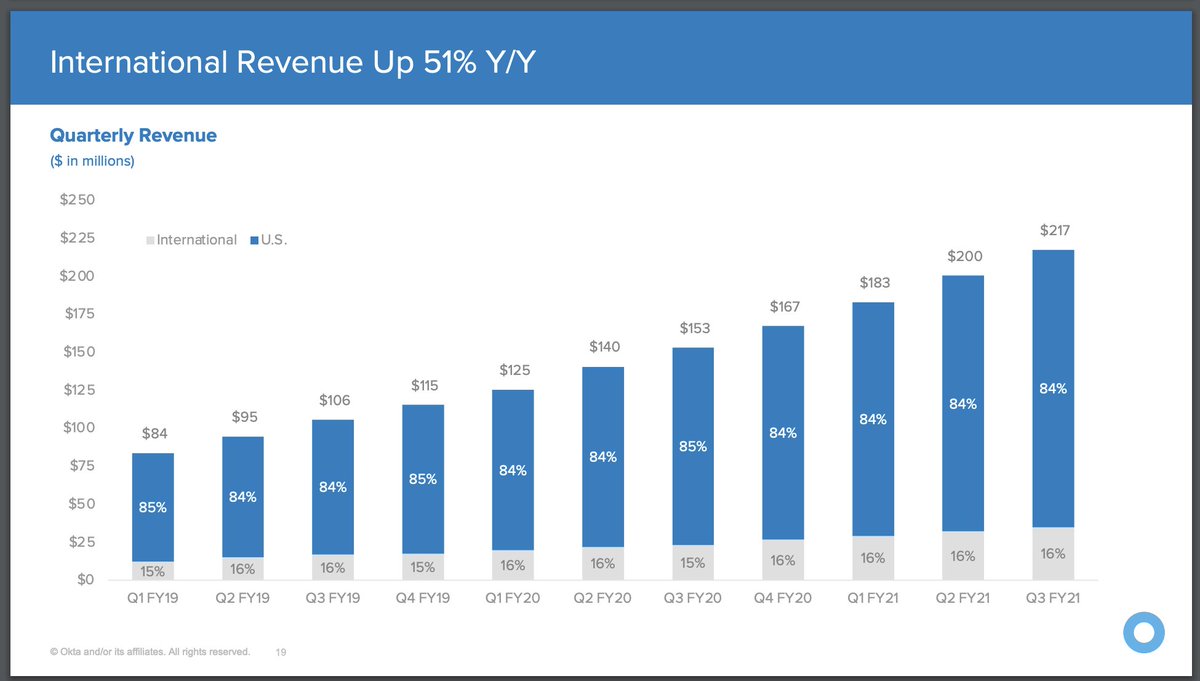

4. Slow(er) to Go Global — But That’s OK.

Okta has achieved its ferocious growth with 84% of its revenue in the U.S. Security products often have a local element to them, but this suggests there is still a ton for Okta to run outside of the U.S.

Okta has achieved its ferocious growth with 84% of its revenue in the U.S. Security products often have a local element to them, but this suggests there is still a ton for Okta to run outside of the U.S.

Most SaaS / Cloud companies at scale tend to have about 60% of their revenue in U.S., 40% in ROW. Only a few are so U.S.-centered.

It shows a ton of room to run for Okta across the globe.

It shows a ton of room to run for Okta across the globe.

#5. $100k+ Customers Growing Fastest — But Smaller Customer Still Growing Quickly

The largest customers growing the fastest at scale (34% by logos, vs 27% overall). We also saw this with Slack, Snowflake, & others. But gap isn’t huge. Small customers are also growing quickly

The largest customers growing the fastest at scale (34% by logos, vs 27% overall). We also saw this with Slack, Snowflake, & others. But gap isn’t huge. Small customers are also growing quickly

Small customers are also growing quickly.

We saw with Zendesk and Shopify that SMBs can often grow just as fast as enterprise customers, even at $1B ARR. Okta seems to split the difference.

A reminder to be careful before you leave the smaller customers behind.

We saw with Zendesk and Shopify that SMBs can often grow just as fast as enterprise customers, even at $1B ARR. Okta seems to split the difference.

A reminder to be careful before you leave the smaller customers behind.

A few bonus learnings:

6. Forecasting torrid growth through 2024.

Okta is projecting 30%-35% growth through 2024. So clearly, there is plenty of confidence in the path to $3B ARR and then $10B ARR. And really, beyond.

It compounds.

6. Forecasting torrid growth through 2024.

Okta is projecting 30%-35% growth through 2024. So clearly, there is plenty of confidence in the path to $3B ARR and then $10B ARR. And really, beyond.

It compounds.

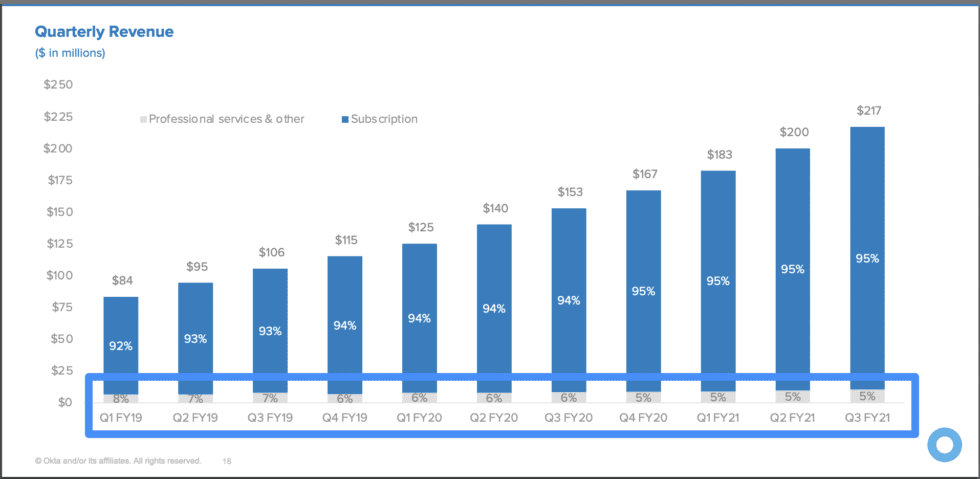

#7. Managing Professional Services Revenue From Just 8% in 2019 to Just 5% Now.

Okta like Snowflake has managed to outsource a lot of lower-margin professional services and not do all the deployment work itself.

Okta like Snowflake has managed to outsource a lot of lower-margin professional services and not do all the deployment work itself.

#8. Doubling TAM by Managing Customer Identity

A consistent theme on SaaStr is how leaders make their TAM & expand it. By moving from original core in Workplace Identity into cross-company Customer Identity, Okta has doubled its TAM & created its second core product line

A consistent theme on SaaStr is how leaders make their TAM & expand it. By moving from original core in Workplace Identity into cross-company Customer Identity, Okta has doubled its TAM & created its second core product line

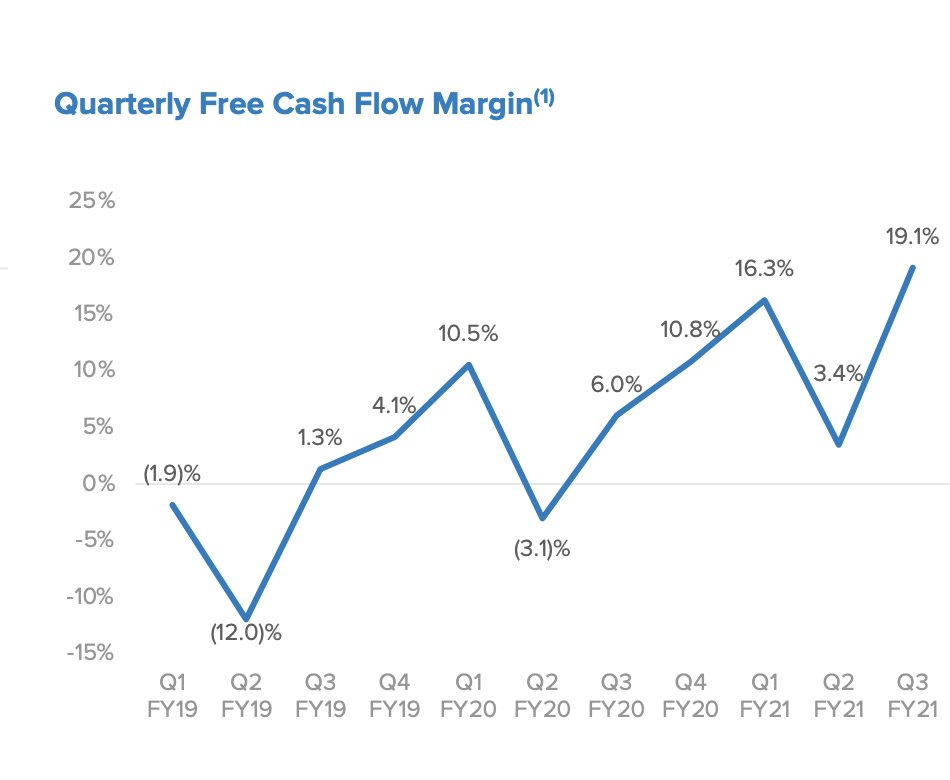

#9. Minting Cash as Approach $1B in ARR.

We’ve seen again and again that however much a SaaS company spends, it often gets quite profitable as it approaches $1B ARR. Okta is no exception. Its Free Cash Margin now is almost 20%. So for each $1 it takes in, it keeps $0.20!

We’ve seen again and again that however much a SaaS company spends, it often gets quite profitable as it approaches $1B ARR. Okta is no exception. Its Free Cash Margin now is almost 20%. So for each $1 it takes in, it keeps $0.20!

Make sure you follow CEO @toddmckinnon his account has some incredible advice and insights

And a deeper dive on all Interesting Learnings here:

saastr.com/5-interesting-…

And a deeper dive on all Interesting Learnings here:

saastr.com/5-interesting-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh