THREAD: Robinhood and other brokerages came under fire last week for restricting trading in certain securities, including $GME and $AMC.

A thread simplifying the underlying mechanics of this drama and explaining why our archaic T+2 settlement system is to blame...

A thread simplifying the underlying mechanics of this drama and explaining why our archaic T+2 settlement system is to blame...

1/ First, if you're unfamiliar with the backdrop to this story, here are the basics.

GameStop (and other "meme stocks") saw a massive price spike last week.

There were fundamental and technical reasons for the rise.

My thread below is a helpful primer.

GameStop (and other "meme stocks") saw a massive price spike last week.

There were fundamental and technical reasons for the rise.

My thread below is a helpful primer.

https://twitter.com/SahilBloom/status/1354436658129563650?s=20

2/ On Thursday, several brokerages, including the popular @RobinhoodApp, halted or restricted trading in many of these stocks.

The public outcry was immediate (and very loud).

Amazingly, it even had @AOC and @TedCruz agreeing on something.

The public outcry was immediate (and very loud).

Amazingly, it even had @AOC and @TedCruz agreeing on something.

https://twitter.com/tedcruz/status/1354833603943931905?s=20

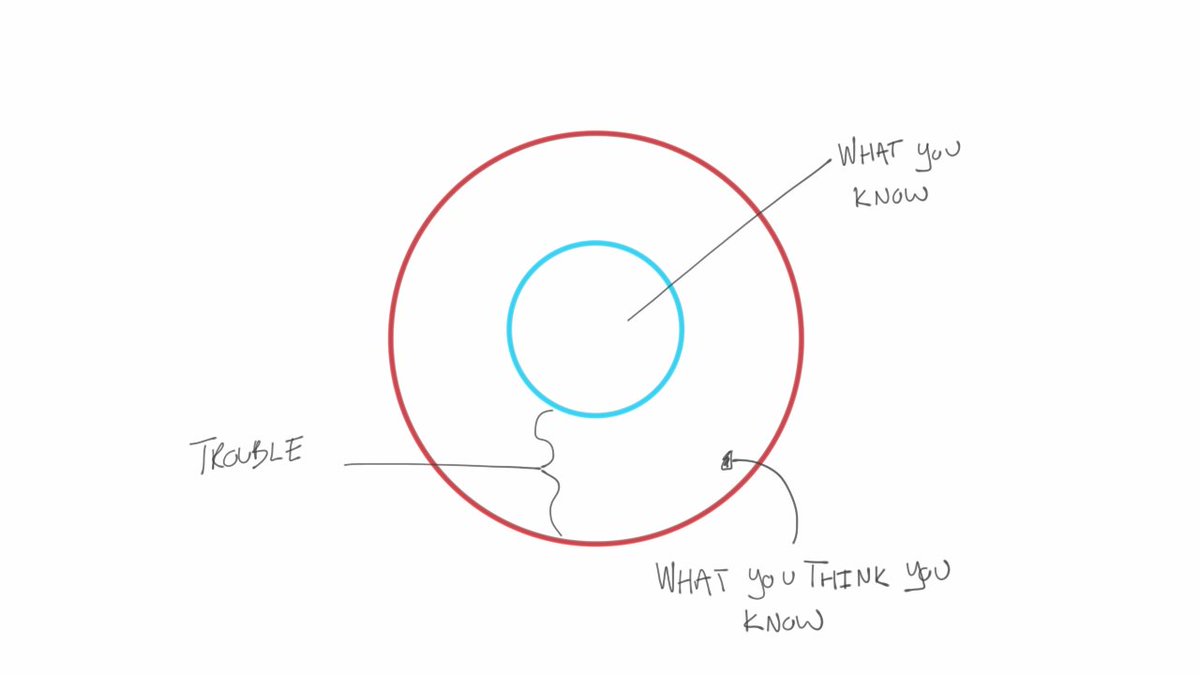

3/ There was speculation suggesting that Robinhood was involved in something nefarious.

Many pointed to their relationship with Citadel - a buyer of Robinhood order flow and a part-owner of infamous $GME short Melvin Capital - as a potential driver of the trading halts.

Many pointed to their relationship with Citadel - a buyer of Robinhood order flow and a part-owner of infamous $GME short Melvin Capital - as a potential driver of the trading halts.

4/ But while this story made for headline-grabbing news, the real driver of the trading halts was much more mundane.

It has to do with our financial system's archaic "T+2 settlement" infrastructure.

It can get a bit complex, so let's simplify it here for everyone to understand.

It has to do with our financial system's archaic "T+2 settlement" infrastructure.

It can get a bit complex, so let's simplify it here for everyone to understand.

5/ "Settlement" is just the process of completing a trade.

In the 1500s, if you went to the market, a trade was considered "settled" when you delivered your [chickens] to another trader and he delivered his [fabrics] to you.

That same concept applies to financial markets.

In the 1500s, if you went to the market, a trade was considered "settled" when you delivered your [chickens] to another trader and he delivered his [fabrics] to you.

That same concept applies to financial markets.

6/ In the early days of Wall Street, similar to the market in the 1500s, "settlement" of trades actually involved delivery of physical stock certificates from seller to buyer.

It may have taken several days for the stock certificates to be delivered and the trade to be settled.

It may have taken several days for the stock certificates to be delivered and the trade to be settled.

7/ Today, all of this is largely done electronically.

No one delivers you physical stock certificates, or if they do, it is very rare (and maybe worth framing!).

Today, stock ownership is digital. Numbers on a screen.

No one delivers you physical stock certificates, or if they do, it is very rare (and maybe worth framing!).

Today, stock ownership is digital. Numbers on a screen.

8/ Despite that fact, most of our financial system still operates on a "T+2 settlement" system.

This means there are 2 business days between the trade and the settlement of that trade.

If I buy a stock on Monday, I don't technically own (or pay for) that stock until Wednesday.

This means there are 2 business days between the trade and the settlement of that trade.

If I buy a stock on Monday, I don't technically own (or pay for) that stock until Wednesday.

9/ In its most basic sense, the T+2 system adds risk.

It adds a 2-day window where something can go wrong.

If that something makes buyer or seller unable to close the trade, that's a problem.

If I buy on Monday and go bankrupt Tuesday, I may not want to settle on Wednesday!

It adds a 2-day window where something can go wrong.

If that something makes buyer or seller unable to close the trade, that's a problem.

If I buy on Monday and go bankrupt Tuesday, I may not want to settle on Wednesday!

10/ If trades are placed but not settled, it starts to disrupt trust in the financial system.

Sellers mistrusting buyers and buyers mistrusting sellers is not good for business!

We handle this risk by having a central clearinghouse to process and settle all trades.

Sellers mistrusting buyers and buyers mistrusting sellers is not good for business!

We handle this risk by having a central clearinghouse to process and settle all trades.

11/ The Depository Trust and Clearing Corporation (DTCC) is the clearinghouse that settles the vast majority of all securities transactions in U.S. markets.

Simply put, the DTCC is the central hub for all of the brokerages to process and settle all of their trades.

Simply put, the DTCC is the central hub for all of the brokerages to process and settle all of their trades.

12/ Here is an (overly simplified) example of how it works.

I click buy for 10,000 shares of $GME on Robinhood.

That buy order is matched with a sell order from another brokerage. We have a deal.

It gets sent to the DTCC for processing and settlement.

I click buy for 10,000 shares of $GME on Robinhood.

That buy order is matched with a sell order from another brokerage. We have a deal.

It gets sent to the DTCC for processing and settlement.

13/ The DTCC provides Robinhood and the other brokerage a report - this includes detail on the securities to be exchanged and the money due to settle the trade.

The DTCC provides a guarantee of the settlement of the transaction.

Both buyer and seller trust this fact.

The DTCC provides a guarantee of the settlement of the transaction.

Both buyer and seller trust this fact.

14/ But the DTCC is taking a risk here by guaranteeing this trade will settle in 2 days!

Accordingly, the DTCC requires Robinhood and the other brokerage to post money (deposits) with them to mitigate this risk.

When market volatility rises, so do DTCC deposit requirements.

Accordingly, the DTCC requires Robinhood and the other brokerage to post money (deposits) with them to mitigate this risk.

When market volatility rises, so do DTCC deposit requirements.

15/ So with these (highly-simplified) plumbing mechanics in mind, we come back to the drama of last week...

With the crazy volatility in $GME and the other "meme stocks," the DTCC and other clearinghouses demanded much higher deposits to cover the implied risks on the trades.

With the crazy volatility in $GME and the other "meme stocks," the DTCC and other clearinghouses demanded much higher deposits to cover the implied risks on the trades.

16/ By all accounts, the increased capital need was significant.

A DTCC spokesman said its overall collateral requirements rose from $26 billion to $34 billion on the day (~30%).

This forced Robinhood and other brokerages (as well as intermediary clearing brokers) to scramble.

A DTCC spokesman said its overall collateral requirements rose from $26 billion to $34 billion on the day (~30%).

This forced Robinhood and other brokerages (as well as intermediary clearing brokers) to scramble.

17/ Unable to meet significantly heightened capital requirements from the DTCC on short notice, Robinhood and others were forced to temporarily halt trading in certain, high volatility securities.

Robinhood even raised $3.4 billion from investors to bolster its cash position.

Robinhood even raised $3.4 billion from investors to bolster its cash position.

18/ In many ways, this entire saga was a result of the archaic T+2 system.

It adds risk to the financial system and appears to be an artifact of a pre-digital world we no longer live in.

@VladTenev, the CEO of @RobinhoodApp, made a compelling case below.

It adds risk to the financial system and appears to be an artifact of a pre-digital world we no longer live in.

@VladTenev, the CEO of @RobinhoodApp, made a compelling case below.

https://twitter.com/vladtenev/status/1356687248746455041?s=20

19/ So that is the (admittedly simplified) version of the underlying mechanics of the @RobinhoodApp trading halt saga and why an archaic settlement system is largely to blame.

There are many layers to this, which I thought @compound248 covered well below.

There are many layers to this, which I thought @compound248 covered well below.

https://twitter.com/compound248/status/1355274739351248898?s=20

20/ If you enjoyed this, follow me for more educational threads on business, money, finance, and economics. You can find all of my threads in the meta-thread below.

https://twitter.com/SahilBloom/status/1284583099775324161?s=20

21/ And if you are less Twitter inclined, sign up for my newsletter here, where you can find all of my old threads and receive all of my new threads directly to your inbox. sahilbloom.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh