1/n

$PINS

Q4 revenue grew 76% year over year to $706 million.

2020 revenue grew 48% year over year to $1,693 million.

Global Monthly Active Users (MAUs) grew 37% year over year to 459 million.

$PINS

Q4 revenue grew 76% year over year to $706 million.

2020 revenue grew 48% year over year to $1,693 million.

Global Monthly Active Users (MAUs) grew 37% year over year to 459 million.

2/n

$PINS

* Revenue: $706 million vs $ $642.95M estimates

$PINS

* Revenue: $706 million vs $ $642.95M estimates

3/n

$PINS

!!! "Our current expectation is that Q1 revenue will grow in the low-70% range year over year."

$PINS

!!! "Our current expectation is that Q1 revenue will grow in the low-70% range year over year."

4/n

$PINS

* EPS $0.43 Beats $0.32 Estimate

* Sales $705.62M Beat $645.58M Estimate

$PINS

* EPS $0.43 Beats $0.32 Estimate

* Sales $705.62M Beat $645.58M Estimate

5/n

$PINS

Guidance for Q1 2021 of 70% revenue growth is a monster beat.

Guidance: ~$460M vs analyst estimates of $430M

$PINS

Guidance for Q1 2021 of 70% revenue growth is a monster beat.

Guidance: ~$460M vs analyst estimates of $430M

6/n

$PINS

This is critical the the "it will have to stop growing this fast" crowd.

Q4 revenue growth: 76%

Q1 Guidance: 'Low 70%'

Guys, it ain't slowing down.

$PINS

This is critical the the "it will have to stop growing this fast" crowd.

Q4 revenue growth: 76%

Q1 Guidance: 'Low 70%'

Guys, it ain't slowing down.

7/n

$PINS

* ARPU up $29 yoy

* Net income (yes profits): 29% of revenue

* Adj EBITDA margins: 42% 🔥🔥🔥

* Total international revenue was $123 million, increase of 145% year over year [But the "international market will never monetize 🤣🤣🤣]

$PINS

* ARPU up $29 yoy

* Net income (yes profits): 29% of revenue

* Adj EBITDA margins: 42% 🔥🔥🔥

* Total international revenue was $123 million, increase of 145% year over year [But the "international market will never monetize 🤣🤣🤣]

8/n

$PINS

ARPU growth was massive:

* U.S. ARPU up 49% year over year.

* International ARPU up 67% year over year.

$PINS

ARPU growth was massive:

* U.S. ARPU up 49% year over year.

* International ARPU up 67% year over year.

10/n

$PINS

Revenue and MAUs are just exploding.

This is a further acceleration and Q1 guidance is for virtually no slow down (low 70% growth).

These are crazy numbers.

$PINS

Revenue and MAUs are just exploding.

This is a further acceleration and Q1 guidance is for virtually no slow down (low 70% growth).

These are crazy numbers.

11/n

$PINS

* EPS: 43 cents vs. 32 cents expected

* Revenue: $706 million vs. $645.6 million

* Monthly Active Users (MAUs): 459 million vs. 449.4 million

* ARPU: $1.57 vs. $1.44

* Adj EBITDA 42% (profits!)

* Q1Guidance: $460M vs $430M

$PINS

* EPS: 43 cents vs. 32 cents expected

* Revenue: $706 million vs. $645.6 million

* Monthly Active Users (MAUs): 459 million vs. 449.4 million

* ARPU: $1.57 vs. $1.44

* Adj EBITDA 42% (profits!)

* Q1Guidance: $460M vs $430M

$PINS Current valuation model by analysts is just broken.

This is not normal.

Guidance to repeat this growth in Q1 points to a discombobulation of current models.

* It's bigger than ppl thought.

* It's more profitable than ppl thought.

It's next step (in 3yrs) is 1B MAU.

This is not normal.

Guidance to repeat this growth in Q1 points to a discombobulation of current models.

* It's bigger than ppl thought.

* It's more profitable than ppl thought.

It's next step (in 3yrs) is 1B MAU.

12/n

$PINS

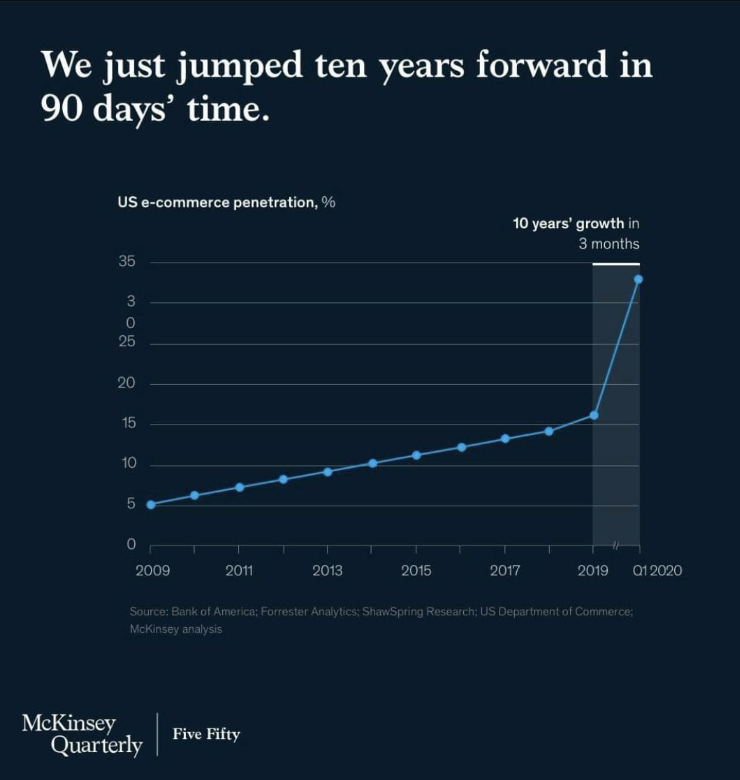

E-commerce is exploding: "Pinners can now pivot into shop mode across all product categories [].

All of these efforts have resulted in strong growth in product-only searches, which have grown by 20x since the beginning of 2020.

$PINS

E-commerce is exploding: "Pinners can now pivot into shop mode across all product categories [].

All of these efforts have resulted in strong growth in product-only searches, which have grown by 20x since the beginning of 2020.

13/n

$PINS

"This complements our computer vision-based product recommendations as our research shows that Pinners are 70% more likely to engage with products tagged in scene images than on standalone product Pins."

$PINS

"This complements our computer vision-based product recommendations as our research shows that Pinners are 70% more likely to engage with products tagged in scene images than on standalone product Pins."

14/n

$PINS

42% Adj EBITDA matched Facebook's $FB 42% operating margin.

$PINS

42% Adj EBITDA matched Facebook's $FB 42% operating margin.

• • •

Missing some Tweet in this thread? You can try to

force a refresh