1/n Some Friday thoughts on #Bitcoin - which were piqued by the excellent @ARKInvest Big Ideas 2021 report, which you can (and should) read here research.ark-invest.com/hubfs/1_Downlo… Before I start

1. I own #BTC

2. I wish I owned more #BTC

3. I am not a bear

4. I'm biased

OK - so here we go

1. I own #BTC

2. I wish I owned more #BTC

3. I am not a bear

4. I'm biased

OK - so here we go

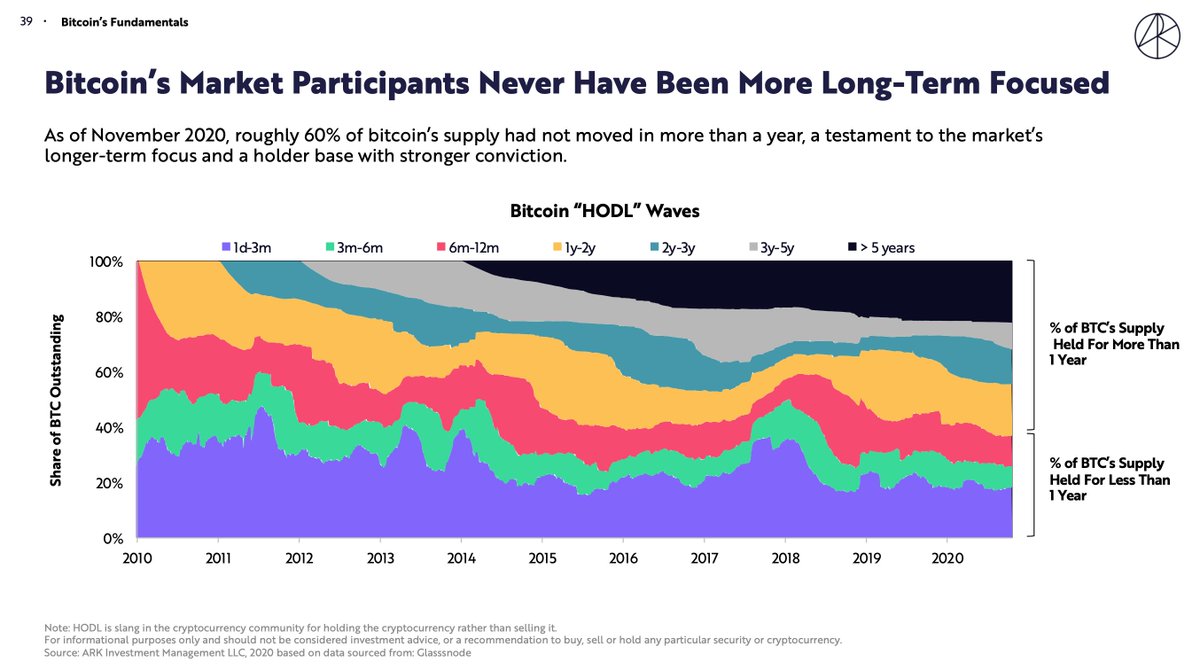

2/n See this chart - and headline "Market participants never more long-term focused" - that may be true, the alternative argument is that 12 years into #bitcoins, never has there been less interest in using it as form of payment. It's all (or mostly) asset price speculation.

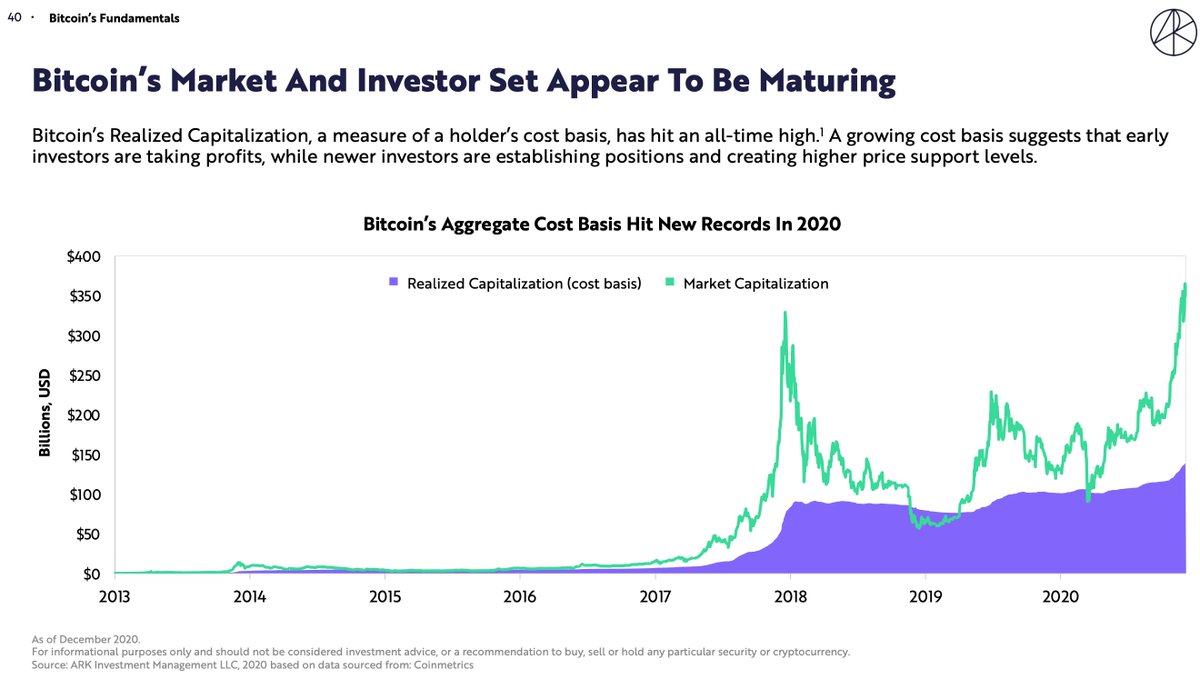

3/n Chart says holder cost basis have hit all-time high, which they claim suggests early investors are taking profits (I agree) and new investors are "creating higher price support levels" - alternative headline - "Bagholders have bought into a bubble at/near top". Time will tell

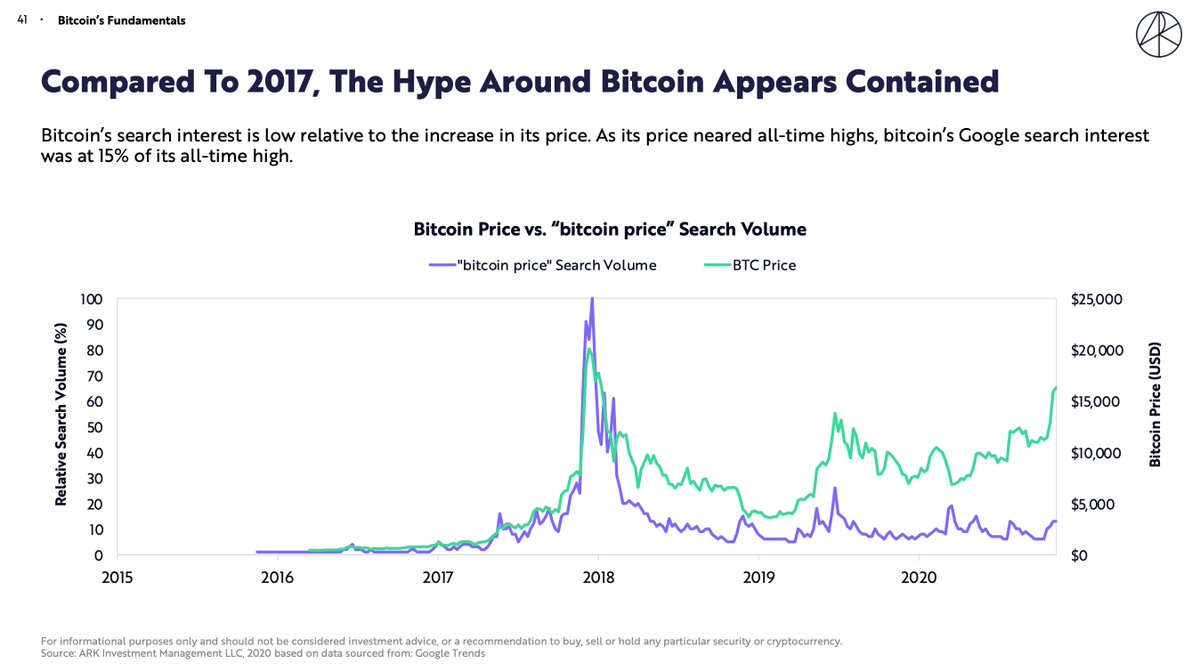

4/n Chart suggest hype isn't as big this time based on Google. Maybe - but those who Googled in 2017 don';t need to do it again. Also - check out second chart (not from @ark) on weekly crypto subreddit subscribers. Seems plenty bubbly from that perspective. Also worth noting

that, according to @findercomau info - 5 million Aussies have an interest in crypto, 13% trade #Bitcoin whilst local exchange @coinspotau has 1 million users coinspot.zendesk.com/hc/en-us/artic… (h/t @josephskewes for the link)

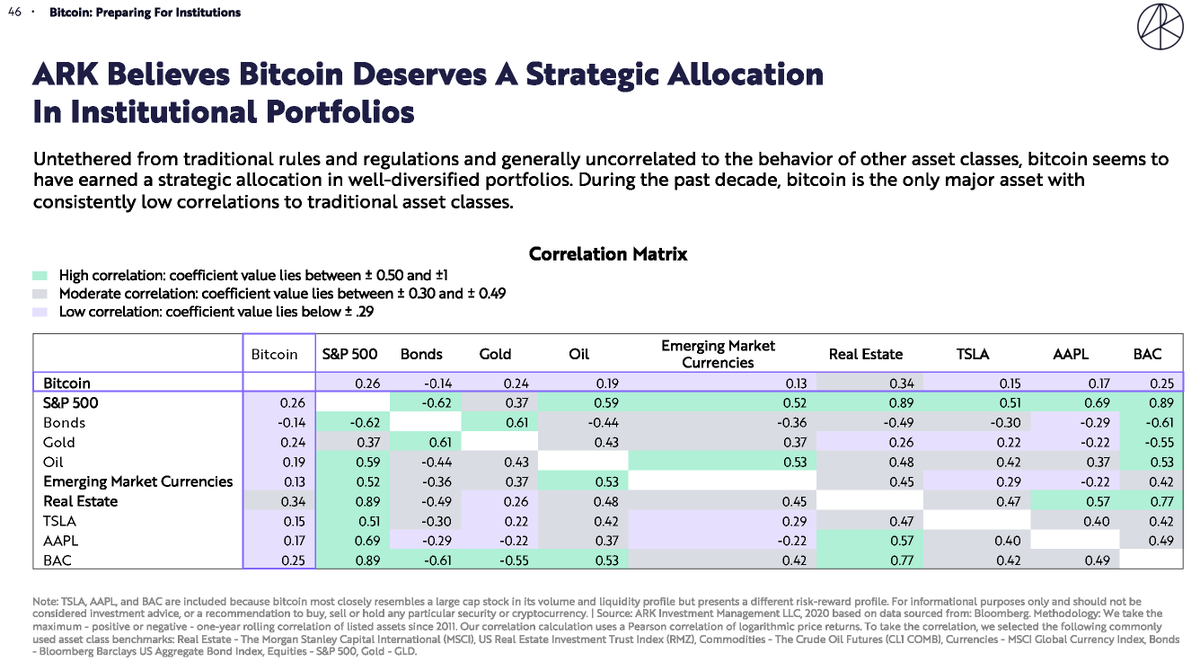

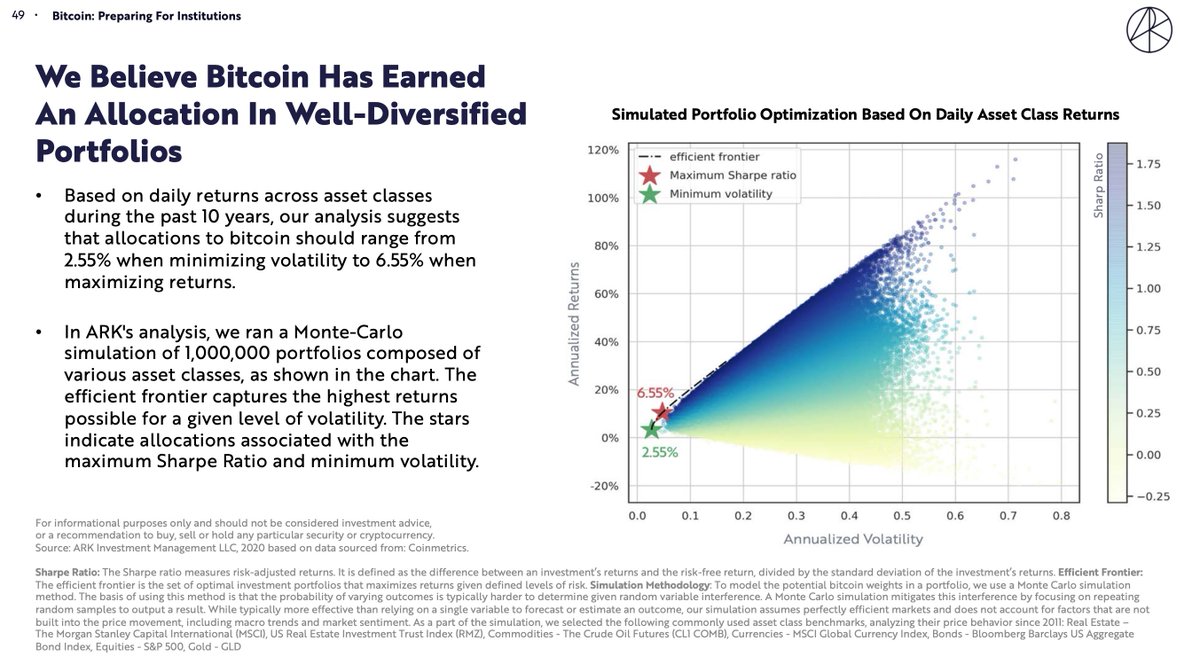

Now onto #BTC role in a portfolio and @ARKInvest say it deserves one as its uncorrelated - see below table, which appears based on data from 2011. All well and good - no arguments (so far) but then consider

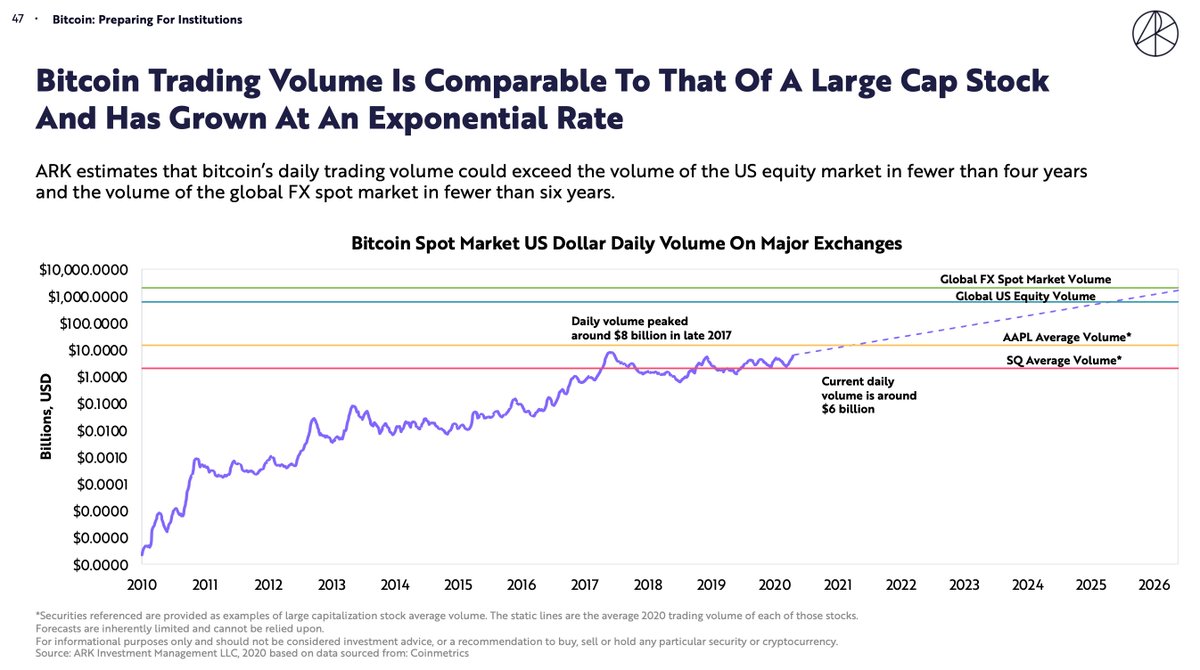

this chart - which shows volume of #BTC traded over time - doesn't look like it hit $1bn in daily turnover until 2016/2017 (happy to be corrected), and market cap was tiny. Ergo - all of the correlation data prior to that is probably meaningless for insto investors

Not because anything wrong with #BTC but it was a Mickey Mouse market up until then (some argue it still is). It would be like using #GME data to make the same point. Ergo for this chart which argues for a 2.55% to 6.55% allocation - based on simulations that used similar data.

Final comment - this should not be interpreted as being anti #Bitcoin because I'm not. Thus endeth the unsolicited spreading of FUD.

Ping @josephskewes @michaelbatnick @bronsuchecki @AlexSaundersAU @profplum99 @RaoulGMI @ttmygh @RonStoeferle @bronsuchecki @JohnFeeney10 @Scutty @Colgo @SantiagoAuFund

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh